Europe Cookies Market Size, Share, Trends and Forecast by Ingredient, Product, Packaging, Sales Channel, and Country, 2025-2033

Europe Cookies Market Size and Share:

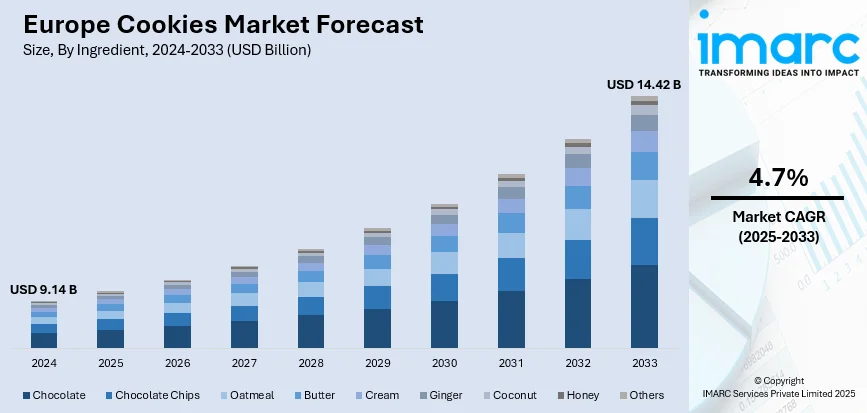

The Europe cookies market size was valued at USD 9.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.42 Billion by 2033, exhibiting a CAGR of 4.7% from 2025-2033. Germany is currently dominating the market with a total share of 25.5% owing to the increased health awareness in Europe is largely changing cookie consumption behavior, with an increased number of consumers driving demand for healthier, organic, and clean-label cookies. The increased interest in nutrition and natural ingredients requires companies to reformulate and innovate their products to capture these wellness-driven consumers. This change not only captures health-conscious consumers but also increases the market appeal in general, targeting a larger consumer base. Therefore, these trends are leading to persistent growth and solidifying the Europe cookies market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.14 Billion |

| Market Forecast in 2033 | USD 14.42 Billion |

| Market Growth Rate (2025-2033) | 4.7% |

The accelerating need for easy and indulgent snack foods is a primary force behind the European cookies market. With lifestyles becoming increasingly busy, consumers look for easy and convenient food products that can fit into their hectic lifestyles without sacrificing taste. Cookies provide a perfect solution as they are a convenient ready-to-eat snack food that fills gaps and pairs well with trend beverages like coffee and tea. Also, the popularity of café culture throughout European cities has further contributed to cookie consumption, as the products are often consumed during social visits and informal gatherings. The cultural trend towards visiting coffee shops and bakeries promotes customers to include cookies in their everyday snack routine. The indulgence factor coupled with convenience has led to increasing retail and foodservice distribution channels. For example, in August 2024, Coca-Cola® and OREO® introduced limited-time cookies and beverages, enhancing the European cookies market through the pairing of iconic brands and addressing consumers' need for innovative, indulgent, and easy-to-consume snacks. Consequently, the cookies sector keeps gaining from expanding penetration in on-the-go and leisure environments, with the latter being the largest single distribution channel in the sector, driving steady growth across Europe.

To get more information on this market, Request Sample

Growing health consciousness among European consumers is heavily impacting the cookies market, serving as a major growth driver. Greater concerns for diet and health have seen consumers increasingly demanding healthier snack options without compromising flavor or satisfaction. This trend is expressed through increasing demand for cookies prepared using organic, natural, and lightly processed ingredients, frequently without artificial preservatives, additives, and high levels of sugars or fats. Clean-label movement and transparency in ingredient origin appeal highly to health-aware consumers who value harmonious diets and health. Product innovation has therefore picked up speed, with manufacturers reformulating conventional cookie formulations to meet these consumer demands. Furthermore, this trend extends the appeal of cookies beyond indulgence to incorporate functional and wellness-directed snacking. By catering to shifting dietary tastes, the cookies market is effectively growing its customer base and strengthening its growth momentum in various European markets.

