Europe Food Stabilizers Market Size, Share, Trends and Forecast by Source, Function, Application, and Country, 2025-2033

Europe Food Stabilizers Market Size and Share:

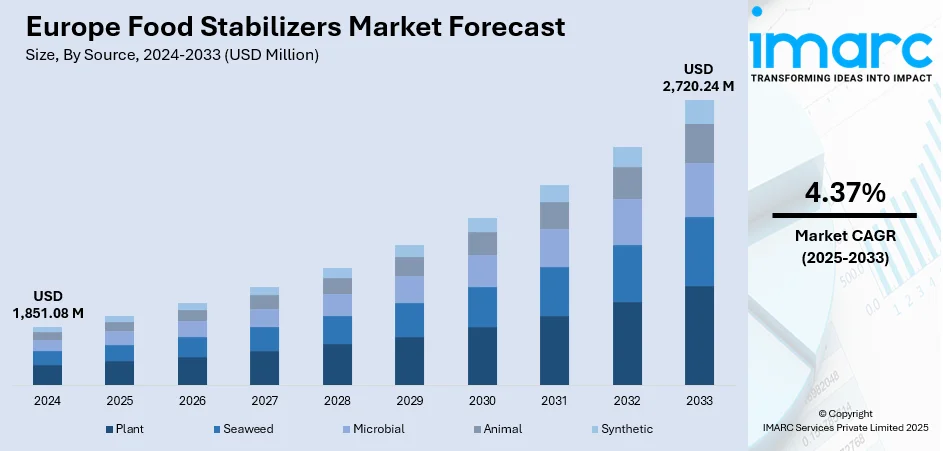

The Europe food stabilizers market size was valued at USD 1,851.08 Million in 2024. Looking forward, the market is estimated to reach USD 2,720.24 Million by 2033, exhibiting a CAGR of 4.37% during 2025-2033. Germany is the current market leader with a commanding market share of approximately 28.9% in 2024. The industry is dominated by the growing need for processed food with longer shelf life as well as homogeneous texture. Apart from this, the paradigm shift towards healthier, clean-label ingredients, the rising demand for organic and gluten-free offerings by masses, and several innovations in stabilizer formulating as well as rising adoption of sustainable and eco-friendly solutions are supporting the Europe food stabilizers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,851.08 Million |

|

Market Forecast in 2033

|

USD 2,720.24 Million |

| Market Growth Rate 2025-2033 | 4.37% |

The market is mainly led by the rising demand for convenience and long shelf-life in processed food. In accordance with this, the extensive use of stabilizers in food items like dairy, sauces, and drinks is giving a boost to the market. Additionally, the rising trend of healthier consumers seeking cleaner and natural food ingredients is also proving to be a major growth driver for the market. In September 2024, Cargill unveiled sustainable pectin solutions derived from upcycled apple pomace and citrus peels, designed to stabilize and enhance the texture of plant-based and reduced-sugar products in the European food market. Pectin, known for its gelling, stabilizing, and thickening properties, is increasingly used in food formulations, including dairy and plant-based dairy products. In addition to this, the expansion of the food and beverage sector, along with rapid urbanization, is resulting in higher consumption of processed foods and ready-to-eat meals, contributing to the Europe food stabilizers market growth.

To get more information on this market, Request Sample

Besides this, the rising demand for gluten-free, organic, and clean-label food products due to growing health awareness is creating lucrative opportunities in the market. Also, the increasing focus on sustainability and environmentally friendly solutions is impacting the market positively. According to a recent survey, 62% of European consumers favor natural ingredients, driving the demand for pectin as a stabilizer in products like jams and dairy, with 33% of new dairy launches featuring reduced sugar content. The market is further driven by the innovation in stabilizer formulations, which cater to diverse consumer needs, and the efforts by key manufacturers to improve the functionality of stabilizers. Apart from this, easy availability of these stabilizers through organized retail channels and e-commerce platforms is propelling the market. Some of the other factors contributing to the market include advancements in food preservation technologies, the rise of plant-based food trends, and extensive research and development (R&D) activities.

Europe Food Stabilizers Market Trends:

Rise of Food Processing Startups and Innovations in the Food Stabilizer Market

The Europe food stabilizer market is witnessing rapid growth, partly due to the surge in food processing startups, which are driving innovation in the food industry. For instance, in 2025, there are 3,731 food processing startups in Europe which include Novozymes, Butternut Box, Bella and Duke, Lesaffre, Greencore. Out of these, 998 startups are funded, with 645 having secured Series A+ funding. This influx of new businesses is pushing the demand for specialized ingredients, including food stabilizers, as they seek to differentiate their products and create new formulations. Startups often prioritize natural ingredients, clean labels, and healthier food options, leading to a higher demand for stabilizers that offer functionality without compromising on health and nutrition. As these startups continue to grow and capture market share, the demand.

