Europe Governance, Risk and Compliance Platform Market Size, Share, Trends and Forecast by Deployment Model, Solution, Component, Service, End User, Vertical, and Country, 2025-2033

Europe Governance, Risk and Compliance Platform Market Size and Share:

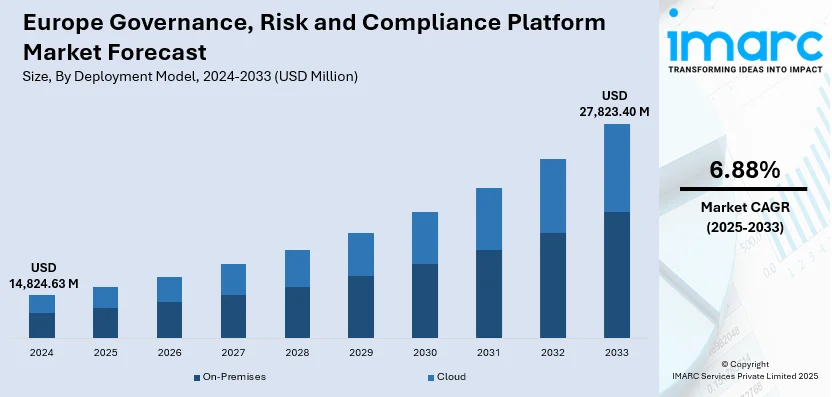

TThe Europe governance, risk and compliance platform market size was valued at USD 14,824.63 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 27,823.40 Million by 2033, exhibiting a CAGR of 6.88% from 2025-2033. Organizations are constantly navigating through a complex network of local, regional, and international regulations, which are changing fast. Moreover, cybersecurity risks are constantly on the rise in terms of their sophistication, and companies are acknowledging the imperative necessity of addressing these threats. Furthermore, digital shift and movement to cloud computing is expanding the Europe governance, risk and compliance platform market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14,824.63 Million |

|

Market Forecast in 2033

|

USD 27,823.40 Million |

| Market Growth Rate 2025-2033 | 6.88% |

The market of the Europe governance, risk and compliance (GRC) platform is growing at a very high pace, led by a number of energetic trends. Organizations are finding it more appropriate to implement GRC platforms to deal with risks, maintain regulatory compliance, and advance governance policies. This trend is picking up because companies from all industries are realizing the need to keep their operations efficient and secure their brand image. Organizations are increasingly using GRC platforms to standardize their risk management processes. They are embedding artificial intelligence (AI) and machine learning (ML) in their systems to make risk assessment and detection automated. These technologies are greatly enhancing the speed and reliability with which potential risks are detected and addressed. AI is also assisting companies in predictive analytics, where they are detecting potential risks before they rise.

To get more information on this market, Request Sample

In addition, organizations are giving greater importance to regulatory compliance given the dynamic nature of legislation. They are using GRC platforms to make sure that they comply with a plethora of local and international regulations. With ever-increasing regulatory requirements, organizations are desperately looking for tools that can provide real-time tracking and reporting functionalities to keep them ahead of the regulatory compliances. The need for cloud-based GRC platforms is also increasing. Businesses are increasingly shifting their operations to cloud-based solutions to achieve higher scalability, flexibility, and affordability. These platforms offer real-time information and accessible reporting, which is becoming vital for enterprises operating in diverse jurisdictions. Cloud-based solutions are also facilitating remote working and improved decision-making among geographically spread teams.

Europe Governance, Risk and Compliance Platform Market Trends:

Growing Regulatory Sophistication and Compliance Burden

The Europe GRC platform market is driven by increasing regulatory complexity. Organizations are constantly navigating through a complex network of local, regional, and international regulations, which are changing fast. Organizations are making efforts to maintain regulatory compliance to evade huge fines and negative word-of-mouth. GRC platforms are being embraced in order to automate the management of compliance activities through centralized tracking, reporting, and auditing. They are assisting companies in keeping pace with regulatory updates, handling documentation effectively, and compliance deadline management more efficiently. With increasing more stringent requirements on organizations, the market for GRC platforms is gradually on the rise, allowing companies to have greater assurance of a more proactive compliance management and minimizing the risk of non-compliance. The European Commission planned to present a proposal for simplifying GDPR by June 2025, as a component of a broader “omnibus package” aimed at lowering bureaucracy and boosting the competitiveness of European firms. This package postponed from its initial April deadline partially aimed to alleviate record-keeping requirements for SMEs, a frequent challenge for smaller entities.

