Europe Feed Vitamins Market Share, Trends and Forecast by Type, Animal Type, and Country 2025-2033

Europe Feed Vitamins Market Size and Share:

The Europe feed vitamins market size was valued at USD 456.60 Million in 2024. Looking forward, the market is projected to reach USD 655.53 Million by 2033, exhibiting a CAGR of 4.10% during 2025-2033. The market is driven by the increasing demand for higher-quality, nutritionally balanced feed materials across the region’s livestock, aquaculture, and pet food industries. Stringent regulations concerning animal feed safety and the growing shift toward sustainable production methods are fueling the adoption of innovative additives, are further augmenting the Europe feed vitamins market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 456.60 Million |

|

Market Forecast in 2033

|

USD 655.53 Million |

| Market Growth Rate 2025-2033 | 4.10% |

The market is primarily driven by the rising demand for high-quality animal feed solutions across various sectors, including livestock, aquaculture, and pet food. In line with this, the increasing awareness around animal health and nutrition is significantly contributing to the market's growth. At Vitafoods Europe 2024, Evonik presented new nutraceutical innovations including AvailOm® omega-3 powder and Boswellia for joint health, along with IN VIVO BIOTICS™ synbiotic solutions. They focus on evidence-based ingredients and advanced delivery technologies for animal and human nutrition markets. In addition to this, the rising consumer preference for meat and dairy products is acting as a substantial growth-inducing factor for the market.

Besides this, the adoption of stringent regulatory standards related to animal health and food safety is encouraging the use of safer, more effective additives. Moreover, the expanding livestock industry and the growing need for sustainable production practices are also driving the adoption of feed vitamins. In May 2025, Adisseo, a French leader in animal nutrition, joined EuropaBio, aiming to promote sustainable and safe animal feed produced through biotechnology. Adisseo, with over 4,200 customers across 110 countries, operates research centers in Europe, the USA, China, and Asia Pacific to develop nutritional solutions for animal feed. Also, the increasing focus on improving feed efficiency and reducing feed costs is positively influencing market demand. The market is further driven by continuous advancements in feed vitamin technology and the growing focus on minimizing the environmental footprint of livestock farming, further augmenting the market share.

Europe Feed Vitamins Market Trends:

Stable Aquaculture Production Amidst Climate Challenges

According to reports, the aquaculture industry in the European Union yielded nearly 1.1 Million Tons of aquatic creatures, valued at €4.8 Billion, in 2023. However, climate change has posed challenges to production, with warming sea temperatures affecting marine life in some regions. This disruption highlights how climate-induced factors directly affect the availability and quality of aquatic products, which, in turn, influences the demand for feed additives like vitamins. Aquaculture relies heavily on quality feed to maintain fish health and growth, with vitamins playing a key role in enhancing immunity, growth rates, and overall health. As these climate challenges intensify, the feed vitamins market must adapt to ensure that the nutritional needs of farmed fish are met. With rising demand for more resilient and adaptive solutions, the industry is seeing increased innovation in feed formulations to address these new challenges, thereby creating a positive Europe feed vitamins market outlook.

Shifts in Consumer Preferences and Regulatory Pressures

European consumer preferences are increasingly shifting towards natural, sustainable, and traceable products, which is having a noticeable impact on the feed vitamins market. This shift is driven by a heightened awareness of the environmental and health implications of synthetic chemicals in food production. Alongside this consumer demand, stricter regulations imposed by the European Union are pushing the feed industry toward more sustainable and ethical practices. Regulatory frameworks focusing on animal welfare and environmental sustainability are becoming more stringent, creating a clear need for producers to adopt cleaner, more efficient production methods for feed ingredients, especially as consumption rates rise, as per the Europe feed vitamins market forecast. As per estimates, the population of Europe reached 744,398,832 in 2025, accounting for 9.04% of the global population. Moreover, per capita consumption of pork, poultry, and beef across the 28 European Union countries reached 31.98 kg, 25.03 kg, and 10.37 kg, respectively, in 2023. These regulatory pressures are fueling the development of more stable and efficient vitamin formulations that meet both consumer expectations and legal requirements. This combination of consumer-driven demand and regulatory pressure is reshaping the feed vitamins market landscape in Europe, encouraging innovation and sustainability.

