Europe Mobile Phone Insurance Market Size, Share, Trends and Forecast by Phone Type, Coverage, Distribution Channel, End User, and Country, 2025-2033

Europe Mobile Phone Insurance Market Size and Share:

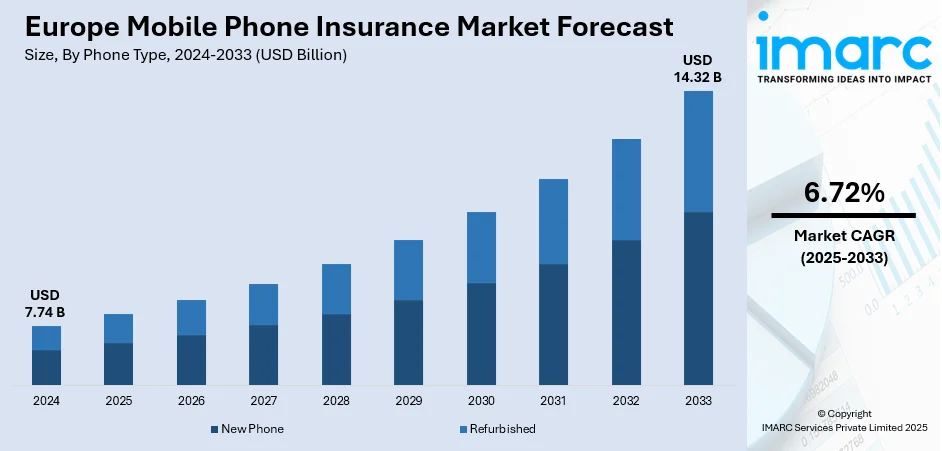

The Europe mobile phone insurance market size was valued at USD 7.74 Billion in 2024. Looking forward, the market is expected to reach USD 14.32 Billion by 2033, exhibiting a CAGR of 6.72% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. The market is witnessing steady expansion, driven by rising smartphone adoption, higher repair and replacement costs, and increasing consumer awareness about device protection. Advancements in coverage options and partnerships with retailers and telecom providers are further fueling growth, contributing to the overall Europe mobile phone insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.74 Billion |

|

Market Forecast in 2033

|

USD 14.32 Billion |

| Market Growth Rate 2025-2033 | 6.72% |

The market is witnessing strong growth, driven by rising smartphone penetration and the increasing value of mobile devices. With consumers investing in high-end models, the financial risk associated with theft, accidental damage, hardware malfunction, and software issues has intensified, making insurance coverage more appealing. A surge in mobile phone thefts across major European cities further fuels demand. For instance, in the United Kingdom, mobile phone theft claims have increased sharply, with London being a key hotspot. Additionally, growing reliance on smartphones for communication, payments, work, and entertainment has made uninterrupted device usage essential, pushing users toward insurance for quick replacements or repairs. Technological advancements are also influencing the market, with insurers adopting business intelligence tools to understand consumer behavior and offer tailored policies.

To get more information on this market, Request Sample

The Europe mobile phone insurance market growth is also driven by rising awareness about extended warranties and value-added services, coupled with competitive premium plans, which are attracting more subscribers. The combination of high device replacement costs, evolving consumer expectations, and innovative distribution channels continues to strengthen the market. For instance, in August 2024, ERGO, O2 Telefónica, and Telefónica Insurance partnered to offer embedded insurance, integrating coverage into third-party products like device protection or travel plans. O2 customers can easily add policies online, with payments handled through their existing O2 bill for a seamless experience. Partnerships between telecom operators and insurance providers are expanding product reach, while digital platforms and direct-to-consumer models are making policy purchase and claim processing more convenient.

Europe Mobile Phone Insurance Market Trends:

Rising Smartphone-Related Risks and Theft Cases

The surge in smartphone thefts, accidental damage, malfunctions, and virus infections is significantly boosting the demand for mobile phone insurance in Europe. Consumers are increasingly seeking protection to safeguard their devices. Notably, mobile phone theft claims in the United Kingdom have grown by 425% since June 2021, with 42% of all thefts occurring in London. Such alarming statistics highlight the need for comprehensive insurance coverage. The rise in high-value smartphones has further amplified the financial risk for users, making insurance an essential consideration. This growing awareness of device protection and the increasing prevalence of thefts are driving more individuals to invest in insurance policies, supporting overall market expansion.

