Europe Biopsy Devices Market Size, Share, Trends and Forecast by Procedure Type, Product, Application, Guidance Technique, End User, and Region, 2025-2033

Europe Biopsy Devices Market Analysis:

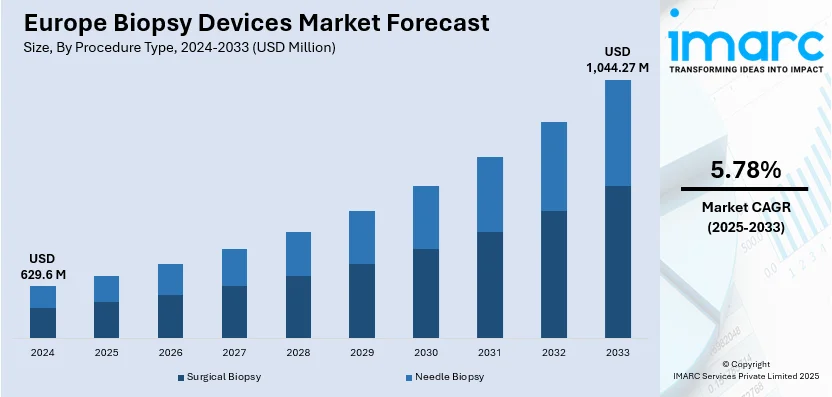

The Europe biopsy devices market size is estimated at USD 629.6 Million in 2024, and is expected to reach USD 1,044.27 Million by 2033, at a CAGR of 5.78% during the forecast period 2025-2033. The market is driven by the growing demand for advanced, cost-effective, and customizable solutions that enhance operational efficiency. Additionally, the rising need for minimally invasive procedures, compliance with strict regulatory standards, technological advancements in imaging and automation, and an increasing emphasis on early cancer detection and preventive healthcare, which ensures faster and more accurate diagnoses, are bolstering the market growth in Europe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 629.6 Million |

|

Market Forecast in 2033

|

USD 1,044.27 Million |

| Market Growth Rate (2025-2033) | 5.78% |

The increasing prevalence of cancer across Europe, particularly breast, lung, and prostate cancers, represents one of the key factors reshaping the Europe biopsy devices market outlook. Early diagnosis through biopsy procedures is essential for effective treatment, leading to a higher need for biopsy devices. Besides this, technological advancements like minimally invasive biopsy tools, such as needle biopsy, image-guided biopsy, and robotic biopsy systems, are improving the precision and comfort of the procedure. The incorporation of automation, artificial intelligence (AI), and digital imaging in biopsy equipment is enhancing precision, decreasing procedure duration, and improving overall patient care. These improvements are enhancing the accessibility of biopsy procedures and motivating healthcare professionals to embrace more advanced solutions.

Moreover, the governing bodies are implementing cancer screening programs, which promote early detection of cancers. These programs often rely on biopsy procedures to confirm diagnoses, thus contributing to higher demand for biopsy devices. Apart from this, continuous improvements in healthcare infrastructure, especially in diagnostic imaging, in European countries are facilitating the use of advanced biopsy devices in hospitals, diagnostic centers, and clinics. In addition, personalized medicine is becoming more popular, as treatments are increasingly customized to fit individual genetic profiles. Biopsy instruments are essential to this trend, especially via liquid biopsy technology and molecular profiling, offering vital information about cancer and other illnesses. This change is promoting the use of advanced biopsy tools that facilitate genetic testing and precise diagnostics.

Europe Biopsy Devices Market Trends:

Technological Advancements in Biopsy Devices

Advancements in biopsy tools, including the creation of automated systems and sophisticated imaging technologies, are fueling Europe biopsy devices market growth. In Europe, tools such as ultrasound-guided biopsy needles, robotic-assisted biopsy systems, and liquid biopsy methods are becoming increasingly popular because of their precision, user-friendliness, and capacity to deliver quick results. These technological developments allow healthcare providers to collect tissue samples more accurately, decreasing complications, shortening recovery time, and improving diagnostic precision. The use of AI in imaging and robotic technologies is enhancing the biopsy process, increasing targeting accuracy and facilitating real-time decision-making throughout procedures. Furthermore, the increasing demand for minimally invasive techniques is pushing the market towards advancements that enhance patient outcomes and decrease discomfort. In 2024, Hologic, Inc. introduced the Brevera Breast Biopsy System equipped with a 7-gauge needle in Europe. This recent enhancement improves the system's functions, allowing radiologists to acquire larger tissue samples more efficiently, which may lessen patient discomfort and shorten procedure duration. The system facilitates integration with current biopsy guidance technologies, optimizing workflows in breast imaging.

