Europe Commercial Printing Market Size, Share, Trends and Forecast by Technology, Print Type, Application, and Country, 2025-2033

Europe Commercial Printing Market Size and Share:

The Europe commercial printing market size was valued at USD 231.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 240.0 Billion by 2033, exhibiting a CAGR of 0.40% during 2025-2033. Germany currently dominates the market in 2024, led by its strong industrial base, sophisticated printing technologies, and demand across packaging, advertisement, and publishing industries. Highly qualified human resources, quality standards, and ongoing innovation further support Germany's leading position, boosting the Europe commercial printing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 231.0 Billion |

| Market Forecast in 2033 | USD 240.0 Billion |

| Market Growth Rate 2025-2033 | 0.40% |

The market is primarily driven by the expanding packaging industry, which continues to experience strong demand due to the growth of e-commerce and the food and beverage sectors. With consumer goods requiring visually appealing and durable packaging, commercial printers are increasingly adopting high-speed, high-resolution printing technologies to meet evolving needs. Moreover, the rise in customized and short-run printing for branding purposes has pushed businesses to seek more flexible and efficient printing solutions. Sustainability is also playing a key role, prompting companies to invest in eco-friendly inks, recyclable materials, and energy-efficient printing processes, aligning with the European Union’s environmental goals. These factors together are boosting the Europe commercial printing market growth by creating consistent demand for advanced commercial printing capabilities.

.webp)

Moreover, digital transformation in other industries is substantially driving the demand for commercial printing services in Europe. Retail, education, healthcare, and finance industries continue to need large amounts of printed material such as brochures, reports, manuals, and marketing content. The hybrid work setup has also helped create the need for professional printing services that maintain quality consistency at dispersed locations. Advances in technology such as automation, AI-driven workflow management, and digital printing have enabled service providers to minimize turnaround time and costs, making commercial printing affordable to small and mid-sized businesses. For instance, according to industry reports, the commercial online printing market in the European Union (EU) is projected to grow by USD 1.84 Billion from 2024 to 2028, at a CAGR of 5.7%. Furthermore, the increasing popularity of on-demand and web-to-print services is enhancing customer experience and offering new revenue streams for commercial printers, solidifying the sector’s importance within Europe’s broader business landscape.

Europe Commercial Printing Market Trends

Growth of Eco-Friendly and Sustainable Printing Practices

The European commercial printing market is witnessing a strong trend toward eco-friendly and sustainable practices, driven by heightened environmental awareness and stricter regulatory standards. With the EU’s printing sector comprising nearly 120,000 companies and employing around 770,000 workers, regulatory compliance and sustainability have become essential for maintaining competitiveness. The increasing demand for recyclable packaging, particularly in light of the paper packaging market’s growth from USD 54.5 Billion in 2024 to a projected USD 75.6 Billion by 2033, has accelerated the adoption of environmentally responsible printing techniques. Printers are investing in sustainable materials such as biodegradable paper and eco-friendly inks that allow for better recyclability and ink separation. This trend not only reduces environmental impact but also enhances brand value for print service providers.

Adoption of Advanced Printing Technologies and Automation

The European commercial printing market is rapidly embracing automation and advanced printing technologies to improve efficiency and meet rising demand for high-quality, customized print solutions. The widespread need for advertising across sectors, combined with consumer preference for fast, flexible, and visually engaging print materials, is fueling this transition. Flexographic printing, in particular, is gaining traction due to its cost-effectiveness and versatility in packaging applications. Automation in prepress and postpress operations, as well as AI-integrated workflow systems, are helping printing businesses optimize production cycles, minimize errors, and reduce operational costs. As competition intensifies, companies are leveraging these technological advancements not only to enhance productivity but also to provide tailored solutions, especially in security printing for pharmaceuticals, tobacco, and alcoholic beverage packaging, areas requiring precision and regulatory compliance. For instance, at FESPA 2025, EFI showcased advanced digital printing solutions aimed at enhancing digital adoption in signage, packaging, and industrial textiles. Featured products include the EFI VUTEk M3h hybrid, Pro 30f+ flatbed, VUTEk Q3h XP hybrid, and VUTEk X3r roll-to-roll LED printers, designed to improve production speed and profitability. EFI emphasizes versatility, high image quality, and cost efficiency, offering new business opportunities. Furthermore, EFI shared valuable insights on personalized, sustainable packaging and digital technologies designed to enhance operational efficiency.

Europe Commercial Printing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe commercial printing market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on technology, print type, and application.

