Europe Butterfly Valve Market Size, Share, Trends and Forecast by Product Type, Material Type, Design, Function, End Use Industry, and Country, 2025-2033

Europe Butterfly Valve Market Size and Share:

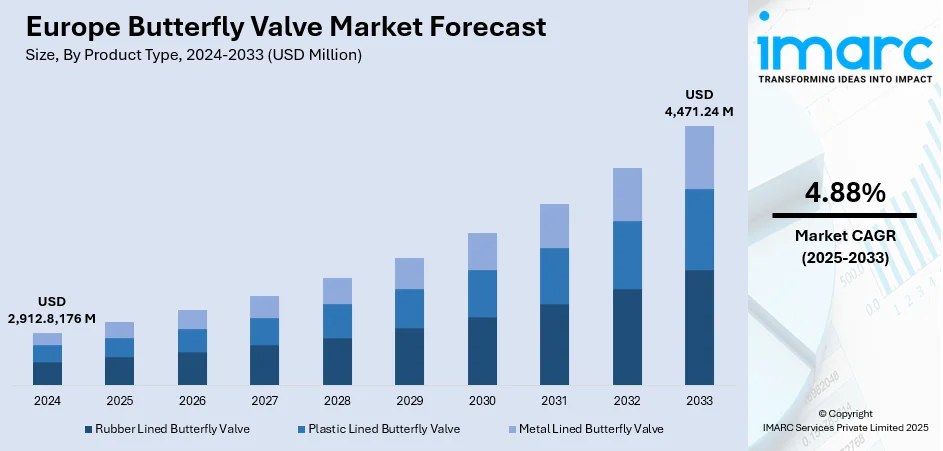

The Europe butterfly valve market size was valued at USD 2,912.8,176 Million in 2024. Looking forward, the market is projected to reach USD 4,471.24 Million by 2033, exhibiting a CAGR of 4.88% during 2025-2033. United Kingdom currently dominates the market in 2024. The market is driven by the rising demand for advanced flow control solutions in industries like oil and gas, power generation, and water treatment. Moreover, the growing emphasis on environmental compliance and efficiency is propelling the market forward, supported by innovations in valve designs and materials. These factors are expected to sustain market growth, further augmenting the Europe butterfly valve market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,912.8,176 Million |

|

Market Forecast in 2033

|

USD 4,471.24 Million |

| Market Growth Rate 2025-2033 | 4.88% |

The market in Europe is mainly driven by the rising demand for advanced flow control solutions in industries such as oil and gas, power generation, and water treatment. In line with this, the increasing investment in renewable energy systems is propelling the need for reliable and efficient valves in energy production. In January 2024, Warex Valve partnered with ChemValve-Schmid to distribute the ChemFlyer | CST PTFE butterfly valve, designed for aggressive and corrosive media. Featuring a one-piece disc and polished sealing surfaces, it reduces torque and extends service life, with flexibility for custom modifications. The valve operates from -60°C to 200°C and complies with standards like PED 2014/68/EU and ATEX 2014/34/EU. Moreover, the growing regulatory pressure for environmental compliance and the need to optimize industrial operations are also acting as significant factors for Europe butterfly valve market growth.

To get more information on this market, Request Sample

In addition to this, the advancement in butterfly valve designs, with features like automation and real-time monitoring, is further augmenting their adoption across various sectors. Besides this, the rise in industrial production and infrastructure development activities is increasing the demand for high-performance flow control solutions, boosting market expansion. In May 2025, Georg Fischer (GF) announced its acquisition of Germany-based VAG-Group, a leading manufacturer of water utility valves including butterfly valves, for CHF 200 Million (approximately USD 218.1 Million). The acquisition strengthens GF's position in the infrastructure sector, particularly in Europe and the Middle East, as VAG's products are crucial for water and power infrastructure. The market is further supported by ongoing innovations in materials and technologies that enhance valve durability and efficiency, ensuring long-term functionality in challenging applications.