Technological Advancements and Industry Consolidation

Technological advancements are playing a key role in transforming the Europe feed vitamins market trends, particularly as companies seek to enhance the efficiency and sustainability of production processes. The adoption of cutting-edge technologies, including precision fermentation and more efficient extraction methods, is helping to improve the consistency and quality of feed vitamin products. These innovations allow for more cost-effective production while ensuring that the vitamins remain bioavailable and effective for livestock and aquaculture use. Based on official data from the European Feed Manufacturers’ Federation (FEFAC), the total industrial compound feed production in the EU27 is projected to reach 146.1 Million Metric Tons in 2025. Additionally, the market is experiencing a trend toward consolidation, with major players merging and forming strategic partnerships to strengthen their competitive positions. This move reflects broader consolidation trends in the feed vitamins market, where larger companies are strengthening their presence through investments and partnerships. These industry shifts are contributing to a more consolidated, innovative market that can better meet the evolving needs of consumers and regulators alike.

Europe Feed Vitamins Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe feed vitamins market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and animal type.

Analysis by Type:

To get more information on this market, Request Sample

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin E

- Others

Vitamin A is crucial for maintaining optimal growth, reproduction, and immune health in animals. It is widely used in feed formulations for poultry, swine, and ruminants to enhance vision, skin health, and immune responses. This segment is especially relevant in the Europe feed vitamins market, where the increasing focus on improving livestock health and productivity is driving demand for Vitamin A additives. Its role in preventing deficiencies and boosting productivity, coupled with the rising consumption of animal products, ensures its continued dominance in the market.

Vitamin B, a complex of essential vitamins, plays a vital role in supporting animal metabolism and energy production. It is highly relevant for livestock such as poultry and swine, as it enhances feed efficiency, growth rates, and immune system function. The increasing demand for optimized feed solutions to improve overall productivity in animal farming is driving the market for Vitamin B. As animal farming practices in Europe become more industrialized, the demand for high-quality feed vitamins like Vitamin B is expected to rise, supporting livestock health and efficient production.

Vitamin C is often used in animal feed for its antioxidant properties, supporting immune function and growth, particularly in young animals. It is essential in preventing stress-related conditions and supporting the overall health of animals in high-density farming environments. While its use is more common in aquaculture and swine farming, its application in poultry is growing as well, driven by increasing concerns about animal health and productivity. The expanding livestock industry and aquaculture in Europe are likely to keep Vitamin C as a key feed vitamin segment in the market.

Analysis by Animal Type:

- Aquaculture

- Poultry

- Ruminants

- Swine

- Others

Aquaculture is one of the fastest-growing sectors in Europe, driven by rising consumer demand for seafood as a sustainable protein source. Fish and shellfish farming require high-quality feed that is rich in vitamins to promote growth, immunity, and disease resistance. As aquaculture operations become more intensive, the demand for feed vitamins, is increasing to maintain healthy stock. The rapid expansion of aquaculture in Europe, coupled with the shift toward sustainable farming practices, makes this a key segment for the feed vitamins market in the region.

Poultry farming is a significant segment of the European animal feed industry, with chickens being the most widely farmed livestock. The growing demand for poultry meat and eggs in Europe drives the need for high-quality feed to optimize growth, feed conversion, and immune function. Vitamin additives play a crucial role in poultry nutrition by improving egg production and preventing deficiencies that can lead to poor health and productivity. As consumer preferences lean toward more protein-rich diets, the poultry segment is expected to continue expanding, thereby augmenting the Europe feed vitamins market growth.

