Europe Cardiac Holter Monitor Market Size, Share, Trends, and Forecast by Product Type, Component, End User, and Country, 2025-2033

Europe Cardiac Holter Monitor Market Overview:

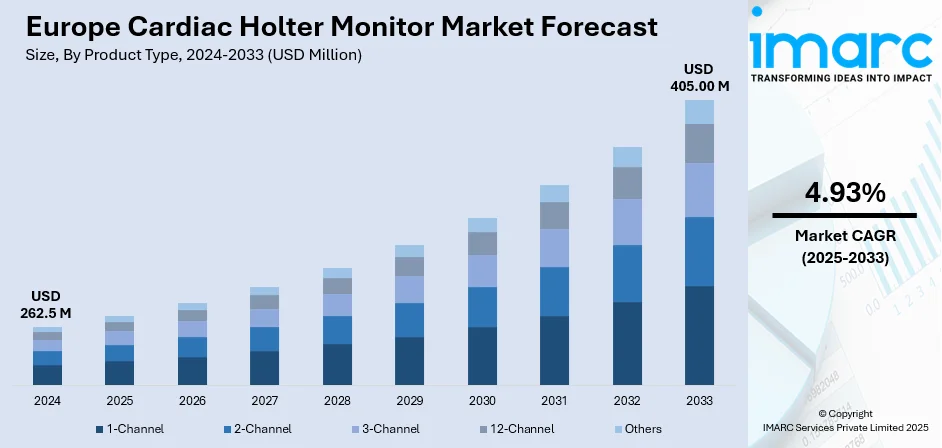

The Europe cardiac holter monitor market size was valued at USD 262.5 Million in 2024. Looking forward, the market is expected to reach USD 405.00 Million by 2033, exhibiting a CAGR of 4.93% during 2025-2033. The United Kingdom currently dominates the market, holding a significant market share in 2024. The market is experiencing steady growth due to rising cardiovascular disease prevalence, increased awareness regarding early diagnosis, and an expanding elderly population. Technological advancements in wearable monitoring devices and supportive healthcare infrastructure also support market expansion. Growing adoption across hospitals and homecare settings further fuels demand, strengthening the overall Europe cardiac holter monitor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 262.5 Million |

|

Market Forecast in 2033

|

USD 405.00 Million |

| Market Growth Rate 2025-2033 | 4.93% |

One of the primary drivers is the increasing prevalence of cardiovascular diseases, especially among the aging population. As the risk of heart conditions rises with age, there is greater demand for continuous and accurate heart monitoring solutions to support early detection and timely intervention. According to an industry report, heart failure is a common condition in Germany, affecting around 4 million individuals across the country. Technological advancements are also playing a crucial role. Modern Holter monitors are now more compact, wearable, and equipped with advanced features such as multi-channel ECG recording, cloud connectivity, and AI-based analysis, which is a major factor driving the Europe cardiac holter monitor market growth. These innovations enhance diagnostic precision while improving patient comfort and enabling real-time remote monitoring, which is particularly beneficial in outpatient and home care settings.

To get more information on this market, Request Sample

Moreover, increasing the awareness about preventative medicine, along with the significance of early diagnosis, has boosted the use of Holter monitors by medical professionals. Such devices are being used by hospitals, clinics, and even primary care doctors in regular cardiac monitoring. Favourable government policies and healthcare infrastructure development throughout Europe are also contributing to adoption. Consequently, there is a great expansion in the market with much focus given to innovation, patient-centric treatment, and wider access to advanced cardiac monitoring technologies.

Europe Cardiac Holter Monitor Market Trends:

Aging Population and Growing Prevalence of Cardiac Disorders

Europe stands as one of the largest cardiac Holter monitor markets globally, largely due to its aging population and the associated rise in heart-related conditions. As per Eurostat, as of January 1, 2024, individuals aged 65 and over constituted 21.6% of the EU population. This demographic shift significantly increases the risk of cardiovascular diseases, fueling demand for continuous heart monitoring solutions. The growing emphasis on early detection and long-term cardiac care among the elderly further supports market growth. The region’s well-developed healthcare infrastructure and increased medical screenings also contribute to higher adoption of Holter monitors, strengthening the region’s position in the global landscape.

