Europe DNA Sequencing Products Market Size, Share, Trends and Forecast by Product Type, Application, End User, and Country, 2025-2033

Europe DNA Sequencing Products Market Size and Share:

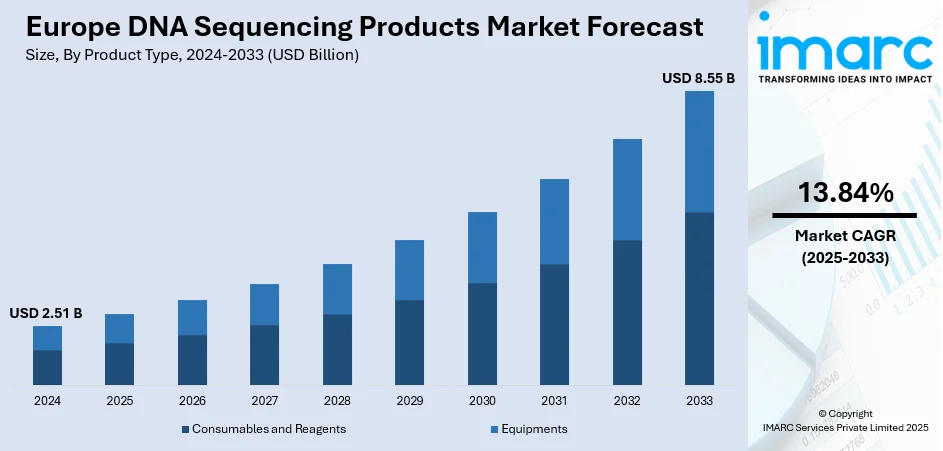

The Europe DNA sequencing products market size was valued at USD 2.51 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.55 Billion by 2033, exhibiting a CAGR of 13.84% during 2025-2033. Germany currently dominates the market, holding a significant share in 2024. The market is sustained by robust government backing for genomic programs, the established healthcare infrastructure, and fast adoption of precision medicine. Public and private organizations throughout the region proactively invest in next-generation sequencing-based research, notably in oncology, rare diseases, and pharmacogenomics. Europe's strong biotech ecosystem fueled by academic collaboration and EU-level funding initiatives also drives sequential demand for instruments. Regulatory environments such as GDPR also drive product development with an emphasis on data compliance and privacy, while further promoting the consistent growth of the Europe DNA sequencing products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.51 Billion |

|

Market Forecast in 2033

|

USD 8.55 Billion |

| Market Growth Rate 2025-2033 | 13.84% |

Active participation of public institutions and governments in promoting genomic studies and precision medicine is one of the strongest drivers of the DNA sequencing products market in Europe. Most European nations have established national genomics initiatives to enhance healthcare outcomes, accelerate innovation, and advance biotech development. For instance, the United Kingdom's Genomics England initiative has been a trailblazer in genome sequencing for personal medicine, and the same is the case in France, Germany, and the Nordic nations. They are usually public-private collaborations and invest heavily in sequencing technology and infrastructure. It is what is special to the region that focus is being placed on responsible data sharing and transborder cooperation within European Union policies that supports the development of pan-European genomic databases. While the objectives incentivize the application of DNA sequencing technologies in clinical and research environments, they also provide stable demand for next-generation sequencing platforms, reagents, and analysis tools in the member states, further ensuring growth in the Europe DNA sequencing products market outlook.

To get more information on this market, Request Sample

Europe's advanced healthcare infrastructure and the progressive adoption of precision medicine are also major growth drivers of the DNA sequencing products market. Numerous European hospitals and research institutions have already adopted genetic testing and sequencing as part of their diagnostic processes, especially in oncology, rare diseases, and inherited disorders. The region's focus on evidence-based medicine and early diagnosis provides a positive climate for the adoption of sequencing technologies. One of the characteristic elements of the European healthcare model is the existence of publicly funded mechanisms that enable wide-scale rollout of genetic testing programs, frequently with the aim of saving long-term healthcare expenditures. In addition, European regulatory agencies are more and more in favor of companion diagnostics and tailored treatments, which are significantly based on genomic data. This trend drives sales of DNA sequencing products, particularly those with high accuracy, scalability, and data protection regulation compliance like GDPR, which is an important factor peculiar to the European market.

