Europe Lipids Market Size, Share, Trends, and Forecast by Type, Source, Form, Application, and Country, 2025-2033

Europe Lipids Market Size and Share:

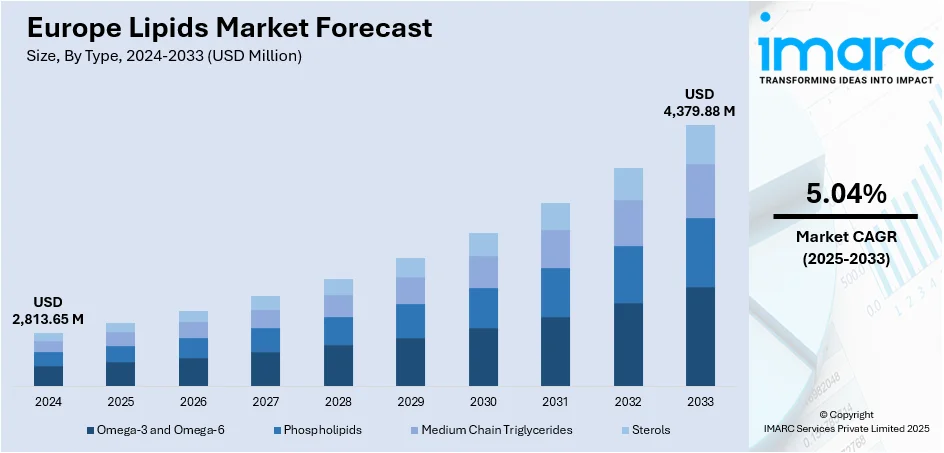

The Europe lipids market size was valued at USD 2,813.65 Million in 2024. Looking forward, the market is expected to reach USD 4,379.88 Million by 2033, exhibiting a CAGR of 5.04% during 2025-2033. The market is experiencing steady growth driven by rising health awareness, increasing demand for functional foods, and expanding applications in pharmaceuticals, nutraceuticals, and cosmetics. Technological advancements and sustainable sourcing practices further accelerate adoption, while green cosmetics and eco-friendly initiatives enhance opportunities, strengthening the overall Europe lipids market share across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,813.65 Million |

|

Market Forecast in 2033

|

USD 4,379.88 Million |

| Market Growth Rate 2025-2033 | 5.04% |

The market is experiencing robust growth, supported by multiple business and consumer-driven factors that are reshaping industry dynamics. One of the most influential drivers is the rising consumer emphasis on health, wellness, and nutrition. With growing awareness regarding the benefits of lipids such as omega-3, omega-6, phospholipids, and medium-chain triglycerides, demand for dietary supplements and functional foods has significantly increased, encouraging businesses to innovate with enriched product portfolios. The Pharmaceutical and nutraceutical applications represent another major growth avenue. Lipids are increasingly utilized in drug delivery systems due to their role in improving bioavailability and therapeutic performance. This trend is encouraging pharmaceutical companies to expand investments in lipid research and production technologies, positioning lipids as critical components in modern healthcare solutions. For instance, in March 2023, Evonik inaugurated a new GMP facility in Hanau, Germany, dedicated to producing lipids for advanced pharmaceutical drug delivery applications. This launch facility supports clinical and small-scale commercial manufacturing, offering tailored lipid quantities. It enhances Evonik’s existing laboratory and large-scale production network, enabling comprehensive partner support throughout development and commercialization stages.

To get more information on this market, Request Sample

The Europe lipids market growth is also driven by the rising cosmetics and personal care sector, due to the rising popularity of natural and sustainable formulations. Plant-based lipids are witnessing strong uptake as consumers favor eco-friendly products, aligning with Europe’s broader sustainability objectives. Companies that integrate renewable sourcing and transparent supply chains gain a competitive advantage in this evolving landscape. Technological advancements in extraction and processing further strengthen the market. Innovations that enhance quality, efficiency, and scalability enable manufacturers to expand across diverse industries while maintaining consistency and compliance. Combined with Europe’s well-established regulatory support and robust distribution networks, these factors create an environment conducive to business growth.

Europe Lipids Market Trends:

Rising Health and Nutritional Awareness

The Europe lipids market is significantly driven by growing consumer awareness about the importance of balanced diets and healthy living. According to a 2023 survey by the European Institute of Innovation and Technology (EIT Food), 56% of respondents reported making an active effort to consume a healthy diet. This shift in consumer behavior has boosted demand for food products rich in beneficial lipids, particularly omega-3 fatty acids. These compounds are increasingly incorporated into functional food and beverage products, fueling innovation across the industry. As individuals continue to prioritize well-being, the trend of integrating lipid-rich ingredients into daily diets remains a critical factor shaping market growth.

