Europe Champagne Market Size, Share, Trends and Forecast by Product, Price, Distribution Channel, and Country, 2026-2034

Europe Champagne Market Size and Share:

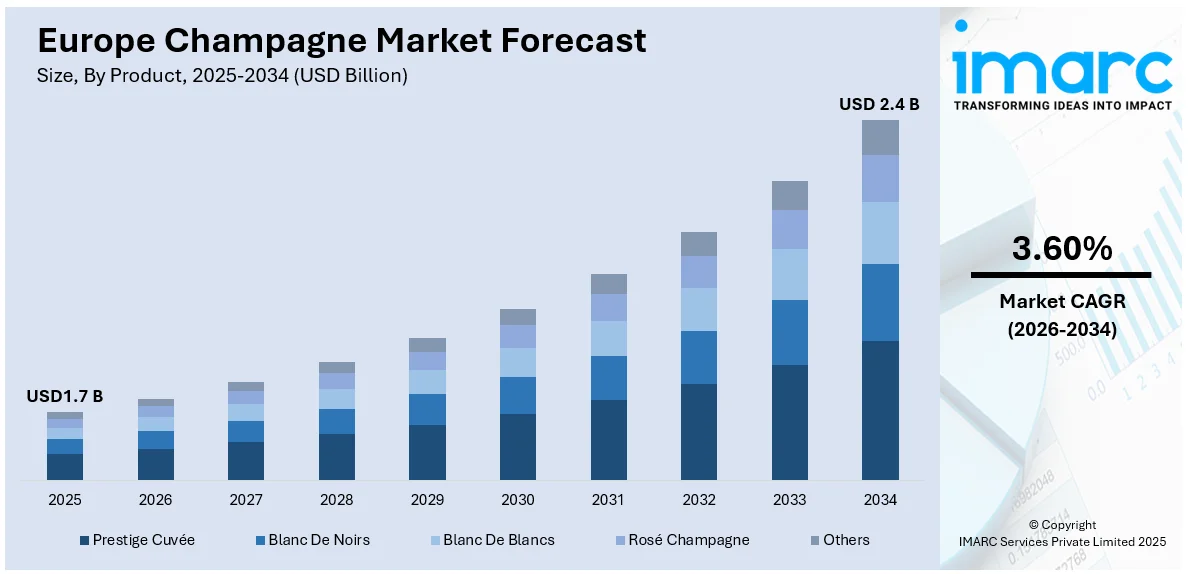

The Europe champagne market size was valued at USD 1.7 Billion in 2025. Looking forward, the market is projected to reach USD 2.4 Billion by 2034, exhibiting a CAGR of 3.60% during 2026-2034. The market is fueled by rising consumer demand for premium products and the popularity of champagne as a celebratory drink and symbol of sophistication. Growth in disposable income and the tourism industry, especially in hospitality environments, are also giving impetus to the market. Besides, the shift in the trend towards online shopping platforms and changing consumer tastes for premium and aged champagnes are further contributing to the Europe champagne market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.7 Billion |

| Market Forecast in 2034 | USD 2.4 Billion |

| Market Growth Rate (2026-2034) | 3.60% |

The market in Europe is primarily driven by the increasing consumer preference for luxury and premium products. In line with this, the growing disposable incomes and evolving lifestyle choices are also providing an impetus to the market. Moreover, the rising popularity of champagne as a symbol of celebration and elegance is also acting as a significant growth-inducing factor for the market. In 2024, champagne shipments totaled 271 Million bottles, with 43.5% consumed domestically in France. The market generated €5.8 Billion in revenue, with 36% from domestic sales and 64% from exports. France's domestic consumption reached 118.2 Million bottles. In addition to this, the expanding tourism industry in Europe, with more tourists seeking luxury experiences, is resulting in higher demand for champagne across various hospitality settings, promoting the Europe champagne market growth.

