Europe Feed Additives Market Report Size, Share, Trends and Forecast by Source, Product Type, Livestock, Form, and Country, 2026-2034

Europe Feed Additives Market Size and Share:

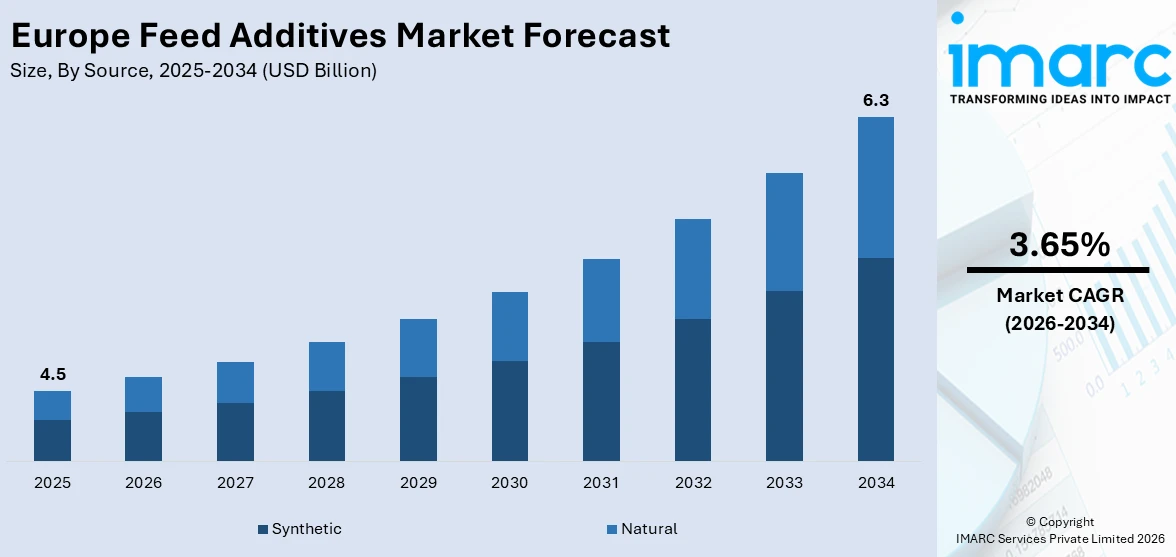

The Europe feed additives market size was valued at USD 4.5 Billion in 2025. The market is expected to reach USD 6.3 Billion by 2034, exhibiting a CAGR of 3.65% during 2026-2034. Spain currently dominates the market, holding a significant market share in 2025. The market is fueled by increasing demand for better animal nutrition and health, backed by regulatory initiatives favoring feed quality and safety throughout Europe. Expansion in meat, dairy, and aquaculture production is motivating livestock farmers to use feed additives that help improve productivity and sustainability. Further, environmental pressures and the demand to minimize antibiotic consumption in animal feeds are also enhancing demand, thereby augmenting the Europe feed additives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.5 Billion |

|

Market Forecast in 2034

|

USD 6.3 Billion |

| Market Growth Rate 2026-2034 | 3.65% |

The market is driven by the growing demand for high-quality animal nutrition, as livestock producers aim to enhance productivity and overall animal health. Stringent regulations on feed safety and quality standards are further encouraging the adoption of advanced additives that comply with these requirements. In parallel, increasing consumer preference for safe, sustainable, and antibiotic-free animal products is accelerating the shift toward natural feed additives. Apart from this, the rise of e-commerce in Europe is also contributing to market growth. In 2024, 94% of individuals aged 16–74 reported using the internet within the past 12 months, with 77% having purchased goods or services online, facilitating easier access to feed products and additives.

In addition to this, one of the growing Europe feed additives market trends is the continual advancements in livestock farming practices, such as precision feeding, which are promoting the use of customized feed solutions. Expanding aquaculture farming is driving demand for specialized additives that support fish health and growth. Environmental sustainability is another key factor, as feed additives help reduce the carbon footprint of livestock operations. For instance, in December 2024, Denmark launched a financial initiative supporting farmers to use a cow feed additive capable of reducing methane emissions by up to 30%, aligning with the country’s goal of cutting overall emissions by 70% by 2030 compared to 1990 levels. Additionally, growing awareness of animal welfare and health has spurred the adoption of additives that strengthen immunity and aid in disease prevention.