Europe Cookies Market Trends:

Increasing Consumer Demand Catalyzed by Convenience and Lifestyle Changes

The cookie market is experiencing substantial growth catalyzed by increasing consumer demand catalyzed by convenience and lifestyle changes. Today's consumers increasingly turn to cookies as convenient, indulgent snacks that accommodate hectic lifestyles, and thus cookies are popular. That trend is reinforced by the widening café culture and increased popularity of social interaction in coffeehouses, bakeries, and food service outlets, where cookies typically accompany beverages. For example, a report for the industry points out that 75% of German visitors to coffee shops would like to spend evenings there, reflecting a change in socializing habits outside the home. Such a changing social trend promotes frequent cookie consumption as part of enjoyment and socialization experiences. Consequently, the cookie market reaps this benefit of convenience, comfort, and social interaction, fueling demand both in retail and hospitality markets. This increasing presence in public spaces continues to underpin strong market growth.

Increased Demand for Premium, Artisanal, and Health-Responsive Cookies

People are increasingly focusing on quality, health, and special experiences in the foods they eat, driving demand for premium and artisanal cookies. This change mirrors an increased value placed on handmade products with unique flavors and textures, frequently created with locally grown, high-quality ingredients. Moreover, consciousness about health is affecting consumer trends, with consumers increasingly looking for substitutes for highly processed food. For instance, 64% of British consumers consider ultra-processed food to be unhealthy, while in Spain, France, and Italy, rates of avoidance are more than 80%. Reacting to this, producers are responding with innovation in producing healthier cookies that are made from organic products, low in sugar and fat, and without artificial additives. This twinned trend for indulgence and well-being widens the market appeal through satisfying both the taste buds and health sensitivities. The cookie market is therefore adapting to these varied consumer needs and expanding its share of a competitive marketplace.

Contribution of E-commerce and Growth in Disposable Incomes towards Market Growth

The swift expansion of e-commerce websites has revolutionized cookie intake through offering consumers easy access to a vast range of products at doorsteps. Such convenience induces greater frequency of purchase and trial of new flavors and higher-end varieties. Furthermore, increasing disposable incomes within Europe are having a beneficial impact on spending in this category. Based on OECD statistics, disposable per capita income at household level in large European economies increased by 0.2% to 3.4% in early 2024, with Poland recording a significant 10.2% increase. The economic boost has made households opt for premium and gourmet cookies, as they are ready to spend more on quality and specialty items. Additionally, advancements in green packaging and ongoing launch of new tastes make products more attractive. All these factors together build profitable expansion prospects for the cookie market, propelling consistent growth in various geographies and consumer segments.

Europe Cookies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe cookies market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on ingredient, product, packaging, and sales channel.

Analysis by Ingredient:

- Chocolate

- Chocolate Chips

- Oatmeal

- Butter

- Cream

- Ginger

- Coconut

- Honey

- Others

Chocolate is the market-leading ingredient in the Europe cookies market forecast in 2024, enjoying a tremendous 34.2% share. This popularity can be attributed to customer affection for intense, decadent flavors that enrich the sensory appeal of cookies. Chocolate is highly versatile and may find its way into different types of cookies, from chips and chunks to coatings and fillings. This ingredient not only fulfills expectations of traditional taste but also enables premium and artisanal product innovation, reaching a variety of consumer segments. Increased demand for premium, ethically produced chocolate further positions it high. Because consumers are looking more and more for indulgent but premium snacking possibilities, the position of chocolate as a signature ingredient reinforces its dominance. Players further capitalize on this tendency by including varying cocoa origins, texture, and levels of flavor intensity to align with shifting taste, hence affirming chocolate's central role in driving market development and customer satisfaction in the Europe cookies market.

