Europe PET Packaging Market Size, Share, Trends and Forecast by Packaging Type, Form, Pack Type, Filling Technology, End User, and Country, 2026-2034

Europe PET Packaging Market Size and Share:

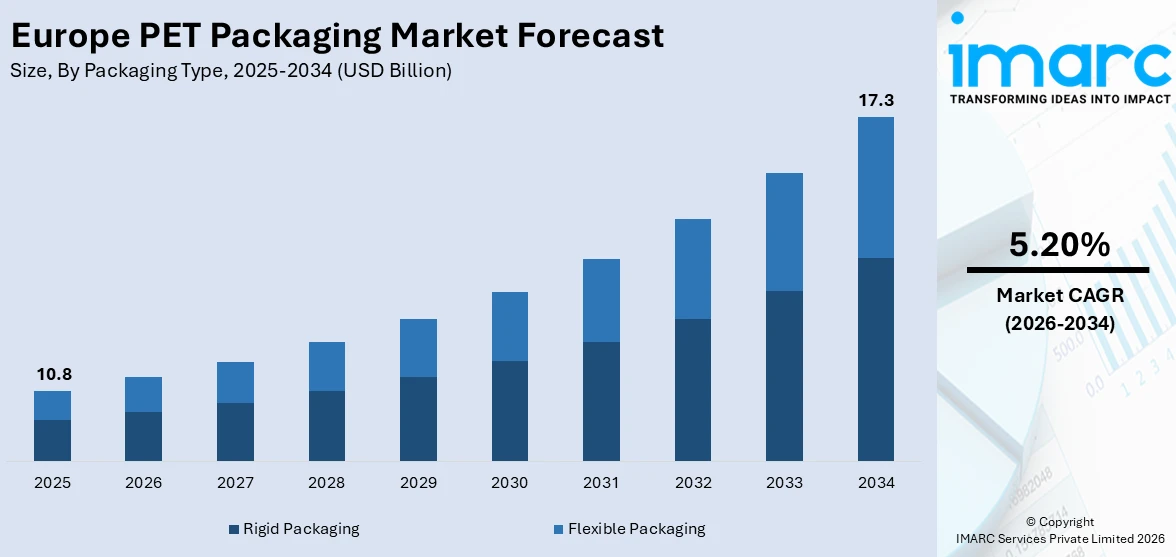

The Europe PET packaging market size was valued at USD 10.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 17.3 Billion by 2034, exhibiting a CAGR of 5.20% from 2026-2034. The expansion of e-commerce drives the demand for durable and lightweight PET packaging that assures product safety. However, due to a lack of adequate waste disposal options, a large amount of packaging waste ends up in landfills, leading to environmental concerns. As a result, packaging industries are shifting towards sustainable alternatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 10.8 Billion |

|

Market Forecast in 2034

|

USD 17.3 Billion |

| Market Growth Rate (2026-2034) | 5.20% |

PET packaging is perfect for e-commerce because it provides product safety throughout shipping and handling. Its lightweight design lowers shipping expenses, making it a cost-effective option for both companies and individuals. The durability and toughness of PET aids in reducing product damage, improving customer satisfaction in online shopping experiences. The increasing need for customized and branded packaging in e-commerce further promotes PET usage. E-commerce sellers need packaging that is simple to store, stack and manage, which PET effectively offers. The growing demand for quick shipping options, like next-day delivery, fuels the necessity for secure packaging materials. PET packaging provides the essential strength and protective features needed for fast delivery services.

To get more information on this market Request Sample

PET packaging provides strength and outstanding barrier capabilities, maintaining the quality of food and drinks. Due to the escalating need for packaged food and drinks, PET packaging continues to be a favored choice. The versatility of PET in packaging both liquid and solid food products make it a preferred choice for numerous applications. PET is clear, allowing visibility, which increasing the attractiveness of packaged goods. The rising demand ready-to-consume (RTC) meals and drinks further accelerates the adoption of PET packaging. PET packaging is also resistant to shattering, providing safer transport and handling of food and drinks. The shift towards healthier, organic and preservative-free foods is encouraging the demand for premium packaging options. The barrier properties of PET assist in safeguarding these delicate products from environmental elements like air and moisture.

