Europe E-Bike Market Report by Mode (Throttle, Pedal Assist), Motor Type (Hub Motor, Mid Drive, and Others), Battery Type (Lead Acid, Lithium Ion, Nickel-Metal Hydride (NiMH), and Others), Class (Class I, Class II, Class III), Design (Foldable, Non-Foldable), Application (Mountain/Trekking Bikes, City/Urban, Cargo, and Others), and Country 2026-2034

Europe E-Bike Market:

The Europe e-bike market size reached USD 6,431.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 10,821.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.00% during 2026-2034. The need for sustainable alternative to conventional motor vehicles owing to the rising pollution levels, favorable government incentives promoting eco-friendly transportation, and technological advancements in battery and motor efficiency are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6,431.5 Million |

| Market Forecast in 2034 | USD 10,821.6 Million |

| Market Growth Rate (2026-2034) | 6.00% |

Access the full market insights report Request Sample

Europe E-Bike Market Analysis:

- Major Market Drivers: Rapid urbanization, increasing traffic congestion, rising environmental consciousness, and growing emphasis on health and fitness are propelling the market growth. Moreover, continuous improvements in battery life, motor efficiency, and e-bike design are also shifting the consumer demand towards e-bikes in Europe.

- Key Market Trends: Rising environmental concerns, continuous innovations in battery technology especially lithium-ion batteries, ongoing infrastructure development, growing emphasis on using eco-friendly transportation, etc., are expected to accelerate the Europe e-bike market demand. Moreover, various European countries have introduced subsidies and incentives to encourage the purchase of e-bikes.

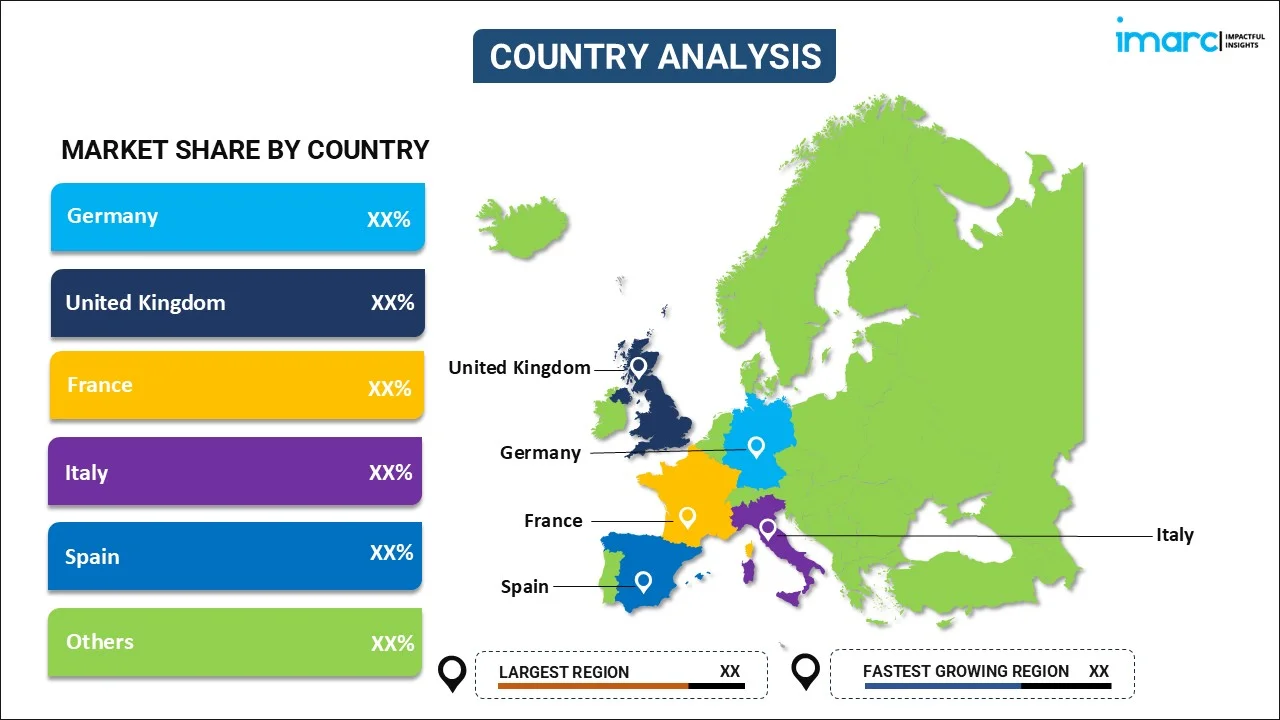

- Geographical Trends: Germany accounted for the largest market share. The country has implemented various incentives to promote e-bike adoption, including subsidies, tax breaks, and funding for e-bike charging infrastructures. These measures make e-bikes more affordable and attractive to consumers. Moreover, it has a strong cycling culture, with a long tradition of bike-friendly policies and infrastructures, thereby driving the growth in the region.

