Europe Pasta Sauce Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Distribution Channel, and Country, 2025-2033

Europe Pasta Sauce Market Size and Share:

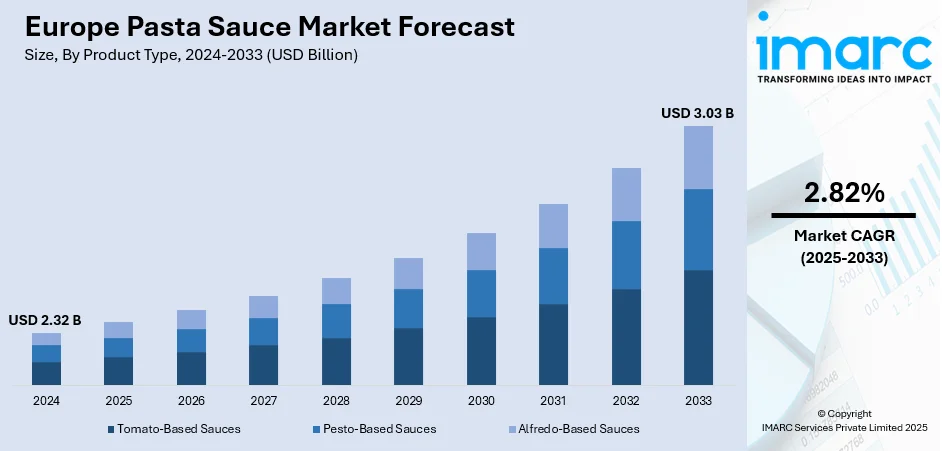

The Europe pasta sauce market size was valued at USD 2.32 Billion in 2024. Looking forward, the market is expected to reach USD 3.03 Billion by 2033, exhibiting a CAGR of 2.82% during 2025-2033. The market is fueled by a strong cultural preference for authentic cuisine, regional flavor variety, and consumers' growing demand for convenient yet true-to-authenticity meal solutions. Health-conscious eating trends fuel demand for clean-label, organic, and plant-based sauce options. Local sourcing, sustainability, and gastronomic heritage also drive purchasing decisions. Companies are also launching innovative formats that meet changing dietary needs without sacrificing flavor, which is making strong contributions toward the expanding Europe pasta sauces market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.32 Billion |

|

Market Forecast in 2033

|

USD 3.03 Billion |

| Market Growth Rate 2025-2033 | 2.82% |

Europe's pasta sauces market is rooted in the continent's rich culinary heritage and affinity for unique regional tastes. Italy, being the historical hub, sets the tone for consumer and producer expectations throughout the continent. In southern Italy and southern France, handcrafted tomato sauces with added herbs of basil, oregano, and thyme continue to appeal in home cooking as well as upscale supermarket shelves. As for the Balkans, including Croatia and Slovenia, pepper-flavored or vegetable-dense sauces are adopted that feature local vegetables and country traditions. In Spain, tomato sauces may include a smoky flavor taken from local paprika cultivars, whereas in Greece, olive oil–based sauces combine flavors from local olive varieties and wild oregano. This strong connection with locally procured ingredients and cuisine strengthens the market, with manufacturers in both countries modifying global pasta sauce forms to suit local cuisine. With European consumers clamoring for true flavors, like Tuscan slow-cooked ragù to Provençal tomato-herb blends, the market is supported by products honoring local identities. This following of local cuisine drives the Europe pasta sauces market demand domestically and inspires cross-border exploration of genuine pasta sauce varieties across the continent.

To get more information on this market, Request Sample

A second strong force driving Europe's pasta sauces market comes from changing consumer attitudes with a focus on healthy and transparent products. Throughout Western and Northern Europe, consumers are increasingly attracted to products featuring clean-label ingredients, which are products that prioritize simplicity with familiar components such as extra-virgin olive oil, sun-ripened tomatoes, wild-gathered herbs, and limited processing. In Scandinavia, for example, sauces with organically cultivated produce and domestically supplied canola oil or root vegetables are on the rise, fitting regional values of sustainability and wellness. At the same time, in Mediterranean markets, light and fresh format sauces like herb-led, olive oil-dense, and artificial additive-free, resonate with consumers looking for flavor and nutritional equilibrium. Vegetarian, vegan, and allergen-friendly pasta sauce formats also gain traction, mirroring the region's commitment to food inclusivity and conscious consumption. Manufacturers are responding by highlighting non-GMO components, recyclable packaging, and traceability of ingredients while relying on consumer trust and value-based openness. The intersection of age-old taste habits and contemporary health-driven behavior fuels innovation: stimulating new ranges adapted to changing diets, e.g., legume-based sauces or health-enhanced vegetable blends, while also repositioning pasta sauces as convenient, flavorful, and in tune with today's European life.

