Europe Oil and Gas Separation Market Size, Share, Trends and Forecast by Technology Type, Vessel Type, Product Type, Application, and Country, 2025-2033

Europe Oil and Gas Separation Market Size and Share:

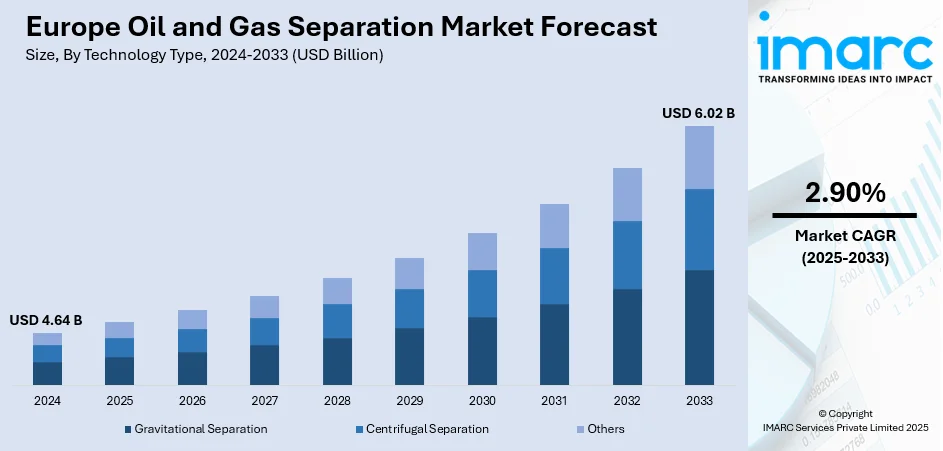

The Europe oil and gas separation market size was valued at USD 4.64 Billion in 2024. The market is projected to reach USD 6.02 Billion by 2033, exhibiting a CAGR of 2.90% from 2025-2033. Germany leads the Europe oil and gas separation market, underpinned by its superior industrial base, engineering capabilities, and energy focus on sustainable practices. Offshore and onshore exploration activity growth, burgeoning demand for effective hydrocarbon processing, and developments in separation systems such as automation and online monitoring drive the market. Rising focus on efficiency of operations and environmental compliance further promotes adoption. These conditions together determine the regional growth pattern, emphasizing the anticipated Europe oil and gas separation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.64 Billion |

|

Market Forecast in 2033

|

USD 6.02 Billion |

| Market Growth Rate 2025-2033 | 2.90% |

One of the major influencers of the Europe oil and gas separation market is the ongoing increase in offshore exploration and production activities throughout the region. As per the reports, in December 2024, Shell and Equinor agreed to enter into a 50-50 joint venture in the UK North Sea, with a production target of more than 140,000 barrels of oil equivalent per day, increasing to 220,000 boed by 2029. Furthermore, Europe has extensive reserves in marine basins within the region, most of which depend on advanced separation equipment to cope with the demands of deepwater and ultra-deepwater environments. Separation solutions are a must in such conditions with the mixing of hydrocarbons with complex fluids that need to be treated efficiently for stability and safety during production. The offshore sector's role in securing energy in Europe has necessitated investment in sophisticated separation technologies with a focus on solutions that are capable of withstanding high pressures and changing compositions of flow. As the maturity of fields increases, the nature of extracted fluids becomes increasingly hard to separate, reaffirming the importance of dependable separation solutions. Boosting dependence on resources from offshore facilities remains a structural driver in defining the evolution of the regional market.

To get more information on this market, Request Sample

The other basic driver of the Europe oil and gas separation market growth is regional emphasis on improving efficiency of operation and utilization of resources. Throughout the oil and gas industry, operators are continuously challenged to maximize recovery, reduce waste, and minimize downtime. Separation systems are critically important in meeting these challenges by providing precise segregation of hydrocarbons, gas, and water, which increases production efficiency and reliability. Efficiency-focused solutions are especially useful because they enable operators to extract the most value from current reserves while also meeting Europe's overall focus on sustainable energy practices. The integration of sophisticated automation and monitoring systems into separation processes has gone even further in terms of improving performance, with predictive maintenance and real-time optimization of operations possible. According to the sources, in March 2025, SNAM and H2SITE entered into a partnership for the development of a Pd-alloy membrane separator for hydrogen-natural gas mixtures, with the aim to recover high-purity hydrogen and enable large-scale industrial applications. Moreover, this not only increases cost-effectiveness but also allows for compliance with environmental goals. By bringing efficiency gains into conjunction with long-term sustainability imperatives, advanced separation technologies form a main driver of growth, supporting their strategic value in Europe's changing energy environment.

Europe Oil and Gas Separation Market Trends:

Expansion of the Oil and Gas Sector Fueling Market Growth

Important expansion in the oil and gas sector forms one of the main drivers of the oil and gas separation market in Europe. The area has seen a growing need for separation technologies because of heightened exploration activity and improved oil recovery operations. Operators are looking for enhanced separation solutions as production levels increase to allow for better management of hydrocarbons without maximizing environmental effects. This has led to a consistent demand for equipment that can operate in varied operating conditions for onshore and offshore projects. Government-promoted policies facilitating the growth of the oil and gas industry have also helped to drive the growth. Such policies have been focused on securing energy supplies and sustaining competitiveness in the international market. These trends further emphasize the inextricable link between the oil and gas sector and the growth of separation equipment demand, thus consolidating its status as a key driver of long-term market growth across Europe.

