Europe Coconut Water Market Report Size, Share, Trends and Forecast by Type, Flavor, Form, Packaging, Distribution Channel, and Country, 2025-2033

Europe Coconut Water Market Size and Share:

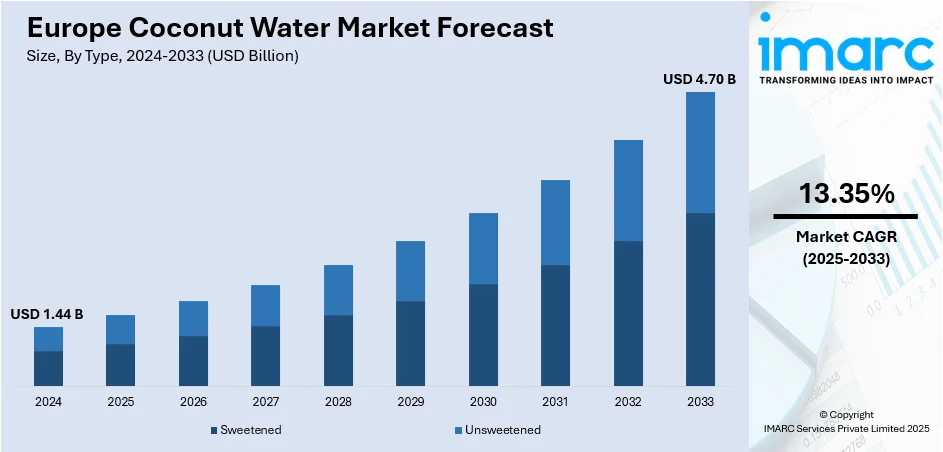

The Europe coconut water market size was valued at USD 1.44 Billion in 2024. The market to expected to reach USD 4.70 Billion by 2033, exhibiting a CAGR of 13.35% during 2025-2033. Germany currently dominates the market in 2024. The market is fueled by increasing consumer demand for natural, low-calorie, and functional beverages as health and wellness trends gain prominence across Europe. Further, rising awareness about the hydrating and electrolyte-rich properties of coconut water is encouraging its adoption. Apart from this, the growing popularity of plant-based diets and clean-label products is further augmenting the Europe coconut water market share, especially among urban, fitness-focused, and environmentally conscious consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.44 Billion |

|

Market Forecast in 2033

|

USD 4.70 Billion |

| Market Growth Rate (2025-2033) | 13.35% |

The market is majorly propelled by the growing health consciousness among European consumers, which has significantly boosted the demand for coconut water, emerging as a preferred choice due to its electrolyte-rich and cholesterol-lowering properties. As per industry reports, in a survey conducted in Germany in May 2024, 2% of respondents identified as vegan, while 8% reported following a vegetarian diet. The rise in vegan, vegetarian, and flexitarian diets across the region has led to increased consumption of plant-based drinks, accelerating the adoption of coconut water as a daily hydration solution. Besides this, the demand for clean-label and organic-certified beverages is encouraging manufacturers to introduce minimally processed, additive-free coconut water products. Additionally, the influence of fitness and wellness trends, especially among Millennials and Gen Z, has positioned coconut water as an ideal post-workout drink due to its natural hydration benefits.

To get more information on this market, Request Sample

In addition to this, one of the emerging Europe coconut water market trends is the growing environmental awareness, which is prompting consumers to favor brands offering sustainable, recyclable, and BPA-free packaging solutions. Apart from that, the increasing availability of flavored and functional variants has further expanded the market’s appeal. According to industry reports, Europe is experiencing significant growth in e-commerce, with sales projected to approach USD 1 Trillion by 2029. The expansion of e-commerce and specialty health food stores has improved product accessibility, allowing brands to reach diverse consumer segments across urban and semi-urban areas in Europe.