To get more information on this market Request Sample

Besides this, the increasing awareness regarding sustainability and eco-friendly production methods is creating lucrative opportunities in the market. For instance, in June 2024, Moët & Chandon partnered with Amcor Capsules to introduce ESSENTIELLE, a plastic-free foil made from aluminum and paper, for its champagne bottles. This innovative packaging solution reduces the carbon footprint by 31% compared to traditional polylaminate foils. Also, the expanding role of online retail platforms is impacting the market positively by offering greater accessibility to a wider customer base. As per the Europe champagne market forecast, the market is further driven by the introduction of new champagne varieties catering to evolving consumer tastes, including drier and vintage options. Apart from this, easy product availability across both traditional and e-commerce channels is propelling the market. The increasing influence of luxury branding and celebrity endorsements is further enhancing the appeal of premium champagne brands. Some of the other factors contributing to the market include the growing influence of social media, the growing adoption of high-end branding by the key players, and extensive product innovation activities.

Europe Champagne Market Trends:

Increased Consumer Spending on Luxury Goods

The growing consumer spending on luxury goods, including alcoholic beverages like champagne, is one of the main drivers of the European market. The increasing demand for premium products is attributed to the rising disposable income and the strengthening appreciation for high-quality, luxury items across Europe. In fact, an industry analysis showed that tax-free sales of luxury goods in Europe increased by 10% to 15% in 2024 compared to 2023, signaling a robust shift towards high-end consumption. Champagne, often associated with celebrations and luxury, is one of the beneficiaries of this trend. As consumers seek premium experiences, they are more willing to indulge in higher-priced sparkling wines, which represents one of the emerging Europe champagne market trends. This shift in consumer preferences has substantially contributed to the growth of the champagne market in the region.

Tourism and the Hospitality Industry’s Role in Champagne Consumption

Europe’s booming tourism and growing hospitality industry are major contributing factors to the increasing consumption of champagne. The region’s rich cultural heritage, coupled with the influx of international tourists, has led to heightened demand for champagne, particularly in hospitality settings. According to the European Travel Commission (ETC), international tourist arrivals in Europe increased by 4.9% in the first quarter of 2025 compared to the same period in 2024, with nights spent up by 2.2%. This surge in tourism, along with the expansion of hotels, bars, and restaurants, has created a dynamic environment for the champagne industry. As tourists indulge in local luxury and traditional celebrations, champagne has become a symbol of refinement and joy, further cementing its place in the European hospitality sector. This growing demand from the tourism and hospitality industries is expected to continue, contributing significantly to the Europe champagne market outlook.

Rise of E-Commerce and Changing Consumer Preferences

The rise of e-commerce and online retail platforms has significantly altered the way consumers purchase champagne, expanding its reach to a broader audience. The growing preference for online shopping has facilitated easier access to luxury products, including champagne, while offering the convenience of home delivery. As per reports, the percentage of online buyers grew from 59% in 2014 to 77% in 2024, marking a 17-percentage point increase over 10 years. This trend has enabled manufacturers to tap into new customer segments, offering a wider variety of champagne through direct-to-consumer channels. Additionally, online platforms provide consumers with more detailed product information, reviews, and personalized recommendations, further enhancing the shopping experience. Moreover, as evolving consumer tastes shift towards lighter, drier, and vintage champagnes, producers are innovating and diversifying their offerings to meet these preferences, further propelling market growth.

Europe Champagne Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe champagne market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on product, price, and distribution channel.

Analysis by Product:

- Prestige Cuvée

- Blanc De Noirs

- Blanc De Blancs

- Rosé Champagne

- Others

Prestige Cuvée represents the epitome of luxury in the European champagne market. It is made from the finest grapes, often from top vineyard sites, and aged for extended periods, which gives it a distinctive flavor profile. These champagnes are generally produced in limited quantities and are often associated with elite champagne houses. As a result, Prestige Cuvée appeals to affluent consumers who are willing to invest in high-quality, exclusive products for special occasions. This segment is driving significant growth in the champagne market, particularly among connoisseurs and collectors looking for rare and exceptional bottles, making it a key product category within the industry.

Blanc De Noirs champagnes, made exclusively from black grape varieties like Pinot Noir and Pinot Meunier, have gained popularity for their rich, bold, and complex flavor profiles. This product category stands out in the market due to its unique production process, which imparts deeper, fuller flavors compared to traditional champagnes. Consumers who prefer a more robust sparkling wine are drawn to Blanc De Noirs, particularly those who appreciate the taste nuances from the black grapes used in production. As the demand for more distinct and premium champagne varieties grows, Blanc De Noirs continues to be a favorite for those seeking a luxury product with a more intense flavor experience.

