Europe Electronic Toll Collection Market Report and Forecast by Technology, System, Subsystem, Offering, Toll Charging, Application, and Country, 2025-2033

Europe Electronic Toll Collection Market Size and Share:

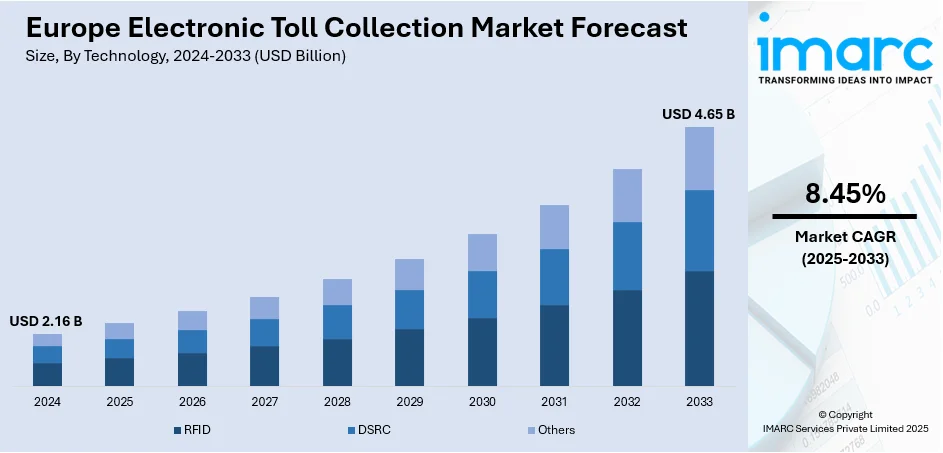

The Europe electronic toll collection market size was valued at USD 2.16 Billion in 2024. The market is projected to reach USD 4.65 Billion by 2033, exhibiting a CAGR of 8.45% from 2025-2033. Germany is currently dominating the market with a share of 28.7% due to surging demand for efficient and interoperable toll collection systems. Technology advancements in DSRC and RFID improve borderless tolling with investments in intelligent transport infrastructure. Hardware and auto vehicle identification are key building blocks supporting market growth. Digital integration and standardization initiatives by governments further accelerate uptake. These factors together set the ground for continuous growth and innovation in the Europe electronic toll collection market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.16 Billion |

|

Market Forecast in 2033

|

USD 4.65 Billion |

| Market Growth Rate 2025-2033 | 8.45% |

The heightening concern for sustainability and environmental responsibility is a key driver for the implementation of electronic toll collection (ETC) systems in Europe. The conventional approaches to tolling involve congestion and idling vehicles at the toll plazas, which increase emissions and pollute the environment. ETC systems facilitate seamless, unobstructed traffic flow by permitting vehicles to travel toll points without interruption, drastically lowering fuel consumption and air emissions. As per the sources, In June 2025, CzechToll’s electronic toll system registered over 900,000 vehicles, processing 102 million toll transactions in May and generating 1.647 billion Czech crowns in tolls, a 9.7% year-on-year increase. Moreover, this is in tune with Europe's wider aspirations to minimize carbon footprints and encourage less polluting transport solutions. Further, ETC facilitates the integration of smart mobility initiatives by allowing for improved traffic management and collection of data, which can be utilized to streamline routes, prevent traffic congestion, and minimize overall emissions. As governments and local authorities make more concerted efforts to reduce greenhouse gas emissions and achieve other environmental goals, the use of ETC systems is an integral part of sustainable transport infrastructure that assists in balancing economic development with environmental protection.

To get more information on this market, Request Sample

Growing complexity and volumes of cross-border traffic throughout Europe are motivating the demand for more efficient and interoperable tolling systems. With so many countries linked by vast road networks, the conventional toll collection process tends to result in delays and administrative hassles for freight carriers and travelers crossing the borders. The need for smoother travel without disruption has precipitated the development and installation of ETC systems with provisions for interoperability across varying national toll infrastructures. Such interoperability allows for seamless toll collection irrespective of the mode of origin of the vehicle, with no need for several toll devices or cash payment in various countries. Through simpler toll payments, ETC systems enhance the ease of logistics movements and improved mobility on the continent. For instance, in April 2025, Toll4Europe announced the upcoming launch of its advanced 4G On-Board Unit, aiming to enhance multi-country electronic toll collection across Europe with greater efficiency and interoperability. Furthermore, this driver emphasizes the need for harmonized tolling solutions to be used in facilitating economic integration and enhancing the efficiency of the European transport network and enabling passenger and freight movement across borders.