Europe Coconut Water Market Trends:

Rising Health Awareness and Cardiovascular Benefits

The increasing preference for natural beverages with functional health benefits is significantly driving demand for coconut water in Europe. Consumers are becoming more health-conscious, actively seeking products that support cardiovascular health, hydration, and low-calorie intake. Coconut water is naturally rich in potassium, which helps in regulating blood pressure and reducing cholesterol levels, key concerns among Europe's aging and urban populations. As awareness grows around the negative impact of sugary drinks and artificially flavored beverages, coconut water has gained popularity as a low-fat, low-sugar alternative. Additionally, the increasing consumption as a natural diuretic assists in rehydration and lowers cholesterol levels. A cholesterol research conducted in the UK found that 54% people in the country could have high total cholesterol levels. This trend is particularly evident in Western European markets like Germany, the UK, and France, where functional beverages continue to gain shelf space and consumer loyalty.

Shift Toward Sustainable and Paper-Based Packaging

Sustainability has become a key influence in the purchasing decisions of European consumers. This, in turn, is contributing to the Europe coconut water market growth. Moreover, the growing use of environment-friendly paper boards and carton packaging for coconut water makes it more accessible to consumers who can consume it regardless of time and space. Researchers indicated that 64% of consumers consider the inclusion of recycled content in product packaging important, while 23% are more inclined to pay a premium for packaging that offers sustainable solutions. These packaging formats offer not only environmental advantages but also improved product shelf life and transportation efficiency. Governments across the region are implementing strict regulations and recycling targets that compel beverage companies to adopt greener packaging practices. Consumer demand for low-carbon, biodegradable, and BPA-free materials is reinforcing this transition. The visual appeal and convenience of paperboard cartons also align with premium branding strategies, enabling companies to communicate sustainability credentials effectively. This packaging trend is becoming integral to market positioning and long-term competitiveness across the region.

Expansion of Plant-Based and Organic Product Lines

The growing demand for plant-based and organic beverages is accelerating the diversification of coconut water offerings in Europe, which is positively impacting the Europe coconut water market outlook. Consumers increasingly associate plant-derived drinks with clean nutrition, ethical sourcing, and digestive wellness. In response, brands are launching organic-certified coconut water lines and blending them with other natural ingredients such as aloe vera, turmeric, and matcha to cater to evolving tastes. This expansion is also influenced by the rising popularity of vegan and flexitarian diets, particularly among Millennials and Gen Z. Organic certifications and non-GMO labeling further enhance the product's appeal in high-income markets such as the UK, Germany, and the Netherlands. In addition to plain coconut water, flavored variants and sparkling coconut-based drinks are gaining traction, offering innovative options without synthetic additives. This trend is supported by premium pricing strategies, effective digital marketing, and health-centric branding, enabling brands to tap into niche consumer segments while aligning with broader wellness and sustainability values.

Europe Coconut Water Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe coconut water market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, flavor, form, packaging, and distribution channel.

Analysis by Type:

- Sweetened

- Unsweetened

Sweetened leads the market in 2024. The segment has been very popular as consumers turn toward drinks that not only provide refreshment but also adds flavor. Although traditional coconut water is preferred for its inherent hydrating quality, the sweetened type attracts consumers who prefer something sweeter and more indulgent. This category has recorded growth fueled by the high demand for more health-oriented alternatives to sugary sodas and juices. Sweet coconut water usually contains additional natural sweeteners, offering a combination of the hydration value of coconut water and the pleasant sweetness desired by many consumers. The segment also benefits from the interest in exotic and functional drinks, making it a convenient, palatable choice in the highly competitive beverage industry. While consumers keep healthy choices at the forefront while not compromising taste, sweetened coconut water takes a major position among Europe's changing beverage trends.

Analysis by Flavor:

- Plain

- Flavoured

Flavoured leads the market in 2024. Flavored coconut water provides consumers with a refreshing new take on the original drink. As demands for variety and distinct taste enhance, flavored coconut water is what consumers are seeking as a more thrilling substitute compared to traditional offerings. It blends coconut water's natural hydrating qualities with a variety of added flavors, including mango, pineapple, and berry, offering a healthy and refreshing choice for conscious drinkers. This sector has appealed to the European market, where consumers are increasingly looking for functional but flavorful drinks. The addition of flavor also broadens the appeal of coconut water beyond hydration, drawing in people who may not have originally thought of it as their beverage of choice. As flavored coconut water becomes ubiquitous in retail environments, it serves to fill the increasing demand for exotic, health-conscious, and varied beverage options, establishing itself as a fixture in the region's expanding market.