Ruminant farming, particularly cattle and sheep, plays an important role in European agriculture. The demand for beef and dairy products continues to rise, creating a need for nutritional solutions to enhance the health and productivity of ruminants. Vitamins, particularly Vitamin A and D, are critical in supporting proper bone growth, immune function, and reproductive health in these animals. As ruminant farming becomes more focused on efficiency and sustainability, the demand for feed vitamins is expected to grow. The sector's size and importance within Europe make it a central focus for the feed vitamins market.

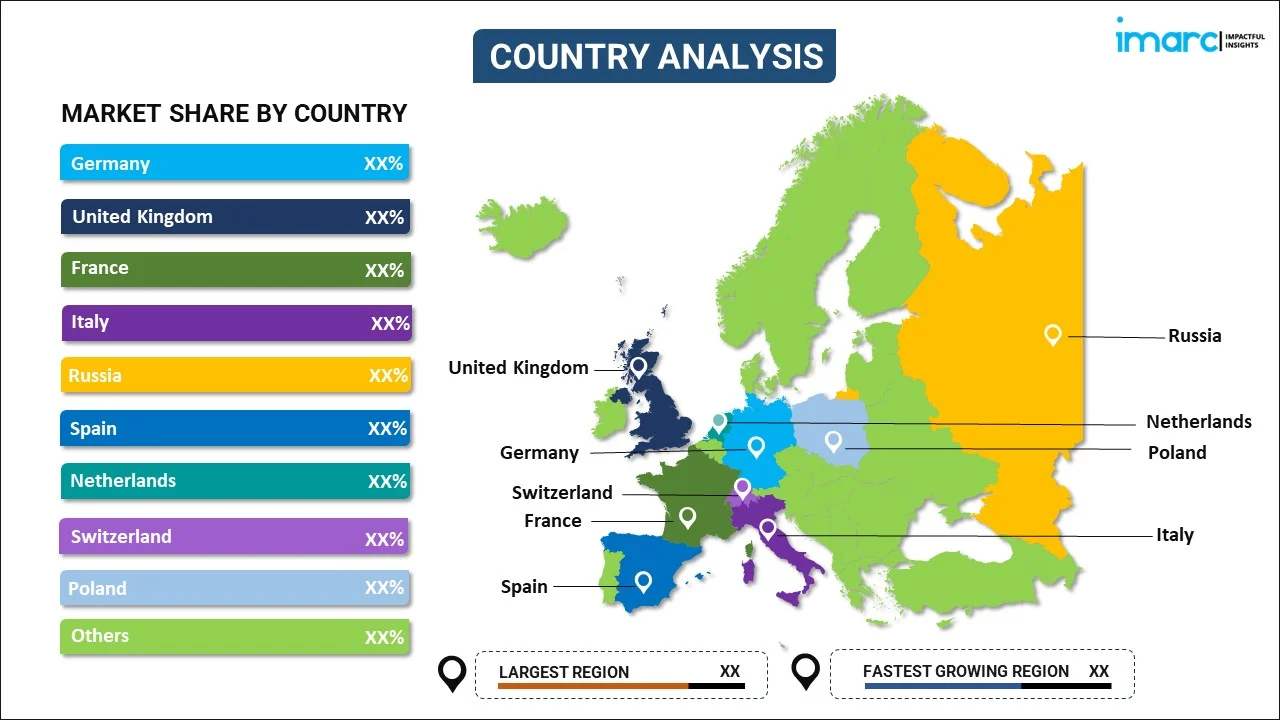

Analysis by Country:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

Germany is one of the dominant players in the European feed vitamins market due to its strong agricultural sector, which includes both intensive livestock farming and a growing aquaculture industry. The country is home to a large number of poultry, swine, and ruminant farms that require high-quality feed vitamins for optimal growth and health. Additionally, Germany’s commitment to sustainability and animal welfare has led to increased demand for eco-friendly and nutritionally balanced feed. As one of the largest agricultural producer in Europe, Germany's market share and demand for feed vitamins are expected to remain significant, according to the Europe feed vitamins market forecast.

