Europe Castor Oil Market Report Size, Share, Trends and Forecast by End Use and Country, 2025-2033

Europe Castor Oil Market Overview:

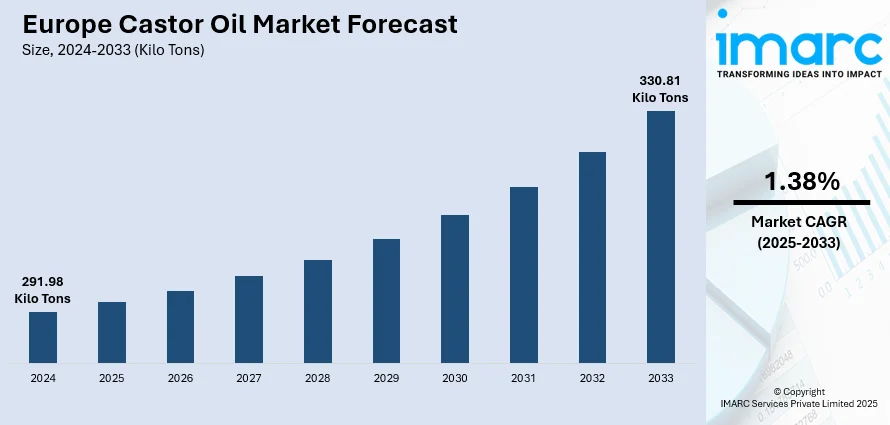

The Europe castor oil market size reached a volume of 291.98 Kilo Tons in 2024. The market is expected to reach a volume of 330.81 Kilo Tons by 2033, exhibiting a CAGR of 1.38% during 2025-2033. United Kingdom currently dominates the market, holding a significant market share in 2024. The market is fueled by the growing demand for natural and sustainable chemicals across industries. In addition, the need for eco-friendly and biodegradable products is driving the use of castor oil in personal care and industry, like lubricants and plastics. Apart from that, advancements within the pharmaceutical industry, where castor oil is used in the formulation of drugs and as an active ingredient carrier, are majorly augmenting the Europe castor oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

291.98 Kilo Tons |

|

Market Forecast in 2033

|

330.81 Kilo Tons |

| Market Growth Rate 2025-2033 | 1.38% |

The market is primarily driven by the region’s growing emphasis on sustainable and bio-based chemicals, as industries increasingly shift away from petrochemical-derived alternatives. Moreover, rising demand for castor oil in pharmaceuticals due to its anti-inflammatory, antimicrobial, and laxative properties is significantly contributing to market growth. According to industry reports, Europe is a leading market for cosmetics and personal care products, with retail sales reaching EUR 104 Billion in 2024. This growth in sales is driving the increased demand for castor oil, as it is widely used in formulations for moisturizers, hair oils, and skin treatments due to its natural emollient properties. As consumer preference shifts towards natural and sustainable ingredients, the demand for castor oil in the cosmetic industry continues to rise. In addition to this, the expanding application of castor oil in manufacturing bio-based plastics and polymers, particularly in packaging and automotive sectors, further fuels demand.

To get more information on this market, Request Sample

In line with this, one of the emerging Europe castor oil market trends is the growing demand for high-performance coatings and adhesives incorporating castor derivatives. A research study published in June 2025 details the synthesis of a novel methacrylated castor oil derivative (“2‑HPRDM”) via reaction with methacrylic anhydride, with methacrylic acid released as a secondary product. The research demonstrates a sustainable route to producing renewable monomers suitable for polymer formulation, emphasizing eco‑friendly feedstock utilization. This innovation carries significant implications for the green polymer and coatings industries seeking bio‑based alternatives. Besides, increasing consumer awareness regarding the environmental and health benefits of plant-based products is influencing purchasing patterns. Apart from that, favorable government policies and research and development (R&D) initiatives supporting green chemistry and renewable raw materials are fostering sustained market expansion across Europe.

Europe Castor Oil Market Trends:

Significant Impact of the Coronavirus Disease (COVID-19) Outbreak

The COVID-19 pandemic has had a notable impact on the Europe castor oil market, reshaping consumer behaviors, industry priorities, and supply chain operations. According to an industry report, more than 2 Million people in the European region have passed away as a result of the COVID-19 pandemic. This increased consumer awareness, and there was a marked shift towards health-oriented and immunity-boosting products, with castor oil gaining traction as a supportive ingredient in natural remedies and immune health supplements. The oil's applications in hand sanitizers, disinfectants, and pharmaceutical formulations also saw increased interest, driven by rising hygiene awareness. On the supply side, the initial disruption in global trade and logistics affected the import of castor oil from major producing countries like India, leading to temporary shortages and price volatility in the European market. However, the post-pandemic recovery phase has seen renewed investment in localized sourcing and distribution channels. Additionally, the surge in e-commerce accelerated the availability of castor oil-based products to consumers across Europe.

