Europe Biocatalyst Market Size, Share, Trends and Forecast by Type, Application, Source, and Country, 2025-2033

Europe Biocatalyst Market Size and Share:

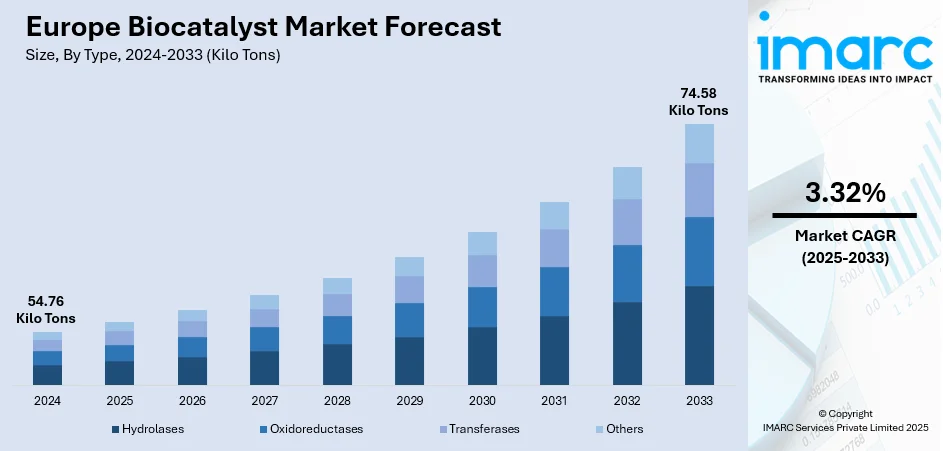

The Europe biocatalyst market size was valued at 54.76 Kilo Tons in 2024. The market is projected to reach 74.58 Kilo Tons by 2033, exhibiting a CAGR of 3.32% from 2025-2033. Germany is the leading nation in the Europe biocatalyst market, aided by a robust industrial setup, advanced research environment, and emphasis on sustainable innovation. The market is boosted by rising demand for environmentally friendly manufacturing processes, the swift replacement of chemical catalysts with enzymes, and relentless advancements in biotechnology. Increasing applications in pharmaceuticals, food and beverages, and biofuels further strengthen growth. Growing research investment and enzyme-based solution adoption are likely to support overall Europe biocatalyst market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

54.76 Kilo Tons |

|

Market Forecast in 2033

|

74.58 Kilo Tons |

| Market Growth Rate 2025-2033 | 3.32% |

The Europe Biocatalyst Market is being largely powered by the high inclination of the region toward green chemistry and sustainable industrial processes. Industry-wise, there is increased demand for cleaner, safer, and more sustainable alternatives to traditional chemical catalysts. As per the sources, in November 2024, Biocatalysts Ltd launched its PlantPro™ enzyme range, designed to enhance taste, texture, and functionality in plant-based beverages, meat, and cheese alternatives, addressing key industry challenges. Moreover, biocatalysts, as they are sourced from nature in the form of enzymes and microorganisms, present a cost-effective method for reducing energy use, reducing harmful byproducts, and bringing production in line with environmentally friendly measures. This makes them extremely desirable for pharmaceuticals, food processing, textiles, and specialty chemicals, where not only is sustainability a market differentiator but also a business requirement. Additionally, raising concern among industries and consumers regarding the environmental advantages of bio-based solutions is developing a conducive climate for mass adoption. With more companies incorporating long-term sustainability into their operations, the dependency on biocatalysts is likely to amplify, boosting Europe biocatalyst market growth and driving the overall growth of the market.

