Europe Oyster Market Size, Share, Trends and Forecast by Oyster Type, End User, Form, and Country, 2026-2034

Europe Oyster Market Size and Share:

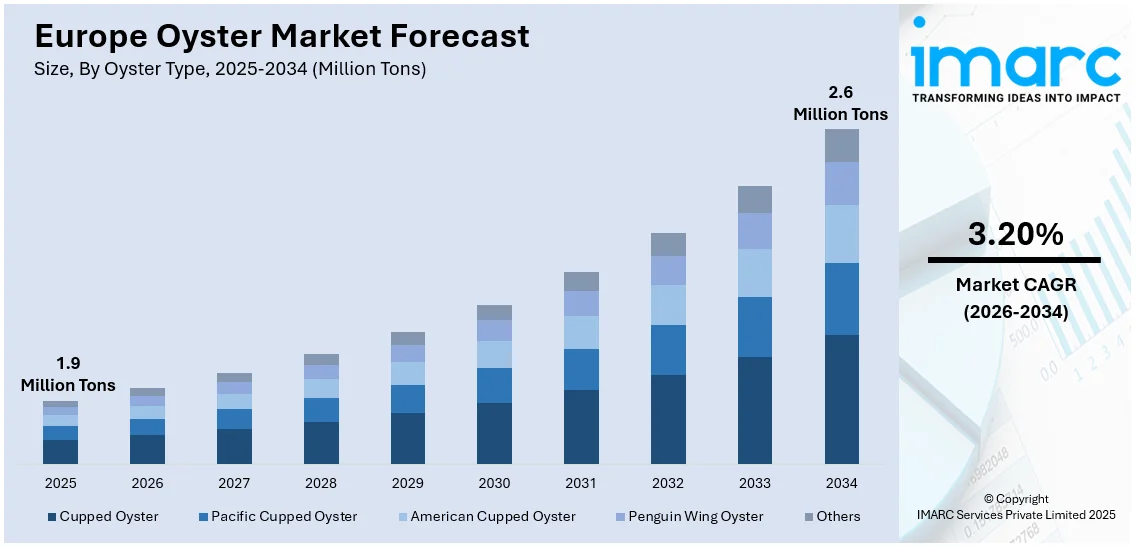

The Europe oyster market size reached 1.9 Million Tons in 2025. Looking forward, IMARC Group estimates the market to reach 2.6 Million Tons by 2034, exhibiting a CAGR of 3.20% from 2026-2034. The market is experiencing growth driven by sustainability initiatives such as reef restoration, rising demand for premium seafood, innovative packaging solutions, increasing consumer preference for organic and eco-labeled products, continual advancements in aquaculture, culinary trends, and improvements in logistics ensuring quality and accessibility across diverse markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

1.9 Million Tons |

|

Market Forecast in 2034

|

2.6 Million Tons |

| Market Growth Rate (2026-2034) | 3.20% |

The Europe market is primarily driven by the expanding tourism sector. Moreover, the increasing emphasis on conserving marine biodiversity is an important factor driving the Europe oyster market growth. Restoration of oyster reefs enhances marine ecosystems, improves water quality, and supports sustainable aquaculture. These initiatives promote environmental sustainability while supporting the economic feasibility of oyster farming through the development of healthy habitats. On 24 February 2024, Purina Europe announced a marine restoration project to support biodiversity, focusing on oyster reef regeneration and ocean health. This initiative demonstrates Purina's commitment to environmental sustainability, aligning with broader efforts in Europe to protect marine ecosystems and restore vital habitats for oysters and other marine species.

To get more information on this market Request Sample

Additionally, genetic research has been enhanced to increase the resilience of oysters to diseases and environmental stressors, ensuring stable production and supply. Marine ecosystem restoration is becoming integrally linked with renewable energy infrastructure, and innovation within the oyster market continues to grow. Offshore wind developments are increasingly incorporating oyster reef restorations to enhance biodiversity and promote environmental balance. For instance, In November 2024, 2023, portable oyster reef structures were deployed near the North Sea's Borssele wind farm. This project aims to enhance marine biodiversity and ecosystem restoration, showcasing Europe’s innovative approach to integrating renewable energy and environmental conservation in offshore wind development.

Europe Oyster Market Trends:

Growing Focus on Marine Ecosystem Restoration in Offshore Development

The increasing focus on restoration of marine ecosystems is promoting innovations in offshore development, thus supporting the Europe oyster market share. The governments and private parties are focusing on sustainability through incorporation of marine restoration projects in the energy infrastructure. For example, On 30th October 2024, Ørsted and Van Oord introduced scalable oyster reef structures in the North Sea. This initiative aims to enhance marine biodiversity and ecosystem restoration in Europe, reflecting their commitment to innovative solutions for sustainable offshore development and environmental stewardship. Oyster reef structures establishment efforts scale up biodiversity and increase resilience to the environment. The sustainability goals are supported through this trend, which helps build regulatory compliance.

