Europe Pressure Transmitter Market Size, Share, Trends, and Forecast by Type, Sensing Technology, Fluid Type, End-Use Industry, and Country, 2025-2033

Europe Pressure Transmitter Market Size and Share:

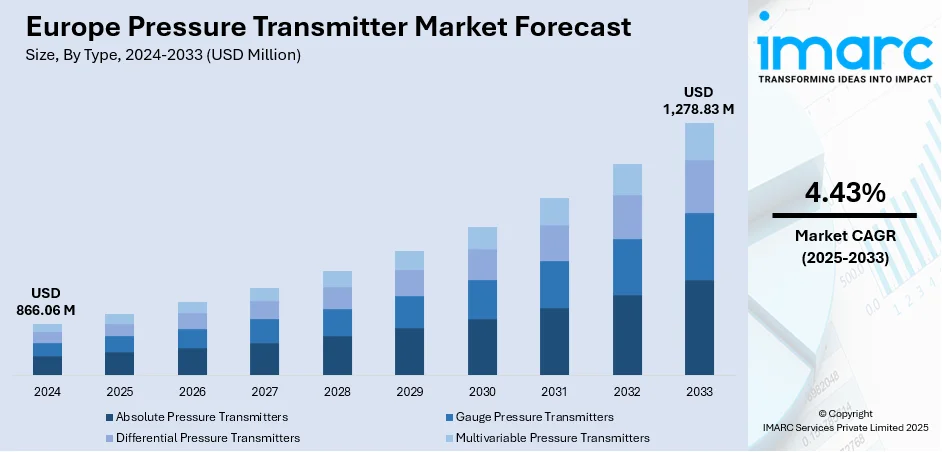

The Europe pressure transmitter market size was valued at USD 866.06 Million in 2024. Looking forward, the market is expected to reach USD 1,278.83 Million by 2033, exhibiting a CAGR of 4.43% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. The market is growing steadily, driven by rising chemical exports, expanding wastewater treatment infrastructure, and increased adoption in oil, gas, mining, and pharmaceutical sectors. Strategic manufacturer expansions and automation in production further enhance demand, strengthening the competitive positioning of the Europe pressure transmitter market share across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 866.06 Million |

|

Market Forecast in 2033

|

USD 1,278.83 Million |

| Market Growth Rate 2025-2033 | 4.43% |

The market is experiencing steady growth, supported by a combination of industrial expansion, infrastructure development, and technological advancements. One of the primary drivers is the increasing demand from the chemical sector, where precise pressure measurement is crucial for process safety, efficiency, and compliance with strict regulations. The growth of chemical exports across Europe has further amplified the need for advanced transmitters that can provide stable and accurate data in challenging environments. Another major factor is the development of wastewater treatment facilities across the European Union. According to the European Commission, there are currently 30,354 urban wastewater treatment plants operating across the EU, highlighting the scale at which pressure transmitters are deployed. These devices are essential for monitoring and controlling water pressure, ensuring smooth operations, and meeting environmental compliance standards.

To get more information on this market, Request Sample

The Europe pressure transmitter market growth is also driven by the rising oil and gas sector. Major projects such as Johan Sverdrup Development, Johan Castberg Field, and Martin Linge Heavy Oil & HPHT Gas Field are creating consistent demand for reliable transmitters to monitor drilling, refining, and distribution processes. Beyond this, mining and pharmaceuticals also contribute, with transmitters being used for slurry monitoring and pressure control in material conveyance systems. The pharmaceutical sector, in particular, benefits from precise instruments to maintain production integrity, given its substantial contribution to Europe’s economy. The market is propelled by automation and technological innovation. For instance, in April 2025, SICK Sensor Intelligence unveiled the PBST touchscreen pressure sensor, expanding its portfolio of dependable, high-precision pressure sensors and switches. Marking the company’s first ceramic cell-based pressure measurement device, the PBST multifunctional IO-Link sensor offers enhanced durability through corrosion resistance while effectively mitigating pressure spikes and surges, reinforcing reliability in demanding industrial environments. With Europe’s focus on AI, smart manufacturing, and automation, demand for advanced, digitally integrated pressure transmitters continues to rise, securing long-term market growth.