Europe Butterfly Valve Market Trends:

Renewable Energy Investment and Demand for Butterfly Valves

As of 2024, as reported, 46.9% of net electricity generated in the EU came from renewable energy sources, which underscores the growing investment in clean energy infrastructure, driving the demand for components like butterfly valves used in controlling flow in renewable systems. This shift is driving significant demand for components like butterfly valves, which are essential for controlling flow in renewable energy systems such as wind, solar, and hydroelectric power. Butterfly valves help regulate the flow of gases and liquids in energy systems, ensuring optimal performance and safety in renewable power plants. With an increasing number of renewable projects being undertaken, the demand for efficient, durable, and high-performance butterfly valves is anticipated to rise in tandem, which is one of the emerging Europe butterfly valve market trends. These valves play a critical role in maintaining system integrity, which is particularly important as renewable energy systems often operate under variable conditions, requiring precise flow control. The growth in renewable energy investment is thus fueling the demand for these valves, solidifying their essential role in the green energy transition.

Environmental Compliance and Industrial Applications

According to the European Environment Agency (EEA), air pollution from Europe’s largest industrial plants costs the region between USD 289.4 Billion to 462.2 Billion annually, highlighting the urgency for more efficient and environmentally compliant industrial equipment further supporting the uptake of high-quality butterfly valves in emission-sensitive applications. This economic toll has spurred a shift toward cleaner technologies in industrial plants, where butterfly valves are widely used for controlling air, gas, and fluid flow in emissions-sensitive applications. The rise in environmental regulations and the push toward reducing industrial emissions are leading to a higher demand for high-quality, durable butterfly valves that meet stringent standards. These valves are critical in controlling exhaust gases, optimizing air filtration, and minimizing pollutants, which are necessary for industries to comply with emission standards. As per the Europe butterfly valve market forecast, with regulatory frameworks continuing to tighten, the adoption of such advanced flow control solutions will become even more critical, driving market growth in the industrial sector.

Industrial Growth and Infrastructure Development

In March 2025, seasonally adjusted industrial production increased by 2.6% in the euro area and 1.9% in the EU, signaling renewed activity in manufacturing and infrastructure development. This uptick in industrial activity is expected to lead to higher demand for components like butterfly valves, which are integral in various industrial applications, including fluid control in pipelines, HVAC systems, and power generation. As infrastructure projects ramp up, the need for efficient, reliable, and cost-effective flow control solutions becomes paramount. Butterfly valves, with their ability to handle high-pressure systems and their versatility in different industrial settings, are becoming an essential part of the manufacturing process. The ongoing industrial growth, coupled with increased investment in infrastructure, creates opportunities for the butterfly valve market to expand, meeting the rising demand for dependable flow control solutions in both new and upgrading facilities.

Europe Butterfly Valve Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Europe butterfly valve market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, material type, design, function, and end-use industry.

Analysis by Product Type:

- Rubber Lined Butterfly Valve

- Plastic Lined Butterfly Valve

- Metal Lined Butterfly Valve

The metal lined butterfly valve is the leading product type in the market as of 2024. Known for their durability and high performance, metal-lined valves are widely used in applications where strength and resistance to harsh operating conditions are essential. These valves are primarily utilized in industries like oil and gas, chemical processing, and power generation. Their ability to withstand high pressures, extreme temperatures, and corrosive fluids makes them ideal for critical applications that demand reliability and longevity. As industries shift toward more demanding operational environments, the demand for metal-lined butterfly valves continues to rise. Their robust construction ensures superior sealing capabilities, contributing to their growing adoption. Furthermore, advancements in metal alloys and coatings have further enhanced the performance and lifespan of these valves, solidifying their position as the largest component in the market.

