Europe Biodegradable Food Service Disposables Market Report Size, Share, Trends and Forecast by Raw Material Type, Product Type, Distribution Channel, and Country, 2025-2033

Europe Biodegradable Food Service Disposables Market Overview:

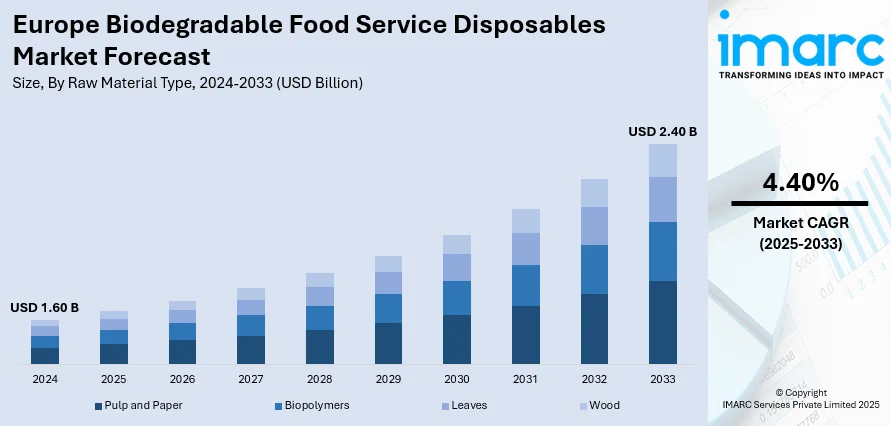

The Europe biodegradable food service disposables market size was valued at USD 1.60 Billion in 2024. Looking forward, the market is estimated to reach USD 2.40 Billion by 2033, exhibiting a CAGR of 4.40% during 2025-2033. Germany currently dominates the market in 2024. The market is driven by increasing environmental concerns regarding single-use plastic and paper products, alongside rising consumer demand for sustainable alternatives. Regulatory actions, including bans and restrictions on plastic disposables, further push the adoption of biodegradable solutions across industries. Additionally, growing awareness of the environmental impact of traditional packaging and the development of cost-effective, eco-friendly alternatives by public-private collaborations are expanding the Europe biodegradable food service disposables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.60 Billion |

| Market Forecast in 2033 | USD 2.40 Billion |

| Market Growth Rate (2025-2033) | 4.40% |

The market in Europe is primarily driven by the growing environmental concerns over plastic and paper disposables. In line with this, the rising consumer preference for sustainable alternatives is also providing an impetus to the market. Moreover, the increasing number of regulations and bans on single-use plastics across various European countries is acting as a significant growth-inducing factor for the market. The EU requires all single-use plastic bottles to have tethered caps by July 2024 and has set ambitious recycling targets of at least 77% collection of plastic bottles by 2025 and 90% by 2029, with at least 25% recycled content in PET bottles for 2025, rising to 30% by 2030. In addition to this, the expanding food service industry, driven by urbanization and lifestyle changes, is resulting in higher demand for eco-friendly packaging solutions, contributing to the Europe biodegradable food service disposables market growth.

To get more information on this market, Request Sample

Besides this, the growing awareness about the environmental impact of non-biodegradable materials is creating lucrative opportunities in the market. Also, the increasing collaboration between government bodies and private enterprises to develop cost-effective, sustainable alternatives is impacting the market positively. The market is further driven by the implementation of favorable government initiatives to reduce the cost of biodegradable alternatives and increase their availability. The new PPWR, which entered into force on February 11, 2025, harmonizes rules across Europe to support the broader adoption of recyclables and biodegradable packaging. It mandates that all packaging placed on the EU market be recyclable by 2030. Apart from this, easy product availability across both online and offline organized retail channels is propelling the market. Some of the other factors contributing to the market include the rising preference for plant-based packaging materials, technological advancements in product manufacturing, and extensive research and development (R&D) activities.

Europe Biodegradable Food Service Disposables Market Trends:

Environmental Concerns Driving the Shift Toward Sustainable Packaging

The European market is being increasingly driven by growing environmental concerns associated with the widespread usage of plastic and paper disposables. The destruction of millions of acres of forests due to paper disposables made from wood fiber is one major issue, compounded by the inner polyurethane layer which restricts their biodegradability. This has sparked widespread awareness and a shift towards fully biodegradable alternatives, which is one of the emerging Europe biodegradable food service disposables market trends. Furthermore, industry reports that the EU aims to cut single-use plastics by 50% by 2025, which is accelerating the shift toward sustainable packaging solutions. The increase in consumer awareness about the harmful environmental impacts of single-use disposables has accelerated the demand for eco-friendly solutions in packaging. This growing demand highlights the importance of finding alternatives that do not contribute to deforestation or plastic pollution.