Analysis by Product:

- Drop Cookies

- Bar Cookies

- Molded Cookies

- No-Bake Cookies

- Ice Box Cookies

- Rolled Cookies

- Sandwich Cookies

- Others

Drop cookies are at the forefront of the product category in the Europe cookies industry with a strong 44.5% market share in 2024. Their appeal lies in their convenience, texture, and ease in flavor adaptation, which makes them a favorite among consumers for quick indulgent bites. Drop cookies' simplicity in preparation and openness to using various ingredients, like nuts, chocolate, and dried fruits, adds to their acceptability across demographics. This product category enjoys good alignment with the trend in consumer behavior towards shareable and portable treats that are both consumable at home and on-the-go. The manufacturers also highlight innovation in this category by launching premium and health-related variants in the form of organic and low-sugar offerings. Widespread popularity and steady year-round demand for drop cookies make them a flagship product, having a strong impact on sales as well as product development strategies, thus cementing market leadership and propelling Europe cookies market growth.

Analysis by Packaging:

- Rigid

- Flexible

- Others

Flexible packaging leads the Europe cookies market, representing 55.9% of the packaging forms used in 2024. It is favored by its affordability, lightness, and capacity to maintain product freshness and quality for long durations. Flexible packaging provides superior protection against air, moisture, and contaminants, which is essential for the flavor and texture of cookies. Additionally, its versatility to custom sizes and shapes enables manufacturers to produce attractive and functional packs that improve shelf presence and user convenience. Sustainability is becoming more incorporated in flexible packaging solutions, with more emphasis being placed on recyclable and biodegradable content compatible with environmental policies as well as consumer demand for green products. These advantages, coupled with the cost-effectiveness of flexible packaging in distribution and logistics, make it the choice of manufacturers by large, playing an essential role in market growth as well as consumer satisfaction in the Europe cookies market outlook.

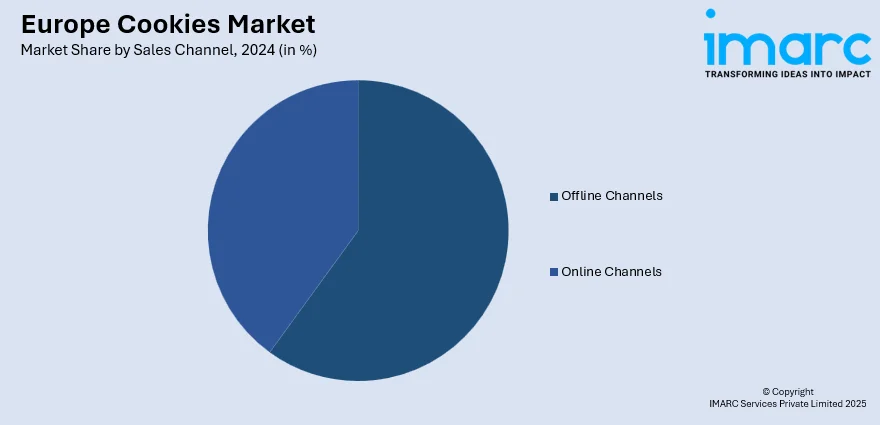

Analysis by Sales Channel:

- Online Channels

- Offline Channels

Offline channels continue to be the most prevalent channel for cookie sales in Europe, constituting 74.2% of overall sales in 2024. Classic retail channels like supermarkets, hypermarkets, convenience stores, and specialty stores remain the major points of purchase for consumers looking for cookies. Consumers' need for immediate product availability, touch inspection, and personalized shopping experiences fuels preference for offline channels. These channels also support impulse purchases by strategic placement of products and in-store marketing, which greatly increase sales of cookies. Even with the expansion of e-commerce, offline retailing is important because of established distribution networks and the wider distribution capabilities of brick-and-mortar stores. Retailers are responding by improving the store experience and adding loyalty programs to keep customers. The persistence of offline channel dominance highlights their vital function as a driver of cookie sales, market support, and consumer purchasing behavior within the Europe cookies market.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany dominates among the leading countries in the Europe cookies market with a 25.5% share in 2024. The German market is marked by a robust consumer demand for high-quality, varied cookie types, ranging from traditional flavors to innovative expressions. Germany's highly advanced retail infrastructure and high levels of disposable incomes drive strong demand for mass-market and premium cookie offerings. Consumers are increasingly in search of artisan and health options, leading manufacturers to launch organic, gluten-free, and low-sugar cookies that meet local tastes. Germany's vibrant café culture also fuels consumption of cookies with beverages, contributing further to market expansion. The nation's inclination towards quality and sustainability standards also impacts product innovation and packaging developments. Being a forerunner market in Europe, Germany is instrumental in determining trends, competitive forces, and playing a key part in the aggregate growth of the Europe cookies market.