Europe PET Packaging Market Trends:

Advancements in PET technology

Improvements in PET technology is significantly enhancing the market by improving product performance and sustainability. Lightweight materials are reducing the amount of PET packaging used, thereby reducing costs and having a smaller environmental footprint. Enhanced barrier properties in PET packaging extend product shelf life by shielding contents from moisture and air. This technological advancement raises customer satisfaction in various sectors, especially the food and beverage (F&B) sector, where freshness is of paramount importance. These needs led AIMPLAS, Covinil and Eroski to join forces in November 2024 to design a recyclable, fully recycling skin pack container from recycled PET. The project will address the issues related to the recycling problem regarding flexible PET by applying chemical recycling and polymerization methods.

Growing demand in pharmaceutical packaging industry

With the growth of the pharmaceutical sector, there is a rising demand for sturdy, safe, and lightweight packaging. PET is an excellent option for packaging various pharmaceutical items because of its protective features. The pharmaceutical sector is placing greater emphasis on sustainability, and the recyclability of PET, which aligns with these environmental objectives. PET is highly flexible and can be molded into various forms to meet specific requirements in the pharmaceutical packaging segment. The chronic diseases and demographic aging in Europe are creating the demand for pharmaceutical products and its packaging. Bayer launched a new eco-friendly PET blister pack for medicinal products in October 2024. Packaging innovation using PET material enhances recyclability. The design promises that items will be safe with the environment too.

Government regulations

Strict regulations in various European countries promote the use of recyclable materials, influencing the Europe PET packaging market outlook. In April 2024, the European Union unveiled new PET recycling regulations designed to enhance sustainability initiatives by enforcing mandatory recycling standards. By the year 2025, PET beverage containers should have 25% recycled plastic, aiming for 30% by 2030. The EU's emphasis on minimizing plastic waste with circular economy measures encourages the use of PET. Policies requiring higher recycling rates for PET materials are driving advancements in recycling technologies. Consequently, PET packaging producers are investing in methods that improve material recycling and minimize waste. Rules aimed at cutting carbon emissions promote the adoption of lightweight and energy-efficient PET packaging options.

Europe PET Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe PET packaging market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on packaging type, form, pack type, filling technology, and end user.

Analysis by Packaging Type:

- Rigid Packaging

- Flexible Packaging

Rigid packaging dominates the market because of its durability and sturdiness, which makes it preferred option for protecting products during transportation. It offers crucial protection for fragile and perishable goods, particularly in the food and beverage (F&B) industry. Rigid PET packaging offers greater versatility for various packaging uses, including bottles, containers and jars. The increasing towards convenient and user-friendly packaging further drives the demand for rigid packaging. Rigid PET packaging integrates well with automatic packaging systems, enhancing production efficiency. It additionally provides improved stacking and storage abilities in comparison to flexible options, resulting in heightened usage across multiple sectors.

Analysis by Form:

- Amorphous PET

- Crystalline PET

Amorphous PET dominates the market share because of its superior clarity and visual attractiveness. It is frequently utilized for packaging items where visibility is critical, like drinks and food products. It offers outstanding clarity, enabling customers to clearly view the product, thereby improving its market appeal. Its flexibility and ease of processing in production contribute to its leading position in the market. It is commonly favored for manufacturing bottles, containers and trays, especially for packaging food and drinks. Amorphous PET exhibits outstanding barrier capabilities against oxygen and moisture, maintaining product quality and freshness.

Analysis by Pack Type:

- Bottles and Jars

- Bags and Pouches

- Trays

- Lids/Caps and Closures

- Others

Bottles and jars lead the Europe PET packaging sector because of their adaptability and extensive application in various industries. PET bottles are especially favored in the food and beverage (F&B) industry due to their essential durability and lightweight characteristics. These pack categories guarantee the secure transport and preservation of liquids while upholding product integrity. PET jars are frequently utilized for food products like jams, sauces, and pickles, offering an airtight seal that prolongs their shelf life. Both bottles and jars provide outstanding resistance to breaking, making them safer and more practical than glass options. The rising demand for sustainable packaging solutions further strengthens the dominance of bottles and jars, as they are fully recyclable and help meet growing environmental concerns.

Analysis by Filling Technology:

- Hot Fill

- Cold Fill

- Aseptic Fill

- Others

Cold fill technology holds the largest market share because it is well-suited for heat-sensitive products. Cold filling helps preserve the freshness, flavor and nutritional value of products without subjecting them to heat, which can degrade quality. It is particularly beneficial for beverages like juices, dairy drinks and ready-to-drink (RTD) teas, that require minimal processing to maintain their original taste and properties. Cold fill technology also eliminates the need for preservatives that appeals to health-conscious individuals seeking natural products. Moreover, the use of cold fill reduces energy consumption during production, which is both cost-effective and environmentally friendly.