To get more information on this market, Request Sample

Another strategic contributor to the Europe biocatalyst market is the high rate of innovation in biotechnology and process improvement. According to the reports, in May 2025, BRAIN Biotech completed the minority buyout of its Dutch subsidiary Breatec B.V., opening a new, enlarged continental European production site and expanding its Baking Application Center. Furthermore, ongoing advances in enzyme engineering, synthetic biology, and computational design are making it possible to develop highly specialized biocatalysts with enhanced performance, stability, and scalability. These technology advances are opening up more application areas for biocatalysts in various industries and enabling chemical transformations with greater precision and higher product yields. Simultaneously, the convergence of digital technologies, including artificial intelligence and machine learning, is speeding up the discovery and tailoring of novel catalysts to the demands of industry. This combination of biotechnology and digital innovation is driving breakthroughs that are at once commercially sustainable and environmentally benign. With industries across the continent pursuing increased productivity while minimizing costs and ecological footprint, such technological innovations are placing biocatalysts firmly at the center as indispensable agents, catalyzing future growth and solidifying the continent's position at the forefront of sustainable and cutting-edge manufacturing trends.

Europe Biocatalyst Market Trends:

Increased Focus on Sustainable Development

The European market is progressively dominated by sustainability objectives, which are transforming corporate initiatives throughout the continent. Several players are embracing green initiatives, frequently aided by cooperative collaborations, joint ventures, and merger and acquisition (M&A) deals. These actions are intended to help harmonize with the continent's ambitious climate goals while at the same time unleashing new avenues for development. One most notable example of this development was in 2025 when ErebaGen, a Warwick spinout, received GBP 1.13 million from Innovate UK to lead the way in pioneering new biocatalysts for green pharmaceutical production. Through its emphasis on enzyme-based solutions, this effort displaces risky chemical processes with more environmentally friendly, safer, and more productive alternatives. Such innovations highlight Europe's growing position as a center of global green innovation. The shift toward sustainable practices is driving competitiveness and defining the direction of the market, making environmental factors inextricably linked to industrial decision-making and technology development.

Emergence of Biocatalysts as Chemical Alternatives

A hallmark trend throughout Europe is the swift movement away from conventional chemical catalysts to biocatalysts in the field of industries. This is being driven by the increasing awareness of enzymes as effective, selective, and environmentally friendly alternatives. Biocatalysts not only minimize dependence on hazardous chemicals but also enhance process yields, decrease energy usage, and reduce hazardous byproducts. Their adoption is particularly significant in pharmaceutical production, specialty chemicals, and food processing, where sustainability and efficiency are essential. Research and development (R&D) activities are playing a central role in advancing enzyme design, optimizing production processes, and expanding their industrial relevance. Furthermore, the commercial potential of biocatalysts is attracting investment and encouraging academia-industry collaborations to accelerate innovation. As Europe biocatalyst market trends further advance, replacement of chemical catalysts with biocatalysts is bound to become even stronger, bringing new opportunities and placing the region at the vanguard of green technology embrace.

Government Support and Technological Innovation

Technology development coupled with policy-inspired investment is heavily influencing Europe's market environment. Governments and innovation agencies are taking an active role in supporting projects that lower emissions, improve efficiency, and hasten the shift to sustainable production. For instance, in March 2025, Innovate UK invested more than GBP 14 million to back 29 projects through the Sustainable Medicines Manufacturing Innovation Programme. This program highlights the increasing focus on the incorporation of innovative biocatalytic processes in the manufacture of pharmaceuticals with a view to limiting waste and minimizing the carbon footprint of the industry. Apart from finance, digitalization and advanced analytics are improving the innovation and use of new catalysts, allowing more efficient and scalable manufacturing processes. The interaction between technological innovation and institutional leadership is creating a conducive atmosphere for the industrial shift. By combining innovative research with organized funding, Europe is becoming a frontrunner in sustainable biotechnology for the manufacturing industry and future-proofed manufacturing processes.

Europe Biocatalyst Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe biocatalyst market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, application, and source.

Analysis by Type:

- Hydrolases

- Oxidoreductases

- Transferases

- Others

Hydrolases are the front-running type segment of the Europe Biocatalyst Market, because of their widespread application in making biochemical transformations efficient and sustainable. Hydrolases catalyze the hydrolysis of chemical bonds, hence playing a key role in sectors like food processing, pharmaceuticals, detergents, and biofuels. Their capacity to operate at mild reaction conditions presents an economical and environmentally friendly option for conventional catalysts that usually demand high energy input or toxic chemicals. In food manufacture, hydrolases are used to enhance texture, flavor, and nutritional content, while in the pharmaceutical industry, they are used for chiral synthesis and drug synthesis. Their application also carries over to waste management, in which they enable ecological degradation of industrial residues. As research continues to try and make enzymes more stable and effective, hydrolases are likely to continue dominating this sector. Their pervasive use underlines their pivotal position in facilitating sustainability and efficiency throughout European industry.