Adoption of Business Intelligence and Strategic Partnerships

Key players in the market are adopting business intelligence (BI) tools to monitor consumer purchasing patterns and identify emerging trends. For instance, the business intelligence market in the United Kingdom is projected to grow at a CAGR of 10.74% during 2025–2033, according to IMARC Group. Insurers are leveraging these insights to design customized policies and targeted marketing campaigns. Additionally, companies are collaborating with telecommunications operators to bundle innovative insurance plans at the point of mobile phone purchase. According to the Europe mobile phone insurance market trends, these partnerships enhance customer convenience, improve insurance penetration, and create new sales channels, ultimately strengthening the competitive position of insurers in the European market.

Shift Toward Digital and Direct-to-Consumer Models

The COVID-19 pandemic accelerated digital adoption, prompting many mobile phone insurance providers to expand their online platforms. Direct-to-consumer assistance models are becoming increasingly popular, enabling insurers to deliver personalized support and faster claim processing. Online insurance portals, offering 24/7 access and time-saving features, are gaining traction across Europe. Customers can now compare plans, submit claims, and manage policies entirely online, enhancing user experience and satisfaction. This digital shift is also enabling insurers to reach a broader audience while reducing operational costs. As consumers continue to embrace digital convenience, the integration of technology-driven services will play a pivotal role in driving the growth of Europe’s mobile phone insurance market.

Europe Mobile Phone Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe mobile phone insurance market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on phone type, coverage, distribution channel, and end user.

Analysis by Phone Type:

- New Phone

- Refurbished

New phone stands as the largest component in 2024, holding 79.6% of the market due to their high purchase value and advanced features, which make them more expensive to repair or replace. Consumers are increasingly opting for insurance at the time of purchase to safeguard against theft, accidental damage, malfunction, or loss. Retailers and telecom operators often bundle insurance policies with new phone sales, making it a convenient and appealing option for buyers. The emotional and financial investment in a brand-new device encourages users to protect it from the start. Moreover, as flagship smartphones continue to rise in cost, customers view insurance as a cost-effective way to mitigate potential risks, driving higher adoption for new devices.

Analysis by Coverage:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

Physical damage leads the market with 60.9% of market share in 2024, as it is the most common risk faced by smartphone users. Incidents such as cracked screens, water damage, and accidental drops occur frequently, regardless of the device’s age or model. Modern smartphones, though technologically advanced, often feature large, delicate displays and slim designs, making them more susceptible to breakage. According to the Europe mobile phone insurance market forecast, repairing these damages can be costly, especially for premium models, prompting consumers to opt for insurance coverage. Many insurance providers highlight physical damage protection as a key benefit, increasing policy uptake. Additionally, bundled insurance plans offered by telecom operators and retailers typically prioritize physical damage coverage, further solidifying their dominance in the market.

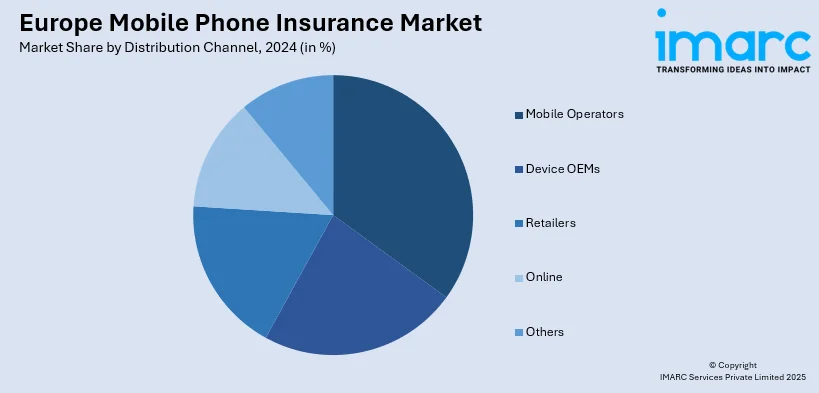

Analysis by Distribution Channel:

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

Mobile operators lead the market with 45.5% of market share in 2024 as they have a direct and established relationship with customers at the point of device purchase. By bundling insurance plans with mobile contracts or installment schemes, operators make enrollment seamless and convenient. Their extensive customer base, trusted brand presence, and ability to offer competitive pricing give them a strong advantage over independent insurers, which is creating a positive impact on the Europe mobile phone insurance market outlook. Operators also leverage targeted marketing, billing integration, and service partnerships to enhance policy adoption. Furthermore, they often provide value-added benefits, such as instant claim processing and device replacement, which boost customer satisfaction and loyalty. This combination of accessibility, convenience, and trust enables mobile operators to dominate the mobile phone insurance market in Europe.