Europe Electronic Toll Collection Market Trends:

Increasing Demand Driven by Logistics and Transportation Industries

The transportation and logistics industries of Europe are major drivers for the expanding use of electronic toll collection (ETC) systems on roads and highways. In 2022, the EU's transport and storage services industry contributed a staggering EUR 642.7 billion in value added, providing jobs for about 10.4 million workers and achieving a net turnover of EUR 1.9 trillion. This strong economic performance highlights the critical contribution of transport in European economic activity, thereby generating considerable demand for effective tolling systems. Europe electronic toll collection market trends reveal that ETC systems enable quicker, automated payment of tolls, easing congestion and enhancing traffic flow. As European road freight and passenger traffic continues to increase, free-flowing and open interoperable tolling systems are crucial to facilitating cross-border transport. Greater dependence on such technology goes a long way in minimizing delays, reducing emissions due to smoother traffic, and enhancing logistics chains' efficiency, making European transport networks overall more competitive.

European Commission's Support for Smart Transportation Initiatives

The European Commission has been at the forefront of promoting smart transportation by providing funding and research initiatives that promote better tolling and mobility networks in Europe. One such example is Pilot on Interoperable Systems for Tolling Applications (PISTA), which is a research effort aimed at implementing interoperable Electronic Fee Collection (EFC) systems across the continent. This project will harmonize tolling procedures, allowing free interoperability between various national toll regimes and simplifying cross-border traffic circulation. By lowering administrative and technical obstacles, interoperable toll systems ensure easier travel and freight transportation, strengthening regional integration and economic unity. These projects illustrate the EU's strategic focus on the integration of digital solutions in transport infrastructure, catering to future needs for mobility, and ensuring that Europe continues to lead the way in smart transport solutions while responding to the growing needs for sustainable and efficient road transport services.

Investment in Intelligent Transport Systems and Infrastructure

The European Union, in July 2024, invested EUR 7 billion to finance 134 projects that aim to enhance smart transport infrastructure and technologies. These investments are geared towards building Intelligent Transport Systems (ITS), safe parking spaces, air traffic control systems, and digital connectivity of cross-border transport infrastructure. ITS implementations allow for real-time management of traffic, enhancing road safety, decreasing congestion, and reducing environmental effects. Digital infrastructure investments also enhance coordination among transport modes and ease toll collection processes through interoperable electronic systems. Improving secure parking solutions solves urban mobility issues and facilitates electric vehicle uptake. Overall, this vast funding is indicative of Europe's forward-thinking focus on revamping its transport infrastructure, enabling sustainable mobility, and utilizing digital innovations for enhancing the efficiency, security, and environmental impact of its transport sector in the years ahead.

Europe Electronic Toll Collection Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe electronic toll collection market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on based on technology, system, subsystem, offering, toll charging, and application.

Analysis by Technology:

- RFID

- DSRC

- Others

Dedicated Short-Range Communication (DSRC) technology remains the market leader in Europe’s electronic toll collection market with a 63.9% market share in 2024. DSRC technology is a wireless communication protocol that supports high-speed, reliable exchanges between road-to-vehicle and vehicle-to-roadside equipment over short distances, making it a perfect fit for toll applications. DSRC allows vehicles to be automatically identified and processed for tolls without stopping, thus improving traffic flow and minimizing congestion. Its mass uptake is facilitated by proven infrastructure compatibility and regulatory support in all European nations. The reliability and low latency of DSRC ensure high accuracy in toll fee computation and vehicle positioning, essential to ensure system efficiency. DSRC also facilitates interoperability between various toll systems in a move to harmonize toll collection within the multi-national European setting. Its robust market share indicates the reliability and effectiveness of the technology to meet the needs of complex road networks and high traffic density across the region.

Analysis by System:

- Transponder - or Tag-Based Toll Collection Systems

- Other Toll Collection Systems

Transponder- or tag-based toll collection systems have a dominant 60.1% market share in Europe's ETC market in 2024, which demonstrates their pivotal role in achieving hassle-free toll transactions. They utilize RFID-based devices installed on vehicles, which interact with roadside readers to automatically charge tolls. They are popular due to their convenience, precision, and capacity to utilize high-speed toll lanes without stopping the vehicles. The ubiquity of transponder systems increases the efficiency of tolling operations due to reduced delays and less manual intervention. In addition, these systems facilitate improved data gathering for traffic observation and infrastructure design. Their ability to work with several tolling zones as well as support border interoperability also helps in their predominance. The high percentage of transponder-based systems indicates their success in serving the requirements of a complicated, high-volume transport situation common in Europe.