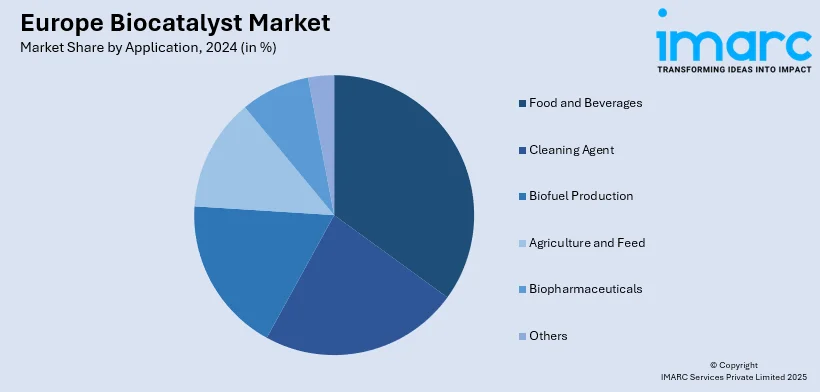

Analysis by Application:

- Food and Beverages

- Cleaning Agent

- Biofuel Production

- Agriculture and Feed

- Biopharmaceuticals

- Others

Food and beverages constitute the most dominant application segment in the Europe Biocatalyst Market, indicative of the high emphasis on product quality and processing innovation in the region. Biocatalysts find broad application in flavor enhancement, aroma, texture, and nutritional content across diverse food segments such as dairy, bakery, and beverages. Enzymes ensure optimal fermentation, digestibility, and shelf life extension while tracking consumers' demand for natural and clean-label products. The increasing focus of the industry on healthier formulations, less use of chemicals, and environmentally friendly processes further encourages the use of biocatalysts. In the beverage market, enzymes have applications in clarification, brewing, and enhancing juice extraction, providing greater efficiency and consistency during production. Implementation of biocatalysts in this segment also promotes reduction in waste and sustainability through maximal utilization of raw materials. With increasing demand for premium, functional, and sustainable food items throughout Europe, the food and beverage industry is poised to remain a key growth driver for biocatalyst uptake.

Analysis by Source:

- Microorganisms

- Plants

- Animals

Microorganisms account for the largest source segment in the Europe biocatalyst market outlook because of their scalability, versatility, and affordability in enzyme production. Bacteria, fungi, and yeasts are extensively used to yield biocatalysts with varied applications across different industries. Their ease of growth, susceptibility to controlled fermentation processes, and high enzyme yields render them extremely desirable for bulk production. Enzymes derived from microorganisms are widely used in pharmaceuticals, food processing, the textile industry, and biofuels, with consistent quality and performance. Furthermore, breakthroughs in genetic engineering and synthetic biology have made it possible to engineer microbial strains for highly specific enzymes with improved stability and activity. This flexibility guarantees ongoing innovation and facilitates the industry shift toward more sustainable, efficient modes of production. With sustainability being a primary concern throughout Europe, microorganisms will be maintained as the source par excellence for biocatalyst development, facilitating stable, scalable, and environmentally friendly solutions for a wide range of industrial uses.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the dominant regional market in the Europe Biocatalyst Market owing to its robust industrial economy, advanced research environment, and focus on eco-friendly innovation. The focus of the country on the adoption of biotechnology in industrial manufacturing has created a conducive environment for the embracement of biocatalysts in various industries such as pharmaceuticals, food processing, and chemicals. Germany's highly developed academic and research infrastructure is central to the creation of innovative enzymes and facilitating industry-science collaborations. The country's regulatory emphasis on emissions reduction and greener processes also pushes biocatalyst use as a green substitute for conventional chemical catalysts further. The nation's high export intensity and image for quality production render it a center for enzyme-driven industrial innovation. While Germany further aligns itself with the European Union's sustainability agenda, leadership in the development of industrial biotechnology is predicted to enhance its status as the leading regional market for biocatalysts in Europe.