Analysis by End User:

- Corporate

- Personal

Personal leads the market with 65.9% of market share in 2024 because individual consumers are increasingly prioritizing the protection of their smartphones against risks such as theft, accidental damage, and technical malfunctions. With smartphones becoming essential for communication, work, entertainment, and financial transactions, the cost of replacement or repair is often high, making insurance an attractive option. The growing adoption of premium and flagship devices has further increased the need for coverage among individuals. Moreover, the convenience of purchasing personal mobile phone insurance through retailers, online platforms, or mobile operators encourages widespread uptake. Rising awareness about affordable, customizable insurance plans tailored to personal use also contributes to the dominance of this segment in the European market

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The Europe mobile phone insurance market demand in Germany is driven by the country’s high smartphone penetration and growing adoption of premium devices, which increases the need for comprehensive protection plans. Rising cases of accidental damage, theft, and technical malfunctions have boosted consumer demand for insurance coverage. Additionally, German consumers are highly tech-savvy and value-added services such as quick claim processing, device replacement, and affordable premium options are attracting more users. The expansion of e-commerce and online insurance platforms has made purchasing and managing policies more convenient. Partnerships between insurance providers, retailers, and mobile network operators are also enhancing distribution channels, further fueling market growth in Germany’s well-established and digitally advanced mobile ecosystem.

Competitive Landscape:

The Europe mobile phone insurance market is highly competitive, with leading players such as Allianz SE, American International Group, Apple Inc., SquareTrade, and Aviva competing alongside specialized regional providers. Companies are strengthening their market presence through strategic alliances with mobile operators, device manufacturers, and retail chains, enabling bundled insurance offerings at the point of sale. Digitalization is a key differentiator, with insurers adopting AI, business intelligence tools, and automated claims systems to enhance customer experience and reduce processing times. Many are also expanding online channels, offering flexible, direct-to-consumer plans with 24/7 support. While established brands dominate through scale and trust, niche providers are gaining traction by delivering competitively priced, customized solutions, driving further diversity and innovation across the European market.

The report provides a comprehensive analysis of the competitive landscape in the Europe mobile phone insurance market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: ERGO Group AG, a Germany-based provider of various insurance solutions, including mobile phone insurance, successfully acquired Munich Re Group’s NEXT Insurance. With this acquisition, NEXT Insurance has been integrated into ERGO's management structure.

- April 2025: Helvetia Group, a provider of various insurance solutions, including mobile phone insurance, headquartered in Switzerland, announced a merger of equals with insurance holding company Baloise Group. The merger of these two companies will create Switzerland’s second-largest insurance group and biggest insurance employer.

- August 2025: AXA announced it has reached an agreement to acquire Prima, Italy’s leading direct insurance provider, which recorded €1.2 Billion in premiums in 2024.

Europe Mobile Phone Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phone Types Covered | New Phone, Refurbished |

| Coverages Covered | Physical Damage, Electronic Damage, Virus Protection, Data Protection, Theft Protection |

| Distribution Channels Covered | Mobile Operators, Device OEMs, Retailers, Online, Others |

| End Users Covered | Corporate, Personal |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe mobile phone insurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe mobile phone insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mobile phone insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile phone insurance market in Europe was valued at USD 7.74 Billion in 2024.

The Europe mobile phone insurance market is projected to exhibit a CAGR of 6.72% during 2025-2033, reaching a value of USD 14.32 Billion by 2033.

The Europe mobile phone insurance market is driven by rising smartphone adoption, increasing incidents of accidental damage and theft, and the high cost of premium devices. Growing consumer awareness and innovative policy offerings from mobile operators and retailers also play a key role.

The Germany currently dominates Europe mobile phone insurance market due to increasing smartphone thefts, costly repairs, and higher ownership of premium devices. Collaborations between insurers and telecom providers, coupled with the rise of convenient digital insurance platforms, are further accelerating market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)