Europe Clean Coal Technologies Market Size, Share, Trends and Forecast by Technology and Country, 2025-2033

Europe Clean Coal Technologies Market Size and Share:

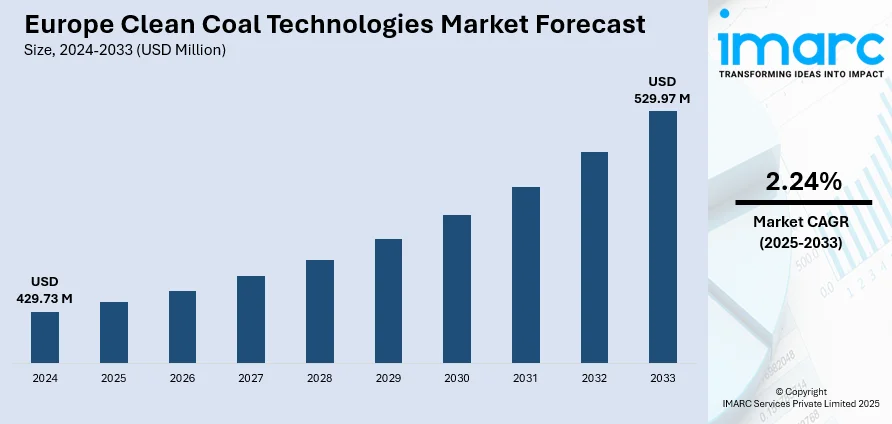

The Europe clean coal technologies market size was valued at USD 429.73 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 529.97 Million by 2033, exhibiting a CAGR of 2.24% during 2025-2033. Germany dominated the market in 2024. Growing energy demand, pressure to reduce CO₂ emissions, aging coal infrastructure upgrades, government funding, and advancements in carbon capture and storage are some of the factors contributing to the Europe clean coal technologies market share. Public acceptance and policy support also influence technology adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 429.73 Million |

|

Market Forecast in 2033

|

USD 529.97 Million |

| Market Growth Rate (2025-2033) | 2.24% |

The market is driven by stricter environmental regulations aimed at reducing CO₂ and other harmful emissions from coal-fired plants. The EU’s climate commitments and targets under the Green Deal push member states to adopt cleaner, more efficient technologies like carbon capture and storage (CCS) and supercritical combustion systems. Rising energy demand, coupled with the need to ensure energy security and reduce dependence on Russian gas, also accelerates investment in clean coal alternatives. Modernization of aging coal power infrastructure and government incentives for low-emission technology upgrades further support Europe clean coal technologies market growth. Additionally, technological advancements that improve the efficiency and cost-effectiveness of clean coal solutions are increasing adoption. Industrial and utility sectors are under growing pressure to transition to cleaner operations without compromising base-load power reliability.

To get more information on this market, Request Sample

Growing focus on carbon capture and storage marks a shift in Europe’s energy approach. As part of its 2030 emissions target, support for coal-reliant regions is increasing. Programs emphasize fair transition strategies, regional collaboration, and workforce inclusion, pointing to a broader movement in decarbonizing conventional fuel reliance. For instance, in January 2025, Europe pushed clean coal innovations to meet its 2030 target of cutting CO₂ emissions by 55%. Technologies like carbon capture and storage are gaining traction. The EU’s Coal Regions in Transition Initiative (CRiT) supports affected communities with technical help, peer learning, and regional collaboration. CRiT works alongside the Just Transition Platform to ensure a fair energy shift without abandoning workers or regions dependent on coal and similar fuels.

Europe Clean Coal Technologies Market Trends:

Shift toward Renewables Altering Energy Priorities

Renewable energy is gaining ground across the European market, gradually influencing how future energy systems shape the Europe clean coal technologies market outlook. As solar, wind, and hydro sources become more integrated into the grid, interest in coal-based solutions, including cleaner variants, is losing momentum. Energy policies are increasingly built around climate commitments that prioritize carbon neutrality over incremental improvements. This shift is creating a more difficult environment for technologies that rely on fossil fuel inputs, even if they're more efficient than traditional methods. Stakeholders in cleaner coal processes now face reduced political backing and lower investment appeal. The direction of change suggests a growing preference for zero-emission approaches, pushing low-emission technologies further out of the spotlight. For example, in 2023, the share of renewables in the EU reached 24.5%, marking a one percentage point increase compared to 2022.

Carbon Capture Gaining Momentum

Deployment of carbon capture and storage projects is accelerating across parts of Northern Europe. Activity has moved from planning to execution, with major initiatives securing investment backing. Focus is shifting toward large-scale capture from industrial sources and permanent offshore storage, supported by national policies and infrastructure plans. There is growing interest in using depleted oil fields and other geological formations for long-term storage, particularly in regions with existing energy expertise. Public-private partnerships are becoming more common, reflecting increased alignment on emissions reduction goals. According to the Europe clean coal technologies market forecast, as more projects secure funding and permits, expectations are rising for wider replication. The shift signals that carbon capture is no longer viewed as a distant solution but as part of the near-term decarbonization toolkit. For instance, in December 2024, three major CCS projects in Denmark and the UK reached Final Investment Decisions. Denmark's Greensand would store 400,000 Tonnes of CO₂ annually, growing to 8 Million by 2030. NEP and NZT Power in the UK would capture up to 4 Million and 2 Million Tonnes, respectively.

