Europe Caramel Chocolate Market Size, Share, Trends and Forecast by Distribution Channel and Country, 2025-2033

Europe Caramel Chocolate Market Size and Share:

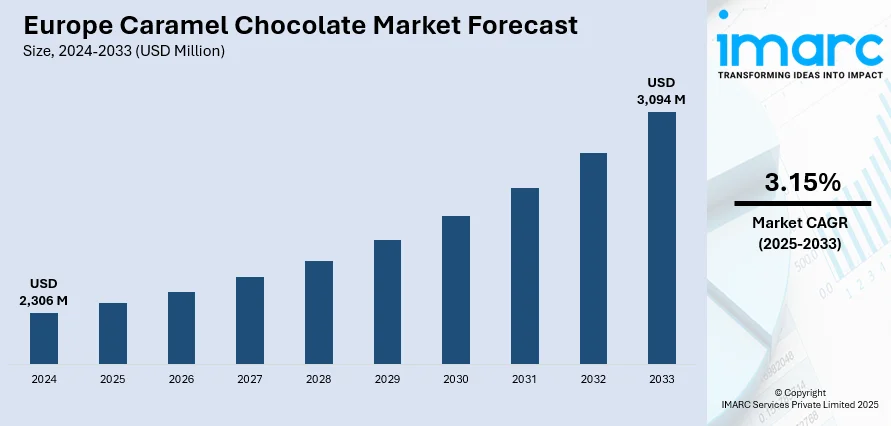

The Europe caramel chocolate market size was valued at USD 2,306 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,094 Million by 2033, exhibiting a CAGR of 3.15% during 2025-2033. Germany currently dominates the market, holding a significant share in 2024. The market is fueled by its rich food culture and extensive desire for high-end, indulgent offerings. Increased health awareness also prompts the creation of clean-label, natural, and plant-based caramel chocolates. This combination of tradition and contemporary wellness trends and increasing consumer segments in the region, directly affects the Europe caramel chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,306 Million |

|

Market Forecast in 2033

|

USD 3,094 Million |

| Market Growth Rate 2025-2033 | 3.15% |

Europe's ancient tradition of high-quality chocolate craftsmanship is one of the chief drivers propelling the caramel chocolate market. Belgium, Switzerland, and France are among those nations that have centuries-long traditions of chocolate manufacturing, which sets high expectations for quality, taste nuance, and traditional techniques on the part of consumers. This tradition instills innovation into caramel-enveloped chocolates as manufacturers try different caramel textures, ranging from soft and creamy to crunchy and salty, to appeal to discerning European tastes. Increasing consumer demand for premium and indulgent confections is a reflection of cultural affection for high-quality confectionery, frequently associated with gift-giving occasions, celebrations, and personal treat indulgence. This cultural environment fosters support for specialty caramel chocolates that combine deep cocoa with buttery, caramelized sugar flavor, fitting for consumers seeking both heritage and innovation. Moreover, European consumers tend to be keen on ethically produced ingredients and open labeling, which encourages companies to emphasize fair trade cocoa and natural caramel ingredients, reinforcing expansion and increasing the Europe caramel chocolate market demand through appeals to regional values.

To get more information on this market, Request Sample

While indulgence is a significant factor, heightened health consciousness in Europe also influences consumer behavior toward caramel chocolate purchases. European consumers increasingly examine ingredient panels and demand products featuring natural, recognizable ingredients with fewer artificial additives. This movement compels manufacturers to produce caramel chocolates with cleaner labels, utilizing organic milk, natural sweetener, and excluding synthetic preservatives or coloring. In addition, portion-control packaging and guilt-free indulgence in balanced content products demonstrate growing interest due to lifestyle change and moderation-focus. Increasing veganism and consumer awareness of lactose intolerance in Europe drive innovation in plant-based dairy-free caramel chocolates responding to niche consumer demands. This health-aware attitude, with the added interest in original tastes and high-quality ingredients, motivates the creation of artisanal caramel chocolates that are seen as tasty and ethically produced, enabling brands to tap into new markets while staying attractive to conventional chocolate aficionados.