Policy Support and Sustainability Initiatives

The emphasis of the European Union on sustainability has revolutionized the oil and gas separation industry. The inclusion of the Net-Zero Industry Act, which calls on oil and gas producers to make a cumulative contribution of an annual CO₂ injection capacity of 50 million tons into geological storage by 2030, denotes the region's proactive measures towards decarbonization. This framework policy is pressurizing industry stakeholders to adopt separation solutions that are capable of managing emissions and facilitating carbon capture processes efficiently. Additionally, Europe is investigating sustainable methods of oil extraction, balancing efficiency with environmental stewardship, which provides favorable conditions for the adoption of separation technology. Policy-driven programs are pressurizing investment in sophisticated systems that reconcile operational productivity with regulation according to tighter environmental standards. These initiatives are making Europe a frontrunner in defining the future of oil and gas operations in terms of sustainability, while at the same time reiterating the need for upgraded separation solutions throughout the continent.

Innovation and Technological Advancements

Technological advancements are a determining factor in optimizing the efficiency and dependability of oil and gas separation equipment. In Europe, firms are launching systems with enhanced capacities for handling liquid and gas, which allow operators to gain higher throughput while having less downtime. This innovation push is heavily supported by the European Commission's commitment to digital and green transformations. The commitment of more than USD 7.9 billion of funding in the Horizon Europe 2025 program reinforces the push for developing leading science, including energy-saving separation technology. Through the encouragement of research and development, Europe is creating a climate that allows new materials, automation, and intelligent monitoring systems to be incorporated into separation processes. Not only do these developments improve the outcome of operations but also contribute to meeting the long-term sustainability needs of the region. Combined, these technology-driven advancements are transforming the market, representing the trend marker in the larger framework of Europe oil and gas separation market trends.

Europe Oil and Gas Separation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe oil and gas separation market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, vessel technology type, product type, and application.

Analysis by Technology Type:

- Gravitational Separation

- Centrifugal Separation

- Others

Gravitational separation is a core technology in the Europe oil and gas separation market outlook because it is simple, reliable, and economical. This process utilizes density contrasts among the oil, gas, and water phases to be efficient in the separation of these substances, thus remaining a popular method both for onshore and offshore operations. Its simple design, minimal maintenance needs, and adaptability to diverse operating conditions all make it an enduring option within the market throughout Europe. Gravitational separation is especially suited for large volumes of fluids, where energy input is low and consistent results are attained compared to more complicated options. In Europe, where sustainability and performance efficiency are both values, the technology meets long-term objectives by delivering reliable performance without restricting resource use. As energy producers look for solutions that meet efficiency along with environmental concerns, gravitational separation technology remains at the forefront, solidifying its position as a pillar in the overall technological direction of the market.

Analysis by Vessel Type:

- Horizontal

- Vertical

- Spherical

Horizontal vessels are most commonly used in the Europe oil and gas separation industry because they can effectively manage high liquid capacities and are also best suited for applications that demand three-phase separation. They offer a greater liquid surface area, which increases settling efficiency and enhances the settling operation. Horizontal separators are normally used where liquid hold-up is pertinent, and thus are well suited to both established and developing fields in Europe. Stable operation under varying flow rates is made possible by the design of horizontal separators, providing more flexibility and reliability in oil and gas processing operations. Moreover, horizontal vessels are especially efficient in onshore facilities, where area limitations are less constrictive than in offshore platforms. The capability to have higher volumes without affecting quality of separation makes this kind of vessel a favored choice in the market. With European operations prioritizing efficiency and performance, horizontal separators remain an essential component in the regional market.

Analysis by Product Type:

- Two-Phase Separators

- Three-Phase Separators

- Scrubbers

- Others

Three-phase separators are a very important product segment in the Europe oil and gas separation industry, allowing for the concurrent separation of oil, gas, and water streams. Their multi-functioning design provides effective processing of production fluids and minimizes the requirement for individual pieces of equipment, thereby optimizing overall operations. These separators are particularly valuable in applications where water cut is high because they enable accurate treatment of complicated fluid mixtures while ensuring operational stability. Three-phase separators are widely used throughout Europe to maximize hydrocarbon recovery while reducing downtime and operational expenses. Their capacity for delivering accurate results under changing flow conditions renders them invaluable in both onshore and offshore operations. In addition, improvements in internal design and control systems have improved their efficiency, thus making them more responsive to contemporary sustainability demands. The extensive use of three-phase separators attests to their significance in enhancing productivity and resource utilization in the European energy sector.