Europe Pasta Sauce Market Trends:

Increase in Urban Lifestyles and Need for Convenient Meals

One of the most defining trends defining the pasta sauces market in Europe is increasing demand for convenient, ready-to-use meal solutions, led mainly by increasing working populations, higher income levels, and hectic lifestyles. According to reports, the employment rate across the European Union reached 75.8% in 2024. The employment rate was 80.8% for men and 70.8% for women. Urban areas all over the continent, starting with Berlin and Paris, and then Amsterdam and Milan, are seeing an increase in dual-income families and time-poor consumers looking for convenient yet satisfactory meals. Pasta sauces, in their different package forms like jars, pouches, and pre-prepared kits, fall into place by providing taste, diversity, and convenience of preparation. Young independent professionals and students particularly prefer pre-prepared sauces combined with dry or fresh pasta to allow them to replicate classic dishes without the time commitment. Brands and retailers have reacted by increasing international and regional sauce varieties on shelf space, providing products that vary from basic tomato-basil mixtures to high-end truffle cream sauces. Convenience is maintained as the drive continues toward innovating in packaging, portion size, and multi-use applications, further fueling the Europe pasta sauces market growth.

Expansion in Organic and Clean-Label Product Range

A concurrent trend within Europe's pasta sauces sector is the dramatic increase in demand for organic, minimally processed, and clean-label products, which is the result of heightened health awareness throughout the region. Organically strong nations include Germany, the Netherlands, and Sweden, while this trend is now extending to condiments and sauces. For instance, the total value of organic products retail sales reached 54.7 Billion Euros in 2023, as per the Research Institute of Organic Agriculture (FiBL). Moreover, the European Union was the second most significant organic products market worldwide in 2023, registering a growth of 3.0% or 1.6 Billion Euros. To counter this, large manufacturers and specialty producers alike are rebranding established product lines or adding new product ranges that highlight whole ingredients, organic certification, and the lack of artificial additives. Labels are now commonly touting the likes of "no added sugar," "preservative-free," or "made with organic herbs" to the discerning shopper who scans nutritional content carefully. This trend is strongest in Northern and Western Europe, where health and sustainability are strongly embedded in consumer culture. Local European sauce manufacturers and traditional Italian brands are also conforming by incorporating high-quality olive oil, sun-dried tomatoes, and chemical-free herbs into their products, so that these products meet contemporary standards of health as well as the traditional standards of cuisine, reflecting further growth in the Europe pasta sauces market outlook.

Innovation Through Regional Flavors and Plant-Based Varieties

Another interesting trend is the increasing diversification of the pasta sauce market through regional taste discovery and the launch of plant-based alternatives. European consumers are progressively more adventurous in their willingness to try new flavors, and manufacturers are capitalizing on this by introducing sauces inspired by pan-European as well as international cuisines. For example, pasta sauces made with Mediterranean ingredients such as artichokes, olives, and capers are becoming popular, whereas Nordic flavor profiles incorporating dill, mustard seeds, and root vegetables are found in niche markets. At the same time, the popularity of vegetarian and vegan diets is encouraging companies to create creamy sauces made from oat milk, almond cream, or ground legumes instead of dairy or meat. Even in nations such as the UK and France, vegan pesto and Bolognese versions are rapidly becoming mainstream. While these innovations attract consumers who are ethically and environmentally aware, they also create new occasions for use, for instance, dips or spreads. Together, these changing tastes and eating habits are transforming the landscape of Europe pasta sauces market trends into something more inclusive, localized, and flexible.

Europe Pasta Sauce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe pasta sauce market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, packaging type, and distribution channel.