To get more information on this market Request Sample

Europe Feed Additives Market Trends:

Rising Poultry Meat Consumption

Europe has witnessed a steady increase in poultry meat consumption, driven by changing dietary patterns, urbanization, and a growing preference for protein-rich, low-fat meat options. As per industry reports, poultry meat consumption in the EU is rising, reaching 25.2 kg per capita in 2025, nearly 10 kg higher than levels recorded at the start of the century. Poultry is often perceived as healthier compared to red meat, prompting consumers to include it more regularly in their diets. This surge in demand has directly influenced the feed additives market, as poultry farming requires high-quality feed enriched with essential nutrients, amino acids, enzymes, and probiotics to enhance growth, improve feed efficiency, and maintain overall bird health. Additionally, the adoption of intensive poultry farming practices necessitates feed additives that mitigate disease risks and optimize performance, ensuring a consistent supply of poultry products. Regulatory focus on animal welfare and sustainable farming practices in Europe further encourages the integration of advanced feed solutions.

Growing Consumption of Animal-Derived Products

The consumption of animal-derived products, including dairy, eggs, and meat, continues to grow across Europe due to rising disposable incomes, evolving dietary preferences, and increasing demand for high-quality protein sources. The Agricultural Market Information Company (AMI) reported that average meat consumption in the EU reached 66 kg per capita in 2024, an increase of 2 kg compared with the previous year. This trend drives the feed additives market as livestock producers seek solutions that enhance production efficiency, improve animal health, and ensure the nutritional quality of end products. Feed additives such as vitamins, minerals, antioxidants, and enzymes play a critical role in supporting growth performance, reproductive health, and disease resistance in cattle, swine, and dairy animals. Producers are increasingly adopting specialized feed supplements to achieve higher milk yields, superior meat quality, and longer productive lifespans for livestock, thereby aligning with consumer expectations for safe, nutritious, and sustainably produced animal products.

Rise of Food Safety Concerns

Heightened food safety concerns in the country are significantly shaping the Europe feed additives market outlook, as consumers and regulators demand stringent measures to prevent contamination and ensure the safety of animal-derived products. Outbreaks of foodborne diseases and contamination incidents have increased the emphasis on safe feed formulations, driving the adoption of feed additives that reduce pathogenic load, control mycotoxins, and enhance gut health in livestock. As per industry reports, in 2023, the European Food Safety Authority (EFSA) recorded an 84.1% rise in dairy-related foodborne outbreaks, with 392 more cases and 30 additional hospitalizations compared to 2022. Additives such as organic acids, probiotics, and prebiotics are increasingly utilized to mitigate microbial risks and improve animal immunity, which in turn enhances the safety and quality of meat, dairy, and egg products. This trend highlights a proactive approach by livestock producers to safeguard public health, maintain compliance, and build consumer trust through improved feed management practices.

Europe Feed Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe feed additives market, along with forecasts at the country levels from 2026-2034. The market has been categorized based on source, product type, livestock, and form.

Analysis by Source:

- Synthetic

- Natural

Synthetic feed additives hold a significant presence in the market due to their high consistency, controlled composition, and targeted functionality. They are widely used to enhance growth performance, nutrient absorption, and overall livestock health. Vitamins, amino acids, and enzymes produced synthetically ensure precise dosages and predictable effects, which is critical for large-scale livestock operations. Additionally, synthetic additives often provide cost-effective solutions compared to natural counterparts, making them a preferred choice for intensive farming systems.

Natural feed additives are gaining increasing importance in Europe, driven by rising consumer demand for sustainable and residue-free animal products. Ingredients such as herbs, plant extracts, probiotics, and essential oils are leveraged to improve immunity, digestive health, and product quality without relying on synthetic chemicals. These additives resonate with the growing emphasis on organic farming and clean-label initiatives, aligning with EU regulations that encourage environmentally friendly practices. While they may be costlier and less concentrated than synthetic options, natural additives offer unique functional benefits.

Analysis by Product Type:

- Amino Acids

- Lysine

- Methionine

- Threonine

- Tryptophan

- Phosphates

- Monocalcium Phosphate

- Dicalcium Phosphate

- Mon0-Dicalcium Phosphate

- Defulorinated Phosphate

- Tricalcium Phosphate

- Others

- Vitamins

- Fat-Soluble

- Water-Soluble

- Acidifiers

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Acetic Acid

- Others

- Carotenoids

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta-Carotene

- Enzymes

- Phytase

- Protease

- Others

- Mycotoxin Detoxifiers

- Binders

- Modifiers

- Flavors and Sweeteners

- Flavors

- Sweeteners

- Antibiotics

- Tetracycline

- Penicillin

- Others

- Minerals

- Potassium

- Calcium

- Phosphorus

- Magnesium

- Sodium

- Iron

- Zinc

- Copper

- Manganese

- Others

- Antioxidants

- Bha

- Bht

- Ethoxyquin

- Others

- Non-Protein Nitrogen

- Urea

- Ammonia

- Others

- Preservatives

- Mold Inhibitors

- Anticaking Agents

- Phytogenics

- Essential Oils

- Herbs and Spices

- Oleoresin

- Others

- Probiotics

- Lactobacilli

- Stretococcus Thermophilus

- Bifidobacteria

- Yeast

Amino acids leads the market in 2025. The segment is largely responsible for boosting the growth of livestock, feed intake efficiency, and general animal health. Major amino acids like lysine, methionine, threonine, and tryptophan are commonly used to maintain equilibrium in diets and provide the specific nutritional needs of poultry, pigs, and ruminants. Their incorporation optimizes protein usage, minimizes nitrogen loss, and promotes ecologically friendly farming, which is in tandem with Europe's strict environmental policies. The increasing interest in the production of high-quality animal protein and economically rational feed formulation also encourages their use. Furthermore, improvements in synthetic and fermentation-produced amino acid manufacturing have made consistent availability, enhanced bioavailability, and market-competitive pricing possible, making them a necessity for feed companies.

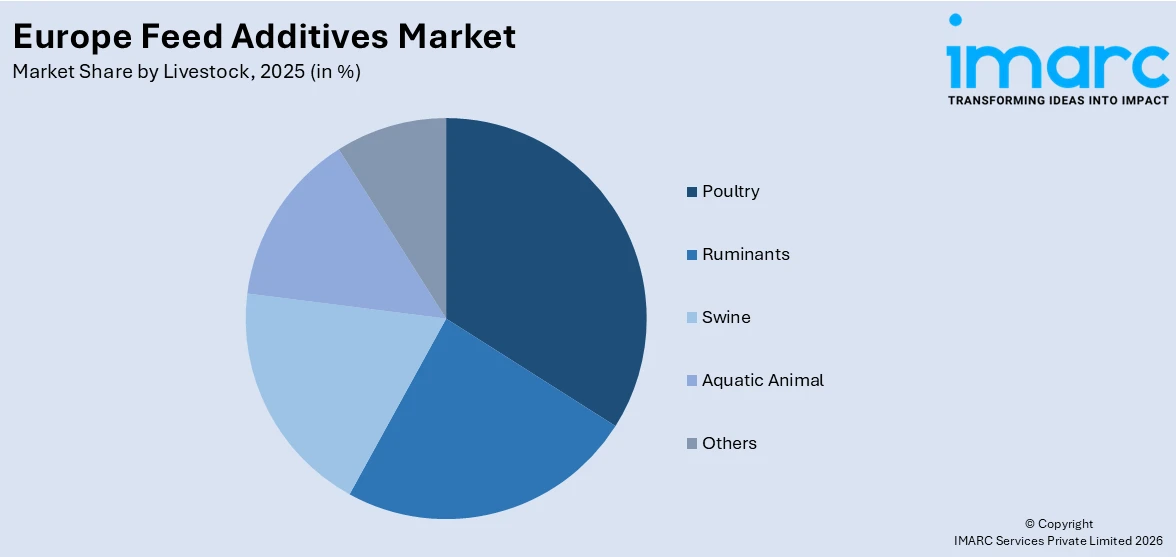

Analysis by Livestock:

Access the comprehensive market breakdown Request Sample

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Sows

- Aquatic Animal

- Others

Poultry leads the market in 2025 due to the high demand for chicken meat and eggs as a dietary staple protein in the region. Feed additives in poultry feed, such as vitamins, amino acids, enzymes, and probiotics, are critical for improvement in growth performance, feed conversion ratio, and flock overall health. The emphasis on limiting antibiotic usage according to EU guidelines has also accelerated the use of natural additives like organic acids, prebiotics, and essential oils, which support immunity and gastrointestinal health. Moreover, the advances in precision nutrition and customized feed formulation have enabled poultry producers to maximize productivity while minimizing environmental footprints, especially nitrogen and phosphorus emissions. With increased consumer demand for high-quality, safe, and sustainably sourced poultry products, the segment supports the Europe feed additives market growth.