Analysis by Material Type:

- Stainless Steel

- Cast Iron

- Aluminum

- Others

Stainless steel continues to lead the market in 2024 due to its superior properties like resistance to corrosion, strength, and longevity. Stainless steel is a preferred material choice in demanding industries such as oil and gas, water treatment, and power generation, where high-pressure and high-temperature resistance is essential. The material’s resistance to corrosion, particularly in water and wastewater applications, makes it ideal for maintaining the integrity of the valve over extended periods. Stainless steel valves are also favored for their aesthetic appeal and ease of maintenance. Furthermore, the growing focus on sustainability and cost-efficiency is driving the preference for stainless steel, as it has a longer service life compared to other materials. Its versatility in various applications, including aggressive chemical environments, positions stainless steel butterfly valves as the dominant material in the market and creates a positive Europe butterfly valve market outlook.

Analysis by Design:

- Centric Butterfly Valve

- Single-Eccentric Butterfly Valve

- Double-Eccentric Butterfly Valve

- Triple-Eccentric Butterfly Valve

In 2024, the triple-eccentric butterfly valve remains the leading design in the European market, largely due to its superior sealing capabilities and ability to handle high-pressure applications. This valve design features three key eccentricities, which enhance its sealing performance, especially when compared to other designs like centric or single-eccentric valves. The triple-eccentric design ensures a more durable, tight shutoff and a longer operational life, which is essential for industries like oil and gas, water and wastewater, and power generation. The design's ability to handle high flow rates and withstand extreme conditions makes it ideal for critical applications requiring precise control and minimal leakage. Additionally, its unique design minimizes wear and tear on the sealing elements, further contributing to its longevity. As industries demand higher performance and efficiency, the triple-eccentric butterfly valve continues to dominate the market in 2024.

Analysis by Function:

- On/Off Valve

- Control Valve

The on/off valve function leads the market in 2024, due to its straightforward operation and widespread use in applications requiring basic flow control. On/off valves are designed to either fully open or close the valve, providing a simple and efficient solution for isolating or controlling the flow of fluids or gases in various industrial systems. These valves are widely used in applications like oil and gas, power generation, and water treatment, where the need for fast, reliable, and cost-effective flow regulation is paramount. Their ease of use and reliability in on/off operations make them highly popular in industries with minimal need for intermediate flow regulation. The growth of industries requiring basic control systems is further fueling the demand for on/off valves, solidifying their position as the leading function in the European market.

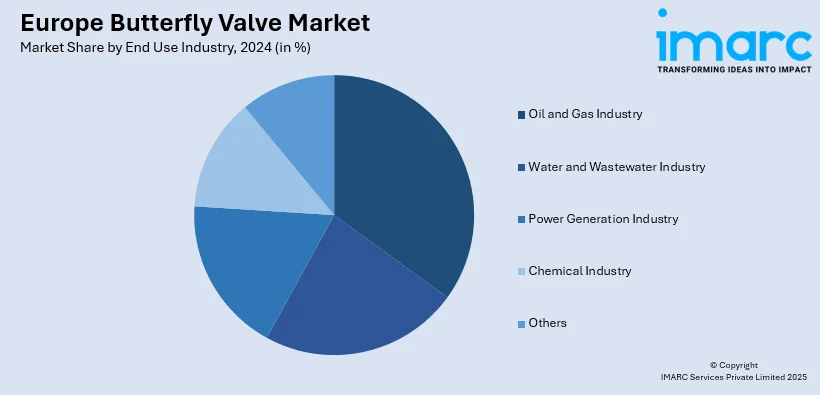

Analysis by End Use Industry:

- Oil and Gas Industry

- Water and Wastewater Industry

- Power Generation Industry

- Chemical Industry

- Others

The oil and gas industry remains the dominant end use industry of butterfly valves in Europe, with the sector accounting for the largest market share in 2024. Butterfly valves are crucial in the oil and gas industry for regulating the flow of liquids and gases in pipelines, refinery units, and offshore platforms. Their ability to operate under high pressure and extreme temperatures makes them ideal for use in upstream, midstream, and downstream applications. Additionally, the oil and gas sector’s increasing investment in infrastructure, particularly in Europe’s offshore oil and gas reserves, is further driving the demand for reliable and durable flow control solutions like butterfly valves. As the industry continues to face challenges such as stringent environmental regulations and operational safety requirements, the demand for high-performance butterfly valves remains strong, positioning the oil and gas industry as the largest consumer of these products in Europe.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, the United Kingdom accounted for the largest market share in the market. This can be attributed to the UK's well-established industrial base, particularly in sectors such as oil and gas, power generation, and water treatment. The country's strong infrastructure and investments in renewable energy projects have further spurred the demand for butterfly valves. Additionally, the UK’s ongoing commitment to environmental regulations and improving energy efficiency requires the integration of high-quality, reliable components like butterfly valves in various industrial processes. The growing industrial activities, coupled with a shift toward sustainable and efficient technologies, positions the UK as the leading market for butterfly valves in Europe. As the demand for advanced flow control solutions continues to rise, the United Kingdom remains a key player in the European butterfly valve industry.

Competitive Landscape:

In the Europe butterfly valve market, key players are focusing on advancing their product offerings to meet the increasing demand for high-performance valves across industries such as oil and gas, water treatment, and power generation. These companies are investing heavily in research and development to improve valve efficiency, durability, and environmental sustainability. A major trend is the development of butterfly valves with enhanced sealing capabilities, especially for use in high-pressure and high-temperature applications. Many players are also incorporating advanced materials like stainless steel and specialized coatings to increase the lifespan and reduce maintenance costs. Moreover, these companies are strategically expanding their geographical presence through partnerships and acquisitions to strengthen their market footprint.

The report provides a comprehensive analysis of the competitive landscape in the Europe butterfly valve market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: ASC unveiled the latest addition to its extensive range of industry-leading valves and actuation products – the Gruvlok® Series 8700 Offset Disc Butterfly Valve. This new valve, available in sizes ranging from 2 to 8 inches, is designed for easy installation in commercial grooved-end systems. Ideal for water, hydrocarbons, and compressed air systems, the Gruvlok® Series 8700 promises enhanced performance and reliability for a variety of industrial applications.

- November 2024: Heap & Partners expanded their Phase valve portfolio by launching a new range of Butterfly Valves, including concentric, double offset, and triple offset designs. Built for demanding applications, these valves handled pressures up to 40 Barg and temperatures up to 500ºC, targeting sectors like marine, oil & gas, and power.

- June 2024: Severn Glocon launched its Oblique Cone Technology (OCT) Triple Offset Butterfly Valve, leveraging over 60 years of engineering expertise. The circular sealing geometry improved shut-off reliability and durability over traditional elliptical designs, offering enhanced performance and minimal downtime for critical operations in oil, gas, chemical, and energy sectors.

Europe Butterfly Valve Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Rubber Lined Butterfly Valve, Plastic Lined Butterfly Valve, Metal Lined Butterfly Valve |

| Material Types Covered | Stainless Steel, Cast Iron, Aluminum, Others |

| Designs Covered | Centric Butterfly Valve, Single-Eccentric Butterfly Valve, Double-Eccentric Butterfly Valve, Triple-Eccentric Butterfly Valve |

| Functions Covered | On/Off Valve, Control Valve |

| End Use Industries Covered | Oil and Gas Industry, Water and Wastewater Industry, Power Generation Industry, Chemical Industry, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe butterfly valve market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe butterfly valve market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe butterfly valve industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The butterfly valve market in Europe was valued at USD 2,912.8,176 Million in 2024.

The Europe butterfly valve market is projected to exhibit a CAGR of 4.88% during 2025-2033, reaching a value of USD 4,471.24 Million by 2033.

The market is driven by rising demand for advanced flow control solutions in industries like oil and gas, power generation, and water treatment, alongside increased renewable energy investments and stricter environmental regulations. Innovations in valve designs, like automation and real-time monitoring, further propel growth.

The United Kingdom currently dominates the Europe butterfly valve market in 2024.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)