Europe DNA Sequencing Products Market Trends:

Substantial Expansion of the Genomics Industry in Europe

Rapid expansion of the genomics industry in a number of countries is one of the leading trends in the Europe DNA sequencing products market. According to a report published by the IMARC Group, the global genomics market reached USD 38.4 Billion in 2024 and is projected to reach USD 113.3 Billion by 2033, growing at a CAGR of 12.77% during 2025-2033. This expansion is driven by heightened awareness about personalized medicine, growing use of genomics in disease diagnosis, and population-scale sequencing programs. Nations like the United Kingdom, Germany, and Finland have initiated national genomics programs to include genetic information in standard care. The UK's 100,000 Genomes Project and follow-on initiatives under Genomics England have made Europe the hub for clinical genomics. Next-generation sequencing technologies are being implemented increasingly in research institutions and hospitals on the continent for oncology, rare diseases, and inherited disorders. This growing embedding of genomics within the clinical environment underpins the wider life sciences ecosystem and generates constant Europe DNA sequencing products market demand.

Investment in Bioinformatics Infrastructure Upgradation

Another dominant trend within the market is the considerable investment by both private companies and national governments to upgrade and enhance bioinformatics infrastructure throughout Europe. Since DNA sequencing creates enormous amounts of intricate data, high-performance computational tools are necessary to store, process, and interpret this data effectively. European nations are proactively investing in cloud computing platforms, secure data exchange networks, and artificial intelligence-based analytics to cater to the increasing demands of genomics research and clinical diagnostics. For instance, in June 2024, MGI Tech inaugurated its new location in Berlin, Germany, to support the life science sector throughout Europe. The new facility features DNA sequencing capabilities to assist innovative applications and projects for MGI clients and partners. Projects such as the European Open Science Cloud (EOSC) and the ELIXIR infrastructure promote unification and harmonization of access to data across borders and make collaboration easier for researchers. Europe stands out due to its adherence to ethical data management, guaranteeing compliance with laws like the General Data Protection Regulation (GDPR). This regulatory push encourages innovation in privacy-protecting technologies and secure platforms, resulting in DNA sequencing offerings with improved data integration capabilities and regulatory compliance features that are apt for Europe's regulatory environment.

Miniaturization and R&D Upsurge

One of the Europe DNA sequencing products market trends is miniaturization of sequencing technologies coupled with an upsurge in research and development (R&D) activities. Breakthroughs in microfluidics, lab-on-chip platforms, and handheld sequencers are transforming how genetic tests are conducted, making sequencing quicker, less expensive, and more widely available. Biotechnology startups and research institutions in Europe are leading the efforts to create miniaturized, point-of-care sequencing platforms that can be used in clinical, field, or even home environments. These advancements are complemented by significant R&D investments from private as well as public sources, supporting innovation throughout the value chain, from sample preparation to data interpretation. For instance, in February 2025, Oxford Nanopore Technologies confirmed its full support for the European Long Read Innovation Network (ELRIN), a new European consortium headed by a team of specialists from the University of Tübingen. This project seeks to accelerate DNA sequencing-based clinical diagnostics by creating a European network to demonstrate the capabilities of Oxford Nanopore’s whole genome sequencing in standard clinical testing. In addition, Europe's culture of collaborative research, supported by EU finance programs such as Horizon Europe, promotes cross-disciplinary innovation in genomics, engineering, and computational biology. The intersection of miniaturization and high-impact R&D places Europe at the forefront globally for next-generation sequencing, with a developing market for small, efficient, and application-specific DNA sequencing solutions.

Europe DNA Sequencing Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe DNA sequencing products market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, application, and end user.

Analysis by Product Type:

- Consumables and Reagents

- Equipments

Consumables and reagents stand as the largest component in 2024. According to the Europe DNA sequencing products market analysis, reagents and consumables are the dominant product type segment within the market due to their constant use across various applications in research and clinical contexts. They are utilized throughout every step of the sequencing process, ranging from sample preparation to data creation, and include items like library prep kits, enzymes, primers, and buffers. Their unabating requirement is compounded by the intensive frequency of sequencing runs performed in academic research, clinical diagnosis, and pharmaceutical discovery. In Europe, where genomics research is greatly subsidized through government programs and institutional partnerships, application of consumables is particularly strong. Moreover, population genomics initiatives and precision medicine programs have contributed tremendously to throughput, further driving demand. Their desire for high-quality, consistent reagents, frequently optimized for particular sequencing platforms, which produces a highly competitive segment. European laboratories also seek products that comply with data protection and quality requirements, allowing established players with compliant products to dominate the marketplace.

