Europe Implantable Medical Devices Market Size, Share, Trends and Forecast by Product, Material, End User, and Country, 2025-2033

Europe Implantable Medical Devices Market Size and Share:

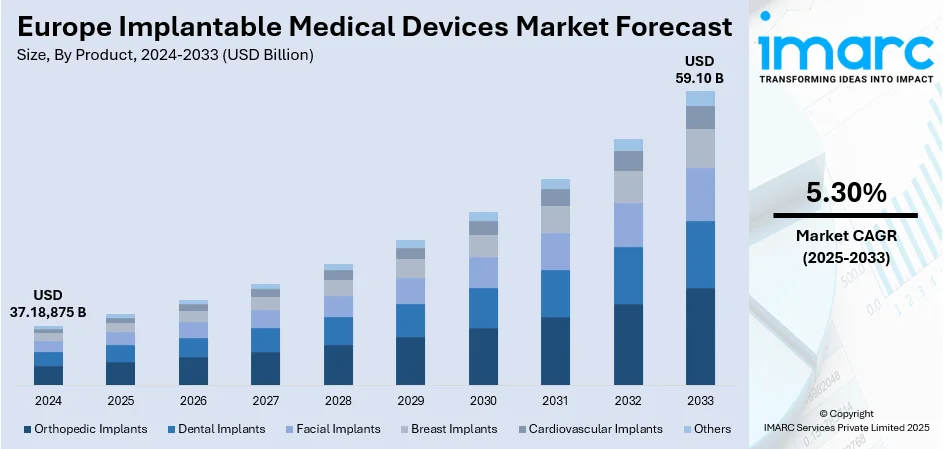

The Europe implantable medical devices market size was valued at USD 37.18,875 Billion in 2024. The market is projected to reach USD 59.10 Billion by 2033, exhibiting a CAGR of 5.30% from 2025-2033. Germany is currently dominating the market owing to the rapid technological advancement, increasing clinical use, and greater adoption in hospitals and specialist care centers. Orthopedic, cardiovascular, and dental implants remain predominant, while polymers are used extensively due to their flexibility and biocompatibility. Germany is leading the market supported by advanced healthcare infrastructure and robust research strength that drives innovation and adoption. Together, these factors highlight the changing patterns propelling the Europe implantable medical devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.18,875 Billion |

| Market Forecast in 2033 | USD 59.10 Billion |

| Market Growth Rate 2025-2033 | 5.30% |

The development of the market is backed by increasing emphasis on enhancing patient outcomes and improving quality of life. According to the sources, in April 2024, MicroPort® CRM launched TALENTIA™ and ENERGYA™ across Europe, offering Bluetooth-enabled implantable cardiac defibrillators and CRT-D devices with advanced tablet-based programming, remote monitoring, and improved patient care features. Moreover, growing consciousness among patients and physicians about the advantages of implantable devices, including the fact that they can restore function and minimize the demand for recurring interventions, is driving demand throughout the region. The devices are incredibly important to the treatment of a large number of conditions, from orthopedic trauma to heart and neurological diseases, and provide long-term solutions that allow people to be healthier, more independent, and have less dependency on recurring interventions. European healthcare systems are increasingly focusing on value-based care, and the use of implantable medical devices is in line with the goal of having effective, sustainable treatment practices. This continued transition towards patient-driven healthcare will continue to promote innovation and uptake, further support the need for implantable devices in contemporary medical practice in Europe.