Europe Pressure Transmitter Market Trends:

Expanding Industrial and Utility Infrastructure

Europe’s pressure transmitter market is strongly driven by its vast industrial infrastructure, particularly in chemicals and wastewater treatment. The rising export of chemicals has amplified the need for precise monitoring equipment, while wastewater facilities remain a major growth contributor. According to the European Commission, there are currently 30,354 urban wastewater treatment plants operating across the EU. These facilities rely heavily on pressure transmitters for monitoring and control, underscoring their critical role in maintaining efficiency and safety. Additionally, applications extend to mining operations where transmitters track slurry pressure, further broadening their usage. This increasing demand across essential industrial sectors highlights the importance of pressure transmitters in Europe’s market expansion.

Rising Oil, Gas, and Pharmaceutical Applications

Investments in oil and gas projects across Europe are significantly boosting demand for pressure transmitters. According to the Europe pressure transmitter market trends, major developments such as Johan Sverdrup Development, Johan Castberg Field, and Martin Linge (Hild) Heavy Oil & HPHT Gas Field are expected to generate strong market opportunities. Beyond oil and gas, the pharmaceutical industry also plays a vital role. Pressure transmitters are used to monitor conveyance systems transporting granules and powders, ensuring consistent product quality. According to the Association of the British Pharmaceutical Industry (ABPI), the sector contributes over USD 22.8 Billion in direct GVA to the UK economy, with USD 58.4 Billion generated through research and development (R&D) spillovers. This highlights the importance of precision instrumentation in pharmaceutical production processes.

Automation and Strategic Manufacturing Expansion

Automation and technological innovation are key growth factors for Europe’s pressure transmitter market. Manufacturers are increasingly adopting automation in device manufacturing processes to enhance efficiency and reduce errors. This aligns with the UK’s USD 111 Billion innovation strategy, which focuses on AI and automation, signaling a positive outlook for advanced instrumentation adoption. At the same time, market players are expanding strategically across the region to strengthen their presence. For instance, Endress+Hauser has expanded operations into Belgium by constructing a new facility, reinforcing Europe’s position as a hub for industrial innovation. Together, rising automation and manufacturer expansion are creating favorable conditions that propel the pressure transmitter market forward across Europe.

Europe Pressure Transmitter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Europe pressure transmitter market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, sensing technology, fluid type, application, and end-use industry.

Analysis by Type:

- Absolute Pressure Transmitters

- Gauge Pressure Transmitters

- Differential Pressure Transmitters

- Multivariable Pressure Transmitters

Differential pressure transmitters hold the largest share in the market due to their versatility and wide-ranging industrial applications. They are extensively used in monitoring flow rates, liquid levels, and filter conditions, making them indispensable across industries such as chemicals, oil and gas, pharmaceuticals, and wastewater treatment. Their ability to provide highly accurate and stable measurements under varying process conditions enhances operational efficiency and safety, which is critical in Europe’s regulated industrial environment. Additionally, differential pressure transmitters are preferred in energy and utility sectors for optimizing processes and ensuring reliability. With rising demand for automation, precision, and compliance with stringent standards, these transmitters continue to dominate, positioning themselves as the most reliable solution in Europe’s industrial landscape.

Analysis by Sensing Technology:

- Strain Gauge

- Capacitive

- Piezoelectric

- Others

Piezoelectric pressure transmitters hold the largest share in the market due to their high sensitivity, durability, and ability to perform accurately under extreme conditions. According to the Europe pressure transmitter market forecast, they are widely adopted in industries such as automotive, aerospace, oil and gas, and pharmaceuticals, where real-time, precise pressure monitoring is essential. Their robust design enables them to withstand high temperatures, vibrations, and dynamic pressure changes, making them ideal for Europe’s demanding industrial applications. Additionally, the growing focus on automation, smart manufacturing, and advanced material testing further strengthens their adoption. As industries increasingly require reliable, long-lasting solutions that maintain accuracy and efficiency, piezoelectric technology continues to dominate, reinforcing its position as the most trusted choice in Europe’s market.

