Europe Orthopedic Braces and Support Market Size, Share, Trends and Forecast by Product, Type, Application, End User, and Country, 2025-2033

Europe Orthopedic Braces and Support Market Size and Share:

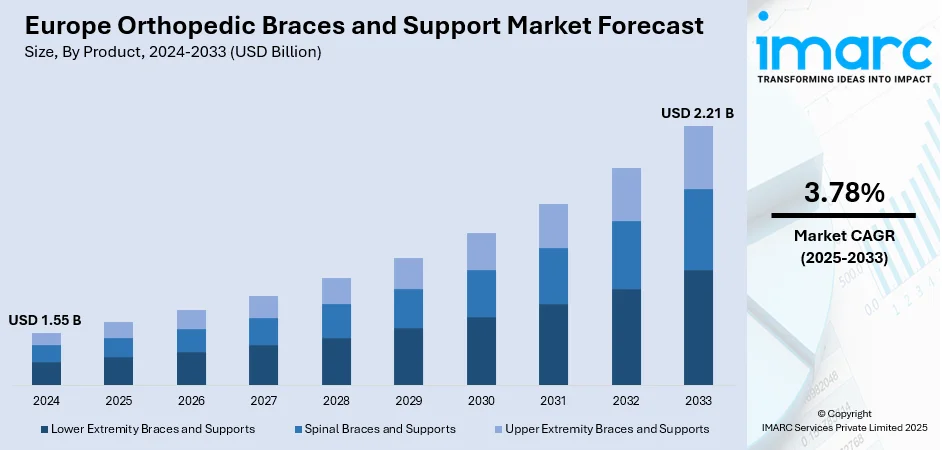

The Europe orthopedic braces and support market size was valued at USD 1.55 Billion in 2024. The market is projected to reach USD 2.21 Billion by 2033, exhibiting a CAGR of 3.78% from 2025-2033. Germany is currently dominating the market owing to the increased instances of musculoskeletal conditions, sports injuries, and greater adoption of preventative orthopedic treatment. Developments in materials, design, and functionality are improving patient comfort and compliance, while e-commerce and clinical channels are increasing access. Demand is rising across applications like ligament injury, osteoarthritis, and post-operative rehabilitation among end users. These reasons are paving the way for the long-term growth of the Europe orthopedic braces and support market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.55 Billion |

|

Market Forecast in 2033

|

USD 2.21 Billion |

| Market Growth Rate 2025-2033 | 3.78% |

Growing sports activity and physical fitness in Europe are going a long way in propelling the demand for orthopedic braces and supports. For instance, in May 2024, Push Sports introduced eight ultra-thin sport braces, such as the football-specific Kicx Ankle Brace, which provides joint support and total mobility through an innovative Prophy-X strap system to avoid ankle sprain. Furthermore, more and more people are participating in high-impact sports, fitness training, and hobbies, which has resulted in increased incidences of sport injuries, such as ligament ruptures, sprains, and fractures. This phenomenon cuts across professional sports and amateur and leisure participants. Orthopedic supports and braces are vital in preventing injuries, facilitating rehabilitation, and improving performance, hence a favorite among athletes and fitness enthusiasts alike. Additionally, campaigns by health workers and sporting bodies on the value of preventative joint support have contributed to increased uptake. Having specialized products for certain sports and activities, and growing focus on long-term mobility and function, further supports market expansion throughout both suburban and urban areas on the continent.

To get more information on this market, Request Sample

Advances in technology in material science and orthopedic engineering are fueling significant Europe orthopedic braces and support market growth. As per the sources, in February 2025, Icarus Medical introduced the Adonis Knee Brace with patented joint-distraction technology, providing light, targeted unloading for osteoarthritis, increasing mobility and pain relief for active patients who want superior non-surgical treatment. Additionally, technological advances in light-weight composites, permeable fabrics, and compliant but strong polymers have facilitated extensive enhancement in comfort, fit, and performance. Designs now include evaporative wicking features, compressible attributes, and body-shaped structures that provide enhanced support while allowing freedom of motion. The developments are appropriate for a wide range of users, ranging from patients recovering from surgery to patients needing long-term stabilization of joints. Furthermore, incorporation of intelligent technologies, including installed sensors for tracking movement and pressure, is a new development of particular significance, allowing healthcare professionals to access real-time information for individualized plans for rehabilitation. The presence of these technologically advanced products not only enhances clinical outcome but also draws in tech-conscious consumers demanding effective, easy-to-use solutions. As technology continues to advance, the use of sophisticated orthopedic bracing and support systems is likely to gain momentum in various patient groups.