Analysis by Subsystem:

- Automated Vehicle Identification

- Automated Vehicle Classification

- Violation Enforcement System

- Transaction Processing

Automated Vehicle Identification (AVI) is a critical subsystem of the electronic toll collection system that precisely identifies vehicles as they move through toll locations. Although there is no data on specific market share, AVI is core to the operation of ETC, utilizing technologies like RFID, license plate recognition, and DSRC to provide accurate vehicle detection and categorization. This sub-system minimizes human error and accelerates toll processing by automatically detecting vehicles and linking them to the correct accounts or billing systems. AVI is also responsible for enforcing toll compliance and fraud prevention through real-time verification of vehicle credentials. Back-end system integration with AVI facilitates efficient data management and reporting, which are critical to the efficiency of operations. While ETC systems become increasingly advanced, AVI is being further enriched with sophisticated imaging and sensor technologies for enhanced accuracy and reliability in Europe's expanding smart transport network.

Analysis by Offering:

- Hardware

- Back Office and Other Services

Hardware continues to be the largest offering segment within the Europe electronic toll collection market growth, which registered a 55.5% share in 2024. It comprises the physical hardware required to operate the system, including transponders, roadside readers, cameras, sensors, and control units. Durable and dependable hardware is key to ensuring smooth communication between the vehicles and tolling infrastructure, reliable toll transactions, and reduced system downtime. High-speed toll collection, interoperability, and integration with Intelligent Transport Systems drive the need for sophisticated hardware. Ongoing advancements in hardware design enhance endurance, weatherproofing, and power efficiency, vital to the requirements of outdoor tolling environments. The dominance of hardware in the market is in line with the constant investments in Europe-wide infrastructure modernization and expansion, as governments replace aged systems to respond to rising traffic volumes and regulatory requirements.

Analysis by Toll Charging:

- Distance Based

- Point Based

- Time Based

- Perimeter Based

Distance-based toll charging models are an increasingly appropriate application in Europe's electronic toll Collection environment, although actual market share figures are unavailable. This model tolls drivers for the distance driven on toll roads, offering a more equitable and open-to-view toll system than flat rates or charges based on time. Distance-based tolling motivates efficient road use and may decrease congestion by rewarding shorter trips or off-peak travel. It is supportive of environmental objectives in that it leads to improved traffic distribution and decreased emissions through more efficient route planning. Physical distance models need to be applied on the basis of highly accurate vehicle locations and data management, which ETC systems facilitate via modern communication technology and embedded software applications. Although still growing, this charging model mirrors the trend toward more dynamic and balanced tolling approaches in the modernizing transport systems in Europe.

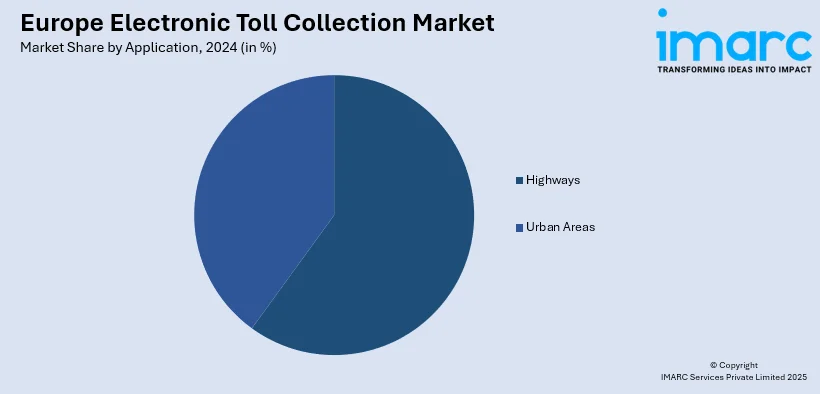

Analysis by Application:

- Highways

- Urban Areas

Highways represent the biggest application segment in Europe electronic toll collection market outlook, with a whopping 74.5% share in 2024. Highways are key routes for passenger and cargo traffic, with high traffic volumes and congestion levels. ETC on motorways ensures smooth vehicle flow by allowing automatic payment of tolls at high speeds, minimizing bottlenecks and enhancing traffic flow. This application has extensive government attention and investment in infrastructure because it has a significant bearing on productivity in the economy and mobility. Incorporating ETC on highways is part of more comprehensive traffic management and facilitates observation of vehicle movement and roadway use trends in real-time. The prevalence of highway uses indicates the importance accorded to optimizing long-distance travel efficiency and the critical role played by ETC systems in the management of some of Europe's busiest motorways.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is leading the electronic toll collection market in Europe with a 28.7% share in 2024, an indication of its vast and sophisticated road infrastructure. The nation's extensive highway and federal road network requires advanced tolling solutions to facilitate the flow of heavy traffic volumes. Germany's emphasis on incorporating advanced ETC technologies and interoperable systems ensures seamless collection of tolls for domestic and foreign vehicles alike. Digital infrastructure investments and intelligent transport programs further complement the expansion of ETC usage. Germany's dominance in this market is motivated by its geographical placement in Europe, high freight traffic, and focus on maximizing transport efficiency and environment-friendliness. The country's share in this market demonstrates its position as an important driver of shaping the future of tolling systems in the larger mobility context in Europe.