Analysis by Technology:

- Lithographic Printing

- Digital Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

Lithographic printing led the European commercial printing market in 2024 due to its high-quality output, cost-efficiency for large-volume jobs, and versatility across various substrates. This technique, also known as offset printing, allows for precise image reproduction and sharp color fidelity, making it ideal for marketing materials, packaging, books, and newspapers. It is particularly favored by enterprises that require consistent branding across high print volumes. Additionally, lithographic presses have become increasingly automated, improving production speed and reducing labor costs. The method’s ability to handle a wide range of paper types and thicknesses further enhances its appeal. With Europe’s strong demand for advertising and printed media, lithography continues to dominate as it offers an optimal balance between quality, efficiency, and scalability in commercial print operations, which, in turn, is helping create a favorable Europe commercial printing market outlook.

Analysis by Print Type:

- Image

- Painting

- Pattern

- Others

Image led the market in 2024 due to the growing demand for visually rich content in advertising, packaging, and promotional materials. Businesses increasingly rely on high-quality images to capture consumer attention and enhance brand identity, especially in competitive sectors like retail, food and beverage, and cosmetics. Technological advancements in high-resolution printing, along with digital workflows, have made image reproduction faster and more cost-effective. Additionally, the rise of personalized marketing and variable data printing has further fueled the need for vibrant, customized imagery across print media. As visual appeal becomes a key differentiator in consumer decision-making, image-centric printing continues to dominate, offering superior detail, color accuracy, and engagement potential across both digital and traditional print formats in Europe.

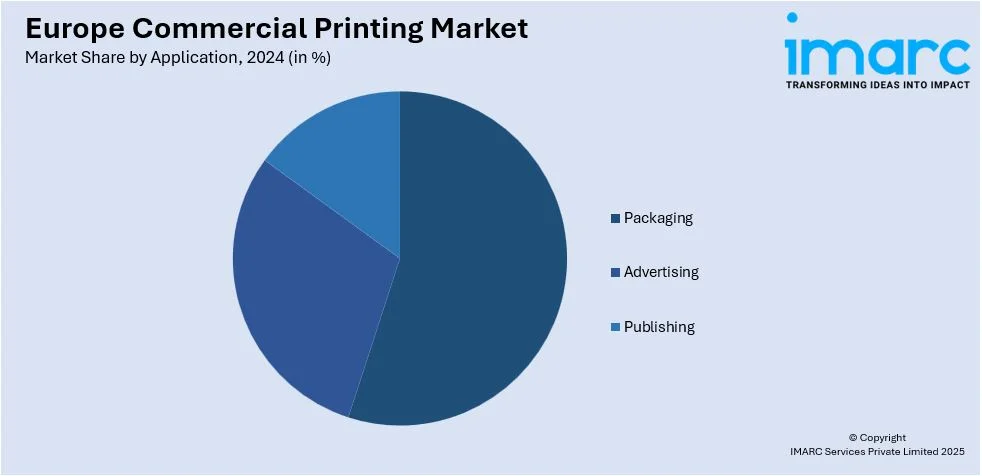

Analysis by Application:

- Packaging

- Advertising

- Publishing

Packaging dominated the European commercial printing market in 2024 due to the surge in demand from industries such as food and beverage, pharmaceuticals, cosmetics, and e-commerce. As brands compete for shelf presence and consumer attention, high-quality printed packaging plays a crucial role in conveying brand identity and product information. The rapid growth of the paper packaging market in Europe underscores this trend. Moreover, regulatory requirements for labeling, traceability, and anti-counterfeiting have further fueled the need for sophisticated printing solutions. Innovations in sustainable packaging, such as recyclable materials and eco-friendly inks, have also contributed to the dominance of this segment, aligning with both consumer preferences and environmental standards.

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. This can be ascribed to its advanced industrial infrastructure, strong economic base, and long-standing expertise in printing technology. As home to some of the world's leading printing press manufacturers and packaging firms, Germany benefits from a well-developed supply chain and high-tech production capabilities. For instance, in April 2024, Heidelberg introduced the Jetfire range, which combines offset and digital printing into a single system. The Jetfire 50, based on Canon’s inkjet technology, offers an output of 9,120 SRA3 sheets per hour and integrates with Heidelberg's Prinect workflow software. The Jetfire 75, launching in 2025, will be faster, printing 8,700 B2 sheets per hour. These innovations aim to provide an efficient, automated solution for print shops, boosting Heidelberg's presence in the growing digital printing market, which is projected to expand by €3 billion by 2028. The country’s robust demand for high-quality packaging and printed materials across sectors like automotive, pharmaceuticals, and consumer goods further supports market dominance. Additionally, Germany's commitment to sustainability and innovation has led to early adoption of eco-friendly inks, automation, and digital printing solutions. Its skilled workforce, supportive government policies, and export-driven economy make it a hub for commercial printing services, maintaining its leadership position in the European market.