Increasing Awareness about Early Diagnosis

Public awareness campaigns and healthcare initiatives across Europe are emphasizing the importance of early cancer detection, driving a significant cultural shift toward proactive healthcare. Early diagnosis allows treatment to commence at an earlier stage, often resulting in improved survival rates and enhanced life quality for patients. Additionally, more individuals are seeking medical evaluations sooner, leading to a rise in the number of biopsies conducted to confirm or rule out diagnoses. This focus on preventive healthcare and early intervention is catalyzing the demand for biopsy procedures, as they play a critical role in providing accurate and timely diagnoses. Increased governmental support and funding for public health programs are also contributing to the accessibility of advanced diagnostic services. Moreover, the heightened awareness among both patients and healthcare professionals about the long-term benefits of early detection continues to reinforce the need for precise, reliable, and minimally invasive biopsy technologies across Europe. As per the article published in 2024, the European Commission highlighted its initiatives during the European Week Against Cancer (May 25-31), focusing on prevention, early detection, and treatment through the EU’s Beating Cancer Plan. Key actions include the #GetScreenedEU campaign, advanced cancer imaging, and addressing inequalities. Backed by €4 billion, the plan promotes innovation and enhanced patient care.

Growing Emphasis on Efficiency and Precision in Healthcare Procedures

The Europe biopsy devices market share is significantly increasing due to the rising demand for advanced, customizable solutions that enhance workflow efficiency and aligns with the broader trend of healthcare optimization. Also, the growing focus on streamlining healthcare procedures is improving operational efficiency in clinical settings, which is also propelling the Europe biopsy devices market size. The need for cost-effective, time-saving tools is driving the adoption of integrated biopsy systems and kits, offering streamlined processes for diagnostic and interventional procedures. Furthermore, compliance with stringent regulatory standards is fostering the development and approval of innovative biopsy technologies. This ensures that the devices meet high safety and performance standards, boosting their credibility and adoption. For instance, in 2024, SYNDEO Medical announced that it has obtained European Medical Device Regulation (MDR) approval for its SYNDEOPack Interventional Procedure Packs™ and Xssential Rapid Delivery Procedure Packs™. These procedure packs contain biopsy instruments, including soft tissue biopsy devices, designed to enhance interventional and surgical processes. The adaptable packs provide cost savings, less packaging, and improved process efficiency for healthcare professionals.

Europe Biopsy Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe biopsy devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on procedure type, product, application, guidance technique and end user.

Analysis by Procedure Type:

- Surgical Biopsy

- Needle Biopsy

Needle biopsy represents the largest segment, mainly because of its minimally invasive characteristics, shorter recovery periods, and high diagnostic precision. This method is commonly used for diagnosing different types of cancers, such as breast, prostate, and lung, because of its flexibility and efficiency. Improvements in imaging technologies like ultrasound and MRI guidance are enhancing the accuracy of needle biopsies, enabling precise tissue sampling with lesser discomfort for patients. The rising inclination towards outpatient and ambulatory procedures is increasing the use of needle biopsy methods. As biopsy needle designs and techniques continue to advance, this segment is becoming more preferred as a key method for early and accurate disease diagnosis.

Analysis by Product:

- Biopsy Guidance Systems

- Needle Based Biopsy Guns

- Biopsy Needles

- Biopsy Forceps

- Others

Needle-based biopsy guns dominate the market share due to their effectiveness, accuracy, and common application in multiple biopsy techniques. These instruments are greatly preferred due to their capacity to collect high-quality tissue samples with low invasiveness, rendering them suitable for uses such as breast, prostate, and lung biopsies. The incorporation of sophisticated functionalities, like automatic and semi-automatic systems, improves user-friendliness and minimizes procedural duration, positively impacting both healthcare providers and patients. The versatility of needle-based biopsy guns for different imaging guidance methods, such as ultrasound and MRI, further enhances their usefulness. Ongoing advancements in design and materials, combined with a keen emphasis on enhancing procedural results, strengthen their leading position in the market.