Analysis by Fluid Type:

- Liquid

- Steam

- Gas

Liquid pressure transmitters hold the largest share in the market because of their widespread use in industries where liquid monitoring and control are essential. Applications in wastewater treatment plants, chemical processing, food and beverage, and pharmaceuticals drive consistent demand, as precise pressure measurement is critical for maintaining quality, safety, and compliance. In Europe, with over 30,000 wastewater treatment plants, liquid pressure transmitters play a vital role in process optimization and environmental management. Their ability to provide accurate readings in harsh conditions, combined with compatibility across a wide range of liquid mediums, enhances their adoption, which is creating a positive impact on the Europe pressure transmitter market outlook. Furthermore, rising automation in manufacturing and infrastructure development ensures liquid pressure transmitters remain indispensable, solidifying their dominance in the regional market.

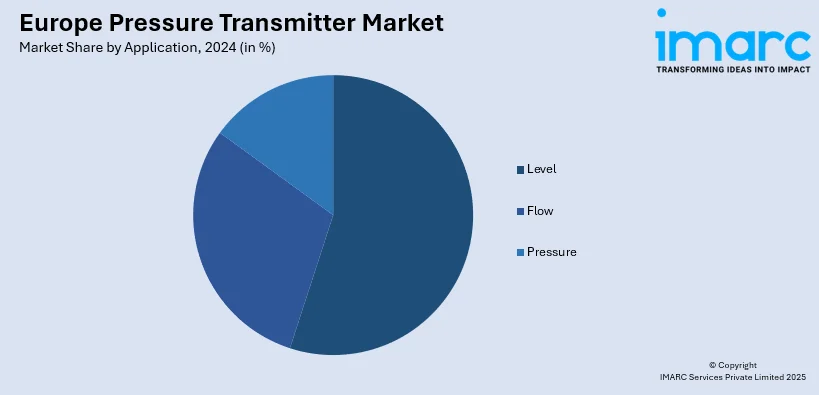

Analysis by Application:

- Flow

- Level

- Pressure

Level pressure transmitters hold the largest share in the market due to their critical role in monitoring and controlling liquid and material levels across diverse industries. They are extensively used in wastewater treatment plants, chemical processing, food and beverage, pharmaceuticals, and oil and gas sectors, where precise level measurement is vital for safety, efficiency, and regulatory compliance. Europe’s large-scale wastewater infrastructure, alongside expanding chemical and pharmaceutical production, consistently drives demand for level transmitters. Their ability to function accurately under challenging conditions, including high pressure and temperature variations, further strengthens adoption. With industries increasingly embracing automation and digital monitoring systems, level transmitters remain essential for maintaining operational reliability, thereby securing their dominant share in the European market.

Analysis by End-Use Industry:

- Oil and Gas

- Power Generation

- Water and Wastewater

- Food and Beverages

- Chemicals

- Metals and Mining

- Pulp and Paper

- Pharmaceuticals

- Others

Oil and gas holds the largest share in the market because of the sector’s heavy reliance on accurate pressure monitoring to ensure safety, efficiency, and regulatory compliance in exploration, production, and refining processes. Pressure transmitters are essential for monitoring pipelines, storage facilities, and drilling operations, where even minor deviations can impact performance and safety. Europe’s ongoing investments in major oil and gas projects, such as Johan Sverdrup Development, Johan Castberg Field, and Martin Linge Heavy Oil & HPHT Gas Field, further drive demand for advanced transmitters. Additionally, the industry’s adoption of automation and digital monitoring systems enhances operational reliability and efficiency. Given its scale and critical requirements, oil and gas continue to dominate the European market.