Competitive Landscape:

The Europe electronic toll collection market’s competitive environment is marked by ongoing innovation and strategic partnerships to improve system interoperability and efficiency. Players in the market concentrate on creating next-generation technologies like DSRC and RFID in order to deliver smooth tolling experiences and meet the growing demand for smart transportation solutions. Focus is on building product portfolios encompassing hardware modules such as transponders and advanced software for automated vehicle identification and transaction processing. Regional programs and regulatory policies promote cross-border interoperable toll systems, prompting companies to adapt their products to changing standards. Also, investments in intelligent transport systems and digital infrastructure are shaping competitive strategies, as the providers aim to offer end-to-end solutions that fit into overall mobility networks. These ongoing dynamics guarantee that the Europe electronic toll collection market forecast continues to be positive, with constant innovations driving growth and development in the industry.

The report provides a comprehensive analysis of the competitive landscape in the Europe electronic toll collection market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Audi expanded its partnership with Tolltickets to offer electronic toll boxes across over ten European countries. The device, launched in Germany, Austria, and Switzerland in 2024, enables seamless, automatic toll payments, reducing wait times, language barriers, and payment hassles for drivers through fully digital, transparent billing.

- July 2025: Verra Mobility partnered with Sixt to launch an electronic toll payment solution for rental vehicles in six major Italian cities. The system enables seamless toll payments across Italy’s 4,500 km network, improving speed, safety, and convenience for travelers, especially during peak tourist seasons.

- May 2025: TotalEnergies and Axxès signed EETS agreements with RDW, joining Toll4Europe and Telepass in preparing for the Netherlands' truck toll launch in mid-2026. The system charges per kilometer, encourages low-emission vehicles, and replaces the Eurovignette, aiming to reduce freight transport emissions and support sustainable mobility initiatives.

- March 2025: Serbia announced plans to launch a joint electronic toll collection system with Greece and Croatia, enabling cross-border toll payments using a single ETC tag. Operational rollout begins before summer with Greece and by year-end with Croatia, enhancing travel convenience across popular regional tourist routes.

- December 2024: Q-Free highlighted its tolling innovations in Portugal, Spain, and France through VP Luis Miranda. Key successes include Multi-Lane Free Flow (MLFF) rollouts, strong local partnerships, and sustainable, interoperable solutions, positioning Q-Free to lead in future mobility trends like Road User Charging and urban congestion management.

Europe Electronic Toll Collection Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | RFID, DSRC, Others |

| Systems Covered | Transponder- or Tag-Based Toll Collection Systems, Other Toll Collection Systems |

| Subsystems Covered | Automated Vehicle Identification, Automated Vehicle Classification, Violation Enforcement System, Transaction Processing |

| Offerings Covered | Hardware, Back Office and Other Services |

| Toll Chargings Covered | Distance Based, Point Based, Time Based, Perimeter Based |

| Applications Covered | Highways, Urban Areas |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe electronic toll collection market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe electronic toll collection market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electronic toll collection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electronic toll collection market in Europe was valued at USD 2.16 Billion in 2024.

The Europe electronic toll collection market is projected to exhibit a CAGR of 8.45% during 2025-2033, reaching a value of USD 4.65 Billion by 2033.

The market is stimulated by the growing need for effective traffic management and borderless toll processing. The developments in DSRC and RFID technologies, coupled with government support for smart transportation infrastructure, encourage widespread adoption. Moreover, the demand to alleviate congestion and improve road safety stimulates the installation of interoperable electronic toll systems throughout the region, driving impressive growth in the market.

Germany accounts for the largest share in the Europe electronic toll collection market with a holding of about 28.7%. This dominance is because it has a vast highway network, high traffic density, and aggressive investments in advanced tolling systems and interoperability. Germany's emphasis on upgrading transport infrastructure and smart mobility integration makes it the dominant regional market for electronic toll collection within Europe.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)