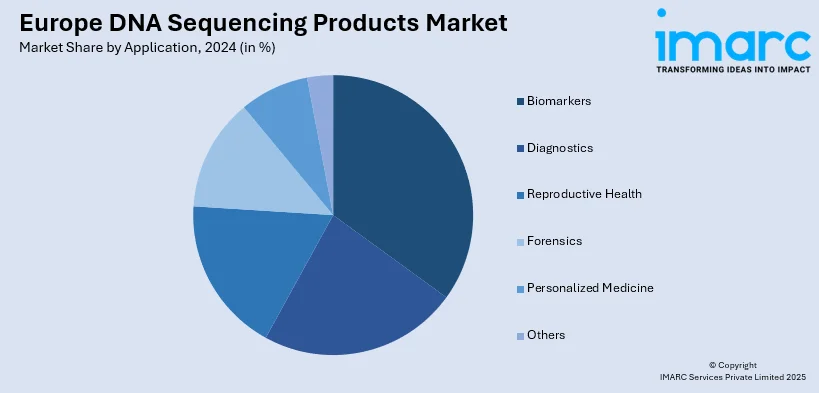

Analysis by Application:

- Biomarkers

- Diagnostics

- Reproductive Health

- Forensics

- Personalized Medicine

- Others

Biomarkers lead the market share in 2024. Biomarkers are the dominant application segment in the Europe DNA sequencing products market owing to their pivotal role in driving precision medicine and targeted therapeutics. Sequencing of DNA is being used to discover genetic biomarkers for many different diseases, especially in oncology, neurology, and rare genetic diseases. In Europe, where there is a focus on early diagnosis and targeted treatment, incorporation of insights derived from biomarkers into clinical practice is growing very fast. Research organizations and biotech firms in nations such as Germany, the UK, and France are working continuously to develop sequencing-based panels of biomarkers for patient stratification, disease monitoring, and prediction of therapeutic response. This use also takes advantage of good public research organization-private pharmaceutical company collaboration carrying out biomarker-driven clinical trials. In addition, European regulatory authorities increasingly endorse the utilization of companion diagnostics based on validated biomarkers for drug prescription. These combined synergize biomarker discovery and validation as a strong and expanding application across the region as per the Europe DNA sequencing products market forecast.

Analysis by End User:

- Academic and Government Research Institutes

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinics

- Others

Academic and government research institutes lead the market share in 2024. Carefully selected and strategically positioned, government and academic research institutions are the prime end-user segment within the Europe DNA sequencing products market, fueled by their seminal position at the forefront of genomics R&D and innovation. These centers carry out much of Europe's high-volume sequencing work, including population health research, rare disease studies, and cancer genomics projects. National initiatives like the UK's Genomics England and France's Plan France Médecine Génomique indicate deep public-sector investment in sequencing as a healthcare progress tool. European research institutions and universities also work closely within EU-funded programs such as Horizon Europe, which enables cross-border information sharing and collaborative studies. These institutions routinely make use of DNA sequencing products such as reagents, platforms, and bioinformatics tools for supporting their high-throughput research requirements. Academic labs also serve as testing laboratories for new sequencing technologies, which speed up product take-up. The continued focus on scientific discovery, public health, and regulatory-compliant data practices secures the dominance of this segment in the European market.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. Germany stands out as the leading regional segment in the Europe DNA sequencing products market, owing to its strong biomedical research infrastructure, robust healthcare system, and highly developed biotechnology sector. The nation has a concentration of premier research institutions, universities, and genome research facilities that are actively involved in advancing sequencing technologies and applications. Population-scale sequencing and sharing of data are facilitated by government-supported programs like the German Human Genome-Phenome Archive, which places demand for high-throughput sequencing platforms and reagents. Germany also encourages tight partnership among academia, public health organizations, and private biotech companies, which leads to faster innovation and mass adoption of DNA sequencing products. Its focus on individualized medicine and companion diagnostics in oncology further supports its dominance of this market. Additionally, Germany’s regulatory environment, skilled workforce, and continued investment in digital health infrastructure create favorable conditions for both domestic and international companies to expand their presence and scale operations in the sequencing space.

