Europe Cable Accessories Market Size, Share, Trends and Forecast by Voltage, Installation, End User, and Country, 2025-2033

Europe Cable Accessories Market Size and Share:

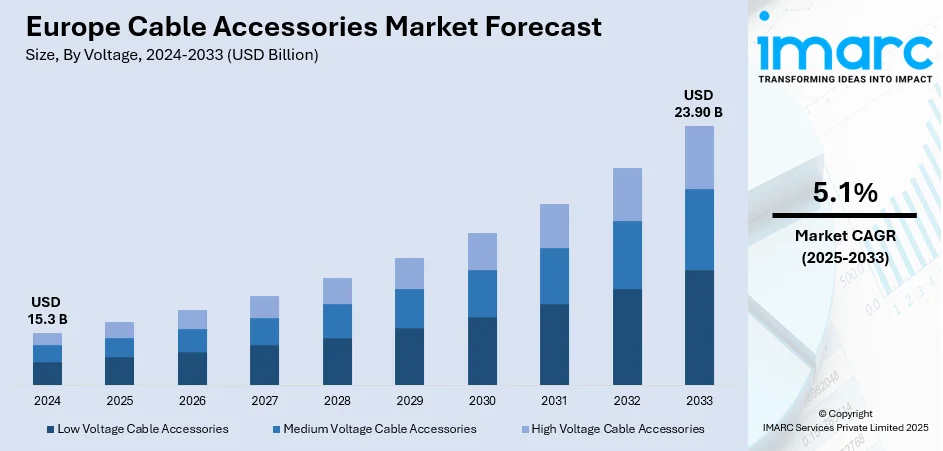

The Europe cable accessories market size was valued at USD 15.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.90 Billion by 2033, exhibiting a CAGR of 5.1% during 2025-2033. Germany dominated the market in 2024. Renewable energy projects, smart grid expansion, infrastructure upgrades, industrial automation, offshore wind farms, and stricter energy efficiency regulations driving demand in medium- and high-voltage segments are some of the factors contributing to the Europe cable accessories market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.3 Billion |

|

Market Forecast in 2033

|

USD 23.90 Billion |

| Market Growth Rate 2025-2033 | 5.1% |

The market is growing due to several factors. The shift toward renewable energy, including wind and solar projects, increases demand for reliable cabling systems. Modernization of aging power grid infrastructure requires advanced accessories to ensure efficient transmission and distribution. Rising adoption of underground cabling, aimed at improving safety and aesthetics in urban areas, also supports demand. Expanding construction activities, both residential and commercial, boost the need for low- and medium-voltage cable solutions. Stricter safety and quality regulations in the region drive manufacturers to develop durable, high-performance products. Technological advancements in cable insulation, joints, and terminations enhance performance and service life. Additionally, cross-border electricity trade in Europe is creating new opportunities for high-voltage cable installations, further supporting Europe cable accessories market growth.

To get more information on this market, Request Sample

Expanding subsea cable networks are boosting Europe’s digital capacity, cutting latency, and enabling faster, more reliable data flows. These systems drive 5G rollout, strengthen cloud services, and support economic growth. Enhanced connectivity fosters innovation, attracts investment, and reinforces Europe’s position as a competitive force in global telecommunications. For instance, in July 2025, Libya inaugurated the 8,700-kilometre Medusa subsea cable on May 11, 2025, linking Tripoli, Misrata, and Benghazi to Europe. Spearheaded by LPTIC, the project enhanced internet speed, supported 5G networks and cloud services, and strengthened Libya’s role in cross-border digital infrastructure and European telecommunications integration.

Europe Cable Accessories Market Trends:

Growing Focus on Renewable Energy Infrastructure

Across Europe, investment in sustainable power generation is prompting an upgrade of supporting electrical networks, shaping the Europe cable accessories market outlook. Expansion of wind, solar, and other low-carbon energy sources is increasing the need for advanced cable systems capable of managing higher loads, longer distances, and complex interconnections. Utilities and developers are prioritizing solutions that enhance efficiency, reduce losses, and perform reliably under varying environmental conditions. This is driving interest in accessories designed for durability, safety, and easy installation, with materials and designs adapted for both land-based and offshore applications. As energy systems become more diversified and interconnected, demand for high-performance cabling components is set to rise, influencing product innovation and supply strategies across the region. According to reports, 46.9% of the net electricity generated in the EU in 2024 came from renewable energy sources, highlighting the region’s strong shift toward sustainable energy and the corresponding need for robust cable infrastructure to support this transformation.