Technological Advancements and Sustainability Initiatives

Technological progress in extraction and processing techniques is playing a crucial role in advancing the Europe lipids market trends. Novel methods improve production efficiency and ensure higher-quality lipid-based products suitable for pharmaceuticals, nutraceuticals, and personal care industries. Additionally, the region is seeing a strong shift toward eco-friendly practices, emphasizing the use of sustainable and renewable lipid sources. This aligns with Europe’s commitment to environmental conservation and responsible sourcing. Manufacturers are investing heavily in green technologies and sustainable supply chains to meet rising consumer expectations for ethical products. The convergence of innovation and sustainability is creating new opportunities, making advanced, eco-conscious lipid solutions more accessible in the European market.

Expanding Applications in Pharmaceuticals and Cosmetics

The pharmaceutical and nutraceutical industries are expanding their use of lipids for innovative drug delivery systems and health-promoting supplements, which strongly supports market growth. For instance, Evonik, a specialty chemicals company headquartered in Germany, commenced construction of a USD 220 Million commercial-scale manufacturing plant for pharmaceutical lipids in the United States in March 2023. Furthermore, the cosmetics sector is experiencing rising demand for green and natural formulations enriched with lipid-based ingredients. The popularity of natural beauty products continues to rise, with the amount of natural ingredients imported into Europe for use in cosmetics reaching 470,561 Tons in 2023, according to a 2024 industry report. This surge reinforces lipids’ growing importance across multiple industries.

Europe Lipids Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe lipids market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, source, form, and application.

Analysis by Type:

- Omega-3 and Omega-6

- Phospholipids

- Medium Chain Triglycerides

- Sterols

Omega-3 and Omega-6 fatty acids dominate the market due to their strong association with heart health, cognitive development, and overall wellness. Increasing consumer awareness regarding preventive healthcare and functional nutrition has driven demand for these essential fatty acids in food, dietary supplements, and fortified beverages. Their integration into infant nutrition, pharmaceuticals, and specialized medical foods further strengthens their market position. Additionally, clinical studies highlighting their benefits in reducing inflammation and supporting cardiovascular health have boosted consumer trust and adoption. With rising health-conscious lifestyles, Omega-3 and Omega-6 continue to hold the largest share in the market.

Phospholipids hold a significant share of the market owing to their extensive use in pharmaceuticals, nutraceuticals, and cosmetics. According to the Europe lipids market forecast, these molecules are vital for cell membrane function and are increasingly applied in advanced drug delivery systems due to their biocompatibility and ability to enhance bioavailability. In the nutraceutical sector, phospholipids are recognized for supporting brain health, liver function, and cardiovascular wellness, which boosts their demand among health-conscious consumers. Furthermore, their rising incorporation in natural skincare and personal care formulations enhances their market appeal. With multifunctional benefits across healthcare and beauty, phospholipids continue to capture a substantial share in the regional market.

Medium Chain Triglycerides (MCTs) command a large share in the market due to their popularity in weight management, sports nutrition, and ketogenic diets. Easily digestible and rapidly converted into energy, MCTs are widely used in functional foods, beverages, and dietary supplements. Their role in improving endurance and cognitive function has further elevated their adoption in fitness and wellness communities. Additionally, the growing popularity of plant-based and clean-label ingredients supports MCT demand, as they are often derived from natural sources like coconut oil. With expanding applications in pharmaceuticals, personal care, and clinical nutrition, MCTs maintain a dominant presence in the market.

Analysis by Source:

- Plant

- Animal

Plant-derived lipids hold a major share in the market due to the growing consumer preference for sustainable, vegan, and health-focused products. Sources like soy, flaxseed, sunflower, and algae are rich in essential fatty acids, including omega-3 and omega-6, which support cardiovascular and cognitive health. The increasing demand for plant-based alternatives in food, nutraceuticals, and cosmetics further boosts their adoption. Additionally, Europe’s strong regulatory emphasis on eco-friendly and renewable sources aligns with plant-based lipid production, encouraging manufacturers to innovate in sustainable processing. Their versatility across functional foods, dietary supplements, and green cosmetics reinforces the dominance of plant lipids in the region.