Competitive Landscape:

Key players in the Europe DNA sequencing products market are actively undertaking strategic initiatives to drive innovation, expand their market presence, and meet the growing demand for advanced genomic solutions. Market leaders like Illumina, Thermo Fisher Scientific, and QIAGEN are placing significant investment in research and development to increase the precision, speed, and scale of their sequencing technologies. The focus is on making clinical applications, most notably in oncology, infectious diseases, and rare genetic disease, possible. Collaborations with European academic centers, hospitals, and biotech companies are also a key part of their strategy, enabling joint research and technology take-up. Besides, firms are localizing their production and distribution networks to comply with European regulatory norms like GDPR and MDR. Some of them are introducing easy-to-use, portable sequencing machines to suit small labs and decentralized settings. Others are working on AI-driven bioinformatics software for quicker analysis and interpretation of data. Strategic acquisitions and expansion in the regions are also enabling these companies to establish a stronger foothold in the market. For example, the purchase of niche biotech firms or the creation of innovation centers in priority nations such as Germany, France, and the UK allows for increased responsiveness to local demands. Taken together, these initiatives are speeding up the development and availability of DNA sequencing technologies throughout Europe.

The report provides a comprehensive analysis of the competitive landscape in the Europe DNA sequencing products market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Eurofins Genomics announced the successful acquisition of LGC Group’s Sanger sequencing division. The acquisition supports Eurofins Genomics' goal of providing a full range of genomic solutions for its clients and strengthens its product offerings in the Sanger sequencing industry, which is a type of DNA sequencing.

- March 2025: The Barts Health NHS Trust in London and the United Kingdom’s Medicines and Healthcare Products Regulatory Agency (MHRA) announced the development of a novel DNA sequencing product for the quicker and more accurate identification of bacterial infections. With this novel system, scientists can identify the precise type of bacterium and the medications to which it may be resistant, allowing physicians to treat patients more effectively by avoiding the use of broad-spectrum antibiotics.

- February 2025: Roche launched its innovative, proprietary sequencing by expansion (SBX) technology, introducing a new class of next-generation DNA sequencing solutions. When paired with a cutting-edge sensor module, SBX chemistry provides ultra-fast, high-throughput DNA sequencing that is adaptable and scalable for a variety of purposes.

- April 2024: Eurofins Genomics AgriGenomics Europe, a global provider of DNA sequencing solutions and products, established a strategic partnership with Gencove to provide a comprehensive, reasonably priced, and high-throughput sequencing solution for low-pass whole genome sequencing (lpWGS) in Europe. This partnership aims to integrate Eurofins Genomics AgriGenomics Europe's capabilities with Gencove's platform for data analytics and administration for the advancement of genotyping technologies.

Europe DNA Sequencing Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Consumables and Reagents, Equipments |

| Applications Covered | Biomarkers, Diagnostics, Reproductive Health, Forensics, Personalized Medicine, Others |

| End Users Covered | Academic and Government Research Institutes, Pharmaceutical and Biotechnology Companies, Hospitals |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe DNA sequencing products market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe DNA sequencing products market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the DNA sequencing products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The DNA sequencing products market in Europe was valued at USD 2.51 Billion in 2024.

The Europe DNA sequencing products market is projected to exhibit a CAGR of 13.84% during 2025-2033, reaching a value of USD 8.55 Billion by 2033.

The Europe DNA sequencing products market is driven by national genomics initiatives, strong academic research, growing adoption of precision medicine, and rising demand for biomarker-based diagnostics. Government funding, public-private collaborations, and an expanding biotech sector further support market growth, particularly in countries like Germany, the UK, and France.

Germany accounts for the largest market share in the Europe DNA sequencing products market, driven by advanced biomedical research, strong government support for genomics, and a well-established healthcare infrastructure. Active collaborations between academic institutions, biotech firms, and public health bodies, along with growing investments in precision medicine and diagnostic innovation, further accelerate demand for sequencing technologies nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)