Blanc De Blancs, made entirely from white grape varieties like Chardonnay, is a highly sought-after champagne known for its delicate and refined taste. It is often favored by those who appreciate a lighter, crisper champagne, with floral and citrus notes that make it a versatile option for a variety of occasions. This product category is synonymous with elegance and sophistication, attracting consumers who prioritize finesse and freshness in their champagne experience. The popularity of Blanc De Blancs is steadily rising, especially among connoisseurs and those looking for a champagne that offers a balanced and clean finish, further solidifying its place in the luxury market.

Rosé Champagne has seen a surge in popularity due to its vibrant color, fruit-forward flavors, and versatility, making it a top choice for both casual and formal occasions. Produced by blending red and white wines or using the skin-contact method, Rosé Champagne offers a unique combination of freshness and richness, with strawberry, raspberry, and cherry notes dominating its profile. This product category appeals to a broad consumer base, from those new to champagne to more seasoned drinkers looking for something lighter but still refined. As consumers seek more visually appealing and approachable sparkling wines, Rosé Champagne continues to captivate with its ability to pair well with a wide variety of foods and occasions.

Analysis by Price:

- Economy

- Mid-Range

- Luxury

Economy champagnes are an essential segment in the European market, offering consumers an affordable option for everyday celebrations. These products are priced lower than premium champagnes and cater to a wide range of consumers looking for a bubbly drink without the luxury price tag. Often sold in supermarkets and hypermarkets, Economy champagnes are popular for casual events, parties, and gatherings where cost-efficiency is a priority. As disposable incomes rise and consumers become more familiar with different champagne options, the Economy segment continues to grow, driven by affordability and increasing interest in sparkling wines for a variety of occasions.

The mid-range price segment in the European champagne market offers a balance of quality and affordability. These champagnes are positioned between Economy and Luxury options, appealing to consumers who seek a premium experience without the high price tag associated with top-tier products. The Mid-Range category is expanding as more consumers gravitate toward quality sparkling wines that offer better flavor profiles, complexity, and craftsmanship compared to basic options. This segment is particularly popular for semi-formal occasions, celebrations, and gifting, as it offers a higher level of sophistication and taste at a more accessible price point. As the demand for premium experiences grows, mid-range champagnes are expected to continue driving growth in the market.

The Luxury price segment dominates the top tier of the European champagne market, catering to consumers who are willing to pay a premium for high-end products. Luxury champagnes include rare vintages, limited-edition releases, and prestigious cuvées that are produced with the finest grapes and undergo extended aging processes. These products are often seen as symbols of exclusivity, celebrating milestones, and are typically enjoyed by affluent consumers and collectors. The increasing consumer desire for unique, luxurious, and exclusive experiences has fueled the growth of this segment, which continues to be a major driver in the champagne market, with brands continuously innovating to offer unparalleled quality and exclusivity.