Increasing Cybersecurity Risks and Risk Management Requirements

Cybersecurity risks are constantly on the rise in terms of their sophistication, and companies are acknowledging the imperative necessity of addressing these threats, thereby impelling the Europe governance, risk and compliance platform market growth. The market for Europe GRC platforms is expanding as companies are incorporating risk management functions into their day-to-day operations. GRC platforms are actively enabling companies to evaluate, track, and manage cyber threats by determining vulnerabilities and perils in real-time. According to the recent analysis by SecurityScorecard, Europe's biggest financial institutions experienced a 25% rise in external cyber breaches in the 2024. As cyberattacks, data breaches, and digital infrastructures become more sophisticated, businesses are turning to GRC platforms to ensure that they have an enterprise-wide risk management program in place. These platforms are facilitating real-time threat intelligence, incident response, and regulatory compliance for cybersecurity. Since cybersecurity is also at the top of the agenda, companies are turning to GRC solutions to handle, mitigate, and monitor possible cyber threats, creating a growing need for these platforms throughout Europe.

Cloud-Based Solutions and Digital Transformation Adoption

One of the major Europe governance, risk and compliance platform market trends include the digital shift and movement to cloud computing having a massive impact on the market. Increasingly, companies are moving their operations to cloud systems for scalability, affordability, and flexibility. Cloud-based GRC platforms are directly empowering companies to automate their governance, risk, and compliance processes with greater collaboration and real-time access to data by distributed teams. These solutions are giving companies the power to bring together information from various sources, enabling quicker decision-making and better risk management. As companies turn more towards cloud-based solutions for their operations, the need for cloud-native GRC platforms is increasing. They are providing greater responsiveness to changing business landscapes, enabling firms to incorporate new regulatory needs and risk management practices without the overhead of on-premises infrastructure management, which is accelerating the adoption of such platforms. Owing to the heightened usage of cloud services, numerous data centers are also coming up in the region. IMARC Group predicts that the Europe data center market is projected to attain USD 130.1 Billion by 2033.

Europe Governance, Risk and Compliance Platform Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe governance, risk and compliance platform market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on deployment model, solution, component, service, end user, and vertical.

Analysis by Deployment Model:

- On-Premises

- Cloud

On-premises stands as the largest component in 2024, holding 55.8% of the market On-premises GRC platforms are useful for providing data security to organizations that want to have complete control over their governance, risk, and compliance functions. One of the main strengths they possess is the added level of security they provide. With on-premises solutions, businesses are able to hold sensitive data in-house, minimizing the threat of third-party data loss and guaranteeing that security controls align with their business needs. On-premises solutions also give organizations more control over how the GRC system is configured, which can be aligned with their unique processes, workflows, and regulatory compliance requirements. On-premises solutions are better integrated with current enterprise systems, facilitating smooth data transfer and enhanced reporting. Also, organizations that implement on-premises GRC platforms are not internet-dependent, which guarantees uninterrupted access to vital tools and data even when a network is interrupted. Lastly, companies can have complete control over their infrastructure and software, guaranteeing compliance with data privacy standards and industry standards.

Analysis by Solution:

- Audit Management

- Risk Management

- Policy Management

- Compliance Management

- Others

Compliance management stands as the largest component in 2024, holding 35.5% of the market. It has many advantages for companies, keeping them up to date with regulatory needs and industry requirements. With active compliance management, companies can prevent expensive fines, penalties, and reputational loss as a result of non-compliance. A strong compliance management system enables organizations to remain current with constantly changing laws and regulations, avoiding costly mistakes and the risk of lagging behind. It also ensures a transparency and accountability culture in the organization, which builds trust among stakeholders, investors, and customers. In addition, successful compliance management supports operational efficiency by minimizing process redundancies and improving streamlined processes, which facilitates easier tracking and reporting of compliance activities. It also reduces the likelihood of security breaches, fraud, and legal challenges by identifying and solving potential risks in advance. Finally, compliance management assures business continuity as it keeps operations within the bounds of the law, thus creating a basis for long-term development and sustained success.

