Europe Printer Market Size, Share, Trends and Forecast by Type, Technology Type, Printer interface, End User and Region, 2025-2033

Europe Printer Market Outlook:

The Europe printer market size was valued at USD 13.2 Billion in 2024. The market is expected to reach USD 19.4 Billion by 2033, exhibiting a CAGR of 4.1% from 2025-2033. The market is experiencing growth driven by advancements in multifunction printing technology and increasing demand for personalized and eco-friendly solutions. Additionally, rising product adoption across industries, such as education, healthcare, and retail is also contributing to the market revenue.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.2 Billion |

|

Market Forecast in 2033

|

USD 19.4 Billion |

| Market Growth Rate 2025-2033 | 4.1% |

The growth of the printer market in Europe is propelled by the continuous advancements in printing technology, which are meeting the rising demand for high-speed, high-resolution printers across various sectors. The businesses are highly adopting multifunction printers that combine printing, scanning, and copying capabilities, reducing operational costs, and improving efficiency. The demand is further amplified by the growing need for customized printing solutions in industries like advertising, packaging, and retail, where branding and personalization play critical roles. Additionally, the shift towards eco-friendly printing solutions which is driven by stricter environmental regulations, has led to raised investments in energy-efficient and sustainable printers, contributing significantly to market expansion. For example, in May 2024, Mutoh’s HydrAton 1642 Printer, featuring innovative water-based UV printing technology, revolutionary print-dry processes, and unique ink film formation which emphasizes sustainability and safer printing environments.

.webp)

The propelling digitization across industries, which has heightened the demand for high-quality printers for documentation and record-keeping purposes. In sectors like education, healthcare, and banking, the requirement for reliable and secure printing solutions is continuing to grow, especially for sensitive or regulated documents. Moreover, the rise of small and medium-sized enterprises (SMEs) in Europe has boosted the adoption of affordable and compact printing devices tailored to their needs. Improved distribution networks and competitive pricing strategies by key players are making these printers highly accessible to businesses of all sizes. The combined innovative leasing models and subscription-based services is creating a robust demand for printers across the European market.

Europe Printer Trends:

Shift Towards Multifunctional and Compact Printers

The Europe printer market is experiencing a growing trend toward multifunctional and compact printing devices. For example, Fujifilm’s Apeos series A3 multifunction printers launched in April 2024 across Europe are offering superior productivity, security, and sustainability, catering to hybrid work needs with advanced digital transformation features. Furthermore, businesses are intensely investing in all-in-one printers that offer printing, scanning, copying, and faxing capabilities in a single unit. This trend is especially prominent among SMEs seeking to optimize office space and reduce equipment costs. Compact designs are also appealing to home office setups, driven by remote work adoption. Manufacturers are responding by offering devices with advanced connectivity options like Wi-Fi and cloud integration, making them suitable for both professional and personal use. Enhanced functionality combined with user-friendly interfaces is making multifunctional printers a preferred choice across various sectors, including retail, healthcare, and education.

Rising Demand for Sustainable and Eco-Friendly Printing

Environmental sustainability is supporting the Europe printer market growth, driven by increasing regulations and consumer awareness. Businesses are prioritizing energy-efficient printers and devices that use eco-friendly materials and consumables, such as recycled cartridges and waterless inks. The growing trend toward reducing carbon footprints has led manufacturers to develop products with lower energy consumption and minimal waste generation. Features like duplex printing and toner-saving modes are gaining traction as they align with sustainability goals. Additionally, programs for cartridge recycling and extended equipment lifecycles are gaining popularity. These innovations are not only addressing regulatory compliance but also enhancing brand image, making eco-conscious printing solutions a critical driver in the market's evolution.

Integration of Advanced Printing Technologies

Technological advancements are transforming the Europe printer market with innovations such as 3D printing, high-speed inkjet, and precision laser technologies. For instance, in November 2024, EOS unveiled the P3 NEXT, a compact, industrial SLS 3D printer offering 50% productivity gains, 30% cost reductions, and advanced materials like PA 2220 and ALM PA 950. Moreover, industries like automotive, healthcare, and packaging are adopting these advanced solutions to meet specific needs, such as prototyping, custom manufacturing, and high-quality imaging. The integration of artificial intelligence (AI) and the Internet of Things (IoT) in printers is enabling predictive maintenance, real-time monitoring, and improved operational efficiency. Additionally, wireless, and mobile printing capabilities are becoming standard, addressing the demand for seamless connectivity in dynamic work environments. This focus on innovation is improving the functional value of printers and widening their application scope which is contributing to the Europe printer market share.

Europe Printer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe printer market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on printer type, technology type, printer interface, and end user.