To get more information on this market, Request Sample

The other major factor for Europe implantable medical devices market growth is the consistent development of healthcare infrastructure, which provides a supportive environment for the adoption of sophisticated medical technologies. Hospitals and specialized clinics have become better equipped with state-of-the-art facilities and trained staff able to perform complicated procedures involving implantable devices. The heightening adoption of digital technologies within healthcare systems has also improved procedural accuracy and device compatibility, providing improved treatment outcomes. Moreover, collaborative research between medical facilities and research centers is promoting the growth of new innovative solutions geared towards patient needs, further enhancing adoption. As per the sources, in July 2025, FineHeart was declared leader of the IPCEI Tech4Cure initiative in Europe, leading the structuring of the implantable medical device industry with its SmartDMIA program to promote innovation and sustainability. Furthermore, with healthcare spending throughout the region more so focused on long-term efficiency and enhanced recovery time, the use of implantable devices becomes more important. This enabling environment, characterized by technological preparedness and professional know-how, facilitates the long-term growth of the market, making implantable medical devices an important piece of the changing healthcare in Europe.

Europe Implantable Medical Devices Market Trends:

Increasing Burden of Chronic Disease and Geriatric Population

Growing incidence of chronic disease, coinciding with the expanding geriatric population, is a key driver of growth in the European healthcare environment. Cardiovascular, neurological, and orthopedic disorders are highly on the rise, making advanced treatment therapies and medical devices a requirement. The European Commission reports that an average of more than six million new cardiovascular disease cases occur every year in the European Union alone, leading to over 1.8 million deaths. This growing challenge underlines the critical necessity for novel, cost-effective, and patient-centered therapeutic solutions. Geriatric populations, being more susceptible to long-term illnesses, are especially spearheading the demand for implantable technology that enhances health outcomes and minimizes hospitalization frequency. With governments and healthcare organizations concentrating on cost-effective disease management, advanced devices are becoming intensely prominent. These population and healthcare factors highly influence the Europe implantable medical devices market trends, illustrating how increasing disease prevalence and ageing population are continually supporting market growth.

Heightened Demand for Aesthetic and Cosmetic Procedures

The increasing trend towards physical improvement is driving market growth, especially in the area of aesthetic and cosmetic procedures. Boosting knowledge of minimally invasive surgical procedures and higher disposable incomes are leading to greater consumer demand for these interventions. Indeed, the UK aesthetics sector saw an 8.4% rise in 2024 as the expanding consumer base for cosmetic treatment became evident. This boom underscores increasing popular acceptance of treatments like dermal fillers, body contouring, and facial augmentation throughout the region. Additionally, advances in medical devices have rendered these treatments safer, quicker, and more efficient, driving wider adoption. Shifts in lifestyle choices and needs for youthful looks are driving consumers throughout different age groups to pursue aesthetic treatments. Health professionals and specialist clinics are broadening their services to meet this demand, which in turn fortifies the general market picture and supports Europe's role as a center for cosmetic innovations.

Biotechnology and Medical Device Technology Advances

Dramatic advances in microelectronics and biotechnology are transforming the availability and performance of advanced implantable medical devices. These products are being designed more and more to minimize hospital stay, facilitate faster recovery, and enhance long-term patient outcomes. Based on the IMARC Group, the UK biotechnology industry attained USD 22.00 billion in 2024 and is anticipated to reach USD 41.47 billion by 2033, reflecting robust momentum in technology development. Advances in biotechnology have made it possible to create more intelligent, long-lasting, and user-friendly devices used in cardiovascular, orthopedic, and neurological interventions. Microelectronics integration made the devices smaller, more accurate, and more effective, opening the door for their expanded use in various specialties within medicine. Not only do they provide better treatment results, but also cost-effectiveness, by diminishing the need for repeat procedures and hospitalization. The growing dependence on next-generation biotechnology-based medical treatments is thus poised to be a key driver of long-term growth in the market over the forecast period.

Europe Implantable Medical Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe implantable medical devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, material, and end user.