Surge in Grid Modernization Initiatives

Europe’s push toward a secure and low-carbon electricity system is fueling large-scale grid modernization projects. Efforts to expand capacity, improve flexibility, and integrate renewable energy sources are accelerating demand for advanced transmission and distribution solutions. This includes upgrades to aging infrastructure, deployment of smart grid technologies, and expansion of interconnections across countries. According to the Europe cable accessories market forecast, the scale of planned investments is prompting innovation in materials, designs, and installation techniques for cables and accessories, ensuring long-term reliability and efficiency. As the electrification of transport, industry, and heating gathers pace, the supporting grid network must adapt to handle fluctuating demand and decentralized generation, creating significant opportunities for high-performance electrical components across the region. A recent report indicates that Europe requires USD 630.72 Billion in grid investments by 2030 to enable a secure, flexible, and decarbonized electricity system.

Integration of Smart Monitoring in Cable Accessories

Manufacturers are introducing cable accessories with built-in sensing capabilities to improve real-time monitoring and asset management in power networks, reflecting Europe cable accessories market trends toward smarter, more connected equipment. These solutions can capture operational data such as current and voltage, enabling utilities to detect anomalies, optimize performance, and extend equipment life. Designed for compatibility with transformers and both air- and gas-insulated switchgear, such products support predictive maintenance strategies and enhance system reliability. The adoption of sensor-equipped accessories aligns with the broader move toward digitalized grid infrastructure, where condition-based monitoring reduces downtime and operational costs. As utilities prioritize smarter, more connected equipment, the role of intelligent cable components is becoming increasingly important in modern energy systems. For instance, the 3M Company offers QS20, a sensor-equipped cable accessory that can be used to measure real-time data related to current and voltage. It is designed to work with transformers and air and gas-insulated switchgear.

Europe Cable Accessories Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe cable accessories market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on voltage, installation, and end user.

Analysis by Voltage:

- Low Voltage Cable Accessories

- Medium Voltage Cable Accessories

- High Voltage Cable Accessories

High voltage cable accessories stood as the largest segment based on voltage in 2024 as utilities and industries upgrade and expand transmission networks to handle growing electricity needs and integrate renewable sources. These accessories, such as joints, terminations, and connectors, are essential for ensuring reliable performance, safety, and efficiency in high-voltage power transmission. Rising investments in offshore wind farms, cross-border interconnections, and grid modernization projects are fueling the procurement of these components. Additionally, the push toward underground cabling in urban areas to reduce visual impact and improve resilience against weather events is boosting their adoption. With strict EU regulations on energy efficiency and system reliability, suppliers of high voltage cable accessories are benefiting from a steady stream of projects across the region, making this segment a key driver of the cable accessories market.

Analysis by Installation:

- Overhead Cable Accessories

- Underground Accessories

Underground accessories led the market in 2024 since countries transitioned to more resilient and aesthetically unobtrusive power networks. Governments and utilities are increasingly replacing overhead lines with underground systems to reduce outage risks from storms, enhance safety, and preserve urban and rural landscapes. This shift drives demand for accessories such as joints, terminations, connectors, and glands specifically designed for underground installations. The expansion of metro rail projects, smart cities, and renewable energy integration further boosts the need for reliable underground cabling solutions. Advanced materials and designs are also extending service life and reducing maintenance costs, encouraging adoption. With strong regulatory backing for grid modernization and environmental protection, the underground accessories segment is becoming a major growth driver in Europe’s cable accessories market.