- Challenges and Opportunities: High initial costs, regulatory uncertainties, inadequate infrastructures, supply chain disruptions, and environmental impact associated with the disposal of battery are some of the factors hindering the market growth. However, as consumers become more environmentally conscious, the demand for sustainable transportation options like e-bikes is increasing. E-bikes offer a low-carbon alternative to cars, appealing to eco-friendly consumers.

Europe E-Bike Market Trends:

Favorable Government Regulations and Incentives

The rising government support is one of the significant factors escalating the market growth. Many European countries are actively promoting e-bike usage through favorable regulations, incentives, and awareness and safety campaigns. For instance, in February 2024, the Government of UK published new information on how to safely buy, charge, and pilot e-bikes in order to improve consumer awareness and safety. Subsidies, tax reductions, and even grants are provided to both manufacturers and consumers to make e-bikes more affordable. For instance, the French government has been granting discounts ranging from €300 to €2000, depending on the individual's financial status. Residents who want to buy a cargo bike, a folding bike, a bike designed for a disabled person, or an electric bike trailer could save up to €2000. Moreover, policymakers are recognizing e-bikes as a solution to reduce urban congestion and lower emissions, aligning with broader goals of sustainability and climate change mitigation. These regulations are often part of comprehensive transportation and environmental policies that support e-bikes along with various forms of green mobility. The effect is a robust and cohesive support system that actively encourages citizens to consider e-bikes as a viable and attractive mode of transportation. For instance, as stated in a November 2023 report by the European Institute of Innovation & Technology's Urban Mobility project, using cargo bikes for "last-mile" delivery could lower pollution and traffic. Cargo bikes can go places where larger cars can't and are simpler to park. These factors are further bolstering the Europe e-bike market revenue.

Rise in Environmental Concerns

The EU government is striving to meet the carbon emission targets due to the growing environmental concerns. For instance, according to the European Commission, in 2023, the EU approved several commission proposals to adapt the EU's climate, energy, transportation, and taxation policies to reduce net greenhouse gas emissions by at least 55% by 2030, relative to 1990 levels. The European Union implemented integrated regulations, known as the Regulation on the Governance of the Energy Union and Climate Action, to guarantee the planning, tracking, and reporting of progress toward its 2030 energy. E-bikes produce zero emissions during operation, making them an environmentally friendly alternative to gasoline-powered vehicles. For instance, according to the article published by Greenmatch, e-bikes are a greener option for transportation than gasoline-powered cars because they emit no emissions when in use. They generate about 14.8g CO2e per kilometer traveled, which is 30% less than the emissions from riding a traditional bike. Moreover, with increasing urbanization, the need for sustainable transportation options is more critical. E-bikes provide an efficient means of transport for short to medium distances, and longer distances helping to alleviate traffic congestion and reduce the reliance on cars. For instance, in March 2024, Cowboy launched Cowboy Cross, an electric bike that aims for comfort and longer trips. With the larger battery capacity, people can ride for 60 to 120 km on a single charge. Moreover, in February 2024, FedEx Express Europe launched e-cargo bikes for work, vehicle pickup and delivery, in Greater London. These factors are further escalating the industry’s growth.

Continuous Infrastructural Developments

The rising development of cycling infrastructure across Europe is a major driver of the e-bike market. Improved infrastructure makes e-biking more accessible, safer, and convenient for users, encouraging more people to switch to e-bikes for their daily commutes and recreational activities. Countries like Germany and the Netherlands have been expanding their network of dedicated bike lanes, separating cyclists from motor vehicle traffic. For instance, in May 2024, German's Hesse state and Darmstadt Regional Council announced to launch a cycle lane to speed pedelecs (e-bikes). In line with this, the Geintegreerd Investing Program reserved around EU 318.8 million additional funds for cycling infrastructure. This enhances safety and encourages more people to consider e-bikes as a viable mode of transportation. Moreover, the installation of public e-bike charging stations across cities ensures that e-bike users have convenient access to recharge their batteries. This infrastructure development addresses range anxiety and makes longer commutes feasible. For instance, in November 2023, the EU passed a new law requiring fast charging facilities for electric vehicles (EVs) every 37 miles on motorways. In line with this, in January 2024, Lotus, an automotive manufacturer, partnered with Bosch and Mobilize to provide customers with access to over 600,000 European charging stations. These factors are positively influencing the Europe e-bike market forecast.