Europe Orthopedic Braces and Support Market Trends:

Increased Incidence of Osteoarthritis and Other Affiliated Disorders

The European market is witnessing high growth rates owing to the rising incidence of osteoarthritis, rheumatoid arthritis, and other musculoskeletal diseases, especially in the elderly population. In 2020, Europe boasted about 120 million people above the age of 55, with an estimated 3.74 million suffering from osteoarthritis and 2.88 million from rheumatoid arthritis. These conditions seriously affect mobility, generating continuous demand for orthopedic supports and braces that reduce pain, correct posture, and facilitate daily performance. Moreover, obesity and osteoporosis, both of which increase the likelihood of joint degeneration, are contributory factors. More than 53% of European Union adults were overweight in 2019, with an even higher rate of men compared to women. With the increasing pool of patients, manufacturers have focused more on research and development, leading to more comfortable, flexible, and technologically enhanced support devices to meet various medical needs in different age ranges.

Technological Innovation and Product Development

Continuous innovation is a hallmark of the region's orthopedic support and brace sector. The manufacturers are taking ergonomics, light materials, and performance-driven designs to address the mounting needs of patients and medical professionals. Developments like adjustable compression systems, permeable fabrics, and sensors incorporated within for real-time monitoring are gaining prominence. Such features enhance not only comfort but also the quality of therapy by encouraging correct joint positioning and minimizing stress. Increased health awareness among consumers coupled with heightened disposable incomes has widened demand for high-end products that blend strength with ease. Tailor-fit options designed to meet specific anatomical needs are finding increasing acceptance, providing enhanced support for both preventive treatment and rehabilitation after injury. This innovation is part of a larger trend across Europe orthopedic braces and support market trends, whereby customized and technology-based devices are becoming a key driver of growth in the years ahead.

E-Commerce Growth Fueling Availability

The accelerated development of Europe's e-commerce market has done much to increase the availability of orthopedic braces and supports. The European E-Commerce Report 2024 reflected a 3% growth in B2C turnover in 2023 from EUR 864 billion to EUR 887 billion. Online shopping websites offer customers detailed product information, customer reviews, and tutorial content, allowing for informed purchase decisions. The online market also provides a wide variety of products, ranging from simple supports to complex orthopedic appliances, to suit different medical needs and price levels. Doorstep delivery convenience, liberal return policies, and promotional discounts during the festive season further boost the adoption rate among consumers. For residents of rural or sparsely medically advanced areas, e-commerce becomes an imperative portal for acquiring quality orthopedic goods without spending significant time traveling. This move towards online buying not only increases the consumer market but also compels makers to invest in robust on-line selling strategies for sustained market development.

Europe Orthopedic Braces and Support Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe orthopedic braces and support market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, type, application, and end user.

Analysis by Product:

- Lower Extremity Braces and Supports

- Spinal Braces and Supports

- Upper Extremity Braces and Supports

Lower extremity supports and braces stabilize the knees, hips, and ankles, aiding in recovery from injury, osteoarthritis management, and strain prevention during activity. Widespread use both post-surgery and in sports rehab, they employ sophisticated materials, ergonomic designs, and adjustable fittings that promote comfort, mobility, and patient compliance and therapeutic efficacy across diverse orthopedic care needs.

Spinal support and bracing provide focused stabilization for the neck and back, supporting posture correction, spinal alignment, and healing from injuries or surgery. Applied to disorders such as scoliosis, herniated discs, and degenerative diseases, they incorporate light, airy materials for enhanced comfort and functionality, promoting consistent treatment adherence and better results in orthopedic and rehabilitative therapy.

Upper limb braces and supports support and help the shoulder, elbow, wrist, and hand in recovering from injury or managing chronic conditions. They restrict injurious movement, minimize strain, and contribute to rehabilitation. With adjustable straps, padding, and breathable materials, they offer both comfort and support, addressing sports-related requirements as well as long-term orthopedic therapies efficiently.