Innovation in Wearable and AI-Integrated Monitoring Devices

Rising interest in personalized and non-invasive diagnostics is accelerating innovation in Europe cardiac holter monitor market trends. The demand for multi-input, patient-driven monitoring solutions has led to the emergence of wearable heart devices integrated with AI, advanced analytics, and cloud connectivity. A notable example includes Cambridge Heartware, a UK-based healthcare firm that introduced a wearable heart monitor capable of transmitting data to the cloud, where adaptive AI algorithms analyze it for clinically relevant arrhythmias. These technological advancements allow for real-time diagnosis, improved patient engagement, and better treatment outcomes, especially for complex cardiac conditions. Such innovations are reshaping how cardiac care is delivered across the region.

Shift Toward Preventive Care and Government Initiatives

The market is witnessing strong momentum from the region’s shift toward preventive healthcare and minimally invasive diagnostic technologies. Governments across Europe are actively promoting cardiovascular disease awareness, which is directly influencing early diagnostics and monitoring adoption. According to a December 2024 report by the World Heart Federation, cardiovascular diseases are the leading cause of death in Europe, resulting in 1.7 million fatalities annually. Furthermore, nearly 60 million Europeans are affected by heart conditions each year, imposing an economic burden of around USD 282 billion. These alarming statistics are prompting healthcare systems to invest in advanced cardiac monitoring tools, driving sustained market growth.

Europe Cardiac Holter Monitor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe cardiac holter monitor market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, component, and end user.

Analysis by Product Type:

- 1-Channel

- 2-Channel

- 3-Channel

- 12-Channel

- Others

The 3-channel segment holds the largest share in the market due to its optimal balance between data accuracy and usability. These monitors offer enhanced diagnostic capabilities compared to single-channel devices by capturing more comprehensive cardiac data across multiple leads, improving the detection of arrhythmias and other heart abnormalities. At the same time, they remain compact, lightweight, and patient-friendly, making them suitable for both clinical and ambulatory settings. Their ability to provide reliable, multi-lead ECG data over extended monitoring periods supports accurate diagnosis while maintaining patient comfort. Furthermore, healthcare providers across Europe favor 3-channel monitors for their cost-effectiveness, efficiency, and compatibility with AI-based diagnostic tools, driving their widespread adoption across hospitals, clinics, and homecare environments.

Analysis by Component:

- Holter Monitoring Devices

- Event Monitoring Devices

- Holter Analysis System and Software

Holter analysis systems and software hold the largest share in the market due to their critical role in interpreting and managing vast amounts of ECG data recorded over extended periods. These solutions provide advanced analytics, automated arrhythmia detection, and customizable reporting, enabling faster and more accurate diagnosis, which is creating a positive impact on the Europe cardiac holter monitor market outlook. Integration with electronic health records (EHR) and cloud-based platforms further enhances accessibility for physicians and supports remote patient monitoring, which is increasingly important in Europe’s healthcare landscape. Continuous innovations in AI-powered algorithms and user-friendly interfaces improve efficiency for clinicians, reducing workload while increasing diagnostic accuracy. Their essential function in turning raw Holter data into actionable clinical insights makes them indispensable, thus driving their dominant position in the market.

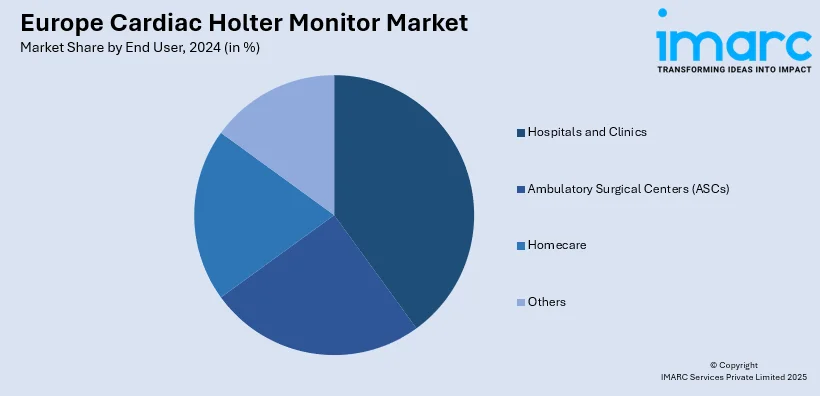

Analysis by End User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Homecare