Growth of the Spa and Personal Wellness Industry

The expansion of the spa and personal wellness industry across Europe is significantly influencing the Europe castor oil market growth, particularly in natural and organic beauty formulations. According to reports, the Europe spa market was valued at USD 49.34 Billion in 2024. The industry is expected to grow at a CAGR of 9.70% during the forecast period of 2025-2034 to attain a valuation of USD 124.53 Billion by 2034. As consumers increasingly prioritize self-care, relaxation, and non-invasive treatments, spa operators and wellness brands are integrating castor oil into massage therapies, aromatherapy, detox treatments, and skincare regimens. Castor oil's deep moisturizing properties, coupled with its ability to promote skin regeneration and reduce inflammation, make it a popular ingredient in body oils, facial serums, and hair masks used in spas and salons. Moreover, spa operators are increasingly sourcing sustainable and ethically produced ingredients, aligning with consumer values around clean beauty and environmental responsibility. The association of castor oil with luxury, wellness, and holistic health practices is reinforcing its demand in premium personal care experiences throughout Europe.

Rising Utilization of Castor Oil for Relieving Various Health Problems

The market is witnessing increased demand due to its expanding applications in health and wellness, which is providing a positive Europe castor oil market outlook. Castor oil is widely recognized for its anti-inflammatory, antimicrobial, and analgesic properties, which make it an effective natural remedy for a variety of ailments. In Europe, the growing consumer preference for plant-based and holistic treatments has led to heightened interest in castor oil for alleviating joint pain, digestive disorders, skin conditions, and menstrual discomfort. It is commonly used in traditional and alternative medicine practices, either as a topical agent or as an oral supplement in controlled doses. A nationwide survey in England, conducted with over 5,000 adults, found that 80% of individuals aged 18 and older chose to alter their lifestyle in 2021 in an effort to improve their health. This shift towards healthier living supports the growth of the market. With rising awareness of its therapeutic benefits, health-conscious consumers and wellness practitioners are increasingly incorporating castor oil into daily routines. This trend is further supported by ongoing clinical research and increased product availability in pharmacies, organic stores, and wellness outlets across the region.

Europe Castor Oil Industry Segmentation:

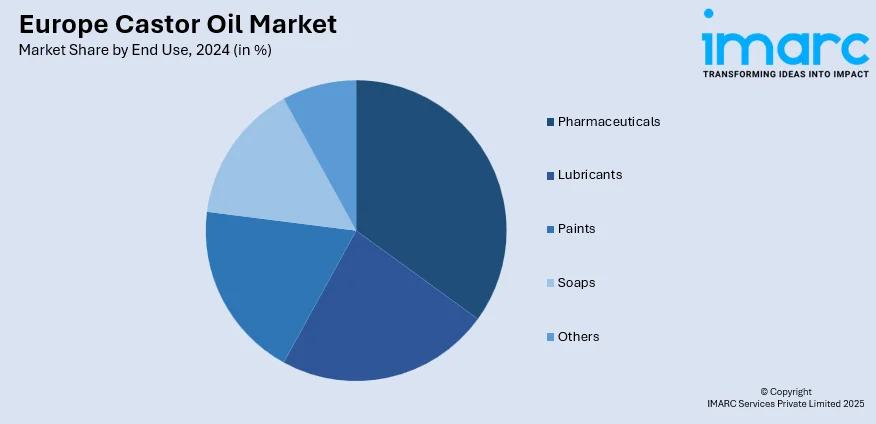

IMARC Group provides an analysis of the key trends in each segment of the Europe castor oil market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on end use.

