Europe Positive Displacement Pumps Market Size, Share, Trends and Forecast by Product Type, Capacity, Pump Characteristics, Raw Material and End Use Industry, and Country, 2025-2033

Europe Positive Displacement Pumps Market Size and Share:

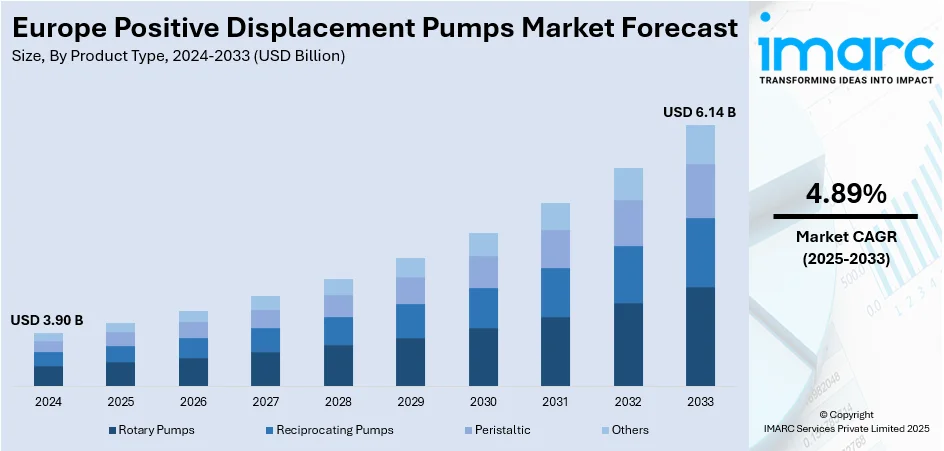

The Europe positive displacement pumps market size was valued at USD 3.90 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.14 Billion by 2033, exhibiting a CAGR of 4.89% from 2025-2033. Germany currently dominates the market, driven by rising demand across water and wastewater treatment, oil and gas, food and beverage, and chemical industries due to their efficiency in handling viscous fluids and precise flow control. Growing urbanization and stricter European union (EU) regulations on water management are accelerating adoption. Additionally, the shift toward energy-efficient pumping solutions, coupled with technological advancements like smart monitoring systems, supports Europe positive displacement pumps market share. Expanding industrial automation and infrastructure investments further strengthen demand for positive displacement pumps in Europe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.90 Billion |

|

Market Forecast in 2033

|

USD 6.14 Billion |

| Market Growth Rate 2025-2033 | 4.89% |

In Europe, stringent environmental regulations and sustainability initiatives are driving heavy investments in water and wastewater treatment infrastructure. The sector is significant, with nearly 79,700 enterprises generating €290.5 billion in turnover and employing 1.6 million people in 2021. Positive displacement pumps play a crucial role here due to their efficiency in handling high-viscosity fluids, sludges, and chemicals with precise dosing. With urbanization, industrial activity, and population growth increasing, the demand for reliable water treatment systems continues to rise. Moreover, the EU’s strong push toward achieving net-zero emissions and stricter clean water standards further supports pump adoption, making them indispensable for sustainable wastewater management across Europe.

To get more information on this market, Request Sample

Technological innovations in positive displacement pumps, such as smart monitoring systems, predictive maintenance, and energy-efficient designs, are key drivers in the Europe positive displacement pumps market outlook. With the EU’s strong push to reduce carbon footprints and boost industrial automation, industries are adopting pumps that lower energy consumption while ensuring high reliability. Advanced IoT-enabled pumps enable real-time monitoring, minimizing downtime and maintenance costs. Notably, EU energy-saving regulations have delivered tangible benefits, with water pump design standards saving 3.3 TWh of electricity in 2020, cutting pump-related use by 1.8%, and saving users about €0.5 billion. These advancements align with Europe’s broader sustainability and efficiency goals.