Regulatory Push for Sustainable Packaging Solutions

Increasing regulations and bans against single-use plastics and paper disposables in Europe are also driving demand for biodegradable packaging. The EU has taken proactive measures to reduce waste by mandating a reduction in packaging waste per capita. For instance, the European Parliament approved new rules in 2024 to reduce, reuse, and recycle packaging waste, mandating EU countries to reduce total packaging waste per capita by 5% by 2030, 10% by 2035, and 15% by 2040. These ambitious goals have pushed manufacturers and industries to adopt biodegradable alternatives to meet these regulations. The government's push for sustainable packaging is also seen as a long-term solution to reduce the financial burden of waste management and recycling, as per the Europe biodegradable food service disposables market forecast. By promoting biodegradable alternatives, the EU aims to reduce environmental harm while easing the pressures on waste management infrastructure.

Technological Advancements in Biodegradable Packaging

Technological advancements have played a crucial role in driving the adoption of biodegradable alternatives, especially in the food service industry. Public-private partnerships have been instrumental in making biodegradable alternatives cost-competitive with traditional petroleum-based disposable products. It has been reported that a USD 1.26 Million grant has been secured for a UK-based sustainable packaging project, reflecting broader public-private efforts to advance cost-competitive, eco-friendly alternatives to petroleum-based disposable products. These efforts are enabling the development of cost-effective alternatives, ensuring that biodegradable packaging can compete with conventional options on price. The increased availability of affordable, sustainable packaging is expected to accelerate its adoption in the food service industry, further promoting environmental sustainability across Europe.

Europe Biodegradable Food Service Disposables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe biodegradable food service disposables market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on raw material type, product type, and distribution channel.

Analysis by Raw Material Type:

- Pulp and Paper

- Biopolymers

- Leaves

- Wood

Pulp and paper stand as the largest component in 2024, primarily due to their versatility and widespread use across various food service applications. This material is preferred for its cost-effectiveness and recyclability, which aligns well with the growing demand for eco-friendly packaging solutions. Additionally, pulp and paper are biodegradable, providing an effective alternative to traditional plastic disposables, further promoting their adoption in the food service industry. Their availability and ease of production, coupled with innovations in processing, are expected to ensure their dominance in the coming years, as they cater to both large-scale and smaller, independent businesses.

Analysis by Product Type:

- Cups

- Clam Shells and Containers

- Plates

- Cutleries

- Others

Cups lead the market in 2024, majorly driven by their widespread usage in cafes, quick-service restaurants, and beverage outlets. The convenience, portability, and growing consumer demand for eco-friendly solutions make biodegradable cups a popular choice. As environmental concerns about plastic waste increase, consumers and businesses alike are leaning towards cups made from sustainable materials such as paper, bioplastics, and plant-based materials. Additionally, advancements in coating technologies to prevent leakage and maintain durability further boost the demand for biodegradable cups, ensuring they continue to lead the market as businesses seek more sustainable packaging solutions.

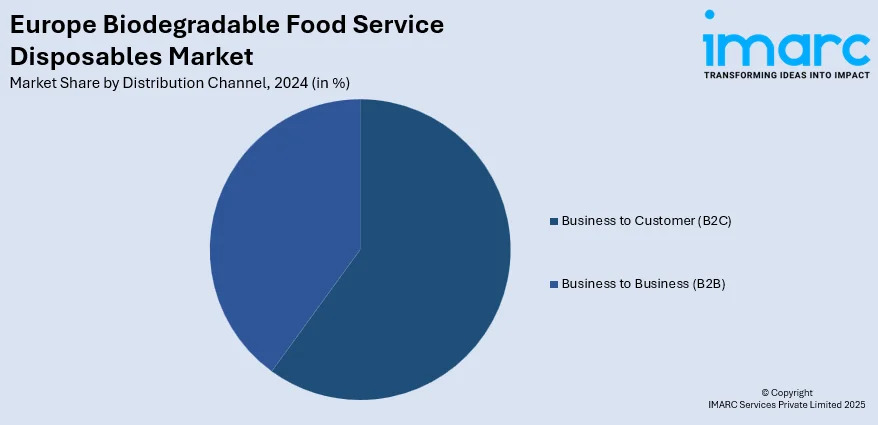

Analysis by Distribution Channel:

- Business to Customer (B2C)

- Business to Business (B2B)

The Business to Customer (B2C) segment is one of the major distribution channels in the market in 2024. This dominance is attributed to the increasing consumer preference for environmentally friendly products, driven by rising awareness of the environmental impact of disposable plastics. Retailers, especially in the food service and grocery sectors, are responding by offering biodegradable disposables to meet the demand from eco-conscious consumers. Online retail platforms are also playing a significant role in driving B2C sales by providing easy access to sustainable products for the average consumer, further boosting the market’s growth. The demand for direct consumer sales is expected to continue rising, supported by increasing consumer awareness and the adoption of sustainable living practices, creating a positive Europe biodegradable food service disposables market outlook.