Europe E-Bike Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe e-bike market report, along with forecasts at the regional and country levels from 2026-2034. Our report has categorized the market based on mode, motor type, battery type, class, design, and application.

Breakup by Mode:

To get detailed segment analysis of this market Request Sample

- Throttle

- Pedal Assist

Pedal assist dominates the market

The report has provided a detailed breakup and analysis of the market based on the mode. This includes throttle and pedal assist. According to the report, pedal assist represented the largest segment.

Pedal assist, also known as Pedelec, requires the rider to pedal to engage the motor. The motor provides assistance proportionally to the rider's pedaling effort, making the ride easier, especially during uphill or strenuous stretches. This mode is attractive to a wide range of consumers, from daily commuters seeking an easier ride to fitness enthusiasts who still want to engage in physical exercise but with added assistance. Since they align with sustainability goals, fitness trends, and regulatory requirements that emphasize human-powered mobility, pedal-assist e-bikes are generally more prevalent in Europe, favoring the segment growth. For instance, in July 2023, Decathlon launched a new Stilus E-Touring e-bike in Europe. The bike is equipped with a torque sensor that helps in making the pedaling experience feel natural with the added power.

Breakup by Motor Type:

- Hub Motor

- Mid Drive

- Others

Hub motor accounts for the majority of the market share

A detailed breakup and analysis of the market based on the motor type has also been provided in the report. This includes hub motor, mid drive, and others. According to the report, hub motor accounted for the largest market share.

Hub motors are integrated into the front or rear wheel's hub and provide direct drive power to the wheels. This type is suitable for casual riders, commuters, and those seeking a cost-effective option. Hub motors often offer sufficient power for flat terrains and daily urban use. Hub motors are commonly used due to their simplicity, lower cost, and ease of maintenance. For instance, in March 2024, Ampler, a European e-bike manufacturer, launched its new variant Curt Anyroad, equipped with non-removable batteries that power a European start 250W rear-hub motor with a max speed of 25km/h.

Breakup by Battery Type:

- Lead Acid

- Lithium Ion

- Nickel-Metal Hydride (NiMH)

- Others

Lead acid represents the most widely used battery type

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lead acid, lithium ion, nickel-metal hydride (NiMH), and others. According to the report, lead acid represented the largest segment.

According to the Europe e-bike market outlook, lead acid batteries are the oldest type of rechargeable batteries, known for their affordability. Often found in lower-cost e-bikes, they are widely preferred by budget-conscious consumers and markets where price is a significant factor. Lithium-ion batteries offer higher energy density, longer lifespans, and are relatively lightweight. They appeal to a wide spectrum of users, from daily commuters to enthusiasts seeking a balance of performance, weight, and cost. These are the most popular battery types in the e-bike industry, owing to their efficiency and modern technological advantages.

Breakup by Class:

- Class I

- Class II

- Class III

Class I holds the largest share in the market

A detailed breakup and analysis of the market based on the class has also been provided in the report. This includes class I, II, and III. According to the report, class I accounted for the largest market share.

Class I e-bikes provide assistance only when the rider is pedaling and usually stop assisting at speeds of around 20 mph (32 kph). They are suitable for urban commuting, fitness, recreational riding, and where regulations require human pedal involvement. As these e-bikes align with many European regulations and appeal to a broad audience, they are highly preferred by daily commuters and leisure riders.

Breakup by Design:

- Foldable

- Non-Foldable

Non-foldable represents the most popular e-bike design

A detailed breakup and analysis of the market have been provided based on design. This includes foldable and non-foldable. According to the report, non-foldable e-bikes accounted for the largest market share.

Non-foldable e-bikes encompass the traditional and standard e-bike design without the ability to fold. They can include various types, from city to mountain bikes, each catering to different riding styles and conditions. Non-foldable e-bikes appeal to a broad range of consumers, including leisure riders, fitness enthusiasts, long-distance commuters, off-road cyclists, and more. They generally offer more diverse options in terms of performance, style, and functionality. For instance, in May 2024, Decathlon launched a non-foldable new e-gravel bike, the Van Rysel E-GRVL AF MD with advanced features such as a carbon fork, Michelin tires, and Bluetooth connectivity.

Breakup by Application:

- Mountain/Trekking Bikes

- City/Urban

- Cargo

- Others

City/urban is the leading application segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes mountain/trekking bikes, city/urban, cargo, and others. According to the report, city/urban represented the largest segment.

City or urban e-bikes are designed for daily commuting, short-distance travel, and use on well-paved roads. They are ideal for urban commuters, casual riders, and those seeking a convenient and eco-friendly alternative to motor vehicles in city environments. As urbanization and environmental consciousness drive the demand for sustainable transport solutions, city or urban e-bikes are gaining immense traction, thus favoring the segment growth. For instance, in March 2024, Himiway introduced the A7 Pro e-bike for urban commuters in Europe.