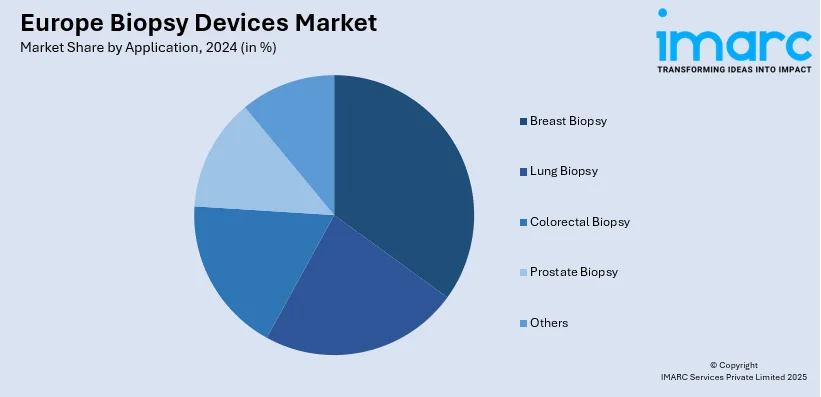

Analysis by Application:

- Breast Biopsy

- Lung Biopsy

- Colorectal Biopsy

- Prostate Biopsy

- Others

Breast biopsy leads the market, supported by the high occurrence of breast cancer and the increasing focus on early detection initiatives. Breast biopsy methods like core needle biopsy and vacuum-assisted biopsy are commonly employed due to their precision in identifying malignant and benign lesions. The growing use of minimally invasive techniques and imaging-assisted procedures, such as ultrasound and stereotactic navigation, is improving patient outcomes and shortening recovery periods. Public health efforts and screening programs throughout Europe are greatly boosting the number of women receiving diagnostic assessments, thereby enhancing the demand for breast biopsy instruments. Consistent improvements in biopsy instruments, along with continuous research efforts, are anticipated to support the expansion of this sector.

Analysis by Guidance Technique:

- Ultrasound-guided Biopsy

- Stereotactic-guided Biopsy

- MRI-guided Biopsy

- Others

Ultrasound-guided biopsy dominates the market primarily because of its adaptability, real-time imaging features, and extensive accessibility in various healthcare environments. This method allows for accurate targeting of lesions, reducing complications and enhancing diagnostic precision. Its non-intrusive characteristics and suitability for different anatomical locations make it a favored option among healthcare professionals for identifying conditions like breast, thyroid, and abdominal cancers. Moreover, procedures guided by ultrasound are more economical than other imaging-based methods, which promotes their use. The method's effectiveness in outpatient and ambulatory environments, along with progress in portable ultrasound technology, has broadened its uses, establishing it as a crucial element of the diagnostic process within Europe’s healthcare systems.

Analysis by End User:

- Hospitals and Clinics

- Academic and Research Institutes

- Others

Hospitals and clinics account for the majority of the market share because of their essential function in delivering specialized diagnostic and treatment services. These establishments frequently utilize sophisticated biopsy instruments and imaging technologies, guaranteeing accurate and dependable diagnostic results. The rising incidence of cancer is leading to a heightened number of biopsy procedures conducted in hospitals and clinics, reinforcing their leadership in this area. Moreover, the availability of qualified healthcare practitioners and the incorporation of interdisciplinary care methods in these environments improves the overall patient experience. Serving as central points for innovation and clinical studies, hospitals and clinics are crucial in embracing and normalizing new biopsy methods throughout Europe.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The United Kingdom represents the largest segment due to its strong healthcare infrastructure and significant emphasis on early cancer diagnosis and treatment. The nation boasts a comprehensive network of diagnostic facilities and hospitals fitted with cutting-edge biopsy technologies, guaranteeing accessibility and effectiveness in operations. Increased cancer awareness campaigns and initiatives from organizations such as the NHS boost the demand for biopsy devices. Moreover, the existence of leading research entities and partnerships with medical device firms is promoting innovation and the uptake of advanced diagnostic technologies. In 2024, SOPHiA GENETICS and AstraZeneca announced a partnership to roll out the MSK-ACCESS® powered with SOPHiA DDM™ liquid biopsy test to 20 institutions globally within a year, including universities in the UK. This initiative aims to make liquid biopsy testing more accessible, complementing traditional solid tissue biopsies for improved cancer diagnosis, monitoring, and treatment.