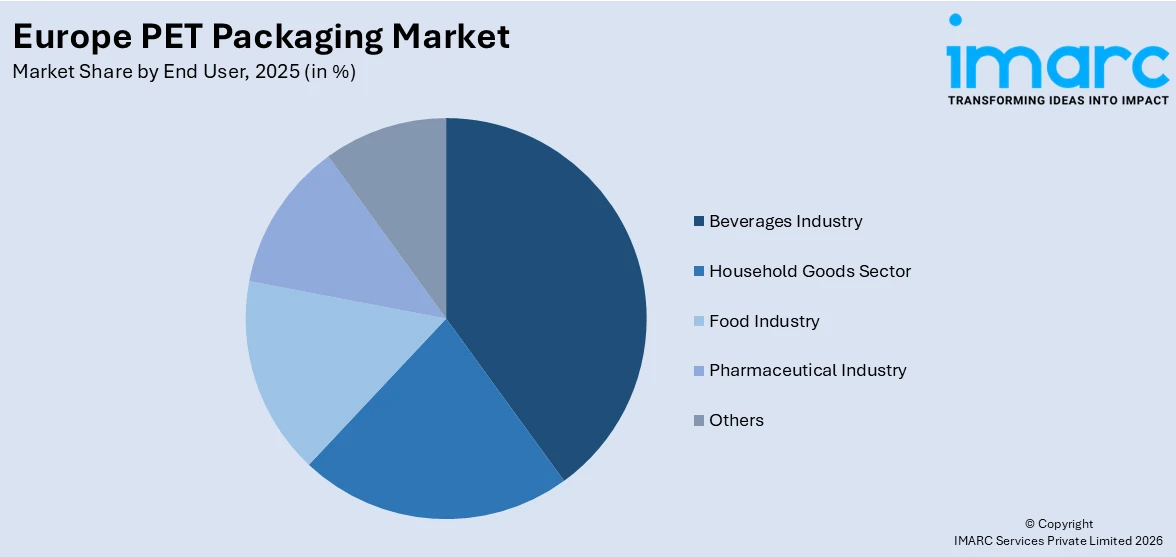

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Beverages Industry

- Bottled Water

- Carbonated Soft Drinks

- Milk and Dairy Products

- Juices

- Beer

- Others

- Household Goods Sector

- Food Industry

- Pharmaceutical Industry

- Others

The drinks industry leads the market because of the strong demand for bottled beverages. PET packaging is the favored option for various beverages like soft drinks, bottled water, juices, and energy drinks. Its durability, light weight, and break-resistant properties make it perfect for beverage packaging, guaranteeing that items stay secure during shipping and storage. PET bottles offer extensive customization options, enabling manufacturers to make unique packaging designs that appeal to the masses. PET packaging offers outstanding barrier qualities that assist in maintaining the freshness, taste, and carbonation of drinks. With customer preferences moving towards convenient, portable, and environmentally-friendly packaging, PET remains the preferred material for beverage packaging.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany represents the biggest segment due to its strong manufacturing sector and high demand for packaged goods. The robust food and beverage (F&B) industry in the nation, especially for bottled water, soft drinks and alcoholic drinks, generates significant demand for PET packaging. Germany's strong infrastructure and advanced production capabilities enable the efficient production of PET packaging materials. Region is also benefiting from the increasing trend of e-commerce, which further drives the demand for packaging solutions. The country's commitment to sustainability and the circular economy also promotes the use of PET due to its recyclability and ability for reuse. In August 2024, ALPHA joined forces with Sea Me, a startup from Germany, to introduce a new line of reusable PET bottles designed for cosmetics. This collaboration aims to improve sustainability in packaging solutions, offering an eco-friendly alternative in the cosmetics industry.

Competitive Landscape:

Innovative and sustainability-focused approaches by key stakeholders affected the market considerably. They spend a lot of money for research and development (R&D) purposes in developing innovative, lightweight, and recyclable PET packaging solutions. Customizable designs are also offered by these companies to cater to various industries, such as food, beverages, and personal care. Companies and regulatory bodies make internal agreements to meet the very stringent norms against the environment and recycling. They also encourage circular economy principles by enhancing the use of recycled PET in their manufacturing processes. Collaborating with raw material suppliers they helps ensure quality consistency and improves the effectiveness of supply chains. Major players are continually expanding their geographic reach through mergers, acquisitions, and partnerships with local companies. They utilize advanced manufacturing technologies to improve efficiency in production and minimize environmental effects. In January 2024, Petainer and Oonly launched a reusable PET water bottle in Hungary, aligned to sustainability goals. The lighter weight of the bottle presents a more eco-friendly alternative to traditional glass bottles.