Breakup by Country:

To get detailed regional analysis of this market Request Sample

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. According to the report, Germany accounted for the largest market share.

According to the Europe e-bike market overview, Germany leads in e-bike sales in Europe since the region has a well-established cycling infrastructure and is driven by strong consumer interest, technological advancements, and government incentives. For instance, in March 2024, CityQ, a startup based in Germany, announced to launch car-like-e-bikes for both cargo and passenger models in the country.

Competitive Landscape:

The market is experiencing moderate growth as several key players are actively engaging in strategies to innovate, expand, and strengthen their presence. The leading manufacturers are investing in research and development (R&D) activities to introduce more efficient, lightweight, and user-friendly e-bike models. Collaborations with technology firms are also resulting in advancements in battery life, motor efficiency, and smart connectivity features. Moreover, customized solutions for various segments, such as urban commuters, mountain bikers, and cargo carriers, are being developed to cater to the diverse needs of consumers across countries. Additionally, vendors are exploring new markets, forging partnerships with local distributors, and promoting their products through targeted marketing campaigns to reach different demographics. Sustainability initiatives are also at the forefront, aligning with governmental environmental goals and growing consumer interest in eco-friendly transportation alternatives. We also expect the market to witness a rise in product innovations and customization, expansion strategies, and sustainability initiatives during the forecast period, reflecting a dynamic and responsive approach to the evolving e-bike market in Europe.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided, including:

- Giant Manufacturing Co. Ltd.

- Kalkhoff Werke GmbH

- Riese & Müller GmbH

- Trek Bicycle Corporation

- Yamaha Motor Co., Ltd.

- Accell Group N.V.

- Gazelle (Royal Dutch Gazelle)

- Moustache Bikes

- Gocycle

Europe E-Bike Market News:

- May 2024: Decathlon launched a new e-gravel bike, the Van Rysel E-GRVL AF MD, with advanced features such as a carbon fork, Michelin tires, and Bluetooth connectivity.

- March 2024: Himiway introduced the A7 Pro e-bike for urban commuters in Europe.

- March 2024: CityQ, a startup based in Germany, announced to launch car-like-e-bikes for both cargo and passenger models in the country.

Europe E-Bike Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Modes Covered | Throttle, Pedal Assist |

| Motor Types Covered | Hub Motor, Mid Drive, Others |

| Battery Types Covered | Lead Acid, Lithium Ion, Nickel-Metal Hydride (NiMH), Others |

| Classes Covered | Class I, Class II, Class III |

| Designs Covered | Foldable, Non-Foldable |

| Applications Covered | Mountain/Trekking Bikes, City/Urban, Cargo, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Giant Manufacturing Co. Ltd., Kalkhoff Werke GmbH, Riese & Müller GmbH, Trek Bicycle Corporation, Yamaha Motor Co., Ltd., Accell Group N.V., Gazelle (Royal Dutch Gazelle), Moustache Bikes, Gocycle, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe e-bike market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe e-bike market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe e-bike industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe e-bike market was valued at USD 6,431.5 Million in 2025.

We expect the Europe e-bike market to exhibit a CAGR of 6.00% during 2026-2034.

The increasing environmental consciousness, along with the rising demand for e-bikes as they are energy-efficient and offer emission-free commuting option over fuel-powered cars, is primarily driving the Europe e-bike market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several European nations, resulting in the temporary closure of numerous manufacturing units for e-bikes.

Based on the mode, the Europe e-bike market has been bifurcated into throttle and pedal assist, where pedal assist currently exhibits a clear dominance in the market.

Based on the motor type, the Europe e-bike market can be segmented into hub motor, mid drive, and others. Currently, hub motor holds the majority of the total market share.

Based on the battery type, the Europe e-bike market has been divided into lead acid, lithium ion, Nickel-Metal Hydride (NiMH), and others. Among these, lead acid currently exhibits a clear dominance in the market.

Based on the class, the Europe e-bike market can be categorized into class I, class II, and class III. Currently, class I accounts for the majority of the total market share.

Based on the design, the Europe e-bike market has been segregated into foldable and non-foldable, where non-foldable currently holds the largest market share.

Based on the application, the Europe e-bike market can be bifurcated into mountain/trekking bikes, city/urban, cargo, and others. Currently, city/urban exhibits a clear dominance in the market.

On a regional level, the market has been classified into Germany, France, United Kingdom, Italy, Spain, and others, where Germany currently dominates the Europe e-bike market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)