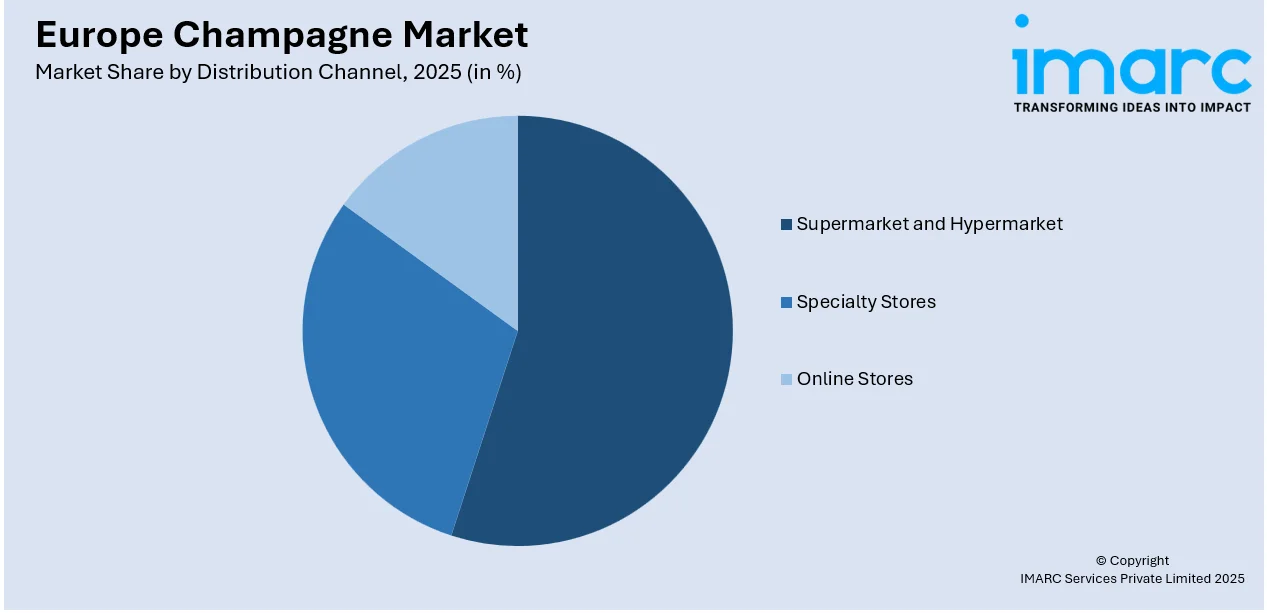

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarket and Hypermarket

- Specialty Stores

- Online Stores

Supermarkets and hypermarkets remain major channels in the champagne distribution landscape, primarily serving the mass-market consumer segment. These retail outlets offer a wide range of affordable and accessible champagne options, catering to everyday consumers looking for a celebratory drink. The convenience of in-store shopping and the ability to purchase champagne alongside other grocery items make supermarkets and hypermarkets a popular choice for many. Additionally, these outlets often run promotions and discounts, making champagne more accessible for casual drinkers. As the demand for sparkling wines continues to rise across different consumer demographics, supermarkets and hypermarkets will maintain a significant share of the distribution channel, providing easy access to popular champagne brands.

Specialty stores play a critical role in the European champagne market by offering a curated selection of high-end and premium champagnes. These stores focus on providing expert knowledge, personalized recommendations, and a tailored shopping experience for consumers seeking luxury, vintage, and exclusive champagne varieties. Consumers visiting specialty stores are often more discerning, seeking products that cater to their specific taste preferences and social occasions. The rise of specialty stores has been supported by the increasing demand for higher-quality sparkling wines, which consumers are more willing to invest in for celebrations, gifts, and special events. These stores also provide a platform for champagne brands to showcase their most exclusive offerings, further propelling the market's growth.

Online stores are becoming an increasingly significant distribution channel for champagne in Europe, driven by the growing preference for e-commerce and the convenience it offers. Online platforms provide consumers with the ability to browse a wide variety of champagne brands, read reviews, and compare prices, all from the comfort of their homes. E-commerce also allows champagne manufacturers to reach a broader audience, including international consumers, without the geographical limitations of physical stores. With the added convenience of home delivery, Online stores are attracting more consumers, particularly younger, tech-savvy buyers who value ease of shopping and access to a diverse range of products. The rise of online retail is expected to continue reshaping the champagne market, with more consumers turning to digital platforms for their purchases.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany plays a significant role in the European champagne market, driven by an increasing appreciation for high-quality sparkling wines. The country’s growing middle class and rising disposable income have contributed to a shift in consumer preferences toward premium champagne options. While Germany is known for its own sparkling wine varieties, there is a strong demand for imported champagne, particularly from renowned French brands. As more German consumers seek out luxury products and unique champagne experiences, Germany’s market share in Europe is expected to grow. The expansion of retail and online platforms further facilitates the availability of premium champagnes, increasing consumer access and boosting demand in the country.

France remains the dominant player in the European champagne market, both in terms of production and consumption. With its deep cultural ties to champagne, the country has a longstanding tradition of celebrating with sparkling wine, which continues to drive high domestic consumption. In 2024, France consumed the largest volume of champagne, further cementing its position as the key market in Europe. French consumers are highly discerning, seeking premium and luxury champagnes for celebrations and everyday enjoyment. France also leads the market in exporting champagne globally, making it a key hub in the industry. With continued innovation and quality-focused production, France is expected to remain the heart of the champagne market for years to come.