Analysis by Product Type:

- Tomato-Based Sauces

- Traditional Sauce

- Marinara Sauce

- Meat Sauce

- Mushroom Sauce

- Roasted Garlic Sauce

- Cheese Sauce

- Tomato and Basil Sauce

- Others

- Pesto-Based Sauces

- Traditional Basil Pesto Sauce

- Sun-Dried Tomato Pesto Sauce

- Others

- Alfredo-Based Sauces

- Traditional Alfredo Sauce

- Garlic Alfredo Sauce

- Cheese Alfredo Sauce

- Others

Tomato-based sauces stand as the largest component in 2024. According to the Europe pasta sauces market analysis, tomato-based sauces represent the leading product type deeply rooted in the region’s culinary traditions and widely favored for their versatility and rich flavor. These nations, including Italy, Spain, and Greece, have relied on tomatoes as the base of their cuisine for decades, shaping purchasing patterns throughout the continent. Sauces come in several variations, including traditional marinara and arrabbiata to slow-cooked ragù and herb-infused, which provide a wide range of appeal for traditionalists and contemporary home cooks. They can be paired with various pasta, vegetables, and proteins and are found in both home culinary settings and foodservice operations. Furthermore, tomato sauces fit best with health trends based on their clean-label and natural antioxidants, as well as low fat content, particularly when made using clean-label or organic ingredients. Manufacturers continue to innovate in this space by introducing reduced-sugar, preservative-free, and regionally themed tomato sauces, further solidifying their stronghold on the product segmentation of the European market.

Analysis by Packaging Type:

- Glass Bottles

- PET

- Cans

- Pouches

- Cartons

Glass Bottles leads the market share in 2024. Glass bottles are the most popular type of packaging in the Europe pasta sauces market due to their premium image, preserve properties, and compatibility with sustainability principles. Consumers in Europe tend to relate glass packaging with superior and authentic quality, especially for traditional tomato-based or gourmet pasta sauces. Glass's transparency also enables customers to see the product visually, which further enhances its value in clean-label and organic-priority markets. Additionally, glass is inert and serves to maintain the flavor, texture, and nutritional value of the sauce over time. In highly developed recycling countries like Germany and the Netherlands, glass containers are favored for recyclability and sustainability, in support of green-focused purchasing choices. Brands in the region are also putting money into glass jars with visually appealing designs, improving shelf presence and reusability. These aspects work toward ensuring that glass bottles remain the top choice of packaging in Europe pasta sauces market segmentation, as per the Europe pasta sauces market forecast.

Analysis by Distribution Channel:

- Direct

- Indirect

- Store-Based Retailing

- Supermarkets

- Specialty Stores

- Convenience Stores

- Online Retailing

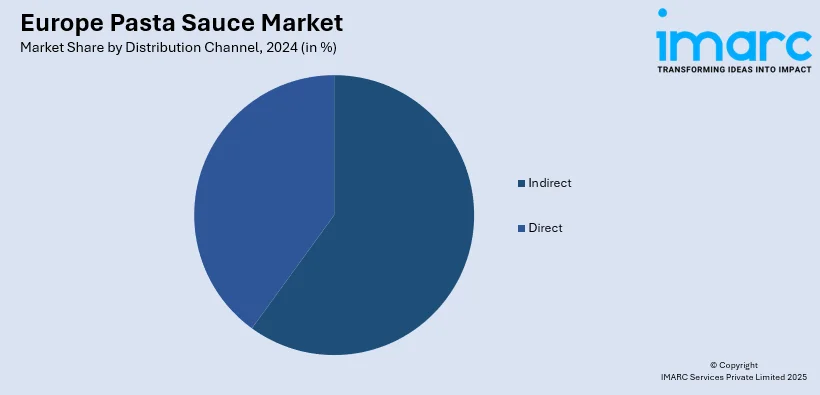

Indirect leads the market share in 2024. Indirect distribution channels are dominated by supermarkets, hypermarkets, convenience stores, and online. These channels provide extensive availability, range, and competitive price, hence the first choice of most European consumers. Supermarkets and hypermarkets, for instance, offer generous shelf space for mainstream and premium brands of pasta sauce, enabling consumers to make price, flavor, packaging, and nutritional content comparisons in one stop. Convenience stores target busy city inhabitants needing speed of eating and meal solution convenience, while the rise of e-commerce platforms for online purchasing of specialty and foreign sauce types is convenient for customers to access from the comfort of their own homes. Furthermore, sales promotion techniques such as discounting, loyalty rewards, and bundling are more easily managed through indirect channels, increasing product visibility and encouraging volume buying. These advantages make indirect distribution, the preferred and most effective route for pasta sauce manufacturers to reach diverse consumer segments across Europe.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany's market for pasta sauces is powered by demand for clean-label, organic products and a high demand for convenience foods. Consumers value health and sustainability, making brands create minimally processed sauces with true flavor. Supermarkets hold major distribution, while regional preferences for spiced and rich sauces expand steadily.

