Europe Caustic Potash Market Report Size, Share, Trends and Forecast by Form, Grade, End Use, and Country, 2025-2033

Europe Caustic Potash Market Overview:

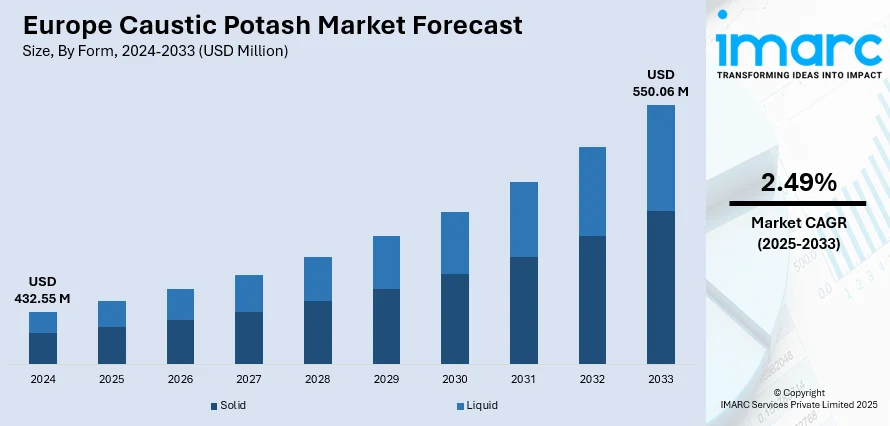

The Europe caustic potash market size was valued at USD 432.55 Million in 2024. The market is projected to reach USD 550.06 Million by 2033, exhibiting a CAGR of 2.49% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. The market is fueled by the increasing demand for fertilizers, particularly in agricultural sectors that rely on potash for soil enrichment. Besides that, the rise in industrial applications such as chemical manufacturing and food processing has contributed to a steady growth in consumption. Moreover, environmental regulations and the shift towards sustainable production methods are also significant factors augmenting the Europe caustic potash market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 432.55 Million |

|

Market Forecast in 2033

|

USD 550.06 Million |

| Market Growth Rate 2025-2033 | 2.49% |

The market is driven by the widespread use of caustic potash in the production of potassium carbonate, which finds applications in glass manufacturing, food processing, and specialty chemicals. The agricultural sector also plays a crucial role, as caustic potash is a vital ingredient in the production of potassium-based fertilizers that enhance crop yields. According to industry reports, Spain’s agrifood exports grew by 5.9% in the first half of 2024, surpassing the 3.5% increase seen in 2023. This growth has driven up the demand for caustic potash, which supports improved crop productivity. Moreover, the growth of the pharmaceutical and personal care industries fuels market demand due to their use in formulation processes and pH adjustment. Furthermore, increasing investments in water treatment infrastructure across Europe contribute to higher consumption, given its effectiveness in neutralizing acids and treating effluents.

To get more information on this market, Request Sample

In addition to this, one of the emerging Europe caustic potash market trends is the rising focus on biodiesel production, as caustic potash acts as a catalyst in transesterification. Besides, stringent environmental regulations encourage the adoption of high-purity grades for safer and greener industrial applications. The European chemical industry, generating a turnover of EUR 655 Billion, is a vital and economically significant sector in the region. With EUR 10.2 Billion invested in research and innovation, the sector continues to drive technological advancements. The strong demand from chemical manufacturing further fuels market growth, while the increasing trend toward localizing supply chains is improving regional production capabilities and product availability. Apart from that, technological advancements in process optimization are improving yield and cost-efficiency, making caustic potash increasingly viable across various end-use segments.

Europe Caustic Potash Market Trends:

Increasing Applications in Pharmaceuticals

The market is witnessing increased application in the pharmaceutical sector. Potassium hydroxide, or caustic potash, has a vital application in the manufacture of different pharmaceutical formulations. Its alkaline nature is vital in the manufacturing process of some active pharmaceutical ingredients (APIs), such as those employed in the manufacturing of pain killers, antiseptics, and anti-inflammatory drugs. In addition, in April, the European Federation of Pharmaceutical Industries and Associations (EFPIA) cautioned that the EU stands to lose more than USD 108 Million worth of scheduled capital and research and development (R&D) investments between 2025 and 2029. This has prompted manufacturers to increase the caustic potash capacities in different countries within Europe. Moreover, the worldwide trend toward customized medicine, involving more subtle and targeted chemical procedures, has created a greater demand for high-purity caustic potash. With the expanding and evolving pharmaceutical industry creating new medicines, caustic potash demand is bound to increase, and it remains an essential drug formulation ingredient.