- Others

Hospitals and clinics hold the largest share in the market due to their central role in cardiac diagnostics and patient care. According to the Europe cardiac holter monitor forecast, these healthcare settings are equipped with advanced medical infrastructure and skilled professionals capable of interpreting complex ECG data, making them the preferred locations for conducting Holter monitoring. The growing incidence of cardiovascular diseases across Europe has led to an increased number of patients seeking regular cardiac assessments, further driving demand within hospitals and clinics. Additionally, these institutions are often the first point of contact for patients experiencing cardiac symptoms, ensuring consistent use of Holter monitors for early diagnosis. Their access to reimbursement support and integration with electronic health records also supports wider adoption of these devices.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The Europe cardiac holter monitor market demand in the United Kingdom is primarily driven by the country’s rising burden of cardiovascular diseases and its aging population. Increased awareness around early detection and preventive care has led to a growing demand for continuous heart monitoring solutions. The UK’s well-established healthcare infrastructure, including the NHS, ensures widespread accessibility to diagnostic tools like Holter monitors. Technological advancements—such as AI-powered wearable monitors and cloud-based ECG data analysis—are further enhancing cardiac care. For instance, UK-based Cambridge Heartware’s AI-integrated Holter devices exemplify the country's innovation in this field. Additionally, supportive government initiatives and public health campaigns aimed at reducing heart disease incidence contribute significantly to market growth, positioning the UK as a key contributor to regional expansion.

Competitive Landscape:

The Europe cardiac Holter monitor market is highly competitive, featuring a mix of global and regional players focused on innovation, product expansion, and strategic partnerships. Leading companies such as GE Healthcare, Philips Healthcare, and Medtronic dominate the landscape with their extensive product portfolios and strong distribution networks. Emerging players like Cambridge Heartware are gaining traction through AI-driven wearable monitors and cloud-based analytics. Companies are increasingly investing in research and development to offer compact, wireless, and multi-channel devices that enhance diagnostic accuracy and patient comfort. Strategic collaborations with hospitals and clinics, along with regulatory approvals and CE marking, are key to expanding market reach. The growing emphasis on digital health and remote monitoring is further intensifying competition across the region.

The report provides a comprehensive analysis of the competitive landscape in the Europe cardiac holter monitor market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Polish med-tech business Medicalgorithmics established a partnership with ACS Diagnostics Inc., a Independent Diagnostic Testing Facility (IDTF) and equipment manufacturer in the United States. Through this partnership, ACS Diagnostics' patented multifunctional CORE 3 ECG wearable device will be integrated with Medicalgorithmics' cutting-edge DeepRhythm Platform (DRP) and DeepRhythmAI (DRAI) artificial intelligence (AI) algorithms. As a result, ACS Diagnostics will be able to provide an expanded range of services, including conventional cardiac holter monitoring, by connecting the DeepRhythm Platform with the CORE 3 devices and the IDTF-receiving software.

- December 2024: Royal Philips and University Hospitals Sussex NHS Foundation Trust (UHSussex) announced the successful completion of a pilot project of the Philips ePatch, a novel extended wear cardiac holter monitor. This completed project marks the first NHS experiment using Philips Cardiologs, an AI-driven arrhythmia ECG analysis system, with a wearable ePatch to monitor cardiac patients.

- November 2024: SmartCardia successfully secured FDA approval for Mobile Outpatient Cardiac Telemetry (OCT/MCT) for its 7-lead live ECG monitoring patch and cloud platform. This follows the FDA's previous approval of SmartCardia for Extended Holter, Event and Holter monitoring. The patch and cloud platform is a comprehensive technology for cardiology practice and can be used with cardiac holter monitors.

- May 2024: BIOTRONIK entered into a partnership with Cardiomatics to expand the availability of Cardiomatics' cutting-edge AI-driven ECG analysis technologies in Germany. Through this partnership, BIOTRONIK's sales department in Germany will distribute Cardiomatics' cutting-edge AI-powered ECG analysis software as well as BIOTRONIK's net_ECG advanced cardiac ECG-Patch Holter Monitor.

Europe Cardiac Holter Monitor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | 1-Channel, 2-Channel, 3-Channel, 12-Channel, Others |

| Components Covered | Holter Monitoring Devices, Event Monitoring Devices, Holter Analysis System and Software |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), Homecare, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe cardiac holter monitor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe cardiac holter monitor market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe cardiac holter monitor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cardiac holter monitor market in Europe was valued at USD 262.5 Million in 2024.

The Europe cardiac holter monitor market is projected to exhibit a CAGR of 4.93% during 2025-2033, reaching a value of USD 405.00 Million by 2033.

The Europe cardiac Holter monitor market is driven by the growing elderly population, rising cardiovascular disease prevalence, and increasing demand for early diagnosis. Technological advancements in wearable, AI-powered monitors and strong healthcare infrastructure further boost adoption. Government initiatives promoting preventive care also support market expansion across the region.

The United Kingdom currently dominates Europe cardiac holter monitor market due to rising heart disease cases, an aging population, technological innovation in wearables, and strong support from public healthcare systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)