Europe Photoresist and Photoresist Ancillaries Market Size, Share, Trends and Forecast by Photoresist Type, Photoresist Ancillaries Type, Application, and Country, 2025-2033

Europe Photoresist and Photoresist Ancillaries Market Size and Share:

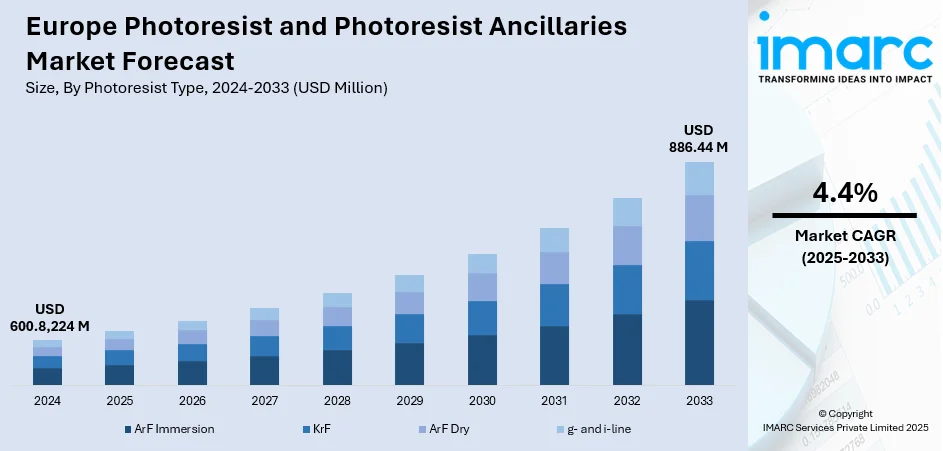

The Europe photoresist and photoresist ancillaries market size was valued at USD 600.8,224 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 886.44 Million by 2033, exhibiting a CAGR of 4.4% from 2025-2033. Germany currently dominates the market driven by the region’s strong semiconductor and electronics industry, growing demand for advanced consumer devices, and rapid adoption of fifth generation (5G) technology. Increasing investments in automotive electronics, especially for electric vehicles and autonomous systems, further boost usage of photoresist materials. Additionally, supportive government initiatives for strengthening domestic chip manufacturing and rising research and development (R&D) in nanotechnology and photolithography processes contribute significantly. Expanding applications in packaging and displays also enhance market growth prospects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 600.8,224 Million |

|

Market Forecast in 2033

|

USD 886.44 Million |

| Market Growth Rate 2025-2033 | 4.4% |

One of the primary drivers of the Europe photoresist and photoresist ancillaries market is the region’s strong semiconductor and electronics ecosystem, fueled by growing demand for high-performance chips in smartphones, laptops, and IoT devices. European manufacturers are increasingly investing in advanced photolithography technologies to meet this demand, while the rapid expansion of data centers, 5G infrastructure, and cloud computing further boosts the need for sophisticated semiconductors. Importantly, the European Chips Act aims to double the EU’s global semiconductor share from around 10% to 20% by 2030, mobilizing €43 billion in public–private investment and attracting over €100 billion total, directly supporting steady demand for photoresist and ancillary materials.

To get more information on this market, Request Sample

The automotive sector in Europe, particularly with the transition to electric vehicles (EVs) and autonomous driving, is a key driver for the Europe photoresist and photoresist ancillaries market growth. Modern vehicles already contain 1,400–1,500 microchips, and this figure is expected to exceed 3,000 chips per vehicle by 2030, underlining the rising semiconductor intensity in automotive systems. Chips power critical functions such as safety systems, infotainment, navigation, and battery management, creating strong demand for advanced semiconductor fabrication. As European automakers accelerate EV production and integrate more digital components, the need for photoresist materials grows. Supportive green mobility policies and demand for smarter cars further amplify this trend, making automotive electronics a vital growth contributor.