The United Kingdom's feed vitamins market is driven by its substantial livestock industry, particularly in poultry, swine, and cattle farming. The country’s strong regulatory frameworks and focus on food safety have led to a growing demand for high-quality, safe feed vitamins. The UK is also investing in sustainable farming practices, which further supports the growth of the feed vitamins market. With an increasing consumer demand for ethically sourced meat and dairy, the UK’s feed vitamins market will likely see steady growth, particularly in the poultry and ruminant segments.

France is one of Europe’s largest producers of meat, particularly poultry and pork, which significantly influences the demand for feed vitamins. The country's well-established farming practices and growing focus on animal health and productivity drive the need for specialized feed additives, including vitamins. France’s commitment to improving livestock efficiency and sustainability is also contributing to the rise in demand for feed vitamins. With a growing emphasis on traceability and product quality, the French feed vitamins market is poised for growth, driven by regulatory support and increased consumer awareness.

Competitive Landscape:

The key players in the Europe feed vitamins market, including companies are focusing on innovation and sustainability to meet the growing demand for high-quality feed solutions. These companies are expanding their product portfolios to include more bioavailable and eco-friendly feed vitamins, supporting both animal health and feed efficiency. Investments in research and development (R&D) are central to their strategies, with a strong emphasis on developing sustainable and effective vitamins for livestock, poultry, and aquaculture. Additionally, these players are strengthening their market positions by expanding production capacities, forming strategic partnerships, and adhering to stringent regulatory standards, ensuring long-term growth in the competitive European feed vitamins sector.

The report provides a comprehensive analysis of the competitive landscape in the Europe feed vitamins market with detailed profiles of all major companies, including.

Latest News and Developments:

- July 2025: The European Food Safety Authority (EFSA) officially confirmed the safety and efficacy of DSM-Firmenich’s 25-hydroxycholecalciferol (25-OH-D₃) for salmonids, other species of fish, and every other animal species. With this confirmation, the established safety and effectiveness of DSM-Firmenich’s Hy-D feed vitamin is extended from swine, ruminants, and poultry to all aquatic and terrestrial animals.

- September 2024: DSM-Firmenich officially launched a new animal nutrition and health premixes production facility in Egypt. The 10,000 square meters facility, which has a manufacturing capacity of approximately 10,000 tons a year, is intended for the processing of vitamins, feed additives, and minerals.

- August 2024: NCC Food Ingredients announced the launch of its new Pet Food and Animal Feed Ingredients line of products. The extensive range of ingredients includes feed vitamins and minerals, providing manufacturers with essential raw materials.

- April 2024: Following the submission of its Hy-D scientific report to the European Food Safety Authority’ (EFSA), DSM-Firmenich reported that it had been granted a renewal of the European Union permit for 25OHD3 from Saccharomyces cerevisiae CBS 146008 in pigs and poultry, as well as an extension for its utilization in ruminants. 25OHD3 is the primary circulatory type of vitamin D3 in animals.

Europe Feed Vitamins Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vitamin A, Vitamin B, Vitamin C, Vitamin E, Others |

| Animal Types Covered | Aquaculture, Poultry, Ruminants, Swine, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe feed vitamins market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe feed vitamins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe feed vitamins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in the region was valued at USD 456.60 Million in 2024.

The Europe feed vitamins market is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching a value of USD 655.53 Million by 2033.

The market is driven by the increasing demand for higher-quality animal feed solutions across livestock, aquaculture, and pet food industries. Rising awareness around animal health and nutrition is significantly contributing to market growth. Additionally, the growing preference for meat and dairy, coupled with stringent regulatory standards, is propelling the adoption of innovative feed vitamins, ensuring safer, more efficient feed solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)