Consumer Preferences Shaping the Food Stabilizer Market

One of the significant Europe food stabilizers market trends is the increasing demand for natural and clean label products. For instance, in Europe, 1 in 2 consumers prefer a natural or clean label approach to healthy eating, which is reshaping the way food manufacturers source ingredients. As consumers become more health-conscious, they are increasingly demanding food products that contain fewer artificial additives and preservatives, prompting manufacturers to turn to natural food stabilizers. This trend is particularly evident in the growing demand for stabilizers such as pectin, which is seen as a safer and healthier alternative to synthetic stabilizers. Manufacturers are therefore adapting by using natural stabilizers to meet consumer preferences for clean and transparent food labeling, contributing significantly to the market’s shift toward more wholesome food options.

Pectin’s Growing Popularity and Consumer Awareness

Pectin has gained significant traction in the European market, driven by its natural origin and versatility in food processing. Pectin use in food products has seen a notable 7% increase in new product launches from 2022 to 2023, signaling a strong consumer and industry preference for this natural stabilizer. At the same time, 50% of European consumers recognize pectin as a key food ingredient, reflecting its growing awareness and the demand for more natural and sustainable alternatives to synthetic stabilizers. Pectin’s widespread recognition and increasing incorporation into various products, such as jams, jellies, and confectionery, are likely to continue fueling its growth in the food stabilizer market. The rising consumer demand for transparency in food ingredients and the push for cleaner labels is aligning with pectin's benefits, further solidifying its role in the European market.

Europe Food Stabilizers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe food stabilizers market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on source, function, and application.

Analysis by Source:

- Plant

- Seaweed

- Microbial

- Animal

- Synthetic

Seaweed stands as the largest component in 2024, holding around 35.8% of the market. Seaweed-derived stabilizers are highly valued for their natural and sustainable properties, making them a preferred choice in food products targeting health-conscious consumers. These stabilizers are primarily used for their gelling, thickening, and emulsifying properties, especially in applications such as dairy, confectionery, and beverages. Seaweed-based stabilizers are also gaining popularity due to increasing demand for clean-label ingredients in food products. Additionally, their ability to contribute to texture and mouthfeel in a wide variety of food products has boosted their demand. With growing concerns over environmental sustainability and the preference for plant-based ingredients, seaweed-based stabilizers are expected to maintain their leadership position in the market.

Analysis by Function:

- Texturizing

- Stabilizing

- Moisture Retention

- Others

Stabilizing leads the market with around 42.6% of market share in 2024. Stabilizers play a crucial role in maintaining the quality and consistency of food products by preventing separation and ensuring uniformity in texture. They are widely used in dairy products, sauces, and dressings to maintain their homogeneity, smooth texture, and extended shelf life. The increasing demand for processed foods and ready-to-eat meals, coupled with the growing need for long-lasting, high-quality products, is propelling the demand for stabilizers. As the food industry continues to evolve with an emphasis on convenience and shelf-life stability, stabilizers remain a core component in product formulation. The importance of stabilizing agents in modern food manufacturing ensures their dominance in the market and creates a positive Europe food stabilizers market outlook.

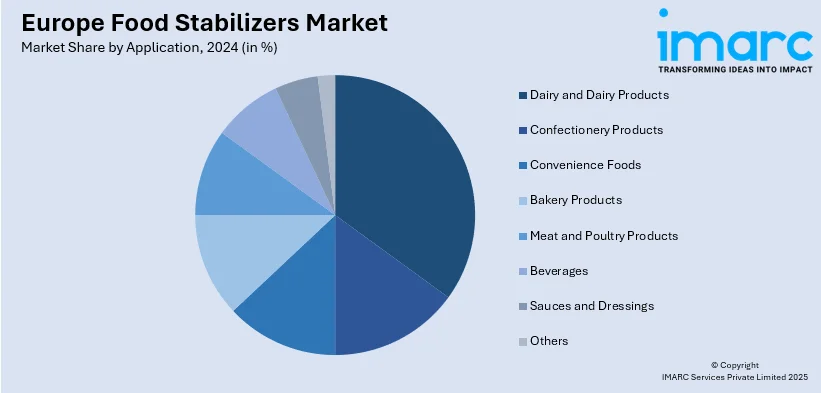

Analysis by Application:

- Dairy and Dairy Products

- Confectionery Products

- Convenience Foods

- Bakery Products

- Meat and Poultry Products

- Beverages

- Sauces and Dressings

- Others

Dairy and dairy products lead the market with around 27.6% of market share in 2024, largely driven by the widespread use of stabilizers to improve the texture, consistency, and shelf life of dairy products such as milk, cheese, yogurt, and ice cream. Stabilizers in dairy applications help prevent the separation of ingredients, enhance product viscosity, and maintain freshness over time. As the demand for premium and functional dairy products rises, there is an increasing reliance on stabilizers to meet consumer expectations for high-quality, long-lasting products. The dairy sector’s demand for clean-label ingredients is also pushing for the use of more natural stabilizing agents derived from plant-based sources. As per the Europe food stabilizers market forecast, this trend is expected to continue as consumer preferences shift toward healthier, more sustainable food options.

Country Analysis:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

In 2024, Germany accounted for the largest market share of around 28.9%. The country's strong food processing industry, combined with its robust demand for processed and convenience foods, makes it a significant player in the food stabilizers market. Germany’s leadership can also be attributed to its extensive use of food stabilizers in dairy, confectionery, and beverages, where stabilizers are essential to maintain product quality, texture, and shelf life. The country's focus on food safety, quality control, and sustainability has also spurred innovation in the development of cleaner and more natural stabilizing agents. As Germany continues to be a hub for the food and beverage industry in Europe, it is expected to maintain a dominant position in the market throughout the forecast period.

Competitive Landscape:

In the Europe food stabilizers market, leading companies are focusing on sustainability and clean-label solutions, catering to the increasing consumer demand for natural and healthier food ingredients. These companies are developing new stabilizer formulations that are free from artificial additives, with an emphasis on plant-based, biodegradable, and organic sources. Many market players are exploring the use of pectin, a naturally derived stabilizer, which has seen an uptick in demand for its use in jams, juices, and other food products. Companies are also investing in advanced technologies to enhance the functionality and performance of stabilizers, such as improving moisture retention and texture in various food applications. Collaboration with food manufacturers and the food service industry is another key strategy, allowing these companies to tailor their stabilizer solutions to meet specific customer needs.

The report provides a comprehensive analysis of the competitive landscape in the Europe food stabilizers market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: KOASTAL, a Swedish start-up, tested a franchise-based seaweed farming model with EU support, enabling fishers to grow sugar kelp using their existing infrastructure, backed by stabilizers like permits, training, equipment, and guaranteed harvest buy-backs.

- May 2025: Tate & Lyle saw improved performance in 2025 following its acquisition of CP Kelco, integrating stabilizers like specialty gums and pectin into its portfolio. The company addressed customer challenges with stabilizers in high-protein fruit smoothies in North America.

- April 2025: the Belgian SPF Santé Publique issued guidance on the labeling and permitted statements for products containing steviol glycosides, including those used as stabilizers, covering various production methods like enzymatic and fermentation processes. The document outlined acceptable claims for packaging and advertising, specifying which forms of steviol glycosides they applied to.

- February 2025: dsm-firmenich sold its stake in the Feed Enzymes Alliance to Novonesis for USD 1.63 Billion, marking the end of their 25-year partnership. The deal, which included feed enzymes used with food stabilizers in animal nutrition, brought in around €1.4 Billion in net cash for dsm-firmenich.

Europe Food Stabilizers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Plant, Seaweed, Microbial, Animal, Synthetic |

| Functions Covered | Texturizing, Stabilizing, Moisture Retention, Others |

| Applications Covered | Dairy and Dairy Products, Confectionery Products, Convenience Foods, Bakery Products, Meat and Poultry Products, Beverages, Sauces and Dressings, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe food stabilizers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe food stabilizers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe food stabilizers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe food stabilizers market was valued at USD 1,851.08 Million in 2024.

The Europe food stabilizers market is projected to exhibit a CAGR of 4.37% during 2025-2033, reaching a value of USD 2,720.24 Million by 2033.

The market is driven by increasing demand for processed food with extended shelf life and homogeneous texture, alongside the shift toward healthier, clean-label ingredients. Innovations in stabilizer formulations and the demand for organic and gluten-free products are further fueling growth.

Germany currently dominates the Europe food stabilizers market, holding a significant market share of around 28.9% in 2024.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)