Competitive Landscape:

Major participants in the market are concentrating on product development and technological progress to enhance their market position. Numerous individuals are putting money into improving the accuracy and precision of biopsy techniques by creating advanced imaging technologies, including ultrasound-guided and MRI-guided biopsy systems. Furthermore, firms are broadening their product ranges to encompass automated and minimally invasive biopsy options, enhancing patient results and decreasing procedure durations. Collaborations, alliances, and strategic mergers and acquisitions are being sought to expand geographical presence and enhance operational efficiency, assisting companies in sustaining a competitive advantage in the market. In 2024, Prothea Technologies, a spin-off from the Universities of Bath and Edinburgh, emerged to transform lung cancer diagnosis and treatment by facilitating biopsy and therapy in one visit. The firm seeks to tackle problems related to imprecise biopsies and minor lesion management through a sophisticated endoscope and laser-ablation technology, backed by a €12M funding. Prothea utilizes fiber-optic technology along with clinical knowledge to enhance patient outcomes and alleviate hospital burdens.

The report provides a comprehensive analysis of the competitive landscape in the Europe biopsy devices market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: A novel Irish technology, CLISTEPROBE, was launched to decrease the waiting period for breast cancer biopsy results. Developed by University College Cork and Health Innovation Hub Ireland, it utilizes real-time bioimpedance sensors to rapidly differentiate between cancerous and non-cancerous tissue. This advancement aims to reduce superfluous procedures, ease the burden on radiologists, and provide faster, more accurate diagnoses.

- January 2024: Clatterbridge Cancer Centre launched a digital plan aimed at improving patient care, staff productivity, and research via data and technology. As a component of this strategy, they tested the OnControl powered biopsy device, which greatly reduces the duration of the bone marrow biopsy process, resulting in less stress and discomfort for patients.

Europe Biopsy Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Procedure Types Covered | Surgical Biopsy, Needle Biopsy |

| Products Covered | Biopsy Guidance Systems, Needle Based Biopsy Guns, Biopsy Needles, Biopsy Forceps, Others |

| Applications Covered | Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy, Others |

| Guidance Techniques Covered | Ultrasound-guided Biopsy, Stereotactic-guided Biopsy, MRI-guided Biopsy, Others |

| End Users Covered | Hospitals and Clinics, Academic and Research Institutes, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe biopsy devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe biopsy devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe biopsy devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe biopsy devices market was valued at USD 629.6 Million in 2024.

The European biopsy devices market is driven by advancements in less invasive procedures, increasing prevalence of cancer, and the escalating demand for early disease detection. Technological innovations in biopsy devices, such as automated systems and imaging guidance, enhance precision. Additionally, the growing focus on personalized medicine and improved reimbursement policies is positively influencing the market.

IMARC estimates the biopsy device market to exhibit a CAGR of 5.78% during 2025-2033.

In 2024, needle biopsy represented the largest segment by procedure type, driven by its less invasive nature, high accuracy in tissue sampling, and the increasing preference for outpatient procedures.

Needle based biopsy guns lead the market by product owing to their precision, minimal invasiveness, and ability to collect high-quality tissue samples for accurate diagnosis in various medical conditions.

Breast biopsy is the leading segment by application, driven by the growing prevalence of breast cancer, advancements in diagnostic technologies, and rising awareness about early detection and treatment options.

In 2024, ultrasound-guided biopsy represented the largest segment by guidance technique attributed to its non-invasive nature, cost-effectiveness, and widespread use in diagnosing various conditions like cancer and musculoskeletal disorders.

Hospitals and clinics lead the market by end user due to their high patient volumes, advanced medical infrastructure, and the increasing demand for efficient, cost-effective healthcare services.

On a regional level, the market has been classified into Germany, France, United Kingdom, Italy, Spain, Others, wherein United Kingdom currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)