Analysis by Printer Type:

- Multi-Functional

- Standalone

Multi-functional printers are widely preferred in Europe due to their ability to combine printing, scanning, copying, and faxing in a single device. They help business users to save costs on equipment and maximise the use of available office space. These machines often feature wireless fidelity (Wi-Fi) and have the ability to work in line with cloud solutions, providing ideal solutions for dynamic, connected workspaces.

Standalone printers serve specific needs by offering dedicated high-quality printing without additional features. They are commonly used in applications like photo printing and industrial tasks requiring consistent performance. Their affordability and simplicity make them suitable for households, small businesses, and industries that prioritize straightforward and reliable printing solutions.

Analysis by Technology Type:

- Dot Matrix Printer

- Inkjet Printer

- LED Printer

- Thermal Printer

- Laser Printer

Dot matrix printer employs impact-based printing technology using pins and ribbons, ideal for continuous forms and carbon copies, ensuring durability and reliability for industrial and banking applications requiring multipart document creation.

The inkjet printer uses nozzles for spraying liquid ink in highly precise manners, making high-resolution outputs of images and text, which is great for creative industries, home users, and small businesses.

LED printer uses the light-emitting diodes to transfer an image onto a drum. This results in energy efficiency, compact design, and dependable performance for high-speed office printing with minimal moving parts.

Thermal printer uses heat-sensitive mechanisms to print and is excellent at producing receipts, labels, and barcodes, making it indispensable for retail, logistics, and healthcare sectors that require fast, clear outputs.

The laser printer relies on laser technology in projecting images onto a photosensitive drum to produce high-speed, cost-effective, and sharp printing for large-scale office tasks and professional documentation.

Analysis by Printer Interface:

- Wired

- Wireless

Wired printers connect to devices via USB, Ethernet, or parallel ports, offering stable and reliable connections. They are ideal for environments requiring secure, uninterrupted printing, such as offices and industrial setups, and are less prone to interference compared to wireless alternatives, ensuring consistent performance for high-volume printing tasks.

Wireless printers use technologies like Wi-Fi, Bluetooth, or NFC to connect devices without physical cables. They help in giving flexibility and convenience in dynamic environments that support mobile printing and multiple users. These are ideal for home and office settings as they get rid of cluttered cabling and make it seamless with smart devices.

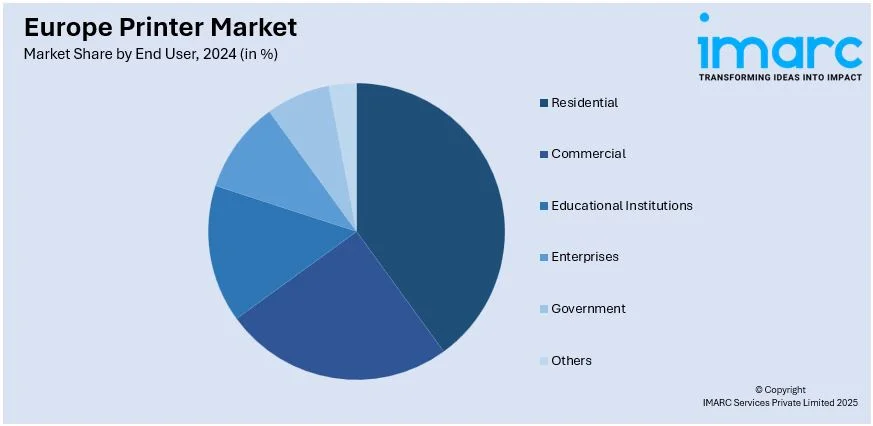

Analysis by End User:

- Residential

- Commercial

- Educational Institutions

- Enterprises

- Government

- Others

Residential users prefer compact, affordable printers for personal use, focusing on basic document printing, photo printing, and occasional creative projects, often requiring wireless connectivity for convenience.

Commercial users demand robust printers with multifunction capabilities to handle high-volume printing needs in industries like retail, advertising, and hospitality, emphasizing cost-efficiency and reliability.

Educational institutions use printers for administrative tasks, student assignments, and teaching materials, prioritizing cost-effectiveness, high-speed output, and durability to meet frequent and varied printing requirements.

Enterprises rely on high-performance printers for large-scale document production, emphasizing speed, security, and advanced connectivity features to streamline workflow in dynamic, multi-user office environments.

Government offices require secure and reliable printers for critical documentation, including legal, administrative, and identity-related printing, often emphasizing compliance with regulatory standards and long-term cost efficiency.

Others category includes healthcare and logistics sectors that demand specialized printers, such as label or barcode printers, to address unique operational requirements like patient records or inventory management.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany plays a significant role in the Europe printer market, due to its developed manufacturing base and high demand for industrial and commercial printing solutions, including 3D printing technologies in automotive and healthcare industries.