Animal-derived lipids account for a significant share of the market owing to their established role in pharmaceuticals, nutraceuticals, and food industries. Lipids from fish oil, dairy, and egg sources are rich in bioactive compounds such as omega-3 fatty acids and phospholipids, offering proven health benefits. Their high bioavailability and effectiveness in clinical nutrition, infant formula, and specialized medical foods strengthen their demand. Furthermore, animal-based lipids are widely used in pharmaceutical drug delivery systems due to their biocompatibility and functional properties. Despite rising plant-based trends, the superior efficacy and nutritional value of animal lipids ensure their continued dominance in the Europe lipids market outlook.

Analysis by Form:

- Powder

- Liquid

Powdered lipids hold a significant share in the market due to their versatility, stability, and extended shelf life. They are widely used in dietary supplements, infant formula, and functional foods because of their ease of incorporation into diverse formulations. Powders also offer better handling, transport, and storage benefits compared to liquid forms. In addition, microencapsulation technologies enhance the bioavailability and taste-masking of lipid powders, making them highly suitable for consumer applications. The growing demand for convenience-driven nutritional products and fortified food solutions across Europe further strengthens the dominance of powdered lipids in the regional market landscape.

Liquid lipids account for a major share of the market as they are extensively used in pharmaceuticals, cosmetics, nutraceuticals, and food processing industries. Their easy solubility, rapid absorption, and high bioavailability make them a preferred choice for formulations requiring efficient nutrient delivery. In the food and beverage sector, liquid lipids are incorporated into oils, spreads, and functional drinks, aligning with consumer demand for health-focused products. In pharmaceuticals, they play a key role in drug delivery systems, while in cosmetics, they provide moisturizing and emollient properties. Their wide application range and functional versatility ensure liquid lipids retain a dominant position in Europe.

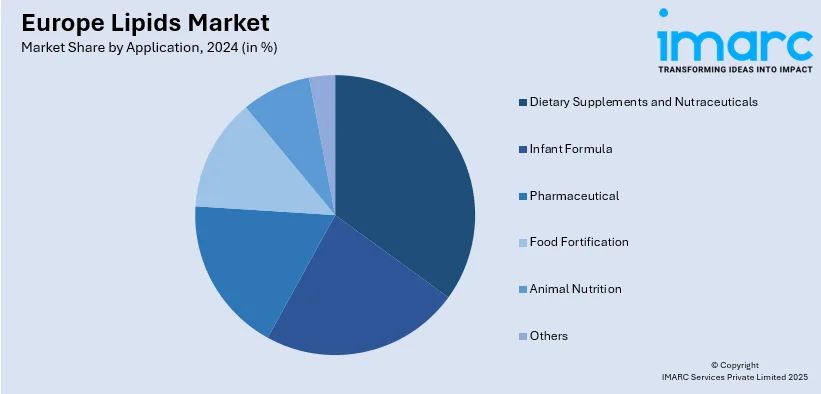

Analysis by Application:

- Dietary Supplements and Nutraceuticals

- Infant Formula

- Pharmaceutical

- Food Fortification

- Animal Nutrition

- Others

Dietary supplements and nutraceuticals dominate the market as consumers increasingly prioritize preventive healthcare and wellness. Lipids such as omega-3, omega-6, and medium-chain triglycerides are widely incorporated into supplements to support heart, brain, and immune health. The growing aging population in Europe and rising health-conscious younger demographics further boost demand. Lipid-based nutraceuticals are also preferred for their bioavailability and ability to deliver essential fatty acids efficiently. With strong consumer awareness, expanding functional food industries, and continuous innovation in supplement formulations, this segment maintains a leading market share, reflecting the shift toward holistic health management and natural product consumption.

Infant formula represents a major share of the market, largely due to the critical role of lipids in early childhood development. Lipids provide essential fatty acids like DHA and ARA, which support brain, vision, and immune system growth in infants. With increasing parental awareness about nutrition and the premiumization of baby food, demand for lipid-enriched formulas continues to rise. European regulations ensure strict quality and safety standards, encouraging manufacturers to develop advanced formulations with plant- and animal-derived lipids. The rising trend of working parents opting for high-quality, ready-to-feed infant nutrition products further strengthens this segment’s dominance across the Europe lipid market demand.

The pharmaceutical sector holds a large share of the market due to the wide use of lipids in drug delivery systems and medical nutrition. Lipids enhance drug solubility, bioavailability, and stability, making them crucial excipients in formulations. They are also applied in intravenous nutrition, vaccines, and novel therapies. Europe’s strong pharmaceutical industry, supported by continuous research and development (R&D) investments and advanced healthcare infrastructure, fuels growth in this segment. The rising demand for personalized medicine, coupled with the need for safe and effective delivery of biologics and active pharmaceutical ingredients, further drives reliance on lipid-based solutions, securing the segment’s substantial market share.