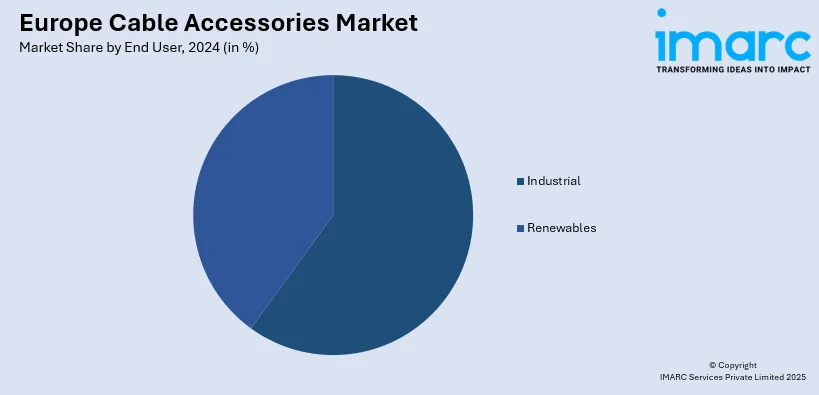

Analysis by End User:

- Industrial

- Renewables

Industrial led the market in 2024, driven by the rapid modernization of manufacturing facilities and the expansion of heavy industries. Sectors like automotive, chemicals, steel, and food processing require extensive power distribution networks and control systems, all of which rely on durable cable accessories such as connectors, glands, terminations, and joints. The ongoing shift toward Industry 4.0, automation, and advanced machinery increases demand for high-performance, heat-resistant, and corrosion-resistant components. Large-scale industrial projects, especially in Eastern Europe, are adding to procurement volumes. Additionally, investments in renewable energy-powered industrial operations and compliance with stringent EU safety and efficiency regulations are pushing companies to upgrade cabling infrastructure, solidifying the industrial segment’s role as a key driver in the European cable accessories market.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share due to its well-established industrial base, extensive power grid, and ongoing modernization of transmission infrastructure. The country’s strong focus on renewable energy, especially wind and solar, has driven the need for advanced cable accessories to ensure efficient power transmission and distribution. Urbanization and the development of smart grid projects have further boosted demand. Germany’s strict quality and safety standards also encourage the adoption of high-performance, durable cable accessories. Its strong manufacturing capabilities and presence of leading industry players contribute to consistent supply and innovation in the sector. With government initiatives promoting sustainable energy and upgrading aging networks, Germany continues to be the leading market in Europe for cable accessories.

Competitive Landscape:

The cable accessories market in Europe has been active with new product launches, strategic partnerships, and supply agreements among leading manufacturers. Companies are expanding production capabilities and forming alliances to meet rising demand, especially for high-voltage and subsea applications. Governments are involved through infrastructure investments, nationalization of strategic manufacturers, and initiatives to improve cable security and maintenance. Industry players are also investing in research and development to enhance the performance, durability, and efficiency of products. Collaboration between utilities, technology providers, and cable producers is common, as it helps accelerate project timelines and strengthen supply chains. At present, partnerships and large-scale agreements are the most widespread practice, often backed by government support or long-term investment commitments.

The report provides a comprehensive analysis of the competitive landscape in the Europe cable accessories market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Strongway Gym Supplies UK launched a compact Smith Machine with integrated cables, targeting home users seeking comprehensive strength training. The unit supported multiple exercises with built-in stations and a tidy weight stack, offering a safe and efficient alternative to commercial gym gear for households with limited space.

- May 2025: Baseus launched its Enercore power accessories range with retractable cables, supporting fast, multi-speed charging for mobile and laptop devices. These smart products included AI-powered thermal management and universal travel adapters. The retractable design improved cable storage and usability, aligning with innovations from Ugreen and Anker for mobile connectivity in Europe.

Europe Cable Accessories Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Voltages Covered | Low Voltage Cable Accessories, Medium Voltage Cable Accessories, High Voltage Cable Accessories |

| Installations Covered | Overhead Cable Accessories, Underground Accessories |

| End Users Covered | Industrial, Renewables |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe cable accessories market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe cable accessories market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe cable accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cable accessories market in Europe was valued at USD 15.3 Billion in 2024.

The Europe cable accessories market is projected to exhibit a CAGR of 5.1% during 2025-2033, reaching a value of USD 23.90 Billion by 2033.

The Europe cable accessories market is driven by the expansion of renewable energy projects, modernization of power grids, rising demand for high-voltage cables, growing construction activities, and stricter safety regulations. Increasing adoption of underground cabling and advancements in material technology also contribute to market growth across the region.

Germany accounted for the largest share of the market in 2024 due to its advanced industrial infrastructure, strong renewable energy investments, and high demand for efficient power distribution systems across various commercial and residential applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)