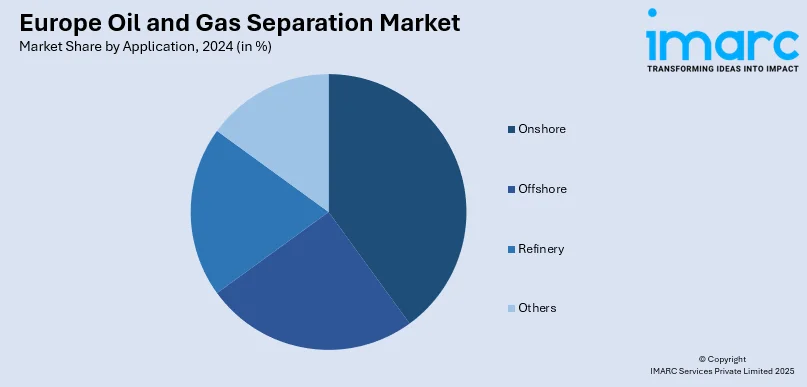

Analysis by Application:

- Onshore

- Offshore

- Refinery

- Others

Onshore applications have a significant portion of the Europe oil and gas separation market due to the mature hydrocarbon fields in the region and ongoing exploration activities in readily accessible reserves. Lower development expenditure is associated with onshore operations as opposed to offshore schemes, which renders investment in sophisticated separation technology more viable and prevalent. Onshore separation systems are built to deal with variable fluid compositions effectively, providing stable operation and environmental conformity. Such plants typically see large volumes of production, requiring trustworthy solutions that can keep producing continuously with minimal maintenance needs. Onshore locations also have more latitude for embedding sophisticated automation and monitoring systems, which improves operational efficiency and predictive maintenance. While Europe tries to keep energy security in balance with sustainability ambitions, onshore projects are still a foundation of the continental industry. The incorporation of state-of-the-art separation technology into onshore operations makes it an even more crucial factor for the market as a whole.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

According to Europe oil and gas separation market analysis, Germany is a key player in the market because of its robust industrial foundation, high-tech capabilities, and focus on sustainability. While Germany is not a top oil and gas producer in the region, it is an engineering excellence and equipment manufacturing hub and a center for innovative separation technology development. Its strict environmental policies and drive towards energy transition have created the demand for high-performance separation systems that also satisfy efficiency and sustainability requirements. Germany's emphasis on research and development, complemented by government-sponsored initiatives, has placed it at the forefront of developing high-performance separation technologies for implementation throughout Europe. Its position as an intermediate refiner, processor, and integrator of renewable technology into conventional energy operations also strengthens its market position. By integrating technological advancement with a robust regulatory environment, Germany continues to set industry standards and make a meaningful contribution to the regional market.

Competitive Landscape:

The Europe oil and gas separation market's competitive environment is dominated by embracing latest technologies, strategic partnerships, and research and development investments for the optimization of operational efficiency as well as sustainability. The top players in the industry are concentrating on creating high-performance separation equipment with capacities to process varying fluid compositions and accommodate onshore as well as offshore operations. There is a growing focus on automation, digital monitoring, and predictive maintenance technology, which allows operators to maximize production while minimizing energy usage. Firms are also focusing on environmentally friendly process and material integration in the design of equipment to meet European regulations. The market is also experiencing a gradual introduction of new vessel types, separators, and advanced control systems, which is fueling uptake across the region. These trends together represent the strategic drivers of the market, offering a guide to the predicted growth trends and overall Europe Oil and Gas Separation Market forecast.

The report provides a comprehensive analysis of the competitive landscape in the market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Ahlstrom introduced a PFAS-free filtration platform for air-oil separation, offering sustainable, high-performance alternatives to traditional fluorochemical-based solutions. Designed for compressors and vacuum pumps, the new media enhanced water repellency and durability without compromising efficiency. The solution was developed at Ahlstrom’s Italian facility to meet rising environmental and regulatory demands.

Europe Oil and Gas Separation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types Covered | Gravitational Separation, Centrifugal Separation, Others |

| Vessel Types Covered | Horizontal, Vertical, Spherical |

| Product Types Covered | Two-Phase Separators, Three-Phase Separators, Scrubbers, Others |

| Applications Covered | Onshore, Offshore, Refinery, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe oil and gas separation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe oil and gas separation market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oil and gas separation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe oil and gas separation market was valued at USD 4.64 Billion in 2024.

The Europe oil and gas separation market is projected to exhibit a CAGR of 2.90% during 2025-2033, reaching a value of USD 6.02 Billion by 2033.

The European oil and gas separation market is dominated by growth in offshore and onshore exploration activities, growing demand for effective hydrocarbon processing, and operational efficiency optimization needs. Technological advancements in separation technologies such as automation and real-time monitoring, coupled with Europe's focus on sustainability and environmental regulatory compliance, are further driving the implementation of new-age separation solutions in the region.

Germany accounts for the largest share in the Europe oil and gas separation market because of its robust industrial base, engineering capabilities, and emphasis on technology development. Its strict environmental policies and programs supporting effective and efficient energy production fuels the use of highly developed separation technologies. Germany's dominance in research, development, and production makes it the most significant contributor to market growth in the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)