France's pasta sauce market combines classic cooking traditions with contemporary convenience. Shoppers prefer gourmet and artisanal sauces produced in France using locally sourced ingredients. Glass is the preferred package for its upscale image. French consumers also appreciate innovation, with increasing demand for Mediterranean-style and vegan sauces that complement changing eating lifestyles.

In the UK, convenience and variety flavor are the pillars upon which the market for pasta sauces relies. Consumers are receptive to international flavors, making fusion and veggie sauces popular. Time-poor lifestyles underpin high supermarket and online purchase. Healthy food trends also support demand for low-sugar, preservative-free, and environmentally friendly packaged sauce products.

Italy, the homeland of pasta culture, prefers classical, homemade-style sauces made with authentic regional ingredients. The market prioritizes quality and heritage cuisine, with people favoring tomato-based sauces with olive oil and herbs. Glass jar packaging prevails, with artisanal and organic products gaining ground among healthy and sophisticated Italian consumers.

Spain's market for pasta sauces is dominated by Mediterranean flavors and local food habits. Consumers prefer the use of olive oil, peppers, and herbs in the sauces. The market is moving toward organic and vegan alternatives due to health trends. Convenience and price remain the driving factors in terms of product availability in retail outlets.

Competitive Landscape:

Major players in the European pasta sauces market are aggressively propelling growth through a mix of product innovation, sustainability, and strategic distribution expansion. Leading brands are investing in introducing new product lines that meet changing consumer tastes, such as organic, plant-based, low-sugar, and allergen-free sauces. These developments stem from the increasing demand for health-oriented and clean-label food in European markets. Firms are also moving upmarket with premium and gourmet products that emphasize true regional taste, like classic Italian recipes or Mediterranean-style blends, to reach discriminating consumers who value both taste and authenticity. Packaging innovations, particularly the use of recyclable glass jars and earth-friendly labeling, respond to increasing environmental awareness among shoppers. Distribution-wise, players are consolidating their presence in both conventional retail shops and online platforms, which are making them widely available and convenient to access. Forming strategic alliances with supermarket chains and online stores is facilitating quicker delivery and improved shelf placement. Certain brands are also focusing on local sourcing ingredients and transparent sourcing processes so that consumers will trust them and develop brand loyalty. Additionally, marketing campaigns highlighting heritage, taste, and nutritional benefits are being used to enhance consumer engagement across Europe. Collectively, these efforts are helping leading companies to maintain a competitive edge and expand their share in the Europe pasta sauces market.

The report provides a comprehensive analysis of the competitive landscape in the Europe pasta sauces market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: The Kraft Heinz Company confirmed that it concluded a deal with NewPrinces S.p.A. for the sale of its infant and specialty foods division in Italy. The agreement aligns with Kraft Heinz's objective to leverage its Accelerate platforms, which include pasta sauces and other ‘Taste Elevation’ items such as HEINZ Tomato Ketchup, to promote revenue growth.

- March 2025: Italy-based Mutti officially launched the Lion Jar, a new glass packaging container for its line of premade tomato sauces, to improve its position in the market for pasta sauces. This strategic launch highlights the Italian company’s aspirations in the pasta sauces sector and demonstrates its desire to combine sustainability, innovation, and legacy.

- January 2025: The Casalasco Group, a prominent food manufacturing company based in Italy, completed the acquisition of Unilever’s pasta sauce retail business in Germany. This acquisition is a part of Unilever's overall strategy to simplify its portfolio and concentrate on its core business divisions in accordance with industry trends in the food and beverage sector.

- December 2024: Platinum Equity successfully acquired a majority share in F.lli Polli S.p.A., a renowned manufacturer of pasta sauces and vegetable preserves based in Italy. With this acquisition, Platinum Equity aims to support the expansion of F.lli Polli beyond Italy into Europe and the US.

Europe Pasta Sauce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Packaging Types Covered | Glass Bottles, PET, Cans, Pouches, Cartons |

| Distribution Channels Covered |

|

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe pasta sauces market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe pasta sauces market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pasta sauces industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pasta sauce market in Europe was valued at USD 2.32 Billion in 2024.

The Europe pasta sauce market is projected to exhibit a CAGR of 2.82% during 2025-2033, reaching a value of USD 3.03 Billion by 2033.

The Europe pasta sauces market is driven by rising demand for convenient meal options, growing health consciousness, and preference for clean-label, organic products. Traditional culinary influence, premiumization trends, and increased disposable income also support market growth. Consumers further seek authentic flavors, sustainable packaging, and quick-prep solutions across both retail and online channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)