Europe Photoresist and Photoresist Ancillaries Market Trends:

Expansion of the Semiconductor Manufacturing Ecosystem

Europe’s growing emphasis on strengthening its semiconductor industry is a re-shaping the photoresist and photoresist ancillaries market trend. With intensifying global competition and rising dependence on chips for digital transformation, the EU is working to expand domestic capacity and reduce reliance on imports. Central to this effort is the EU Chips Act, enacted in September 2023, which targets doubling Europe’s semiconductor market share from 10% to 20% by 2030. Backed by €43 billion in public–private investments, the initiative also seeks to drive innovation in photolithography technologies and ensure supply chain resilience. Simultaneously, growth in cloud computing, artificial intelligence, and 5G networks is fueling demand for advanced semiconductors, boosting photoresist consumption. With Germany, France, and the Netherlands emerging as key semiconductor hubs, and ongoing advances in miniaturization and energy-efficient designs, demand for high-performance photoresist materials is set for steady expansion.

Rising Demand for Automotive Electronics and EV Technologies

The rapid transformation of the European automotive industry is another major driver of the photoresist and photoresist ancillaries market. As Europe leads the global shift towards electric vehicles (EVs) and smart mobility, demand for advanced semiconductors in automotive applications is soaring. Photoresists are essential in manufacturing integrated circuits that power key automotive systems, including autonomous driving features, battery management, infotainment, and safety technologies. European automakers are investing heavily in EV production capacity and digital automotive solutions to comply with stringent carbon reduction regulations and meet consumer demand for connected, eco-friendly cars. This transition requires highly reliable and energy-efficient chips, further boosting the usage of advanced photoresist formulations. Moreover, collaborations between automotive OEMs and semiconductor manufacturers across Europe are fostering innovation in chip design, solidifying Europe photoresist and photoresist ancillaries market demand.

Technological Advancements in Photolithography and Nanotechnology

Rapid technological progress in photolithography and nanotechnology is significantly propelling the demand for photoresist and ancillary materials in Europe. As industries move towards producing smaller, faster, and more efficient electronic devices, there is an increasing need for advanced photolithography processes capable of creating ultra-fine circuit patterns. Extreme ultraviolet (EUV) lithography, in particular, is gaining momentum in Europe, driving demand for next-generation photoresist formulations with superior resolution and sensitivity. Research institutions and semiconductor firms in the region are heavily investing in nanotechnology R&D, enabling breakthroughs in memory devices, sensors, and display technologies. Additionally, Europe’s strong presence in industrial automation, aerospace, and healthcare electronics is expanding applications for high-precision chips, further intensifying market growth. These technological advancements ensure continuous innovation in photoresist development, strengthening Europe’s competitiveness in global semiconductor manufacturing thus positively impacting the Europe photoresist and photoresist ancillaries market outlook.

Europe Photoresist and Photoresist Ancillaries Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe photoresist and photoresist ancillaries market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on photoresist type, photoresist ancillaries type, and application.

Analysis by Photoresist Type:

- ArF Immersion

- KrF

- ArF Dry

- g- and i-line

Based on the Europe photoresist and photoresist ancillaries market analysis, the KrF photoresists account for the majority of shares driven by their wide adoption in semiconductor manufacturing and cost-effectiveness compared to more advanced alternatives. They are extensively used in applications such as memory chips, logic devices, and microcontrollers, which are critical for consumer electronics, automotive electronics, and industrial systems. KrF resists provide a strong balance between performance and affordability, making them highly suitable for mass production processes. Their compatibility with established photolithography equipment further supports their dominance. Additionally, the rising demand for integrated circuits in electric vehicles, IoT, and 5G technologies continues to drive KrF usage, ensuring their strong market share despite emerging lithography innovations.

