Europe Frac Sand Market Size, Share, Trends and Forecast by Type, Application, and Country, 2025-2033

Europe Frac Sand Market Size and Share:

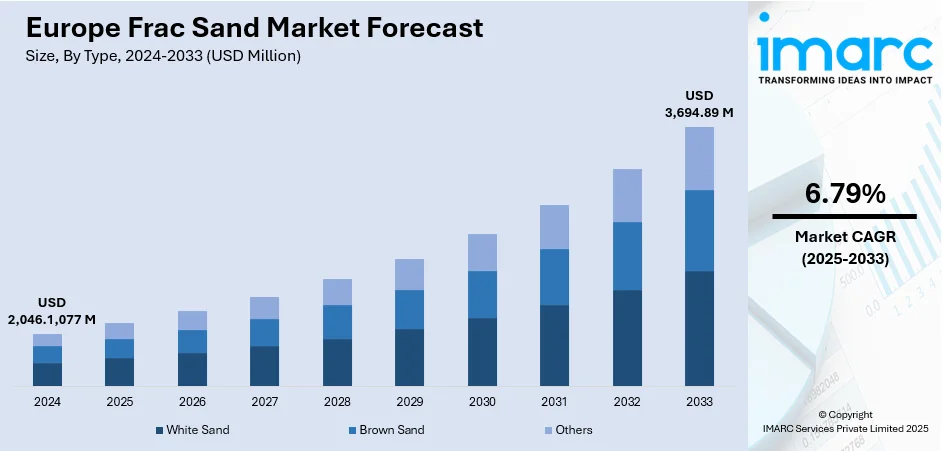

The Europe frac sand market size was valued at USD 2,046.1,077 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,694.89 Million by 2033, exhibiting a CAGR of 6.79% from 2025-2033. United Kingdom currently dominates the market, holding a market share of 30.0% in 2024. The market is driven by increasing shale gas exploration, rising hydraulic fracturing activities, and growing energy demand. Technological advancements in drilling and fracking improve efficiency, boosting sand consumption. Supportive government policies for domestic energy production further encourage market growth. Additionally, demand for high-purity silica sand is increasing due to its superior performance in fracking operations. Infrastructure developments in Eastern Europe and investment in unconventional oil and gas projects also fuel Europe frac sand market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,046.1,077 Million |

|

Market Forecast in 2033

|

USD 3,694.89 Million |

| Market Growth Rate 2025-2033 | 6.79% |

The expansion of shale gas projects across Europe, particularly in countries exploring domestic energy independence, is a key driver of the frac sand market. Hydraulic fracturing relies heavily on high-quality silica sand to prop open fractures in shale formations, enabling optimal hydrocarbon flow. As European nations seek to reduce reliance on imported fossil fuels, investment in unconventional oil and gas exploration is increasing. This surge in drilling activity directly raises the demand for frac sand, especially premium grades with high crush resistance, essential for maximizing well productivity and operational efficiency in challenging geological formations.

To get more information on this market, Request Sample

Advancements in drilling techniques, such as horizontal drilling and multi-stage hydraulic fracturing, have significantly improved extraction efficiency in Europe’s oil and gas sector. These technologies require greater volumes and more consistent quality of frac sand to sustain high-pressure operations and enhance recovery rates. Improved logistics, automated sand handling systems, and better proppant placement methods are also optimizing sand usage, reducing wastage, and lowering operational costs. This technological evolution is encouraging companies to expand production and import of high-grade silica sand, thereby driving steady market growth across Europe’s frac sand supply chain.

Europe Frac Sand Market Trends:

Expansion of Shale Gas Exploration and Hydraulic Fracturing

Shale gas exploration in Europe, although still developing compared to North America, is gaining momentum as countries seek greater energy independence and diversification. Hydraulic fracturing, a key method in shale gas extraction, depends on frac sand to keep fractures open and allow hydrocarbons to flow efficiently. Nations such as the UK, Poland, and others with potential shale reserves are investing in exploratory and production drilling projects. This expansion drives the demand for high-quality frac sand with superior crush strength and uniform grain size. Moreover, increasing energy consumption, coupled with the need to reduce reliance on imported oil and gas, further strengthens investment in unconventional resources. As drilling projects scale up, the demand for consistent, high-purity silica sand rises, making shale gas exploration a central key Europe frac sand market trend.

Technological Advancements in Drilling and Fracking Techniques

The European oil and gas sector is adopting advanced drilling and hydraulic fracturing technologies to improve efficiency and reduce operational costs. Techniques such as horizontal drilling and multi-stage fracturing enable operators to access more hydrocarbons from a single well, which increases the volume and quality requirements for frac sand. These methods demand proppants with high conductivity, crush resistance, and optimal grain size to maintain fracture stability under intense pressures. Furthermore, improved logistics, sand-handling equipment, and on-site storage systems have enhanced the speed and safety of sand delivery to well sites. By optimizing sand placement and reducing material wastage, technology-driven efficiencies are encouraging higher frac sand usage per well. This integration of innovation into operations directly fuels the Europe frac sand market growth, as energy companies increasingly rely on premium-grade sand to maximize recovery rates.

Growing Demand for High-Purity Silica Sand

High-purity silica sand is a critical component in the frac sand market due to its superior performance in high-pressure fracturing operations. European energy producers are increasingly specifying sand with high silica content, uniform shape, and consistent size distribution to optimize oil and gas recovery. This shift toward quality over quantity is being driven by the need for operational efficiency, longer-lasting wells, and reduced environmental impact through fewer drilling sites. The rising preference for imported premium-grade sand, particularly from established producers in the United States, reflects the stringent performance requirements in European fracking projects. Additionally, expanding unconventional oil and gas projects in Eastern Europe, combined with stricter regulations on proppant quality, is increasing demand for specialized, high-purity silica sand, making it a significant driver of Europe frac sand market demand.