Europe Caramel Chocolate Market Trends:

Increasing Salted Caramel Chocolate Product Consumption

Salted caramel chocolate is one of the favorite flavor trends of recent years in Europe's caramel chocolate industry. For instance, in March 2023, Cadbury launched a new range of salted caramel flavor chocolates in the United Kingdom. The new Cadbury Dairy Milk Salted Caramel line comes in three distinctive formats: Cadbury Fingers, buttons, and tablet. The trend caters to the upscale taste of European consumers, whereby the combination of sweet and salty provides a richer and more luxurious taste experience. Salted caramel chocolates, which marry rich caramel with a touch of sea salt, are desirable to a broad spectrum of consumers, from conventional chocolate aficionados to younger consumers looking for new tastes. The trend is very prevalent in nations such as the UK, France, and the Nordic countries, where salt-infused food products have achieved cultural acceptance. European manufacturers take advantage of this by providing varieties of a different type of salt, like fleur de sel or smoked sea salt, and thereby increasing the regional specificity and gourmet value. This taste innovation not only fuels product variety but also meets the overall consumer trend for premium, artisanal, and textured confectionery experiences.

Increased Number of Cafés in the Region Enhancing On-the-Go Consumption

Growth in café culture across the region is one of the significant Europe caramel chocolate market trends that is influencing the industry. Social centers today are cafés where consumers look for good snacks and sinful treats to pair with a cup of coffee or tea. This setting provides a good platform for caramel chocolate offerings, particularly single-serve or bite-sized portions that can fit into the trend of being consumed on the move. According to industry reports, the market for branded coffee shops in Europe rose 4.7% in 2025, reaching 51,042 locations in the previous 12 months. Nations such as Italy, Germany, and Spain have also seen an increase in specialty and boutique coffee shops, numerous which focus on artisanal offerings, such as regionally produced chocolates with caramel infusions. This increase leads manufacturers to create packaging and product forms conducive to café retail, like shared chocolate bars or luxury truffles as companion pairings. The trend of cafés serves to bridge the chasm between indulgence and regular consumption, making caramel chocolates both a luxury item and a budget-friendly indulgence that becomes part of daily habits throughout Europe.

Maturity of Organized Retail Industry and Aggressive Marketing Strategies

According to the Europe caramel chocolate market forecast, the region’s well-developed organized retail industry is another key force behind recent trends, enabling brands to enjoy high reach and visibility. For instance, the retail sector in Europe makes up 11.5% of the value added in the EU, comprising approximately 5.5 million enterprises. Out of all industry ecosystems, the retail sector produces the most value, with a gross value added of more than €1.4 Billion. Supermarket chains, hypermarkets, and specialty stores are the market leaders, with a vast range of caramel chocolate products that provide consumers with many choices for different tastes. Stores often partner with companies to develop special flavors and limited-edition offerings that create buzz and drive customers back to the store. Ambitious marketing tactics such as in-store promotions, limited-edition introductions, and online promotion, enable brands to win consumers' hearts in a highly competitive marketplace. Second, loyalty schemes and influencer collaborations are commonly employed to reach younger audiences and foster brand loyalty. Sophisticated supply chains and merchandising abilities of the organized retail industry also enable agile responses to new trends, including the growing popularity of organic or vegan caramel chocolates. This retail scenario assures that caramel chocolate is a leading and changing segment in the European confectionery market.

Europe Caramel Chocolate Industry Segmentation:

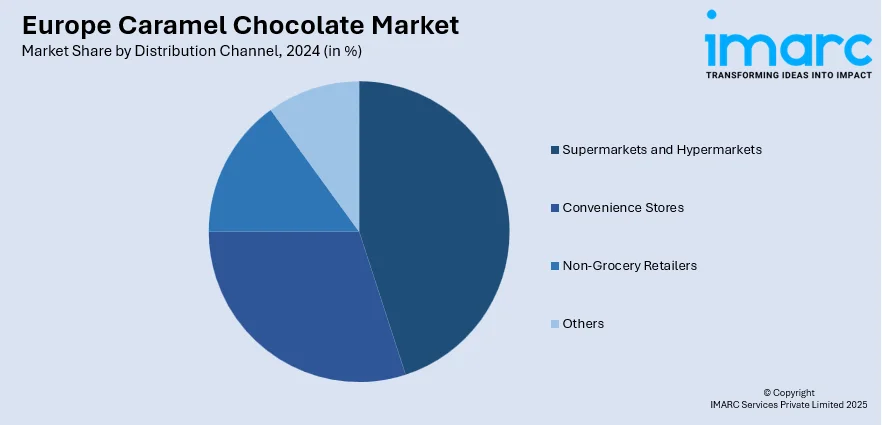

IMARC Group provides an analysis of the key trends in each segment of the Europe caramel chocolate market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on distribution channel.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Non-Grocery Retailers