Europe Positive Displacement Pumps Market Trends:

Technological Advancements and Smart Pumping Solutions

Rapid technological innovation is reshaping the Europe positive displacement pumps market trends. Modern pumps are increasingly being integrated with smart monitoring systems, Internet of Things (IoT)-enabled sensors, and predictive maintenance capabilities, which improve reliability and reduce operational costs. Energy efficiency is also a critical driver, as European industries face growing pressure to minimize energy consumption and carbon emissions. Manufacturers are introducing advanced pump designs with lower lifecycle costs, higher durability, and improved efficiency, appealing to end-users across oil and gas, chemicals, and food and beverage industries. Moreover, automation trends in European manufacturing enhance demand for digitally connected pump solutions that can deliver real-time performance data. These innovations not only align with the EU’s climate and energy efficiency targets but also strengthen competitiveness for companies adopting state-of-the-art positive displacement pumps, accelerating widespread market penetration.

Expanding Water and Wastewater Treatment Sector

Europe’s growing focus on environmental sustainability and water resource management is a major driver for the positive displacement pumps market. The EU’s first water efficiency plan calls for a 10% reduction in water use by 2030 and highlights that only 2.4% of urban wastewater is currently reused, emphasizing the urgent need to upgrade treatment infrastructure. Strict EU directives require municipalities and industries to enhance wastewater efficiency and adopt reuse practices, creating opportunities for advanced pumping solutions. Positive displacement pumps are particularly valued for their ability to handle high-viscosity fluids, slurries, and chemicals with consistent flow and precise dosing. With accelerating urbanization and rising industrial wastewater generation, demand for reliable treatment systems continues to expand. Additionally, investments in upgrading aging facilities across Germany, France, and the UK reinforce adoption. The shift toward circular economies, recycling, and eco-friendly water usage positions these pumps as essential to meeting Europe’s sustainability goals.

Growth in Food, Beverage, and Pharmaceutical Industries

Europe’s strong and expanding food, beverage, and pharmaceutical sectors represent a major growth driver for the positive displacement pumps market. These industries require precise, hygienic, and contamination-free pumping solutions for handling sensitive fluids, such as dairy, juices, syrups, vaccines, and liquid medicines. Positive displacement pumps are preferred because of their ability to maintain gentle fluid handling, exact dosing, and consistent flow without compromising product integrity. Stringent EU regulations on food safety and pharmaceutical manufacturing standards further increase reliance on high-quality pumps that meet sanitary requirements. Growing demand for processed foods, packaged beverages, and pharmaceutical products across Europe fuels pump adoption, particularly in countries like Germany, France, Italy, and the UK. Additionally, the rising trend of automation in production facilities enhances demand for reliable and efficient pumping systems, making positive displacement pumps integral to these critical industries.

Europe Positive Displacement Pumps Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe positive displacement pumps market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on product type, capacity, pump characteristics, raw material, and end use industry.

Analysis by Product Type:

- Rotary Pumps

- Vane

- Screw

- Lobe

- Gear

- Progressing Cavity (PC)

- Others

- Reciprocating Pumps

- Piston

- Diaphragm

- Plunger

- Others

- Peristaltic

- Others

According to the Europe positive displacement pumps market forecast, the rotary pumps account for the majority of shares driven by their versatility, efficiency, and ability to handle a wide range of fluid types, including viscous, abrasive, and shear-sensitive materials. They are widely used across industries such as chemicals, food and beverage, oil and gas, and wastewater treatment due to their smooth, continuous flow and low pulsation performance. Rotary pumps also offer high reliability, durability, and easy maintenance, making them a preferred choice for critical industrial operations. Their adaptability to varying pressure and flow requirements further strengthens demand. Additionally, growing industrial automation and the push for energy-efficient solutions in Europe support the dominance of rotary pumps in the regional market.

Analysis by Capacity:

- Low Capacity Pumps

- Medium Capacity Pumps

- High Capacity Pumps

Low-capacity pumps dominate the market demand owing to their extensive use in applications requiring precise flow control and handling of small volumes of fluids. Industries such as pharmaceuticals, food and beverage, and specialty chemicals rely heavily on these pumps for dosing, metering, and transferring sensitive or viscous liquids with accuracy. Their compact design, cost-effectiveness, and energy efficiency make them attractive for operations where high capacity is unnecessary. Additionally, the rising demand for automation and hygienic processing across Europe further supports the use of low-capacity pumps. Their ability to deliver reliability, precision, and compliance with stringent European regulatory standards drives their widespread adoption, ensuring dominance in overall Europe positive displacement pumps market demand.