Analysis by Product:

- Orthopedic Implants

- Dental Implants

- Facial Implants

- Breast Implants

- Cardiovascular Implants

- Others

Orthopedic implants are the dominant product type as per the Europe implantable medical devices market outlook, fueled by the expanding demand for treatments targeting bone fractures, joint diseases, and degenerative disorders. These implants are of vital importance to restore mobility, alleviate pain, and enhance the quality of life of patients of all age groups. Ongoing design and material innovations have rendered orthopedic implants longer-lasting, lighter, and capable of conforming to the specific needs of an individual patient. The growing popularity of minimally invasive orthopedic interventions has further boosted their use within surgical procedures in Europe. As healthcare systems focus more on quicker recovery periods and long-term performance, orthopedic implants continue to be a keystone of current surgical interventions. With their extensive use in hip, knee, spine, and trauma procedures, they are well-rooted as the top segment. With the prevalence of musculoskeletal diseases expected to grow further, orthopedic implants are set to remain dominant in the regional market.

Analysis by Material:

- Polymers

- Metals

- Ceramics

- Biologics

Polymers are the most prominent material in the European implantable medical devices market, due to their versatility, biocompatibility, and flexibility in various medical applications. Their capacity to simulate natural tissue characteristics while providing strength and elasticity has made them pivotal in the manufacturing of a wide variety of implants such as orthopedic, dental, and cardiovascular devices. Advances in polymer technology have allowed the creation of drug-delivering and bioresorbable implants that optimize therapy while reducing complications. Polymers are also preferred due to their low cost, easy production, and ability to be customized in patient-specific applications. The compatibility of the material with cutting-edge technologies, including 3D printing, only adds to its position in future medical devices. With continued innovation in polymers used in the medical field with durability alongside increased safety, this segment remains the market leader in material choices. The large demand across specialties in healthcare underscores the pivotal position of polymers in determining the future direction of implantable devices.

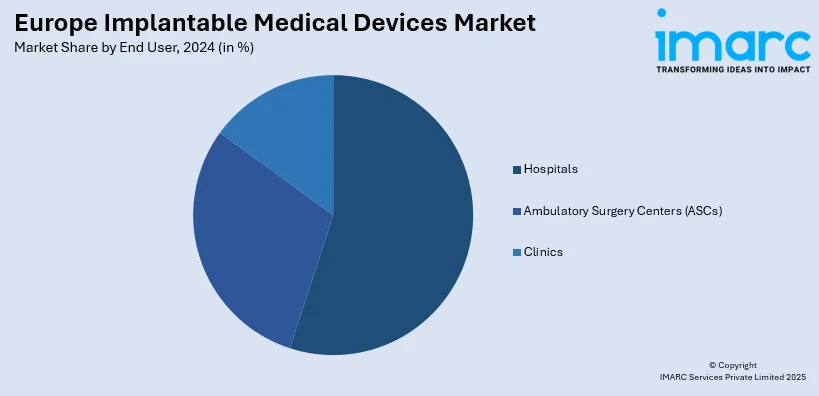

Analysis by End User:

- Hospitals

- Ambulatory Surgery Centers (ASCs)

- Clinics

Hospitals represent the top end-user segment for the Europe implantable medical devices market due to their advanced infrastructure, expert professionals, and extensive patient care facilities. Such institutions are the first point of call for undertaking complex operations involving the use of implantable devices within orthopedic, cardiovascular, and neurological fields. Hospitals also possess advanced diagnostic and imaging technology, which increases the accuracy of implant operations and outcomes. The congregation of multidisciplinary teams in hospitals facilitates effective treatment planning and post-operative recovery, such that they are the first option for individuals undergoing implant-related procedures. In addition, hospitals tend to be the central venues for clinical trials and the implementation of new implant technologies, which reinforces their leadership status in the industry. As the demand for specialty and advanced surgery continues to grow, hospitals remain at the forefront of promoting the use of implantable medical devices throughout Europe.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany dominates the European implantable medical devices market, driven by its superior healthcare infrastructure, robust focus on research and development, and high degree of adoption of medical technologies. The healthcare system within Germany is known for its accessibility, efficiency, and incorporation of cutting-edge practices, thereby emerging as a primary hotspot for the adoption of implantable devices. German healthcare facilities are leading the way in adopting advanced surgical methods and sponsoring clinical studies that promote ongoing innovation within the discipline. A highly qualified medical staff and extensive availability of specialized treatment further support Germany's position at the top. The nation also emphasizes much quality control and patient protection, with implantable devices subject to rigorous performance and reliability criteria. As more demand for orthopedic, cardiovascular, and dental implants arises, Germany continues to lead in technology adoption and delivery of healthcare, solidifying its position as the regional implantable medical devices market leader.