Competitive Landscape:

The Europe cookies market competitive landscape is dominated by a wide range of players emphasizing innovation, product variation, and strategic distribution to gain market share. Industry players focus on creating distinct taste profiles and premium brands in response to changing consumer demand for indulgence and healthful products. Research and development investments allow for the launch of new formulations such as organic, gluten-free, and sugar-reduced forms. Companies are also increasing their footprint with stronger e-commerce capabilities and relationships with retail and foodservice outlets in Europe. Sustainability initiatives, including green packaging and responsible sourcing, are increasingly being incorporated into business strategies to comply with regulations and customer demands. Competitive forces are also influenced by local preferences and demand for local flavors, leading players to make offerings more local in nature. Overall, the environment is very dynamic, and innovation, consumerism, and widespread distribution networks are contributing towards growth and market positioning in the Europe cookies market.

The report provides a comprehensive analysis of the competitive landscape in the Europe cookies market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: London-based Doughlicious introduced a new line of vegan, gluten-free, ambient, soft-baked cookies in four varieties: Double Chocolate Chip, Salted Caramel, Chocolate Chip, and Banana Good Granola. British oats were used to make the cookies perfect for on-the-go snacking.

- January 2025: Valeo Foods Group completed the acquisition of I.D.C. Holding, a leading Slovakian manufacturer of wafers, biscuits, confectionery, and chocolate. The move strengthens Valeo's Central and Eastern European presence, adding well-known brands such as Horalky, Mila, and Lina to its portfolio.

- July 2024: The consumer brand FBC UK has launched two new dark chocolate lines: Fox's Fabulous Half Coated Dark Chocolate Cookies and Chocolatey Dark Chocolate Rounds, available exclusively in Tesco. Targeting the expanding UK premium treats sector, these new additions reflect increasing consumer demand for dark chocolate within the sweet biscuits market.

- June 2024: Mondelēz and Lotus Bakeries announced a joint venture to introduce co-branded chocolate offerings in Europe. Early launches will blend Biscoff with Cadbury in the United Kingdom and Milka in Europe in 2025, enhancing their positions in premium cookies and chocolate in major European markets.

- June 2024: Subway debuted its Footlong Sidekicks line in the UK and Ireland with cookies, churros, and tortilla dippers. It added new All-Star subs, Waffle Fries, and enhanced its digital presence with a new app, loyalty program, and in-store kiosks to enhance convenience and sales.

Europe Cookies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredients Covered | Chocolate, Chocolate Chips, Oatmeal, Butter, Cream, Ginger, Coconut, Honey, Others |

| Products Covered | Drop Cookies, Bar Cookies, Molded Cookies, No-Bake Cookies, Ice Box Cookies, Rolled Cookies, Sandwich Cookies, Others |

| Packagings Covered | Rigid, Flexible, Others |

| Sales Channels Covered | Online Channels, Offline Channels |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe cookies market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe cookies market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cookies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cookies market in the Europe was valued at USD 9.14 Billion in 2024.

The Europe cookies market is projected to exhibit a CAGR of 4.7% during 2025-2033, reaching a value of USD 14.42 Billion by 2033.

Key drivers of the Europe cookies market include increasing consumer inclination towards indulgent and convenient snacking, the growth of café culture promoting cookie eating with beverages, and increased health awareness driving demand for organic, healthy, and clean-label alternatives. Also, higher disposable incomes and the growth of online shopping platforms make access easier and variety wider, and also add further encouragement to the appeal and growth of the market in Europe through innovation in packaging and flavors.

The offline sales channel dominates the Europe cookies market, capturing 74.2% of the market share. Traditional retail outlets like supermarkets and convenience stores remain preferred for their accessibility and immediate product availability. Despite the growing popularity of online shopping, offline channels continue to drive the majority of cookie purchases across Europe, maintaining their critical role in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)