Analysis by Pump Characteristics:

- Standard Pumps

- Engineered Pumps

- Special Purpose Pumps

Standard pumps hold the market growth in the Europe Positive Displacement Pumps market owing to their wide applicability, cost-effectiveness, and ease of availability across various industries. These pumps are highly versatile and meet the requirements of sectors such as water treatment, chemicals, food and beverage, and oil and gas without the need for heavy customization, making them a preferred choice for general operations. Their relatively lower initial investment and simple maintenance further drive adoption, especially among small and medium-sized enterprises. Additionally, compliance with European quality and safety standards enhances their reliability. As industries increasingly seek efficient yet affordable pumping solutions, standard pumps continue to dominate demand, supporting overall market growth across the region.

Analysis by Raw Material:

- Bronze

- Cast Iron

- Polycarbonate

- Stainless Steel

- Others

Based on the Europe positive displacement pumps market analysis, bronze dominates the market demand driven by its exceptional durability, corrosion resistance, and suitability for handling a wide range of fluids. Bronze components are particularly favored in water and wastewater applications, marine environments, and industries where pumps are exposed to harsh operating conditions. Their ability to resist wear and maintain performance under high pressure and temperature makes them a reliable material choice. Additionally, bronze’s antimicrobial properties make it suitable for food and beverage as well as pharmaceutical applications, where hygiene and safety are critical. The combination of strength, longevity, and adaptability across diverse sectors ensures bronze remains the preferred material, driving its significant share in the European market.

Analysis by End Use Industry:

- Oil and Gas

- Water and Wastewater

- Automotive

- Chemicals and Petrochemicals

- Others

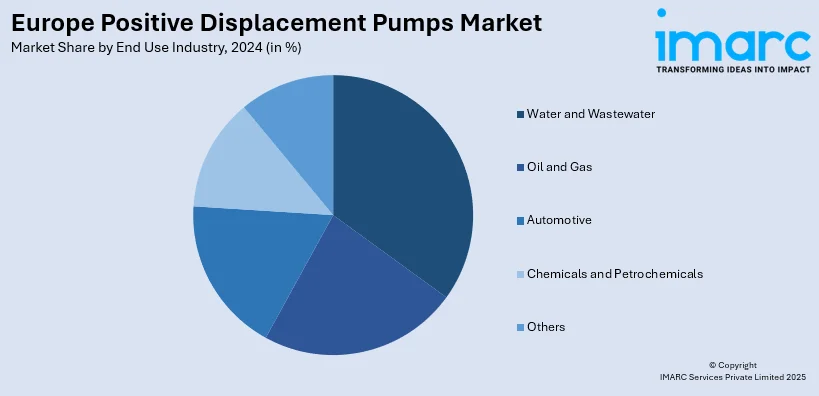

Water and wastewater account for the majority of shares due to the region’s strict environmental regulations, urbanization, and rising demand for sustainable water management. Positive displacement pumps are highly valued in this sector for their efficiency in handling sludge, slurry, chemicals, and other viscous fluids while maintaining accurate flow and dosing. The European Union’s focus on improving wastewater treatment infrastructure, recycling, and achieving circular economy goals further strengthens adoption. Aging water treatment plants across several countries are also being upgraded, boosting demand for advanced pump technologies. Additionally, growing industrial activity and municipal requirements for clean water management ensure steady investments, making water and wastewater treatment the leading application segment in Europe’s market.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany accounts for the majority of shares owing to its strong industrial base, advanced manufacturing capabilities, and high adoption of innovative technologies. The country’s well-established chemical, pharmaceutical, food and beverage, and automotive sectors drive consistent demand for reliable and efficient pumping systems. Furthermore, Germany’s strict environmental regulations and significant investments in water and wastewater treatment infrastructure increase reliance on positive displacement pumps due to their precision and ability to handle complex fluids. The nation’s emphasis on energy efficiency and automation also accelerates adoption of smart and sustainable pump solutions. Combined with its role as a hub for engineering excellence and technological innovation, Germany continues to lead the regional market with dominant market share.