Analysis by Component:

- Software

- Services

Software leads the market with 60.9% of market share in 2024. It provides several advantages that contribute considerably to business efficiency and operations. Automation is one of the greatest benefits of software, through which companies can automate repetitive tasks, minimize human faults, and conserve time. Through automation of such processes as data entry, reporting, and analysis, software solutions enable workers to concentrate on higher-value activities that innovate and grow the company. Software also enhances data administration and decision-making. It consolidates the storage of data, providing ease of access, maintenance, and analysis of information, such that companies can have accurate and real-time information at hand. This promotes better decision-making, efficient use of resources, and improved performance monitoring. Software also improves teamwork and communication between and within teams. Cloud-based applications, for instance, enable real-time collaboration irrespective of location. These services provide businesses with a variety of beneficial advantages in terms of accessing expert knowledge and advice to enhance performance and meet objectives. One of the main benefits is the access to professional expertise and skills that are not always present in-house.

Analysis by Service:

- Integration

- Consulting

- Support

Consulting leads the market with 45.8% of market share in 2024. Consultants are experienced industry professionals with deep industry expertise and knowledge, offering new points of view and creative solutions to challenging issues. Externally derived insight assists organizations in recognizing opportunities for improvement, simplifying operations, and creating successful strategies. Secondly, consulting services provide unbiased advice, untainted by internal politics, enabling companies to take informed decisions. Organizations can also use consultants to guide them through change, including digital transformation, mergers, or changes in regulations, by offering insights on best practices and ensuring a smooth transition. Finally, employing consultants enables companies to cater to short-term requirements without engaging in long-term staff additions, making it an economical way of accessing expertise on a need basis. These companies are now more and more recognizing the importance of GRC platforms to manage and streamline their businesses efficiently. With their growth, they have to deal with more intricate regulatory demands, changing risks, and the necessity of strong internal controls.

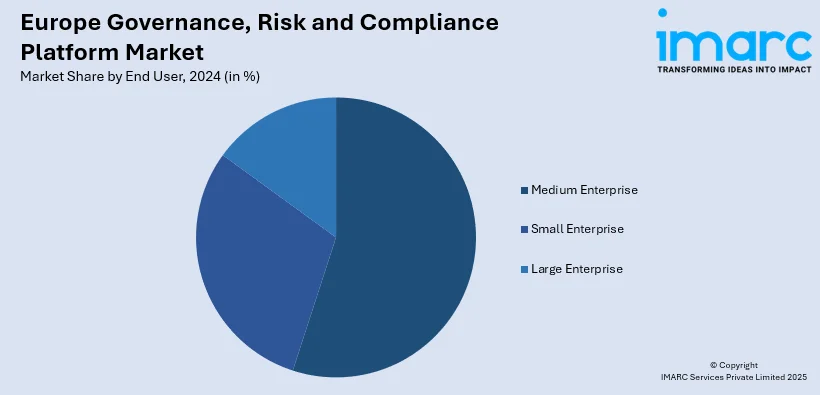

Analysis by End User:

- Small Enterprise

- Medium Enterprise

- Large Enterprise

Medium enterprise leads the market in 2024. These businesses are coming to realize that they need GRC platforms in order to effectively streamline and manage their operations. As the businesses expand, they encounter more sophisticated regulatory requirements, changing risks, and requirements for sound internal controls. GRC platforms assist medium-sized businesses in automating compliance processes, which keeps them in line with industry regulations and prevents costly fines or reputational loss. Moreover, GRC platforms also offer a unified system for managing risks, allowing companies to identify, evaluate, and counter possible risks across the different departments. This proactive risk management ensures that medium businesses can act immediately in response to creeping risks, whether cybersecurity, financial, or operational risks. Moreover, GRC platforms increase transparency and accountability, facilitating enhanced decision-making and promoting an effective governance structure.

Analysis by Vertical:

- BFSI

- Construction and Engineering

- Energy and Utilities

- Government

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- Telecom and IT

- Transportation and Logistics

- Others

BFSI leads the market with 25.8% of market share in 2024. The Banking, Financial Services, and Insurance (BFSI) sector has a critical need for GRC platforms due to the complex regulatory landscape and the high volume of risks they face. Financial institutions are constantly navigating evolving regulations, such as GDPR, Basel III, and anti-money laundering (AML) laws. GRC platforms help these organizations automate compliance processes, ensuring adherence to these regulations while reducing the risk of fines, penalties, or reputational damage. Additionally, the BFSI sector deals with various risks, including operational, financial, cybersecurity, and market risks. GRC platforms enable firms to recognize, assess, and manage these risks more effectively, providing real-time insights and improving decision-making. These platforms also facilitate better internal controls and reporting, essential for maintaining transparency and meeting regulatory reporting requirements. Overall, GRC platforms are crucial for ensuring the stability, security, and compliance of BFSI institutions, supporting their long-term sustainability and maintaining customer trust.