Emerging Innovations in Packaging and Preservation

Emerging innovations in packaging and preservation is enhancing the oyster market through the increase in shelf life of products and ensuring freshness. Modified atmosphere packaging and eco-friendly materials enable producers to cater to a wider market, including e-commerce and retail sectors. These innovations also appeal to environmentally conscious consumers by reducing waste and maintaining sustainability. Better preservation techniques ensure oysters remain fresh during transport, making them available for regions far from production areas. This focus on innovation supports market expansion by ensuring that consumers get fresh and of high-quality seafood.

Expansion of Premium Seafood Offerings

The increasing demand for high-quality seafood is prompting strategic acquisitions and collaborations among leading companies. Businesses are expanding their product lines by adding premium items, like oysters, to meet changing consumer tastes. This approach propels competitiveness while maintaining traditional seafood brands. Investments in high-end seafood reflect the rising interest in gourmet dining, further fueling market expansion. By broadening access to valuable products, companies are reinforcing their positions in Europe's premium seafood market, paving the way for more innovation and sustainable sourcing practices. In April 2024, French seafood company Mericq announced the acquisition of Maison Blanc, the owner of the prestigious Gillardeau oyster brand. This strategic move strengthens Mericq's position in Europe’s premium seafood market, highlighting its commitment to expanding offerings and preserving the legacy of fine oyster production.

Europe Oyster Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe oyster market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on oyster type, end user, and form.

Analysis by Oyster Type:

- Cupped Oyster

- Pacific Cupped Oyster

- American Cupped Oyster

- Penguin Wing Oyster

- Others

Cupped oysters are the most segment in the market due to their widespread popularity, versatility, and adaptability to different conditions of aquaculture. These oysters, particularly the Pacific oyster, Crassostrea gigas, are highly preferred for flavor and plump texture which is suitable for a varied consumer preference. Their good farming characteristics, such as robust resistance to environmental fluctuations, rapid growth rates, are also economical for producers. The other advantages are that cupped oysters have a significant market share in retail as well as fine dining, due to constant demand in domestic as well as export markets. Its versatility in any culinary trend also adds to its demand, making it the biggest market share holder in oyster markets.

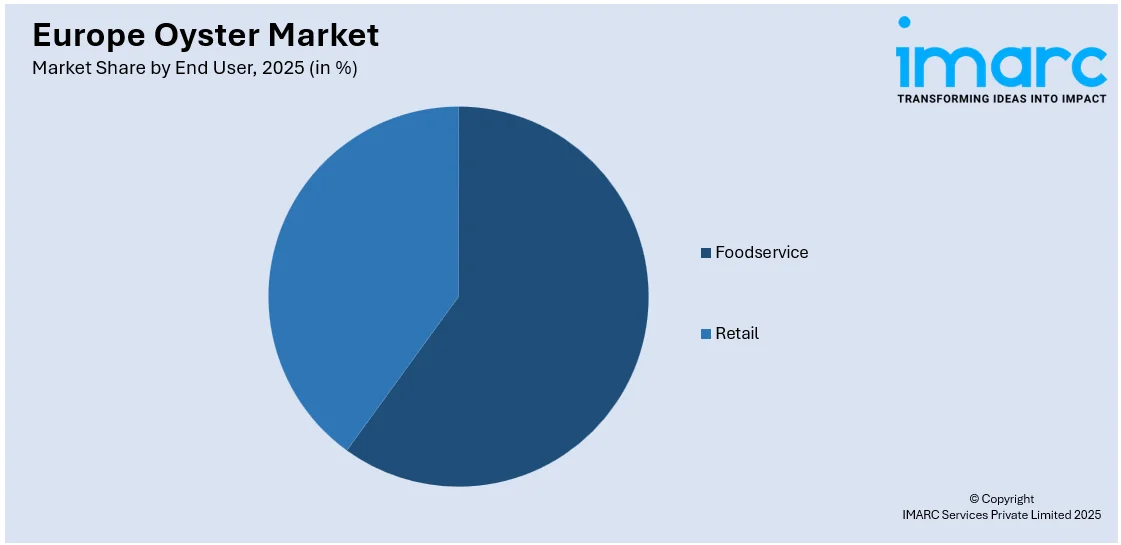

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Foodservice

- Retail

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Outlets

- Online Channels

- Others

The retail segment is the largest end user in the European oyster market, catering to a wide consumer base seeking high-quality seafood for home preparation. Increasing awareness of the nutritional benefits of oysters has driven demand within supermarkets, specialty seafood outlets, and online platforms. Retailers offer convenience and accessibility, providing fresh and packaged oysters in various sizes to suit individual preferences. The expansion of e-commerce platforms has further increased the retail reach by allowing consumers to directly order fresh oysters from the producers. Seasonal promotions, sustainable sourcing certifications, and traceability initiatives have helped to increase consumer trust, thus strengthening the dominance of the retail segment. Shifts in home-cooked gourmet meals have significantly contributed to the rise in retail sales of oysters.