- Others

Supermarkets and hypermarkets stand as the largest component in 2024. Supermarkets and hypermarkets act as the key distribution channels according to the Europe caramel chocolate market analysis, driving product availability and consumer reach. The big store formats provide extensive product offerings of caramel chocolate products from mass-market brands to premium and artisanal products, appealing to consumers with various preferences in different European countries. Their widespread geographic coverage, both in urban and suburban areas, makes caramel chocolates widely accessible to a large clientele. Supermarkets and hypermarkets also enjoy heavy footfalls and the potential to conduct high-volume promotions, seasonal visibility, and premium product launches, which translate into impulse buying and brand salience. The organized retail industry's advanced supply chain management also enables consistent stock availability and diversity. In addition, these channels tend to cooperate with manufacturers for private label caramel chocolate offerings, widening options for price-conscious shoppers. In total, supermarkets and hypermarkets are essential to maintaining and expanding the Europe caramel chocolate market through extensive distribution and market support initiatives.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. The Germany region is a prime regional segment contributing to the Europe caramel chocolate market outlook, owing to its vast and heterogeneous consumer base with a healthy affinity for high-end confectionery. German consumers have an age-old culture of consuming chocolate, tending to prefer rich, creamy, and adventurous tastes, hence the popularity of caramel chocolate. The nation's strong retail framework, with high-density supermarket chains, hypermarkets, and specialty outlets, guarantees ample availability of caramel chocolate offerings. German consumers also embrace sustainability and ethical sourcing, which encourages manufacturers to provide organic and fair-trade caramel chocolates that align with these needs. In addition, Germany's affluent café culture and increasing demand for high-end and handcrafted chocolates fuel the market's growth. Festivals and seasonal events also drive sales of caramel chocolates, as giving and indulgence are culturally important. This blend of consumer refinement, superior retail channels, and changing trends makes Germany the top player in the Europe caramel chocolate market.

Competitive Landscape:

Major companies within the Europe caramel chocolate industry are aggressively leading development by employing a mix of innovation, collaborative partnerships, and sustainability. Top producers are continually investing in product development to develop fresh flavors, textures, and formats that resonate with changing consumer taste. For instance, numerous brands are testing salted caramel forms, organic components, and plant-based formulations to target niche markets while retaining wide appeal. For increasing market presence, businesses are entering partnerships with retail chains, cafes, and specialty outlets so that their caramel chocolate products are widely available and see the light of day. Hostile marketing efforts, such as social media offers, influencer collaborations, and limited-release season-specific launches, generate buzz and brand affinity. Furthermore, sustainability has been a top priority, with market leaders making commitments to ethically sourced cocoa and sustainable packaging to address the rise of demand for responsible products across Europe. Technology investments, including e-commerce platforms and bespoke consumer experiences, also play a part in fueling sales. With the integration of innovation, robust distribution, and corporate social responsibility, major players are defining the competitive market and driving the Europe caramel chocolate market growth.

The report provides a comprehensive analysis of the competitive landscape in the Europe caramel chocolate market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Prominent Belgian chocolate company Guylian revealed that it would introduce its new Caramel Sea Salt flavor chocolates during the Tax Free World Association (TFWA) Asia Pacific 2025. The new range of caramel chocolates presents an inventive approach to flavors and sustainability. The products are available in seahorse shapes and come individually packaged.

- February 2025: Switzerland-based Nestle announced the launch of its new KitKat chocolate tablets in Europe. The new KitKat tablets are available in three distinct flavors: salted caramel, hazelnut, and double chocolate.

- May 2024: Renowned Swiss confectionery company Lindt & Sprüngli launched a new Salted Caramel limited edition chocolate range in partnership with Avolta, an international travel retailer. Available for a brief period across Avolta’s airport locations, the 2024 edition of Lindt’s Salted Caramel chocolates showcases the company’s dedication to staying at the forefront of special assortment offerings.

- March 2024: UK-based confectionery brand Cadbury launched two new Dairy Milk chocolate products, the Caramel Nut Crunch and the Nutty Praline Crisp. The chocolates have been manufactured using sustainably sourced cocoa and will feature 70% larger chunks in comparison to the Dairy Milk 180g.

Europe Caramel Chocolate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Non-Grocery Retailers, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe caramel chocolate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe caramel chocolate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the caramel chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The caramel chocolate market in Europe was valued at USD 2,306 Million in 2024.

The Europe caramel chocolate market is projected to exhibit a CAGR of 3.15% during 2025-2033, reaching a value of USD 3,094 Million by 2033.

The Europe caramel chocolate market is driven by consumer demand for indulgent and premium treats, alongside a preference for unique flavor combinations like salted caramel. Product innovation, including healthier and ethically sourced options, and the increasing accessibility through diverse retail channels and e-commerce, are also key drivers.

Germany dominates the market due to the country’s affluent café culture and increasing demand for high-end and handcrafted chocolates. Festivals and seasonal events also drive sales of caramel chocolates, as giving and indulgence are culturally important.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)