Analysis by Country:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

Germany’s lipid market growth is fueled by its strong pharmaceutical and nutraceutical industries. The country emphasizes preventive healthcare, creating demand for lipid-based supplements like omega-3 and phospholipids. A growing trend toward functional foods and fortified products supports wider lipid applications in the food sector. Germany’s robust research and research (R&D) capabilities also foster advanced processing and extraction technologies, ensuring high-quality lipid production. The demand for sustainable and plant-based lipids is also increasing, in line with Germany’s environmental goals. With a well-established cosmetics sector adopting natural and bio-based ingredients, lipids are witnessing wider applications, reinforcing Germany’s leadership in the European lipid market.

The United Kingdom’s lipid market is driven by its strong consumer preference for functional foods, dietary supplements, and green cosmetics. Rising health awareness is pushing demand for omega-3 fatty acids and medium-chain triglycerides in daily nutrition. The growing vegan and plant-based movement is supporting plant-derived lipid applications across food and beverages. Additionally, the UK’s pharmaceutical sector increasingly relies on lipid-based drug delivery systems, further driving adoption. With government-backed initiatives promoting healthy eating and sustainability, the market is shifting toward bio-based and renewable lipid sources. Digital retail channels also make lipid-based nutraceuticals and cosmetics more accessible, reinforcing market expansion.

In France, the lipid market is supported by strong consumer demand for nutraceuticals and functional foods enriched with omega fatty acids and phospholipids. French consumers prioritize health and natural nutrition, driving the adoption of plant-derived lipids in food products. The cosmetics industry, renowned worldwide, increasingly integrates lipids for skincare and personal care solutions. Pharmaceutical applications also play a significant role, with growing investments in lipid-based drug formulations. France’s regulatory support for sustainable and eco-friendly sourcing further fuels innovation. Additionally, rising demand for infant formula enriched with specialized lipids contributes to the country’s growing position in the European lipid market.

Italy’s lipid market is expanding due to strong consumer interest in natural and functional nutrition. The country’s rich culinary tradition supports the inclusion of lipid-rich products in daily diets, with increasing demand for fortified foods and supplements. Lipids also see rising application in Italy’s flourishing cosmetics and skincare industries, which emphasize natural formulations. Pharmaceutical companies are investing in lipid-based delivery systems, strengthening their role in drug innovation. Italy’s growing preference for plant-based products aligns with the shift toward sustainability, boosting plant-derived lipid consumption. Together, these factors contribute to Italy’s growing role as a key player in the European lipid market.

Russia’s lipid market growth is primarily driven by increasing awareness regarding dietary health and rising demand for nutritional supplements. The country is witnessing growing consumption of omega-3 and other lipid-rich nutraceuticals, especially in urban areas. Food fortification with functional lipids is expanding to address nutritional gaps. Russia’s pharmaceutical sector is also investing in lipid-based drug delivery technologies. Moreover, with a growing cosmetics market, lipids are being incorporated into skincare and personal care products. Domestic demand for cost-effective and sustainable lipid sourcing is rising, supporting local production. Together, these trends reinforce the steady development of Russia’s lipid market within Europe.

Spain’s lipid market is driven by the country’s strong food and beverage sector, with increasing demand for fortified and functional food products. Consumers are actively seeking omega-3 and phospholipid-enriched foods as part of a balanced Mediterranean diet. Nutraceutical adoption is also rising, supported by growing health consciousness. Spain’s cosmetics industry is increasingly using natural lipids in skincare and haircare products, boosting demand. The pharmaceutical sector is expanding its reliance on lipid-based excipients and drug delivery systems. Additionally, Spain’s shift toward sustainability is fostering the adoption of plant-based and renewable lipid sources, further consolidating the country’s position in the Europe lipids market.

The Netherlands plays a central role in the market due to its advanced food processing industry and strong focus on nutritional innovation. The country is a hub for functional foods and nutraceuticals, with lipids widely used to enhance product value. Health-conscious consumers are fueling demand for omega fatty acids and plant-based lipid alternatives. The pharmaceutical sector also utilizes lipids in drug formulation and delivery systems. Additionally, the Netherlands’ cosmetics industry increasingly incorporates bio-based lipids in skincare. The nation’s emphasis on sustainability and renewable resources further accelerates adoption. Its strong trade infrastructure supports lipid imports and exports across Europe.