Analysis by Photoresist Ancillaries Type:

- Anti-Reflective Coatings

- Remover

- Developer

- Others

Anti-reflective coatings dominate market demand due to their essential role in enhancing photolithography precision and improving semiconductor device performance. These coatings minimize reflection and scattering of light during the lithography process, enabling accurate pattern transfer for advanced integrated circuits. With the growing adoption of high-resolution and miniaturized chips in electronics, automotive systems, and 5G devices, the need for reliable anti-reflective solutions has surged. Additionally, advancements in EUV lithography and nanotechnology further strengthen their importance in next-generation semiconductor fabrication. Their ability to reduce defects, improve yield rates, and ensure higher efficiency makes them a critical ancillary material, ensuring their dominance in overall market demand across Europe.

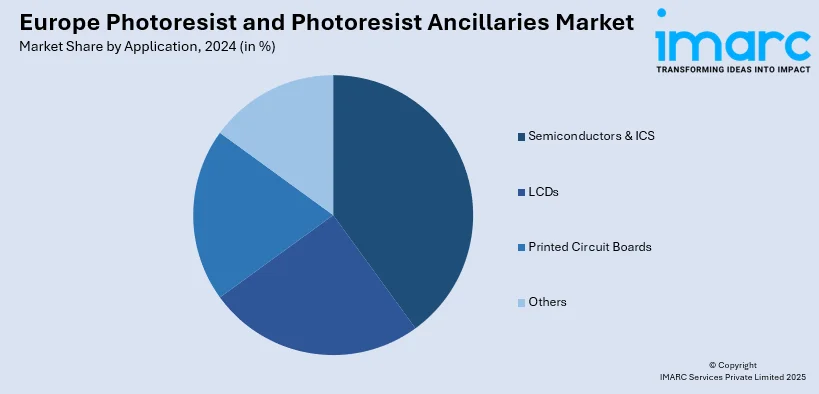

Analysis by Application:

- Semiconductors & ICS

- LCDs

- Printed Circuit Boards

- Others

According to the Europe photoresist and photoresist ancillaries market forecast, the semiconductors & ICs represent the largest market share owing to their critical role in powering modern technologies. The surge in demand for consumer electronics, 5G infrastructure, cloud computing, and IoT applications has significantly increased the need for advanced chips, driving higher consumption of photoresist materials. Additionally, Europe’s strong push toward digitalization, combined with rising investments in domestic semiconductor manufacturing under initiatives like the EU Chips Act, further boosts this segment. The integration of ICs into automotive electronics, particularly in electric vehicles and autonomous driving systems, also amplifies demand. With continuous miniaturization, improved efficiency requirements, and growing applications across industries, semiconductors and ICs remain the dominant and most influential segment in shaping market growth.

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the leading region due to its strong semiconductor manufacturing base, advanced automotive industry, and significant investments in research and development. As a hub for high-tech industries, Germany drives demand for photoresist materials through its extensive use of microelectronics in automotive electronics, industrial automation, and consumer devices. The country’s leadership in electric vehicles and smart mobility further accelerates semiconductor requirements, directly boosting photoresist consumption. Additionally, Germany’s robust collaborations between universities, research institutes, and industry players foster innovation in nanotechnology and photolithography. With supportive government policies, well-established infrastructure, and a focus on technological leadership, Germany remains the most influential and rapidly growing market in the region.

Competitive Landscape:

The competitive landscape of the Europe photoresist and photoresist ancillaries market is characterized by intense rivalry, driven by rapid technological advancements and the demand for high-performance semiconductor materials. Market players compete primarily on innovation, focusing on developing advanced formulations with enhanced resolution, sensitivity, and environmental sustainability. Strategic partnerships with semiconductor manufacturers, research institutions, and automotive firms are common to accelerate R&D and strengthen market presence. Companies also invest heavily in expanding production capacities to meet the growing demand fueled by 5G, EVs, and IoT applications. Sustainability initiatives, such as eco-friendly materials and reduced chemical waste, are becoming critical differentiators. Furthermore, the market shows moderate consolidation, with established players holding strong positions while smaller innovators compete through niche technologies. Overall, the landscape is dynamic, innovation-driven, and shaped by evolving semiconductor and electronics manufacturing requirements across Europe.