Analysis by Type:

- Soft and Elastic Braces and Supports

- Hinged Braces and Supports

- Hard and Rigid Braces and Supports

According to Europe orthopedic braces and support market analysis, soft and elastic supports and braces have a large market share in the European orthopedic devices market because they are comfortable, adjustable, and can be used for a variety of conditions. They are most popular for mild to moderate joint instability, recovery from surgery, and prophylactic use in active individuals. Their light weight, breathable nature, and adjustability make them well suited for long-term patient compliance. Demand is also fueled by Europe's growing population of elderly people, growing participation in recreational sport, and growing awareness of the importance of early intervention in musculoskeletal care. Manufacturers are spending on high-tech textile technology, adding moisture-wicking materials and anatomically shaped designs to enhance support without loss of flexibility. Online retailers are taking products to wider audiences, providing product descriptions, size charts, and specialist user guidance. This availability, coupled with increasing healthcare focus on non-surgical treatment strategies, guarantees the sustained expansion of soft and elastic braces throughout Europe.

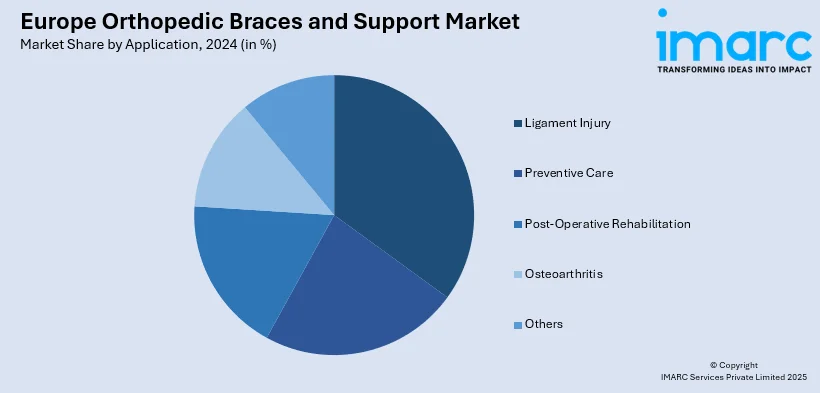

Analysis by Application:

- Ligament Injury

- Preventive Care

- Post-Operative Rehabilitation

- Osteoarthritis

- Others

Ligament injuries, especially those to the knee and ankle, are a major driver of demand for orthopedic bracing in Europe. Increased sports activity, active lifestyles, and on-the-job injuries have created a growing number of cases of ligament strains, sprains, and tears. Therapy usually combines physical therapy with bracing to stabilize the joint, limit injurious movement, and facilitate healing. Functional braces for ligament injuries make use of adjustable hinges, differential compression zones, and light yet strong materials to provide stability without restricting movement. Adoption of bracing solutions early on is promoted by physicians to shorten recovery periods and minimize re-injury. Furthermore, the incidence of anterior cruciate ligament (ACL) injury among sportspeople has driven the demand for specialized knee braces in professional and amateur sports. The increasing accessibility of tailor-made braces for particular ligament injuries also enhances adoption, so this segment is a prime growth driver for Europe's orthopedic industry.

Analysis by End User:

- Orthopedic Clinics

- Hospitals and Surgical Centers

- Over-the-Counter (OTC) Platforms

- Others

Orthopedic clinics are of key importance to influencing demand for braces and supports in Europe, acting as initial points of contact for diagnosis, prescription, and product fitting. Growing prevalence of musculoskeletal disorders, post-operative rehabilitation, and sporting injuries has raised patient visits to specialist orthopedic clinics. Clinics offer professional evaluation that directs the choice of correct braces to guarantee optimal fit and therapeutic benefit. Most European clinics have also incorporated sophisticated diagnostic equipment and gait analysis systems to prescribe highly tailored support solutions. The credibility that comes with clinic-recommended products lends immense impetus to adoption, with patients assuming the devices to be more reliable than their off-the-shelf counterparts. Additionally, clinics work in partnership with manufacturers to test new designs, providing feedback that translates into product refinement. As the region's geriatric population rises and preventive orthopedic services gain importance, the clinics' role as a treatment facility and distribution hub is anticipated to increase, further solidifying their grip on the market.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the prime market for orthopedic braces and supports within Europe, fueled by its superior healthcare infrastructure, high healthcare spend, and emphasis on rehabilitation and preventive care. The ageing population in Germany, combined with an expanding incidence of osteoarthritis, ligament injuries, and other musculoskeletal disorders, has resulted in high demand for conventional as well as customized bracing solutions. Germany's highly developed orthopedic manufacturing infrastructure and focus on technological innovation allow for the production of high-quality, ergonomically shaped products that comply with rigorous regulatory requirements. The prevalence of sports and fitness activities also supports a consistent demand for injury-prevention supports. Additionally, the availability of strong insurance coverage for orthopedic devices facilitates patient access, and cooperative arrangements between clinics, hospitals, and manufacturers guarantee proper distribution and patient education. With its combination of medical competence, industrial capacity, and health-oriented population, Germany remains at the forefront of regional market innovation and adoption rates.