Analysis by Form:

- Coconut Water

- Coconut Water Powder

Coconut water leads the market in 2024. It is known for its natural attractions and health features. As hydration and health become the priorities for consumers, pure coconut water is viewed as a healthy, low-calorie drink alternative to sugar-filled drinks. It is valued for its dense electrolyte content and is thus popular with sportspeople and wellness enthusiasts. Demand for pure coconut water remains on the rise as it tends to be sold as a natural, organic product, without artificial additives and preservatives. Its popularity is particularly high given the larger trend towards clean-label products, where shoppers are increasingly selective about ingredient clarity. The expansion of this segment underscores the growing demand for natural, functional beverages that hydrate without additives, making coconut water a vital component of the market.

Analysis by Packaging:

- Carton

- Bottles

- Others

Carton leads the market in 2024. Carton packaging is an important factor in both product attractiveness and function within the market. Cartons are therefore the handy solution for the quality and freshness of coconut water as they entail a plug-tight seal that helps preserve the wonderful beverage's indigenous taste and nutrient content. They are also lightweight, durable, and easy to store, which makes them both a manufacturer's and consumer's preferred choice. Also, carton packaging is generally regarded as less harmful to the environment than plastic, reflecting the growing consumer demand for sustainable, responsible products. As consumers in Europe become increasingly concerned about their environmental footprint, carton packaging has emerged as a key point of differentiation, reflecting the marketplace trend towards more responsible packaging solutions. Ease of recyclability also adds to their popularity, allowing coconut water brands to leverage the trend of sustainability while presenting a convenient, functional packaging solution.

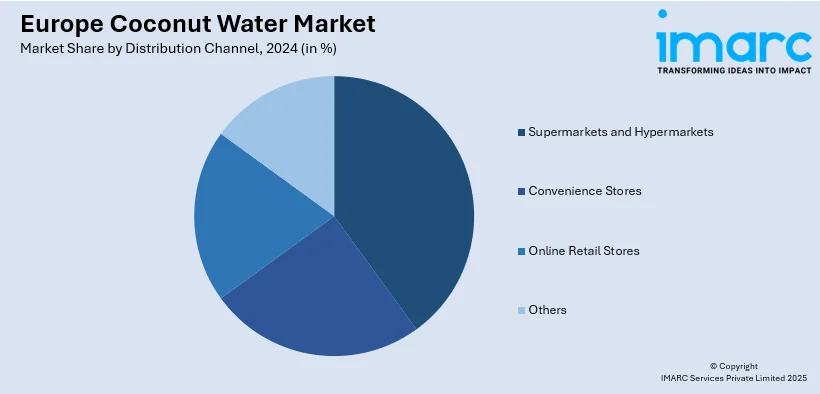

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Supermarkets and hypermarkets lead the market in 2024. The segment motivates widespread availability and consumer accessibility. These retail stores are convenient, enabling consumers to quickly locate an array of coconut water brands under one roof. Their extensive reach makes coconut water available to a wide base of consumers who are health-conscious and functional beverage seekers. Hypermarkets and supermarkets are also central platforms for visibility, as they tend to have high-visibility shelf space and promotional placements that capture the target consumer's attention. As consumers increasingly seek healthier, hydrating substitutes, these retailers have become crucial in fulfilling that demand through traditional coconut water and flavored coconut water offerings. In addition, the growth of private-label coconut water in supermarkets and hypermarkets adds more weight to its significance, offering consumers an increased number of options at affordable prices. These channels are important in defining the growth of the coconut water market in Europe.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. The nation has a highly health-conscious customer base that increasingly demands functional beverages with natural components, thus favoring market growth. Germany has witnessed a consistent rise in the sale of coconut water as well as its flavored forms. Additionally, the market demand is fueled by the nation's increasing emphasis on well-being, sustainability, and clean-label food, with consumers gravitating toward beverages that complement their lifestyle. Also, Germany's highly developed retail system, including supermarkets and health-oriented stores, guarantees convenient availability of a vast array of coconut water brands. This has created a competitive market, with both international and domestic brands competing for consumers' attention. The importance of Germany in the coconut water market is expected to continue, given its influential consumer trends and purchasing power.