The United Kingdom is one of the most important markets for champagne in Europe, driven by a growing appetite for luxury and premium sparkling wines. Champagne is often associated with celebrations, gifting, and social events in the UK, and it is widely consumed during special occasions such as New Year’s Eve, weddings, and other milestone events. The market has seen a rise in demand for premium champagnes, especially among affluent consumers who are increasingly willing to invest in high-quality products. Additionally, the popularity of champagne in the UK has been supported by the growing culture of luxury drinking experiences in restaurants, bars, and hospitality venues.

Italy has traditionally been known for its own sparkling wines, such as Prosecco and Lambrusco, but the demand for champagne has been steadily increasing in recent years. This trend is fueled by the growing interest in premium, luxury beverages, especially among Italy’s younger generation, who are more inclined to explore international wine options. As Italians become more accustomed to enjoying champagne as part of their social gatherings and celebrations, the market has seen a surge in both domestic consumption and imports from France. The increasing availability of champagne in retail outlets, bars, and restaurants, coupled with the rise of digital platforms for direct-to-consumer sales, has contributed to the overall growth of the champagne sector in Italy.

In Spain, the demand for champagne is expanding, driven by a shift towards premium alcoholic beverages. Though Spain is traditionally known for Cava, there is growing interest in imported champagne, particularly from high-end brands in France. This shift in consumer behavior is driven by a younger, affluent demographic that increasingly favors luxury products and experiences. Champagne is becoming more popular at social events and upscale dining establishments, where it is often served as a symbol of celebration and sophistication. Spain’s strong tourism industry also plays a key role in the champagne market, with international visitors seeking local luxury experiences, including champagne.

Competitive Landscape:

Key players in the Europe champagne market are focusing on innovations and sustainability to cater to evolving consumer preferences. Many are expanding their product offerings by introducing new champagne varieties, such as drier, lighter, and vintage options, to appeal to diverse taste profiles. In addition, significant investments are being made in eco-friendly production methods, including the use of sustainable packaging and reduced carbon footprints, aligning with growing environmental concerns. Players are also leveraging digital platforms to enhance consumer reach, utilizing e-commerce and direct-to-consumer channels for better accessibility. Furthermore, partnerships and collaborations between producers and distributors are being strengthened to expand market presence and improve supply chain efficiency, positioning brands for long-term growth in a competitive and dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the Europe champagne market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Champagne Lanson partnered with Avolta to launch exclusive Wimbledon activations in UK airports. Limited-edition pouches of Lanson’s Le Black Création and Le Rosé Création were sold at locations like Heathrow and Gatwick, with the activations selling out within a week, highlighting demand for premium Champagne experiences.

- June 2025: Aldi is expected to launch a limited-edition Supernova Champagne, inspired by Oasis, at its Bury New Road store on July 7. The drink, made with Veuve Monsigny Brut, features a unique bottle design. Fans can win bottles by entering a prize draw on Aldi’s Facebook page until June 30.

- April 2025: Protein Works launched 'Doms Proteinon,' a non-alcoholic, protein-infused champagne offering 20g of protein per glass. This limited-edition beverage combines health and celebration, featuring clear whey protein, amino acids, and electrolytes, catering to the growing demand for protein and alcohol-free champagnes.

- February 2025: Pernod Ricard considered selling its champagne brand G.H. Mumm as part of a shift towards premium spirits. The potential sale, which could have attracted interest from beverage companies, was valued at more than EUR 600 Million. This followed Pernod's divestment of wine brands in 2024.

Europe Champagne Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Prestige Cuvée, Blanc De Noirs, Blanc De Blancs, Rosé Champagne, Others |

| Prices Covered | Economy, Mid-range, Luxury |

| Distribution Channels Covered | Supermarket and Hypermarket, Specialty Stores, Online Stores |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe champagne market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe champagne market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe champagne industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The champagne market in Europe was valued at USD 1.7 Billion in 2025.

The Europe champagne market is projected to exhibit a CAGR of 3.60% during 2026-2034, reaching a value of USD 2.4 Billion by 2034.

The Europe champagne market is driven by the increasing consumer preference for luxury and premium products. Rising disposable incomes, evolving lifestyle choices, and the popularity of champagne as a symbol of celebration are also contributing factors. Additionally, the growing tourism industry, shifting consumer tastes toward premium and aged champagnes, and the rise of online shopping platforms are propelling the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)