The Business to Business (B2B) segment is a key contributor to the market, driven by the increasing demand from industries such as hospitality, foodservice chains, and institutional catering. In 2024, the B2B segment is experiencing substantial growth as businesses, particularly large-scale foodservice operators, seek to adopt more sustainable practices in response to consumer demand and government regulations. Many large enterprises and food chains are transitioning to biodegradable packaging for their takeaway and delivery services, recognizing the value of aligning with environmental sustainability goals. Additionally, the growing trend of corporate responsibility and environmental commitments from B2B companies is further driving the adoption of biodegradable foodservice disposables.

Country Analysis:

- Germany

- Italy

- United Kingdom (UK)

- France

- Spain

- Rest of Europe

In 2024, Germany accounted for the largest market share, largely due to its strong regulatory environment and commitment to environmental sustainability. The country’s emphasis on reducing plastic waste through legislative measures, including bans and restrictions on single-use plastics, is driving the shift towards biodegradable alternatives. Germany is also home to several key manufacturers of biodegradable disposables, further supporting its market dominance. The growing consumer demand for eco-friendly packaging, coupled with advancements in product development, positions Germany as a leader in the European market. As sustainability remains a key policy focus, Germany’s role in expanding the biodegradable disposables market is expected to grow even stronger in the years to come.

Competitive Landscape:

Key players in the Europe biodegradable food service disposables market are focusing on expanding their product portfolios and improving sustainability through innovative materials. Companies are increasingly investing in research and development to create cost-effective, eco-friendly alternatives to traditional plastic and paper products, such as plant-based and biopolymer-based disposables. They are also enhancing their manufacturing capabilities to meet the growing demand for sustainable packaging solutions in the food service industry. Moreover, partnerships between public and private sectors are accelerating the development of biodegradable materials. Major players are also improving their supply chain efficiency and offering customized solutions to cater to specific market needs, helping to maintain competitiveness in a rapidly evolving market. These efforts are aimed at strengthening their market positions and driving growth.

The report provides a comprehensive analysis of the competitive landscape in the Europe biodegradable food service disposables market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Booker launched its CaterPro packaging range, offering 255 disposable items including compostable boxes, straws, and wooden cutlery. Designed for pubs and bars offering takeaway and outdoor service, the range ensures food-grade quality and clear disposal guidance, catering to evolving consumer demands for sustainable, high-performance food-to-go packaging.

- May 2025: Starbucks began rolling out its new home-compostable and widely recyclable hot cups and fiber lids across ten European countries. Developed with partners in Wales and Italy, the innovation eliminated plastic linings, simplifying recycling and aligning with EU packaging regulations while enhancing sustainability in on-the-go beverage consumption.

- March 2025: NatureWorks introduced Ingeo Extend 4950D, a new PLA polymer enabling faster biodegradation and improved production efficiency of compostable BOPLA films. Ideal for food packaging like condiment packets and coffee pods, the material reduced costs, enhanced sealing, and met growing European regulatory demands for sustainable, compostable flexible packaging.

Europe Biodegradable Food Service Disposables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Material Types Covered | Pulp and Paper, Biopolymers, Leaves, Wood |

| Product Types Covered | Cups, Clamshells and Containers, Plates, Cutleries, Others |

| Distribution Channels Covered | Business to Business (B2B), Business to Customer (B2C) |

| Regions Covered | Germany, Italy, United Kingdom (UK), France, Spain, Rest of Europe |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe biodegradable food service disposables market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe biodegradable food service disposables market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe biodegradable food service disposables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biodegradable food service disposables market in Europe was valued at USD 1.60 Billion in 2024.

The Europe biodegradable food service disposables market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a value of USD 2.40 Billion by 2033.

The market is driven by environmental concerns over plastic waste, rising consumer demand for sustainable packaging, regulatory bans on single-use plastics, technological advancements in biodegradable materials, and increased public-private collaborations.

Germany accounts for the largest share in the Europe biodegradable food service disposables market due to strong regulatory support, manufacturing presence, and high consumer awareness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)