Competitive Landscape:

The market is dominated by both traditional beverage players and new health-oriented brands. Moreover, firms are actively resorting to product differentiation in the form of organic certifications, no-added-sugar credentials, and eco-friendly packaging to attract the health-oriented consumer segment. Also, industry players are further diversifying their offerings with flavored and functional extensions, such as electrolyte-rich and vitamin-enriched varieties, to satisfy consumer’s changing tastes. Additionally, strategic partnerships with retail chains and online marketplaces are being utilized to drive visibility and reach across urban and semi-urban areas. Investments in supply chain improvement and cold-chain logistics are also driving product freshness and shelf life. The market is also seeing heightened promotional activities and influencer-driven campaigns to drive brand loyalty and customer connect. According to the Europe coconut water market forecast, heightened product formulation innovation and sustainable sourcing strategies will be a driving force in defining competitive edge, with consumers placing environmental concerns and health factors as key drivers of their purchasing decisions.

The report provides a comprehensive analysis of the competitive landscape in the Europe coconut water market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Community Foods launched Bonsoy Sparkling Coconut Water in the UK, marking the first product of its kind in the market. Available via Ocado, the low-sugar, fruit-based beverage caters to health-conscious consumers and taps into a 22% growth in premium coconut product demand.

- June 2025: CUPP and Vita Coco launched a limited-edition Summer Menu in the UK, blending bubble tea with Vita Coco’s electrolyte-rich coconut water. The Electro Blue range features refreshing, low-sugar drinks with wellness ingredients like mint, lime, and butterfly pea tea, available in stores and via delivery platforms.

- May 2025: Rebel Kitchen Coconut Water launched its first-ever GBP 250k ad campaign across London and the South-East. Highlighting its raw, organic, non-pasteurised pink coconut water, the campaign targets commuters and includes digital, social, and sampling efforts to boost awareness and trial during peak summer hydration season.

- March 2025: Boyne Capital, with co-investor Fifth Ocean Capital, acquired Blue Monkey Beverages, a Vancouver- and Long Beach-based maker of coconut water, sparkling juices, and chips. The brand, free from added sugars and preservatives, is expanding distribution across North America, Asia, the Caribbean, and is preparing to enter the UK and Australia.

- January 2025: Vita Coco introduced its “Treats” line, starting with Strawberries & Cream, as the UK’s first low-calorie, no-added-sugar coconut drink in meal deals across thousands of stores, followed by a 250 ml convenience format in June. The launch taps into a 17% growth in non‑alcoholic drinks and a 22% surge in premium coconut product demand.

Europe Coconut Water Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sweetened, Unsweetened |

| Flavors Covered | Plain, Flavored |

| Forms Covered | Coconut Water, Coconut Water Powder |

| Packagings Covered | Carton, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe coconut water market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe coconut water market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the coconut water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The coconut water market in Europe was valued at USD 1.44 Billion in 2024.

The Europe coconut water market is projected to exhibit a CAGR of 13.35% during 2025-2033, reaching a value of USD 4.70 Billion by 2033.

The market is driven by increasing consumer demand for healthy, natural beverages. Rising health-consciousness, growing preferences for plant-based drinks, and a shift toward low-calorie and low-sugar alternatives contribute to its growth. Additionally, coconut water’s hydrating properties and appeal as a post-workout drink are fueling its popularity.

Sweetened dominate the type segment in the market in 2024 due to its appealing taste and wider acceptance among consumers. The sweeter flavor profile aligns with consumer preferences for beverages that combine health benefits with enjoyable taste, making it a popular choice in the market over unsweetened variants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)