Public Financing Driving Clean Energy Investment

Large-scale public investment is playing a bigger role in accelerating the shift to low-carbon systems in Southern Europe. Financial institutions are directing more capital toward energy infrastructure, renewable power, and storage, with a strong emphasis on long-term climate goals. This approach supports both physical upgrades and broader transition efforts, such as grid resilience and emissions reduction. A growing share of funding is now tied to specific climate benchmarks, reflecting stricter environmental criteria. The focus is not just on generation, but on integrating systems that can handle variable energy flows and support regional demand. This pattern of investment suggests continued support for clean energy development through public channels, especially in areas facing economic or structural hurdles to private funding. In parallel, the market for Europe clean coal technologies market trends is seeing a slow but steady shift, with emerging trends aimed at reducing emissions through carbon capture and more efficient combustion methods, particularly in regions where coal still plays a transitional role. For example, in 2024, the EIB Group invested EUR 12.3 Billion in Spain, focusing on energy transition projects, including EUR 5 Billion in energy infrastructure, renewable energy, energy storage, and EUR 7.2 Billion for climate action.

Europe Clean Coal Technologies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe clean coal technologies market, along with forecasts at the country levels from 2025-2033. The market has been categorized based on technology and country.

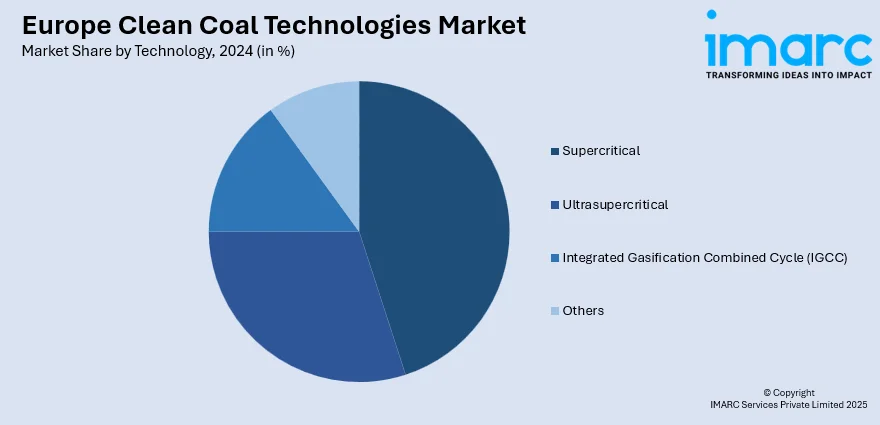

Analysis by Technology:

- Supercritical

- Ultrasupercritical

- Integrated Gasification Combined Cycle (IGCC)

- Others

Supercritical stood as the largest technology in 2024 due to its higher efficiency and lower emissions compared to traditional coal-fired systems. Supercritical plants operate at higher temperatures and pressures, which allows for better fuel conversion and reduced carbon output. This is especially important in Europe, where strict emissions regulations and carbon pricing policies are pushing utilities to adopt cleaner power generation methods without abandoning coal entirely. Countries with aging coal infrastructure are also retrofitting or replacing older subcritical units with supercritical systems to meet EU targets. The technology balances reliability with environmental standards, making it a preferred option for transitional energy strategies. As member states aim to decarbonize while maintaining energy security, supercritical systems offer a practical, scalable upgrade pathway that aligns with broader policy goals and investor pressure for cleaner assets.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share, driven by its early adoption of emission reduction policies and strong regulatory framework. The country has heavily invested in modernizing its coal-fired power plants with cleaner technologies like supercritical and ultra-supercritical combustion, carbon capture and storage (CCS), and flue gas desulfurization. Germany's industrial base, particularly in the energy and manufacturing sectors, has pushed for efficiency improvements and environmental compliance, further accelerating clean coal deployment. Public and private sector collaboration, along with funding for research and innovation in cleaner fossil fuel use, has positioned Germany ahead of other European countries. Its strategic approach balances energy security, economic interests, and environmental responsibility, making it a key player in shaping the clean coal segment within Europe’s broader energy transition efforts.

Competitive Landscape:

Europe’s clean coal technologies market is marked by steady government involvement, public research, and regional collaborations. Funding tends to support pilot projects, academic studies, and repurposing of existing coal infrastructure. Rather than commercial product launches, the focus is on feasibility research, system upgrades, and long-term decarbonization strategies. Partnerships between research institutes, local governments, and utilities are common, often tied to broader energy transition goals. Cross-border cooperation is growing, especially in areas like carbon capture and storage. Private sector participation is cautious, with most developments driven by public policy and environmental commitments. Agreements and joint studies are more frequent than new technology announcements. Right now, research-backed collaboration and government-led initiatives are the most common practices shaping this space.

The report provides a comprehensive analysis of the competitive landscape in the Europe clean coal technologies market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: The European Commission announced EUR 175 Million for the 2025 Research Fund for Coal and Steel (RFCS), with EUR 35 Million allocated to coal sector initiatives. The funding will support clean technologies, including repurposing closed mines, waste treatment, methane monitoring, and recycling critical raw materials, aligned with the EU Green Deal.

Europe Clean Coal Technologies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Supercritical, Ultrasupercritical, Integrated Gasification Combined Cycle (IGCC), Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe clean coal technologies market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe clean coal technologies market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe clean coal technologies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The clean coal technologies market in Europe was valued at USD 429.73 Million in 2024.

The Europe clean coal technologies market is projected to exhibit a CAGR of 2.24% during 2025-2033, reaching a value of USD 529.97 Million by 2033.

Key drivers of the Europe clean coal technologies market include tightening emissions regulations, EU funding for carbon capture, upgrades in power generation infrastructure, rising energy demand, and pressure to reduce reliance on imported natural gas. Innovation in combustion and gasification processes also supports the shift to cleaner coal use.

Germany accounted for the largest share in 2024 due to strong government support, advanced industrial infrastructure, and significant investment in cleaner coal-based energy solutions to meet emission targets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)