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany plays a pivotal role in driving the Europe pressure transmitter market demand, supported by its strong industrial base and focus on advanced technologies. The country’s well-established chemical and pharmaceutical industries require high-precision monitoring tools to maintain efficiency, safety, and compliance with strict regulations. Germany’s extensive wastewater treatment infrastructure further boosts demand, as pressure transmitters are essential for monitoring and control in treatment plants. Additionally, the nation’s commitment to automation and digital transformation in manufacturing enhances the adoption of intelligent transmitters across sectors. Investments in energy, oil, and gas projects, along with renewable initiatives, create further opportunities for deployment. Together, these factors position Germany as a key growth hub, reinforcing its importance in shaping the overall trajectory of the market.

Competitive Landscape:

The competitive landscape of the Europe pressure transmitter market is characterized by the presence of global and regional players focusing on innovation, automation, and strategic expansion. Leading companies such as Endress+Hauser, Siemens, ABB, and Schneider Electric emphasize advanced technologies to deliver high-precision, reliable transmitters across industries. Many players are strengthening their footprint through facility expansions, mergers, and collaborations to enhance service capabilities. Rising demand from chemicals, wastewater, oil and gas, and pharmaceuticals has intensified competition, prompting firms to invest in research and development (R&D) for smarter and more efficient devices. Additionally, the adoption of AI-driven automation and digital monitoring solutions is shaping competitive dynamics, with companies differentiating themselves through technology integration, energy efficiency, and customized solutions tailored to diverse industrial needs.

The report provides a comprehensive analysis of the competitive landscape in the Europe pressure transmitter market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Trafag has unveiled its latest innovation, the 8271 CMP Pressure Transmitter, designed to offer high accuracy and durability in demanding applications. Featuring a compact, rugged construction, the transmitter is well-suited for harsh environments. For added reliability, an optional 5-fold overpressure resistance protects against pressure spikes. The transmitter utilizes a thin-film-on-steel measuring principle, ensuring excellent long-term stability and an accuracy of ±0.5% FS typ. or ±0.3% FS typ. @ 25℃, making it ideal for critical applications.

- May 2024: Schneider Electric officially opened its new smart factory in Hungary, significantly enhancing its production capacity for the European market. The facility leverages advanced digital technologies and automation to optimize production processes and improve efficiency. This expansion underscores Schneider Electric's commitment to meeting growing demand for sustainable energy solutions and strengthening its presence in Europe.

Europe Pressure Transmitter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Absolute Pressure Transmitters, Gauge Pressure Transmitters, Differential Pressure Transmitters, Multivariable Pressure Transmitters |

| Sensing Technologies Covered | Strain Gauge, Capacitive, Piezoelectric, Others |

| Fluid Types Covered | Liquid, Steam, Gas |

| Applications Covered | Flow, Level, Pressure |

| End-Use Industries Covered | Oil and Gas, Power Generation, Water and Wastewater, Food and Beverages, Chemicals, Metals and Mining, Pulp and Paper, Pharmaceuticals, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe pressure transmitter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe pressure transmitter market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe pressure transmitter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pressure transmitter market in Europe was valued at USD 866.06 Million in 2024.

The Europe pressure transmitter market is projected to exhibit a CAGR of 4.43% during 2025-2033, reaching a value of USD 1,278.83 Million by 2033.

The Europe pressure transmitter market is driven by expanding chemical exports, widespread adoption in wastewater treatment plants, and rising investments in oil and gas projects. Additional demand stems from applications in mining and pharmaceuticals, alongside growing automation and strategic manufacturing expansions that enhance efficiency and strengthen market growth across the region.

Germany currently dominates Europe pressure transmitter market due to its strong chemical and pharmaceutical industries, extensive wastewater treatment infrastructure, and advanced manufacturing practices. Growing investments in automation, energy, and industrial projects further support adoption, reinforcing Germany’s role as a key contributor to the Europe pressure transmitter market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)