Competitive Landscape:

The competitive landscape of the European commercial printing market is characterized by the presence of numerous established players and emerging firms offering a diverse range of printing solutions. With the shift toward sustainable practices, many players are adopting eco-friendly materials and energy-efficient technologies to meet regulatory and consumer demands. For instance, in May 2025, Kyocera launched the MZ7001 SRA3 Series, featuring six color and three monochrome MFPs designed for hybrid working environments. These devices offer fast print speeds, cloud compatibility, advanced security features, and AI-powered capabilities to streamline workflows. With a focus on sustainability, the MZ7001 series is carbon-neutral, energy-efficient, and equipped with a real-time sustainability display. The series enhances productivity, simplifies document management, and supports secure, cloud-based operations, helping businesses improve efficiency and reduce environmental impact. Digitalization and automation are also reshaping competition, as firms integrate advanced printing techniques, AI-driven workflows, and web-to-print platforms to enhance efficiency and customer experience. Strategic partnerships, investments in R&D, and regional expansion are common approaches to gaining market share. Overall, the Europe commercial printing market forecast depicts that the market is expected to remain fragmented but highly dynamic, with constant innovation driving competitiveness and growth.

The report provides a comprehensive analysis of the competitive landscape in the Europe commercial printing market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: AstroNova is set to unveil two high-performance digital label presses and a direct-to-package printer at the FESPA Global Print Expo 2025 in Berlin, Germany. The new additions to AstroNova’s QuickLabel line, the QL-425 and QL-435 professional label presses, are designed for light to medium production segments, offering enhanced speed, flexibility, and cost-efficiency. Additionally, the company will introduce the VP-800, a solution capable of printing on various packaging materials including corrugated cardboard, die-cut boxes, and paper bags.

- April 2025: InkTec announced the first European sale of its Jetrix XAR320-Hybrid printer following its debut at the Sign & Digital UK event in February. Digitalprint.ie, an Irish supplier serving the sign, print, and graphics sectors, purchased the hybrid large-format printer, which combines flatbed and 3.2m roll-to-roll functionality.

- October 2024: Ricoh established Ricoh Printing Solutions Europe Limited in Telford, UK, to consolidate its industrial printing business in Europe. Set to begin operations in April 2025, the company centralized sales, engineering, and R&D functions, aiming to enhance inkjet technology, improve customer support, and drive the digitization of printing processes.

- October 2024: SATO launched the LR4NX print and apply labeling machines in Europe, selling them across 38 countries. Designed for high-volume labeling in food production, manufacturing, and e-commerce, the machines featured easy installation, operational visibility, and compatibility with multiple printer languages. SATO aimed to meet Europe's growing demand for labeling automation.

- November 2024: Impossible Objects launched its CBAM 25 3D printer in Europe, offering unprecedented speed and material capabilities. Printing layers in four seconds, it is 15 times faster than HP’s Multi Jet Fusion. The CBAM 25 produces strong, precise composite parts, drawing strong industry interest at Formnext. It aims to revolutionize high-volume 3D printing.

Europe Commercial Printing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Lithographic Printing, Digital Printing, Flexographic Printing, Screen Printing, Gravure Printing, Others |

| Print Types Covered | Image, Painting, Pattern, Others |

| Applications Covered | Packaging, Advertising, Publishing |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe commercial printing market from 2019-2033.

- The Europe commercial printing market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe commercial printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe commercial printing market was valued at USD 231.0 Billion in 2024.

The Europe commercial printing market is projected to exhibit a CAGR of 0.40% during 2025-2033, reaching a value of USD 240.0 Billion by 2033.

Key factors driving the Europe commercial printing market include increasing demand for high-quality packaging, advancements in printing technology, and growing environmental concerns prompting the adoption of eco-friendly inks. Additionally, automation and digitalization are enhancing efficiency, while regulatory pressures and the rise of e-commerce further boost the demand for printed materials.

Germany accounted for the largest share of the market in 2024 due to its strong industrial base, advanced printing technology, and high demand for packaging materials. The country's emphasis on innovation, sustainability, and efficiency, along with its robust manufacturing sector, solidifies its market leadership in the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)