Competitive Landscape:

The competitive dynamics of the Europe biocatalyst market are influenced by ongoing innovation, collaborative strategies, and high emphasis on sustainability. Market players are investing more in innovative enzyme technologies, with a view to enhancing efficiency, stability, and flexibility in various industrial applications. Academic-industry research collaborations are propelling the invention of new biocatalysts, facilitating commercialization and increase in market penetration. Firms are distinguishing themselves on the basis of specialization in application-enzyme specific products, especially in pharma, food processing, and biofuels, where demand continues high for environmentally friendly solutions. Moreover, geographic growth and incorporation of digital technologies in enzyme designing are emerging as important strategies to ensure competitiveness. With an increasing emphasis on green chemistry and optimization of resources, the industry is likely to experience stable cycles of innovation. As regulatory environments throughout Europe will continue to promote sustainable practices, the Europe biocatalyst market forecast points towards significant opportunities for those who can provide scalable, effective, and environmentally friendly solutions.

The report provides a comprehensive analysis of the competitive landscape in the Europe biocatalyst market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: CATCO2NVERS featured at Biotrans 2025 in Basel, showcased its biocatalytic CO₂ conversion research. A poster on enantioselective D-lactic acid synthesis using engineered enzymes highlighted scalable, stereoselective biotransformations, reinforcing the project’s role in advancing biocatalyst-driven, sustainable CO₂ valorisation within synthetic biology and carbon circularity.

- May 2025: BRAIN Biotech acquired full ownership of Breatec B.V. and announced a new production and warehousing hub near Den Bosch, Netherlands. The site will feature an expanded Baking Application Center focused on enzyme-based biocatalysts, enhancing innovation, customer collaboration, and operational synergies across its growing bakery enzymes business.

- February 2025: Barcelona-based biotech startup ZYMVOL raised EUR 3 Million in seed funding to advance its computational enzyme engineering platform. Specializing in biocatalysts, ZYMVOL aims to replace harmful industrial chemicals with sustainable enzymes, reducing emissions and energy use across sectors while accelerating development through high-accuracy computer simulations.

- February 2025: Capgemini unveiled a generative AI-driven methodology for protein engineering that reduces data requirements by over 99%. Developed at its Cambridge biotech lab, the breakthrough enhances biocatalyst development, accelerates sustainable solutions in healthcare and environment, and enables faster innovation in bioengineering using minimal experimental data.

- January 2025: Latvia, Lithuania, and Estonia launched the Baltic Biotechnology Hub to unify their biotech sectors. Backed by the EU’s Horizon Europe programme, the initiative fosters innovation, talent, investment, and biocatalyst development through cross-border collaboration, aiming to strengthen the region’s global competitiveness in sustainable biotechnology solutions.

Europe Biocatalyst Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Tons USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydrolases, Oxidoreductases, Transferases, Others |

| Applications Covered | Food and Beverages, Cleaning Agent, Biofuel Production, Agriculture and Feed, Biopharmaceuticals, Others |

| Sources Covered | Microorganisms, Plants, Animals |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe biocatalyst market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe biocatalyst market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biocatalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe biocatalyst market reached a volume of 54.76 Kilo Tons in 2024.

The Europe biocatalyst market is projected to exhibit a CAGR of 3.32% during 2025-2033, reaching a value of 74.58 Kilo Tons by 2033.

Key drivers of the Europe biocatalyst market are growing need for environmentally friendly and sustainable production processes, rising substitution of chemical catalysts with enzymes, and ongoing developments in biotechnology. Strong R&D activities, rising industrial use in pharmaceuticals, food and beverages, and biofuels, as well as government support, are further driving adoption and overall market growth.

Germany accounts for the largest share in the Europe biocatalyst market, because of its robust industrial foundation, advanced biotechnology research infrastructure, and emphasis on sustainable innovation. Germany's premium on environmentally friendly production practices, regulatory encouragement of green manufacturing, and implementation of enzyme-based solutions in pharmaceuticals, food processing, and biofuels cement its position as Europe's top regional market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)