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. The market is experiencing significant growth, owing to several key factors that are reshaping how organizations manage risk, compliance, and governance. Businesses in Germany are increasingly adopting advanced GRC platforms to streamline their operations and ensure compliance with stringent regulations. These platforms are helping organizations navigate complex regulatory landscapes, mitigate risks, and enhance governance practices, contributing to the market's rapid expansion. Companies in Germany are continuously integrating artificial intelligence (AI) and machine learning (ML) technologies into their GRC platforms. These technologies are automating risk identification, assessment, and mitigation processes, allowing businesses to proactively manage potential threats. AI and ML are also improving the accuracy of data analysis, helping organizations detect emerging risks faster and make more informed decisions. As these technologies evolve, businesses are increasingly relying on them to strengthen their GRC capabilities.

Competitive Landscape:

Major players in the market are increasingly developing their offerings and strengthening their technologies to satisfy the increasing demand. Top players are incorporating artificial intelligence (AI) and machine learning (ML) in their platforms to mechanize risk identification and compliance procedures. Most are also emphasizing cloud-based deployment to offer flexibility and real-time access to data. Moreover, these players are providing industry-specific solutions for sectors like banking, healthcare, and manufacturing, catering to sector-specific regulatory requirements. Strategic collaborations and mergers are another norm, allowing companies to enhance their capabilities and improve their market share. As per the Europe governance, risk and compliance platform market forecast, through constant innovation, players in the market are expected to enhance the overall performance and efficiency of GRC platforms.

The report provides a comprehensive analysis of the competitive landscape in the Europe governance, risk and compliance platform market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Swiss GRC, a provider of software solutions for governance, risk and compliance, is expanding its product portfolio with a new standalone solution in the area of Contract Lifecycle Management (CLM). With the launch of Contraqto, the Lucerne-based company is bringing modern, user-friendly and future-oriented contract management software to the market.

- July 2025: Fasqon introduced Europe’s first all-in-one Web3 banking platform combining crypto wallets, euro payments, and IBAN-enabled cards. Targeting financial inefficiencies, it addressed compliance challenges through a partnership with Portugal’s Bison Bank, offering secure, regulation-aligned tools for European entrepreneurs seeking faster, flexible cross-border payment and digital asset management.

- June 2025: OKAST partnered with Axeptio to implement a GDPR-compliant consent management platform across its streaming services. Integrated first with Bouygues Telecom’s “My TV Europe,” the solution enabled transparent user consent across devices, aligning with evolving European privacy laws and supporting the ASAP4EU consortium’s push for digital advertising transparency.

- May 2025: Axiom GRC launched a first-of-its-kind business resilience platform, marking a significant milestone in the global Governance, Risk, and Compliance (GRC) landscape. The platform, backed by £500 million in private equity investment, integrates a wide range of GRC capabilities, offering the most comprehensive solution on the market. This innovative platform is designed to help organizations manage risks, compliance, and governance with enhanced efficiency and resilience.

Europe Governance, Risk and Compliance Platform Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Models Covered | On-Premises, Cloud |

| Solutions Covered | Audit Management, Risk Management, Policy Management, Compliance Management, Others |

| Components Covered | Software, Services |

| Services Covered | Integration, Consulting, Support |

| End Users Covered | Small Enterprise, Medium Enterprise, Large Enterprise |

| Verticals Covered | BFSI, Construction and Engineering, Energy and Utilities, Government, Healthcare, Manufacturing, Retail and Consumer Goods, Telecom and IT, Transportation and Logistics, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe governance, risk and compliance platform market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe governance, risk and compliance platform market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the keyword industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The governance, risk and compliance platform market in Europe was valued at USD 14,824.63 Million in 2024.

The Europe governance, risk and compliance platform market is projected to exhibit a CAGR of 6.88% during 2025-2033, reaching a value of USD 27,823.40 Million by 2033.

Key factors driving the market include increasing regulatory complexity, rising cybersecurity risks, and the shift to cloud-based solutions. Organizations are adopting GRC platforms to manage risks, ensure compliance, and streamline operations amidst changing regulations and advanced cyber threats.

On-premises deployment accounts for the largest share in the Europe governance, risk, and compliance platform market, holding around 55.8% of the market in 2024, due to the added security and control it offers organizations.

Germany accounts for the largest share in the Europe governance, risk, and compliance platform market, driven by the country's adoption of advanced GRC platforms to meet regulatory and risk management needs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)