Europe Frac Sand Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe Frac Sand market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- White Sand

- Brown Sand

- Others

Based on the Europe frac sand market analysis, the brown sand dominates the market with a share of 59.8% due to its cost-effectiveness and wide availability compared to white sand. Although it has slightly lower purity, brown sand offers adequate strength and performance for many hydraulic fracturing applications, making it a preferred choice for cost-conscious operators. Its local or regional sourcing reduces transportation expenses, enhancing its appeal in markets aiming to optimize operational budgets. Brown sand is well-suited for shallower or less demanding wells, where ultra-high purity is not critical. Additionally, ongoing improvements in processing and grading have enhanced its quality, allowing it to meet industry standards while maintaining a lower price point, thereby sustaining its dominance in the regional frac sand market.

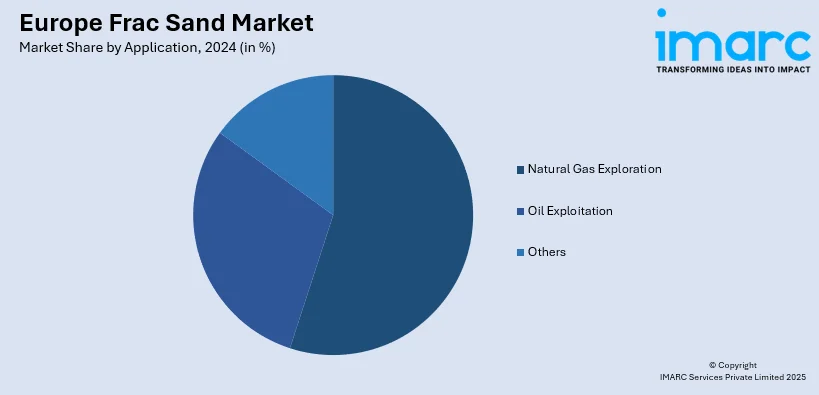

Analysis by Application:

- Oil Exploitation

- Natural Gas Exploration

- Others

Natural gas exploration accounts for 65.5% of the Europe frac sand market due to the region’s increasing focus on cleaner-burning energy sources and reducing carbon emissions. Natural gas is viewed as a transitional fuel, supporting the shift from coal and oil to renewable energy. Hydraulic fracturing in gas-rich shale formations relies heavily on high-quality frac sand to enhance well productivity and sustain fracture conductivity under high pressure. Rising energy demand, combined with geopolitical pressures to reduce reliance on imported gas, has intensified exploration and production activities. Technological advancements in drilling, along with investments in unconventional gas projects, are further boosting frac sand consumption, making natural gas exploration the dominant segment in the regional market.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

According the Europe frac sand market forecast, the United Kingdom holds a 30.0% share primarily driven primarily by its active shale gas exploration initiatives and supportive regulatory framework for domestic energy development. The country’s focus on reducing reliance on imported fossil fuels has accelerated investment in hydraulic fracturing projects, particularly in areas with promising shale reserves. Advanced drilling technologies, such as horizontal drilling and multi-stage fracturing, have boosted frac sand consumption by enabling greater recovery rates per well. Additionally, improvements in supply chain infrastructure and proppant handling systems have enhanced operational efficiency. The UK’s commitment to energy security, combined with technological adoption and resource potential, positions it as the leading regional market for frac sand in Europe.

Competitive Landscape:

The competitive landscape is characterized by a mix of domestic producers and international suppliers competing to meet the region’s growing demand for high-quality silica sand. Market players focus on product quality, grain size consistency, and crush resistance to differentiate offerings. Technological integration in mining, processing, and logistics is enhancing operational efficiency and delivery reliability. Competition is also shaped by strategic partnerships with oilfield service providers, expansion of distribution networks, and investment in advanced processing facilities. Additionally, imported sand from established global markets intensifies rivalry, pushing local suppliers to improve standards. Environmental compliance, cost efficiency, and supply chain resilience remain critical factors influencing Europe frac sand market outlook.

The report provides a comprehensive analysis of the competitive landscape in the Europe frac sand market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: Belgium-based international material solutions company Sibelco, which also manufactures silica (quartz) frac sand, officially resumed manufacturing operations at its Spruce Pine high purity quartz mine. The company has also resumed customer shipments from the site.

Europe Frac Sand Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | White Sand, Brown Sand, Others |

| Applications Covered | Oil Exploitation, Natural Gas Exploration, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe frac sand market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe frac sand market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe frac sand industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe frac sand market was valued at USD 2,046.1,077 Million in 2024.

The Europe frac sand market is projected to exhibit a CAGR of 6.79% during 2025-2033, reaching a value of USD 3,694.89 Million by 2033.

Key factors driving the Europe frac sand market include rising shale gas and natural gas exploration, technological advancements in drilling and hydraulic fracturing, and increasing demand for high-purity silica sand. Supportive energy policies, infrastructure development, and the push for energy independence further boost market growth across the region.

Brown sand leads the market with 59.8% share due to its lower cost and abundant availability versus white sand. It delivers sufficient strength for many fracking operations, making it ideal for budget-conscious projects. Local sourcing further reduces transport costs, enhancing its competitiveness in the Europe frac sand market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)