Strategic Partnerships Between Companies

Strategic alliances between firms are becoming a major driver of the Europe caustic potash market growth. With competition growing and dynamics in the market changing, firms are looking for partnerships to reach out to more markets, exchange technological advancements, and rationalize supply chains. Such alliances commonly aim at maximizing production efficiency, cutting the cost of operations, and improving product quality. For instance, Evonik and AkzoNobel have started a joint venture in Germany with a 120,000 tons of caustic potash per year manufacturing unit. Likewise, INOVYN has started a new manufacturing unit of caustic potash in Antwerp. These partnerships allow companies to reach new distribution channels, rationalize operations, and offset risks of raw material supply. In addition, joint ventures assist businesses in adhering to changing environmental laws through collaboration in more environmentally friendly production technologies.

Technological Developments in Production Procedures

Technological developments are positively impacting the Europe caustic potash market outlook. With the increasing environmental concerns and rising production expenses, businesses are emphasizing enhancing the productivity of their production procedures through automation and innovation. Besides this, the implementation of digital technologies like AI and ML into production processes has enabled greater control over production with greater accuracy, resulting in greater efficiency and reduced costs. Also, real-time monitoring and predictive maintenance systems are implemented to reduce downtime and achieve the best possible performance of production facilities. Additionally, innovations in green chemistry are encouraging more sustainable processes for caustic potash manufacturing, lowering the carbon footprint of production processes. Such technological breakthroughs allow businesses to increase product quality, adhere to strict regulatory requirements, and remain competitive.

Europe Caustic Potash Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe caustic potash market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on form, grade, and end use.

Analysis by Form:

- Solid

- Liquid

Solid leads the market in 2024. The segment offers greater stability, ease of storage, and transportation over its liquid state. Solid caustic potash, usually in flakes or pellet shape, finds extensive application in industries like agriculture, drugs, and chemicals, where high concentration accuracy and long shelf life are essential. It is especially used in the manufacture of fertilizers and specialty chemical compositions, where reactivity and solubility are under management. The solid state also allows for lower-cost bulk handling and reduces risks of spillage, making it suitable for long-distance trade in and outside Europe. Moreover, rigorous environmental regulations in the region favor the use of solid caustic potash in cases requiring safer handling and a minimum environmental footprint. As increased demand for high-purity potassium hydroxide in industrial and consumer markets continues to spread, the solid form remains an important in the European market.

Analysis by Grade:

- Industrial

- Reagent

- Pharma

Industrial leads the market in 2024. Industrial-grade caustic potash is known for its extensive application across different manufacturing industries. The industrial grade is mainly applied in the manufacture of chemicals based on potassium, soaps and detergents, biodiesel, and water treatment. Its high reactivity and alkalinity also make it indispensable in chemical synthesis and pH adjustment procedures. In Europe, where the sustainability of industry is prioritized alongside strict quality standards, the industrial-grade caustic potash finds favor due to its reliability and conformity to regulatory standards. Increased demand from end-use industries like agriculture, where it is utilized in the manufacture of potassium carbonate and potassium phosphate, also adds to its market importance. Moreover, the trend towards green energy and eco-friendly chemicals has boosted its application in biofuel manufacture, so industrial-grade caustic potash is a keystone of Europe's changing industrial and environmental paradigm.

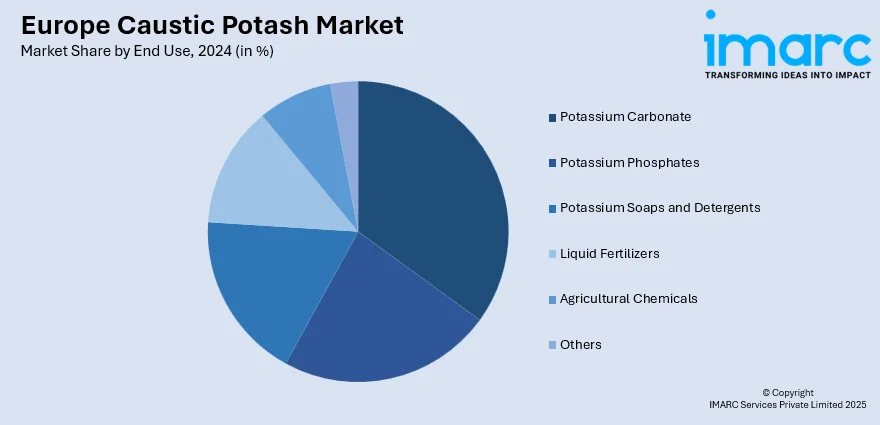

Analysis by End Use:

- Potassium Carbonate

- Potassium Phosphates

- Potassium Soaps and Detergents

- Liquid Fertilizers

- Agricultural Chemicals

- Others

Potassium carbonate leads the market in 2024. The segment is fueled by its widespread use in various industries, including glassmaking, food processing, and specialty chemicals. Caustic potash is an important raw material used in the manufacture of potassium carbonate, with preference for its alkaline nature, solubility in water, and thermal stability. In Europe, where the production of good-quality glass and ceramics is prevalent, potassium carbonate is employed for increased durability and clarity, further increasing caustic potash demand. Furthermore, its usage in food-grade products, such as a pH regulator and buffering agent, fits with the region's stringent food safety protocols. The increasing application of green detergents and fertilizers also makes it significant. As European industries increasingly turn towards environmentally friendly and performance-driven materials, caustic potash requirement in the production of potassium carbonate is a core and developing segment in the market.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share due to the country's robust industry base and diversified end-use industries. Germany, one of the biggest chemical production centers in Europe, is responsible for a considerable portion of caustic potash use, especially in terms of fertilizers, industrial chemicals, and water treatment. Additional focus by the country on advanced production, renewable energy, and regulatory compliance positively contributes to the continued demand for high-purity potassium hydroxide. Apart from this, the expanding pharmaceutical and agri-food industries sectors, where caustic potash is extensively used as a reagent or processing aid. The region benefits from well-established supply chains, technological expertise, and stringent regulatory frameworks, which promote the use of high-grade caustic potash. With Europe steadily moving towards sustainable and efficient industrial practices, Germany is among the leading players in the development and growth of the global caustic potash market.

Competitive Landscape:

The market is dominated by a combination of well-established players and several emerging players. Major drivers propelling competition in the market are manufacturing capacity, geographical distribution channels, and technological innovation in manufacturing processes. Besides, numerous firms also emphasize cost-effectiveness and ramping up output to serve industries like agriculture, chemical production, and food processing. In addition, rising demand for industrial chemicals and fertilizers has led to capacity growth investments as well as product development investments. According to the Europe caustic potash market forecast, caustic potash demand is expected to increase steadily, driven by growth in industrial segments and the increase in agriculture activities, particularly in Eastern Europe. This expansion will further fuel competition, with business houses competing to provide more sustainable and cost-effective production options in order to comply with environmental standards. Volatility in raw material prices such as potash also influences competitive forces, as manufacturers seek to keep costs in check while ensuring quality.

The report provides a comprehensive analysis of the competitive landscape in the Europe caustic potash market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Unid Co. expanded its operations by completing a new potassium hydroxide plant in Yichang, China, aiming to strengthen its leadership in the global chemical market. The expansion supported increasing demand for chemical products including castor oil derivatives in Europe and Asia.

- May 2025: Iraq launched its largest petrochemical plant and a new industrial city in Basra in May 2025 with Chinese partnership, marking a boost to industrial output including chlorine-based chemicals vital for oil and water sectors. The initiative also highlighted potential export to Europe and increased demand for inputs like castor oil in eco-friendly chemical production.

- April 2025: Michigan Potash Operating LLC received approval from the Michigan Department of Environment, Great Lakes, and Energy (EGLE) to install a new salt and potash processing facility in Osceola County. The project, which is expected to include Europe-sourced castor oil in its operations, marks a significant step forward in the company’s expansion plans.

Europe Caustic Potash Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

|

Scope of the Report

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Solid, Liquid |

| Grades Covered | Industrial, Reagent, Pharma |

| End Uses Covered | Potassium Carbonate, Potassium Phosphates, Potassium Soaps and Detergents, Liquid Fertilizers, Agricultural Chemicals, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe caustic potash market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe caustic potash market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the caustic potash industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe caustic potash market reached a value of USD 432.55 Million in 2024.

The Europe caustic potash market is projected to exhibit a CAGR of 2.49% during 2025-2033, reaching a value of USD 550.06 Million by 2033.

The market is driven by increasing demand in the agriculture sector for fertilizers, growing industrial applications such as soap and detergent manufacturing, and rising need for water treatment chemicals. Additionally, advancements in production technologies and the push for sustainable agriculture are supporting market growth.

Solid dominates the form segment in the market in 2024 due its ease of handling, longer shelf life, and widespread use in industrial applications, including fertilizers and detergents. Its stability and cost-effectiveness compared to other forms also contribute to its larger market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)