Analysis by Form:

- Fresh

- Frozen

- Canned

- Others

Fresh oysters are the most popular choice in the market due to their superior taste, texture, and preference for immediate consumption, especially in Europe, where fresh seafood is a culinary staple. Restaurants, retailers, and consumers see freshness as a crucial quality indicator, increasing the demand for raw and live oysters. Innovations in logistics, cold-chain management, and packaging methods help keep fresh oysters in top condition and efficiently delivered to markets. Furthermore, fresh oysters hold cultural importance across many European areas, frequently appearing in festive and gourmet meals. The rising trend for natural, unprocessed foods also enhances the appeal of fresh oysters compared to frozen or canned options, making them the largest segment in this category.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

France dominates the European oyster market due to its rich culinary heritage, advanced oyster farming, and high local consumption. Renowned for premium oyster types like Belon and Gillardeau, France has established itself as a leader in high-quality oyster production. The country's vast coastline and ideal farming conditions facilitate large-scale oyster farming, ensuring a steady supply. Additionally, strong international demand for French oysters bolsters the country's market position. Seasonal oyster festivals and a passion for gourmet cuisine further enhance oyster consumption. France's well-established farming methods, commitment to sustainability, and government backing for seafood production reinforce its status as the largest regional segment in the European oyster market.

Competitive Landscape:

Key players in the European market are now strategizing for strengthening their position in the market and adapting to the changing demands of consumers. Companies are now investing in sustainable aquaculture practices, such as reef restoration projects, which can improve biodiversity and help companies meet environmental goals. They are working with research institutions to innovate disease-resistant oyster strains, thus making production stable. Leading producers are also expanding their product portfolios to premium and organic varieties in response to growing consumer demand for high-quality, eco-friendly seafood. Moreover, key players are using e-commerce platforms to reach a wider customer base, thereby offering them direct-to-consumer sales with traceability. Additionally, through mergers and acquisitions, such as integrating famous brands into existing portfolios, market leaders are able to gain a larger share of the premium segment while expanding their market in export markets worldwide.

The report provides a comprehensive analysis of the competitive landscape in the Europe oyster market with detailed profiles of all major companies.

Latest News and Developments:

- On 3rd July 2024, Jan De Nul and partners-initiated Europe’s first oyster reef restoration project in the Belgian North Sea. This innovative initiative aims to enhance marine biodiversity and ecosystem health, showcasing a significant step in oyster habitat restoration and environmental sustainability efforts within the region.

- On 10th July 2024, European initiative launched an oyster reef restoration project in the North Sea, aiming to enhance marine biodiversity and ecosystem health. The project emphasizes sustainability and ecological balance, aligning with global efforts to restore native oyster populations across Europe’s marine ecosystems.

Europe Oyster Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oyster Type Covered | Cupped Oyster, Pacific Cupped Oyster, American Cupped Oyster, Penguin Wing Oyster, Others |

| End Users Covered |

|

| Forms Covered | Fresh, Frozen, Canned, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe oyster market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe oyster market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe oyster industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An oyster is a marine mollusk that is widely consumed as a delicacy and used in culinary applications, including gourmet dining and seafood preparation. In addition to this, it is vital for marine biodiversity through their role in ecosystem restoration and water filtration.

The Europe oyster market size reached 1.9 Million Tons in 2025.

IMARC estimates the Europe oyster market to exhibit a CAGR of 3.20% during 2026-2034.

Key factors include changing sustainability initiatives, reef restoration, growing demand for premium seafood, eco-labeled products, culinary trends, and continual advancements in aquaculture and logistics.

In 2025, cupped oyster represented the largest segment by oyster type, driven by its versatility, flavor, and robust farming characteristics.

Retail leads the market by end user, due to the growing consumer demand for accessible, high-quality oysters in supermarkets and online platforms.

Fresh oyster is the leading segment by form, driven by consumer preference for superior taste and unprocessed seafood.

On a regional level, the market has been classified into France, Germany, United Kingdom, Italy, Spain, Others, wherein France currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)