The report provides a comprehensive analysis of the competitive landscape in the Europe PET packaging market with detailed profiles of all major companies.

Latest News and Developments:

- May 2024: L'Occitane collaborated with Carbios to develop a 100%-PET bottle utilizing enzymatic recycling technology. The bottle was kept on display at CARBIOS’ Stand D02 at “Edition Spéciale” by LuxePack that was held on 4-5 June 2024 in Paris. This partnership aids L'Occitane in minimizing its dependence on fossil-derived plastics and supports its sustainability objectives. Carbios' groundbreaking enzymatic technique can effectively recycle PET waste that conventional methods find challenging.

Europe PET Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Rigid Packaging, Flexible Packaging |

| Forms Covered | Amorphous PET, Crystalline PET |

| Pack Types Covered | Bottles and Jars, Bags and Pouches, Trays, Lids/Caps and Closures, Others |

| Filling Technologies Covered | Hot Fill, Cold Fill, Aseptic Fill, Others |

| End Users Covered |

|

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe PET packaging market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe PET packaging market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe PET packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

PET packaging is made from polyethylene terephthalate, a durable and lightweight plastic material. It is frequently used in food, beverages and personal care items because of its durability and versatility. PET packaging provides excellent barrier properties, preserving product freshness and extending shelf life. It is recyclable that makes it an environmentally friendly option for sustainable packaging alternatives. PET is preferred for its clarity, improving the visual appeal of products.

The Europe PET packaging market share was valued at USD 10.8 Billion in 2025.

IMARC estimates the Europe PET packaging market to exhibit a CAGR of 5.20% during 2026-2034.

Major factors influencing the market are the rising preference for eco-friendly and recyclable packaging options. The rising Europe PET packaging market demand for convenient and lightweight packaging for food and beverages is driving market expansion. Improvements in PET technology, like better barrier features, are improving product effectiveness. Strict regulations that encourage recycling and sustainability also enhance PET utilization. Moreover, the rising reliance on e-commerce portals and the demand for protective packaging solutions are strengthening market growth.

In 2024, rigid packaging represented the biggest segment by packaging type due to its remarkable durability and strength. It offers enhanced protection for goods, especially fragile ones, during transport and handling. The increasing demand for safe, secure and lightweight packaging in various industries drives the adoption of rigid packaging. PET rigid packaging is preferred for its excellent visual attractiveness, which is vital for customer-targeted products.

Amorphous PET leads the market by form owing to its superior clarity and aesthetic appeal. It is highly preferred for applications requiring transparency, such as beverage and food packaging. This form of PET offers excellent moldability, making it suitable for a wide range of packaging types. Additionally, amorphous PET has strong barrier properties that help preserve product quality and extend shelf life. Its ease of processing during manufacturing further contributes to its adoption in several industries.

Bottles and jars represent the top segment in pack types, driven by their extensive application in packaging. These packaging types offer outstanding security and maintenance for drinks, edibles and personal care items. PET bottles and jars are lightweight, making them cost-effective for transportation and handling. They are shatterproof, which enhances safety during usage and transportation. The increasing need for convenient, user-friendly packaging across different sectors encourages their sales.

Cold fill is the dominant segment of the Europe PET packaging market because it is ideal for heat-sensitive items. It maintains the authentic taste and nutritional quality of drinks without the need for high-temperature treatment. This approach is especially preferred for packaging juices, dairy and ready-to-consumer (RTC) drinks. It saves energy as it needs less heating than hot fill methods, which lowers costs and carbon footprint.

The bottled drinks market is dominated by the beverages industry due to their high demand. PET bottles are ideal for containing water, soft drinks and juices, ensuring freshness and maintaining quality. Their lightweight characteristics makes them economical and convenient for transport and consumption while on the move. PET packaging provides excellent durability and resistance to breakage, which is crucial for storing and handling beverages.

On a regional level, the market has been classified into Germany, France, United Kingdom, Italy, Spain and Others, wherein Germany currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)