Competitive Landscape:

The Europe implantable medical devices market is influenced by ongoing innovation, technological integration, and clinical scope expansion. Producers are continually more interested in creating advanced devices with toughness, accuracy, and biocompatibility to ensure enhanced patient outcomes and durability. Increased demand for minimally invasive treatments has promoted the creation of smaller and more adaptable implants that fit into changing medical practices. R&D collaboration and co-operation with medical establishments are also contributing to the development of custom-fit solutions specific to patients' needs. In addition, European regulatory structures uphold product safety and performance, compelling businesses to spend money on thorough testing and quality controls. As healthcare systems increasingly focus on patient-focused care, implantable devices are being marketed as critical tools for contemporary treatments. Coupled with advances in materials science and biotechnology, the Europe implantable medical devices market forecast shows continued growth and increased competitiveness through the next few years.

The report provides a comprehensive analysis of the competitive landscape in the Europe implantable medical devices market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Auxilium began clinical trials for its NeuroSpan Bridge, the first space-bioprinted nerve regeneration implant, at major U.S. centres. Initially printed aboard the ISS using AMP-1, the implant supported nerve regrowth through microchannel-guided structures. This breakthrough marked a major step in regenerative medicine and advanced bioprinting innovation.

- March 2025: RevBio initiated a pivotal clinical trial in Europe for its dental implant stabilisation product after receiving regulatory and ethics approvals in multiple countries. With 30 of 75 patients already enrolled, the trial aimed to secure CE marking, enabling commercial sales and expanding RevBio’s presence in the European dental implant market.

- March 2025: POLYTECH Health & Aesthetics launched a UK subsidiary to expand access to its innovative breast implants, including the lightweight B-Lite and reconstruction-friendly Microthane. The expansion strengthened ties with NHS hospitals and improved the availability of clinically proven implants designed for enhanced comfort, safety, and aesthetic outcomes in British surgical care.

- February 2025: Bioretec secured CE mark approval for its RemeOs™ Trauma Screw product group, enabling immediate commercialisation across Europe. The portfolio featured absorbable magnesium alloy screws for adult and pediatric trauma cases. The approval facilitated global expansion, real-world evidence collection, and positioned Bioretec for broader U.S. indication approvals and market penetration.

Europe Implantable Medical Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Orthopedic Implants, Dental Implants, Facial Implants, Breast Implants, Cardiovascular Implants, Others |

| Materials Covered | Polymers, Metals, Ceramics, Biologics |

| End Users Covered | Hospitals, Ambulatory Surgery Centers (ASCs), Clinics |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe implantable medical devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe implantable medical devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the implantable medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe implantable medical devices market was valued at USD 37.18,875 Billion in 2024.

The Europe implantable medical devices market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 59.10 Billion by 2033.

Rising demand for advanced healthcare solutions, increasing incidence of chronic diseases, and greater adoption of minimally invasive treatments drive the Europe implantable medical devices market. Ongoing developments in device technologies and materials, along with broadening application areas in orthopedic, cardiovascular, and dental care, further enhance uptake, bolstering hospital, clinic, and specialized healthcare facility growth.

Germany accounts for the largest share in Europe implantable medical devices market, because of its well-developed healthcare infrastructure, rigid emphasis on research and development, and extensive adoption of advanced medical technologies. Skilled labor, across-the-board availability of specialized treatment, and quality standard focus render the country a top hub for implantable device use and technological advancement.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)