Switzerland’s lipid market benefits from its advanced pharmaceutical and nutraceutical industries. The country is known for innovation in drug delivery systems, where lipids play a critical role as excipients and active carriers. Growing consumer interest in health supplements enriched with omega-3 and phospholipids is driving nutraceutical adoption. Switzerland’s cosmetics and skincare industries also use lipids extensively, focusing on premium and natural ingredients. With sustainability being a key focus, plant-based lipid sourcing is gaining traction. Additionally, Switzerland’s strong research and development (R&D) infrastructure supports the development of high-quality lipid products, ensuring consistent demand and reinforcing its position as an important European lipid market player.

Poland’s lipid market is expanding due to rising consumer awareness about health and nutrition. Increasing adoption of dietary supplements and fortified foods enriched with omega fatty acids is driving demand. The pharmaceutical industry is also growing, with lipids used in drug delivery technologies. Poland’s cosmetics sector, particularly in skincare and haircare, is increasingly incorporating lipid-based natural ingredients. Affordable production capabilities make Poland a cost-effective hub for lipid manufacturing, further supporting market growth. Additionally, growing emphasis on sustainable and plant-based products aligns with European environmental trends. These factors collectively strengthen Poland’s presence in the regional lipid market and boost domestic demand.

Competitive Landscape:

The competitive landscape of the Europe lipids market is characterized by the presence of global corporations and regional players actively expanding their portfolios to cater to diverse applications. Leading companies focus on research-driven innovations, particularly in functional foods, pharmaceuticals, and nutraceuticals, to strengthen their market presence. Strategic collaborations, mergers, and acquisitions are common, enabling firms to enhance production capacity and distribution networks. Sustainability is also a defining competitive factor, with businesses increasingly investing in plant-based and renewable lipid sources to align with Europe’s environmental goals. Additionally, firms are leveraging advanced extraction and processing technologies to deliver high-quality, application-specific lipids, further intensifying competition while creating opportunities for differentiation in the market.

The report provides a comprehensive analysis of the competitive landscape in the Europe lipids market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: UK-based LIPID MAPS officially launched its innovative Standards Spectra Database containing more than 1,000 interactive, high-quality MS/MS spectra covered by the Oxylipin umbrella, which is a metabolite lipid of polyunsaturated fatty acids (PUFAs), including omega-3 and omega-6. This database, which was developed to assist researchers, offers entirely searchable spectra, along with extensive, standardized metadata such as equipment specs, measurement conditions, and sample data.

- May 2025: Croda International PLC, a renowned manufacturer of cutting-edge lipids, vaccine adjuvants, and pharmaceutical excipients, officially inaugurated its recently expanded Super Refined production plant in Leek, UK. The launch of this expanded site is a significant advancement for the company, enhancing its capacity to provide clients across the globe with its extensive line of high-purity excipients.

- July 2024: DSM-Firmenich divested its Marine Lipids division to KD Pharma Group, a leading CDMO in nutritional and pharmaceutical lipids, in return for a minority stake in the enlarged KD entity. The deal includes DSM-Firmenich’s fish oil Omega-3 business serving the Food and Beverage, Dietary Supplement, and Pharma sectors, along with the MEG-3 brand and production facilities in Peru and Canada.

- February 2024: CordenPharma officially launched its new Lipid NanoParticle (LNP) Starter Kits for efficient mRNA formulation in the creation of mRNA-based medicines, including gene treatments or mRNA vaccinations. The four essential lipids (helper lipids/PEGylated lipids/sterols, ionizable lipids) included in the new LNP kits are carefully selected utilizing representative substances sourced on a commercial basis.

Europe Lipids Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Omega-3 and Omega-6, Phospholipids, Medium Chain Triglycerides, Sterols |

| Sources Covered | Plant, Animal |

| Forms Covered | Powder, Liquid |

| Applications Covered | Dietary Supplements and Nutraceuticals, Infant Formula, Pharmaceutical, Food Fortification, Animal Nutrition, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe lipids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe lipids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe lipids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lipids market in Europe was valued at USD 2,813.65 Million in 2024.

The Europe lipids market is projected to exhibit a CAGR of 5.04% during 2025-2033, reaching a value of USD 4,379.88 Million by 2033.

The Europe lipids market is driven by rising demand for functional foods, growing awareness about health benefits associated with omega fatty acids, and increasing applications in pharmaceuticals and nutraceuticals. Expanding use in cosmetics and personal care, coupled with advancements in lipid-based drug delivery systems, further supports market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)