The report provides a comprehensive analysis of the competitive landscape in the Europe photoresist and photoresist ancillaries market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Fujifilm developed a PFAS-free negative ArF immersion resist for advanced semiconductor manufacturing, demonstrating high yield in 28nm metal wiring with imec. Leveraging expertise from Europe and Japan, the innovation supports eco-friendly chipmaking amid global PFAS regulations and ongoing customer evaluations for early commercialization.

- June 2025: The EUR 55 Million GENESIS project launched in Grenoble to lead Europe’s transition to sustainable semiconductor manufacturing. Coordinated by CEA-Leti, the initiative focuses on PFAS-free photoresists, real-time emission monitoring, waste reduction, and raw material reuse, aligning with the European Green Deal and strengthening Europe’s green chip ecosystem.

- May 2025: Asahi Kasei launched the TA Series of Sunfort dry film photoresist for advanced semiconductor packaging in AI servers. Developed across Japan, the U.S., and Germany, it enables ultra-fine wiring for panel-level processing, enhancing yield, cost-efficiency, and performance amid growing demand in global semiconductor markets.

- March 2025: UK-based Irresistible Materials appointed Dinesh R. Bettadapur as CEO to accelerate commercialization of its EUV photoresist platform. A University of Birmingham spin-out, the company aims to lead the UK’s semiconductor innovation, offering faster, greener, high-resolution resists to meet growing global demand for advanced chip manufacturing.

- February 2025: Temasek-owned Accuron Technologies acquired a controlling stake in Netherlands-based Trymax Semiconductor, a specialist in plasma-based photoresist removal, UV curing, and etching technologies. The deal strengthens Accuron’s Etch & Clean portfolio and European semiconductor presence, with Trymax’s founders continuing to lead the firm into expanded global operations.

Europe Photoresist and Photoresist Ancillaries Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Photoresist Types Covered | ArF Immersion, KrF, ArF Dry, g- and i-line |

| Photoresist Ancillaries Types Covered | Anti-Reflective Coatings, Remover, Developer, Others |

| Applications Covered | Semiconductors & ICS, LCDs, Printed Circuit Boards, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe photoresist and photoresist ancillaries market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe photoresist and photoresist ancillaries market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe photoresist and photoresist ancillaries industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The photoresist and photoresist ancillaries market in Europe was valued at USD 600.8,224 Million in 2024.

The Europe photoresist and photoresist ancillaries market is projected to exhibit a CAGR of 4.4% during 2025-2033, reaching a value of USD 886.44 Million by 2033.

The Europe photoresist and photoresist ancillaries market is driven by growing semiconductor demand, expansion of automotive electronics with EV adoption, and rising use of advanced consumer devices. Government initiatives like the EU Chips Act, coupled with advancements in nanotechnology and photolithography, further accelerate regional market growth and innovation.

KrF photoresists hold the largest share due to their widespread use in semiconductor manufacturing, offering an optimal balance of performance and affordability. Their compatibility with existing photolithography systems and suitability for mass production of memory and logic devices make them a cost-effective choice, sustaining strong market dominance.

Anti-reflective coatings lead market demand as they reduce light reflection and scattering during photolithography, ensuring precise pattern transfer and higher yield in semiconductor fabrication. Their role in improving device efficiency, supporting miniaturization, and enabling advanced lithography processes makes them indispensable in Europe’s growing semiconductor industry.

Semiconductors & ICs hold the largest market share as they are essential for powering modern technologies, from consumer electronics to automotive and 5G infrastructure. Rising demand for miniaturized, high-performance chips and Europe’s push for domestic semiconductor production drive significant consumption of photoresist materials in this segment.

Germany leads the market with its robust semiconductor manufacturing base, advanced automotive sector, and heavy investments in R&D. Strong demand for microelectronics in EVs, automation, and consumer devices, along with government support and industry–research collaborations, positions Germany as the dominant region in Europe’s photoresist market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)