Competitive Landscape:

The Europe orthopedic braces and support market's competitive landscape is marked by a blend of well-established medical device manufacturers and specialty orthopedic product providers, each concentrating on product development, expansion of distribution channels, and patient-focused solutions. Firms are focusing on R&D to launch braces with better comfort, adjustability, and biomechanical performance, meeting various needs like injury prevention, post-surgery rehabilitation, and long-term condition management. Strategic partnerships with healthcare centers, sports organizations, and physiotherapy clinics are increasing brand reach and uptake levels. Also, incorporating new materials and new technologies such as motion sensors and data-recording functionality is revolutionizing performance levels in the market. Retail pharmacies and e-commerce platforms continue to consolidate distribution channels, making them more accessible to users in urban and rural settings. With these advancements supporting it, the Europe orthopedic braces and support market forecast predicts continued growth based on increasing demand for functional, long-lasting, and bespoke orthopedic devices.

The report provides a comprehensive analysis of the competitive landscape in the Europe orthopedic braces and support market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Align Technology launched integrated consumer and professional campaigns for Invisalign treatment for children and teenagers, highlighting solutions such as the Invisalign Palatal Expander System and the Invisalign System with mandibular advancement. The campaigns aim to educate parents and support doctors in treating growing patients with innovative orthodontic options.

- November 2024: Align Technology received CE Mark approval for its Invisalign Palatal Expander System in Europe, offering a removable, 3D-printed solution for skeletal and dental expansion in growing patients. This system complements Invisalign First aligners, providing a comprehensive early intervention treatment for children and teens.

- November 2024: Auxein launched advanced orthopedic and arthroscopy products at MEDICA 2024, including AV-Wiselock Plates, Bioabsorbable implants, and braces/support systems, such as the GFS Ultimate Button with Brace/Tape. The company also achieved EU-MDR certification, solidifying its leadership in orthopedic solutions, and showcased bioabsorbable implants for minimally invasive surgeries.

- November 2024: OrthoPediatrics expanded its DF2 Brace portfolio with enhanced indications for post-operative stabilization and femur fracture fixation. The updated brace, now available in extended sizes, has been launched in Europe, the Middle East, and the Asia-Pacific region, providing an alternative to spica casting for pediatric patients aged 6 months to 5 years.

Europe Orthopedic Braces and Support Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Lower Extremity Braces and Supports, Spinal Braces and Supports, Upper Extremity Braces and Supports. |

| Types Covered | Soft and Elastic Braces and Supports, Hinged Braces and Supports, Hard and Rigid Braces and Supports. |

| Applications Covered | Ligament Injury, Preventive Care, Post-Operative Rehabilitation, Osteoarthritis, Others. |

| End Users Covered | Orthopedic Clinics, Hospitals and Surgical Centers, Over-the-Counter (OTC) Platforms, Others. |

| Regions Covered | Germany, France, United Kingdom, Italy, Spain, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe orthopedic braces and support market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe orthopedic braces and support market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the orthopedic braces and support industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The orthopedic braces and support market in Europe was valued at USD 1.55 Billion in 2024.

The Europe orthopedic braces and support market is projected to exhibit a CAGR of 3.78% during 2025-2033, reaching a value of USD 2.21 Billion by 2033.

The market in Europe is being fuelled by mounting cases of osteoarthritis, ligament strains, and musculoskeletal conditions, particularly in the geriatric population. Increased participation in sports, innovations in bracing technology, and increased internet penetration promoting e-commerce further drive adoption, as well as heightened awareness of non-surgical treatment options for mobility enhancement and injury avoidance.

Germany accounts for the largest share in the Europe orthopedic braces and support market, owing to the country's well-developed healthcare infrastructure, robust orthopedic manufacturing industry, and high utilization of rehabilitation and preventive care solutions. Geriatric population growth, high sports participation, and encouraging insurance coverage for orthopedic devices further enhance Germany's stronghold on the regional market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)