Analysis by Form:

- Dry

- Liquid

Dry leads the market in 2025 due to its convenience to handle, store, and mix with feeds. The powdered vitamins, amino acids, enzymes, and minerals are among the feed additives that make it easy to accurately dose and have a long shelf life, making them a good fit for large-scale feed manufacturing operations. Dry forms minimize the risk of microbial contamination and provide for uniform blending, with consistent delivery of nutrients to animals. They are also economical compared to liquid products, with significant savings on transport and storage. In Europe, with its focus on regulatory standards for feed quality and safety, dry feed additives bring reliability and compliance benefits. Their applicability in a variety of livestock segments, such as poultry, pigs, and ruminants, further reinforces their market significance, catering to both traditional and modern animal production practices and addressing the increasing demand for high-quality, efficient feed solutions.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2025, Spain accounted for the largest market share due to its extensive and diversified livestock sector, comprising poultry, pig, and dairy farms. The emphasis of the country on intensive and semi-intensive animal rearing leads to high demand for feed additives like amino acids, vitamins, enzymes, and probiotics, which support growth performance, feed efficiency, and animal well-being. Spain's regulatory compliance with EU standards guarantees safe and quality feed production, promoting the use of both synthetic and natural additives. Increased consumer demand for sustainable and residue-free animal products has further spurred the use of natural feed solutions, including organic acids and plant extracts. In addition, developments in feed formulation technologies and precision nutrition in Spain enhance effective resource utilization and environmental regulatory compliance, positioning the country as a valuable strategic location for feed additive producers serving the wider European market.

Competitive Landscape:

The market is extremely competitive with the presence of a high number of global and regional players competing for market share. Players in this industry are investing in innovation, product development, and strategic alliances to cater to increased demand for quality and sustainable feed solutions. Major players in the market are making investments in research and development to improve the effectiveness of products, with specific emphasis on enhancing animal well-being, maximizing feed efficiency, and minimizing the environmental footprint of livestock production. On the other hand, the movement towards organic and natural feed additives is building pace as a result of expanding consumer concern about food safety and sustainability. Quality standards and regulatory frameworks are also driving the competitive dynamics, with firms having to adhere to strict regulations. According to the Europe feed additives market forecast, the demand for amino acids, enzymes, and vitamins will keep increasing, thereby driving the competitiveness of companies. Opportunities in developing markets are also being sought out by players to take advantage of growing livestock farming operations.

The report provides a comprehensive analysis of the competitive landscape in the Europe feed additives market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: The EU approved Proteon Pharmaceuticals’ bacteriophage-based additive BAFASAL for poultry feed, following EFSA’s positive safety and efficacy review. Published in the Official Journal on 15 July, the authorization enables EU-wide use, marking a breakthrough for phage technology in animal nutrition and sustainable poultry production.

- January 2025: Phytobiotics and Feed Expert Sp. z o.o. launched Phytobiotics CEE Sp. z o.o. in Poznań, Poland. The joint venture combines both companies’ product portfolios to serve animal nutrition markets in Central and Eastern Europe, starting with Poland and the Baltics, with future regional expansion planned.

- December 2024: Oqualim, Qualimat, and Qualimat Sud-Ouest merged to form a unified structure, Ogualim, effective January 2025. The new body will unite over 310 French animal feed companies, enhancing consistency in certification, quality management, and feed safety while strengthening national and international recognition of French standards.

- September 2024: dsm-firmenich secured EU authorization for HiPhorius, its next-generation phytase for poultry, swine, and aquaculture. The enzyme improves phosphorus digestibility, reduces feed costs, enhances growth rates, and lowers environmental impact. This milestone strengthens the dsm-firmenich and Novonesis Alliance’s commitment to sustainable, innovative feed solutions across Europe.

- August 2024: UK-based Volac launched a new website for its feed additives division, showcasing evidence-based products and technical support aimed at improving livestock efficiency and sustainability. The site emphasizes Volac’s expertise in microbiology, biochemistry, enzymology, and immunology, offering solutions for mycotoxin management, phytogenic innovations, and nutraceutical products.

Europe Feed Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Synthetic, Natural |

| Product Types Covered |

|

| Livestocks Covered |

|

| Forms Covered | Dry, Liquid |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe feed additives market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe feed additives market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe feed additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The feed additives market in Europe is valued at USD 4.5 Billion in 2025.

The Europe feed additives market is projected to exhibit a CAGR of 3.65% during 2026-2034, reaching a value of USD 6.3 Billion by 2034.

The market is driven by the increasing demand for high-quality animal nutrition, rising awareness about animal health, and the growing trend of sustainable livestock farming. Regulatory support for improved feed quality, alongside advancements in animal feed formulations, also plays a significant role in market growth.

Amino acids dominate the product type segment in the market in 2025 due to their essential role in animal growth, metabolism, and overall health. Their ability to enhance feed efficiency, improve meat quality, and support sustainable farming practices further boosts their demand among livestock producers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)