Competitive Landscape:

The competitive landscape is characterized by intense rivalry among global and regional manufacturers focusing on innovation, energy efficiency, and regulatory compliance. Companies compete through advanced product designs, smart pump technologies, and integration of IoT-based monitoring solutions to address growing demand for efficiency and sustainability. The market is also influenced by strong emphasis on after-sales services, customization, and cost-effectiveness to cater to diverse end-user industries such as water treatment, chemicals, oil and gas, and food processing. Additionally, strategic partnerships, mergers, and acquisitions are common as players aim to expand their geographic presence and strengthen market share. The industry’s competitive edge largely depends on technological advancement, reliability, and alignment with Europe’s stringent environmental standards.

The report provides a comprehensive analysis of the competitive landscape in the Europe positive displacement pumps market with detailed profiles of all major companies, including:

Latest News and Developments:

- August 2025: Blackmer, a part of PSG and a Dover company, has launched its new Hydraulic Adapter Kit designed to upgrade the LB080 and LB160 Series Reciprocating Gas Compressors. The patent-pending kit is specifically designed for mobile liquid petroleum gas (LPG) applications, transforming existing compressor setups into compact, chassis-mounted, hydraulically-driven systems.

- August 2025: Pneumofore has launched its brand-new semi-annual magazine, offering an in-depth look into the company’s latest innovations and updates from its global operations. Designed for partners, employees, customers, and anyone interested in pneumatic equipment and Rotary Vane technology, the magazine features exclusive content, including application highlights, success stories, technical insights, and updates from across Pneumofore’s world.

Europe Positive Displacement Pumps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Capacities Covered | Low Capacity Pumps, Medium Capacity Pumps, High Capacity Pumps |

| Pump Characteristics Covered | Standard Pumps, Engineered Pumps, Special Purpose Pumps |

| Raw Materials Covered | Bronze, Cast Iron, Polycarbonate, Stainless Steel, Others |

| End Use Industries Covered | Oil and Gas, Water and Wastewater , Automotive, Chemicals and Petrochemicals, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Othres |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe positive displacement pumps market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe positive displacement pumps market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe positive displacement pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The positive displacement pumps market in Europe was valued at USD 3.90 Billion in 2024.

The Europe positive displacement pumps market is projected to exhibit a CAGR of 4.89% during 2025-2033, reaching a value of USD 6.14 Billion by 2033.

The Europe positive displacement pumps market is driven by rising demand in water and wastewater treatment, strict EU environmental regulations, and growing industrial applications in food, beverage, chemicals, and pharmaceuticals. Technological advancements, energy efficiency requirements, and increased automation further fuel adoption, ensuring reliable, precise fluid handling across diverse industries.

Rotary pumps lead the market due to their versatility, efficiency, and ability to handle viscous, abrasive, and shear-sensitive fluids. Their smooth, continuous flow, durability, and low maintenance make them ideal for industries like chemicals, food, and wastewater, driving their dominance in regional market demand.

Low-capacity pumps dominate as they are essential for applications requiring precise flow control and accurate handling of small fluid volumes. Widely used in pharmaceuticals, food, and specialty chemicals, their efficiency, cost-effectiveness, and compliance with strict EU standards make them highly preferred across industries.

Standard pumps drive market growth due to their versatility, cost-effectiveness, and easy availability. Widely used across industries like water treatment, chemicals, and food processing, they offer reliable performance with lower investment and maintenance needs, making them a preferred choice for diverse industrial applications.

Bronze dominates the market due to its exceptional durability, corrosion resistance, and versatility in handling diverse fluids. Its reliability in harsh conditions and suitability for water, wastewater, marine, and hygienic applications make it the preferred material, ensuring long-lasting performance and driving strong market demand.

Water and wastewater dominate the market as strict EU environmental regulations, rapid urbanization, and growing industrial activity drive demand for efficient treatment solutions. The need for sustainable water management, recycling, and upgraded infrastructure further fuels adoption, positioning pumps as essential to compliance and resource efficiency.

Germany holds the majority share in Europe’s positive displacement pumps market due to its robust industrial base, advanced engineering, and strong manufacturing capabilities. High adoption of innovative technologies, combined with significant demand from chemical, pharmaceutical, food, and wastewater sectors, reinforces Germany’s leadership and drives sustained market growth across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)