Analysis by End Use:

- Pharmaceuticals

- Lubricants

- Paints

- Soaps

- Others

Pharmaceuticals lead the market in 2024 due to the oil's versatile chemical composition and functional benefits. Castor oil and its derivatives, particularly hydrogenated castor oil and ricinoleic acid, are widely used in drug formulations, excipients, and as carriers for active pharmaceutical ingredients. The oil's natural origin, biocompatibility, and non-toxic nature make it suitable for applications in laxatives, topical medications, capsules, and ophthalmic solutions. With Europe's strong regulatory emphasis on safety, sustainability, and clean-label ingredients, the demand for plant-based pharmaceutical excipients has been rising steadily. Castor oil's role aligns well with this shift, driving its importance in the formulation of eco-friendly and effective medicinal products. Furthermore, an ageing population and a growing focus on preventive healthcare are increasing the pharmaceutical industry's demand for castor oil-based solutions. As innovations in drug delivery systems progresses, the relevance of castor oil in pharmaceutical applications is expected to strengthen further.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, United Kingdom accounted for the largest market share, driven by its well-established pharmaceutical, cosmetic, and specialty chemicals industries. As a key consumer of castor oil derivatives, the UK leverages the oil’s bio-based properties in a variety of applications, ranging from medicinal formulations to high-performance lubricants and skincare products. The country’s growing emphasis on sustainability and eco-friendly raw materials has further increased the adoption of castor oil, particularly in the development of green chemicals and clean-label consumer products. Additionally, regulatory support for bio-based inputs and innovation funding encourages manufacturers and researchers to explore castor oil as a viable alternative to petroleum-based compounds. The UK’s advanced research and development (R&D) infrastructure and strategic import links make it a vital hub for castor oil utilization and distribution in Europe. With rising demand across industrial and consumer sectors, the UK continues to play a critical role in shaping regional trends and driving sustainable growth in the market.

Competitive Landscape:

The competitive landscape of the market is characterized by moderate fragmentation, with numerous regional producers and suppliers aiming for market share. Further, key players operate across the value chain, focusing on efficient processing technologies, diversified product portfolios, and sustainable sourcing practices. Besides that, innovation in end-use applications, strategic collaborations, and investments in research and development (R&D) activities support market development. Regulatory support for renewable and bio-based materials is further intensifying competition among manufacturers to deliver high-quality, eco-friendly castor oil derivatives. Companies are increasingly targeting product differentiation and value addition to strengthen their market positioning. Additionally, the shift towards circular economy practices has encouraged players to integrate environmentally conscious production models. According to the Europe castor oil market forecast, the market demand is expected to grow steadily over the coming years, prompting increased capacity expansions and market entry by new players, thereby intensifying competition and reshaping the regional market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the Europe castor oil market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Sky Organics expanded its organic hair care range by launching two new products formulated with castor oil to enhance curl and scalp health. The innovation reflected its continued commitment to natural care solutions and was expected to draw attention across Europe’s organic beauty market.

- April 2025: Solabia Group launched innovative skin longevity actives and relocated its headquarters to La Défense, strengthening its biotech presence in Europe. The company’s OleoShine Green, made from hydrogenated castor oil, won gold for its sustainable, ultra-glossy performance.

- March 2025: Eni’s Kenyan castor oil supplier Janari Farms had received the first ISCC EU low ILUC certificate for cultivating castor on severely degraded land without displacing food crops. The certification supported Eni’s biofuel efforts in Europe by promoting sustainable castor oil feedstock practices.

- February 2025: BASF and its partners published the 2024 results of the world’s first sustainable castor bean program, showing certified castor oil yields rose by 57% and over 9,000 hectares were cultivated under the SuCCESS® code. Europe benefited from the stable supply of sustainable castor oil, as more than 8,000 farmers were certified and over 100,000 metric tons of seeds were cultivated.

- February 2025: Croda Beauty revealed new data showcasing the performance of its Crodabond CSN ingredient, derived from hydrogenated castor oil, for hair repair. The studies confirmed that 1–2% Crodabond CSN effectively sealed split ends and improved shine and smoothness.

Europe Castor Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Pharmaceuticals, Lubricants, Paints, Soaps, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe castor oil market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe castor oil market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the castor oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The castor oil market in Europe reached a volume of 291.98 Kilo Tons in 2024.

The Europe castor oil market is projected to exhibit a CAGR of 1.38% during 2025-2033, reaching a volume of 330.81 Kilo Tons by 2033.

The market is driven by growing demand across industries like pharmaceuticals, cosmetics, and biofuels. Increased consumer awareness of natural and sustainable products boosts its use in personal care items. Additionally, rising demand for biodegradable lubricants, medical products, and eco-friendly industrial applications contributes to market growth.

Pharmaceuticals dominate the end use segment in the market in 2024 due to castor oil’s versatile applications in drug formulations, including as a laxative and carrier for various drugs. Its non-toxic and soothing properties make it ideal for formulations in both oral and topical medicinal products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)