France printer market has grown on the back of high adoption in education, government, and creative industries with increasing investments in inkjet and multifunction printers.

The UK printer market benefits from strong demand from the SME and retail sectors, while interest in cloud-enabled, energy-efficient printers in support of hybrid work and e-commerce growth continues to increase.

Italy's printer market remains highly focused on affordability and multifunctionality, with sales largely to small businesses and home offices, and increasing demand for eco-friendly printers that align with national goals on sustainability.

The growth in Spanish markets is due to rapidly developing digital transformation initiatives, growing the demand for high-class printing technologies in advertising and design, as well as in logistics.

The growth perspective for emerging European markets results from the adoption of advanced technology, growing e-commerce, and increasing demand for efficient solutions for printing in smaller economies, for instance, Poland and the Netherlands.

Competitive Landscape:

The Europe printer market exhibits dynamic evolution, primarily from the basis of technological influences, industry-specific requirements, and growing attention towards sustainability. Market segments like commercial printing, packaging, publishing, as well as specialty applications-are influenced by the emergence of innovations in digital printing technologies as well as new developments in offset printing. The demand for high-quality, customized print solutions is growing in e-commerce, retail, and advertising sectors, as precision and adaptability become increasingly important. Manufacturers are focusing on sustainability initiatives are changing the face of the industry, as businesses embrace eco-friendly inks, energy-efficient processes, and recyclable materials to meet regulatory and consumer expectations. Moreover, the revival of traditional print media and the integration of digital solutions, such as augmented reality in print, clearly show the region's commitment to marrying tradition with innovation.

The report provides a comprehensive analysis of the competitive landscape in the Europe printer market with detailed profiles of all major companies.

Latest News and Developments:

- April 2024: Fujifilm Europe announced the launch of its Apeos series of multifunction office printers in the European market, marking their debut outside the Asia Pacific region. These printers are built on Fujifilm's extensive expertise in print technology and are aimed at supporting businesses in adapting to the evolving office environment.

- May 2024: Heidelberg introduced the Jetfire range, uniting offset and digital printing in a single system. Featuring Canon’s inkjet technology and Prinect Touch Free automation, it enhances efficiency, flexibility, and productivity for commercial print providers.

- October 2024: Canon launched the imageFORCE C7165, a new multifunction printer designed for business environments. This printer utilizes Canon's imageFORCE technology platform, which incorporates Machine Learning AI to improve security, reliability, and print quality. The printer offers a resolution of 4800dpi and utilizes Canon’s Security Environment Estimation Technology to recommend optimal security settings and detect network changes in real time, minimizing vulnerabilities. It also employs machine learning for predictive maintenance, allowing it to forecast part lifespans and alert users to potential failures, thus reducing downtime.

- October 2024: Ricoh Company, Ltd. announced the establishment of Ricoh Printing Solutions Europe Limited (RPSE), which will be headquartered in Telford, UK, and is set to begin operations in April 2025. This new company aims to oversee Ricoh's industrial printing business in Europe by consolidating key functions such as sales, engineering support, and evaluation of industrial inkjet printing technologies, including textile printers and inkjet heads.

- October 2024: SATO Holdings Corporation introduced its LR4NX series print and apply labeling machines in Europe, targeting high-volume labeling operations in sectors like food production, manufacturing, and e-commerce. The machines will be available in 38 countries, including key markets such as the UK, France, Germany, and Italy, on a made-to-order basis.

- November 2024: Toshiba introduced the BX410T, an industrial label printer aimed to enhance productivity and facilitate integration in complex business environments. It combines real-time and Linux operating systems for improved performance, along with long-lasting print heads and ribbon-saving technology reduce total cost of ownership.

Europe Printer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Printer Types Covered | Multi-Functional, Standalone |

| Technology Types Covered | Dot Matrix Printer, Inkjet Printer, LED Printer, Thermal Printer, Laser Printer |

| Printer Interfaces Covered | Wired, Wireless |

| End Users Covered | Residential, Commercial, Educational Institutions, Enterprises, Government, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe printer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe printer market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe printer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The printer market in Europe was valued at USD 13.2 Billion in 2024.

The market in Europe is primarily driven by the advancements in multifunctional and eco-friendly printers, rising demand for personalized printing in advertising and packaging, increasing adoption by SMEs, and technological innovations such as 3D printing and IoT integration, catering to diverse industries such as healthcare, education, and retail.

IMARC estimates the printer market to exhibit a CAGR of 4.1% during 2025-2033, reaching a value of USD 19.4 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)