Europe PVC Pipes Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Europe PVC Pipes Market Size and Share:

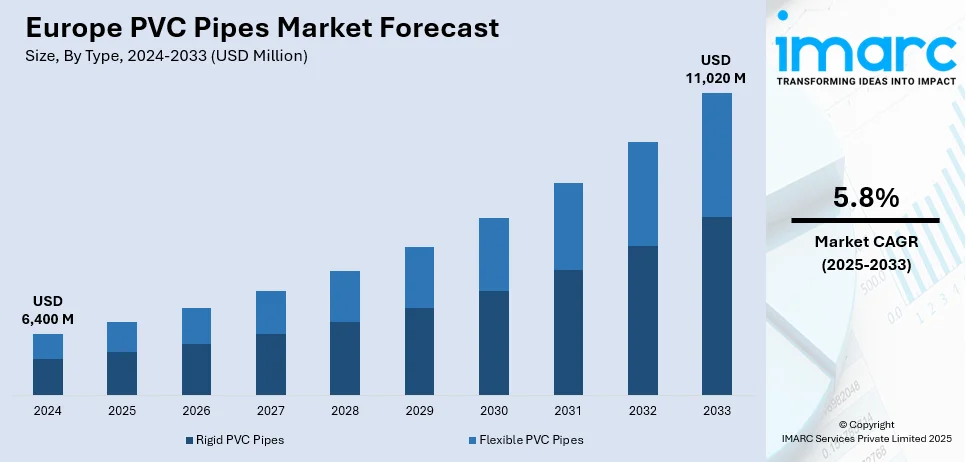

The Europe PVC pipes market size was valued at 6.86 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 9.6 Million Tons by 2033, exhibiting a CAGR of 3.7% from 2025-2033. The increasing number of infrastructure projects, a growing need for durable and cost-effective piping solutions, and widespread adoption in water supply, sewage, and irrigation systems is bolstering the market growth. Furthermore, government investments in housing and urban development projects continue to catalyze the demand for PVC pipes across the region. Technological advancements in manufacturing, enhanced chemical resistance, and environmental benefits like lower carbon emissions further contribute in the expansion of the Europe PVC pipes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 6.86 Million Tons |

| Market Forecast in 2033 | 9.6 Million Tons |

| Market Growth Rate 2025-2033 | 3.7% |

There is a continuous need to modernize old water supply and sanitation systems throughout the European region. This necessitates using materials for piping that are resilient, effective, and compatible with modern engineering standards. PVC pipes fulfill these criteria, making them a favored option in numerous infrastructure enhancements, such as water distribution, sewage, and drainage systems. Furthermore, many governing authorities and regulatory agencies in Europe are emphasizing the importance of minimizing the environmental impact of building materials. PVC pipes are recyclable and energy-efficient in their production, conforming to sustainability requirements. Utilizing them aids in lowering total emissions and reinforces wider environmental policy aims.

In addition, PVC pipes provide a beneficial equilibrium between cost and efficiency. They possess an extended operational lifespan, withstand chemical and physical damage, and need little upkeep. This renders them financially appealing throughout their lifetime, particularly when compared to other materials that could involve greater installation or repair expenses. Apart from this, ongoing advancements in PVC pipe formulations and production methods are boosting product dependability. Innovative techniques enhance pressure durability, adaptability, and joint strength, allowing the pipes to satisfy elevated technical standards. This expands their variety of industrial and municipal uses, catalyzing the Europe PVC pipes market demand in various sectors.

Europe PVC Pipes Market Trends:

Rising Construction Activities

The expansion of the construction sector, fueled by widespread infrastructure projects in residential, commercial, and industrial areas, is driving the need for PVC pipes in Europe. Authorities and private entities are investing heavily in the construction of roads, bridges, tunnels, housing developments, and utility systems, all of which necessitate strong and effective piping solutions. The European Investment Bank (EIB) directs about 20–30% of its yearly lending to initiatives focused on developing resilient cities, increasing access to social and affordable housing, and enhancing sustainable urban services, which, in turn, indirectly catalyzes the demand for construction-grade materials like PVC pipes. These pipes are extensively utilized in plumbing, drainage, and water supply systems because of their significant benefits, including affordability, simplicity in handling and installation, and a prolonged service life with robust resistance to corrosion and chemical degradation. Their lightweight characteristics and versatility make them appropriate for underground utilities, sewage systems, and stormwater control. With an increasing number of European nations dedicated to enhancing and broadening their infrastructure, the need for durable and dependable materials is growing, making PVC pipes a favored option. Their adaptability in uses spanning from irrigation to intricate construction endeavors further enhances their contribution to Europe's changing infrastructure scene. This strong momentum is expected to positively influence the Europe PVC pipes market forecast in the coming years.

Emerging Technological Advancements

Innovations in PVC pipe production are significantly influencing the product landscape by creating pipes with enhanced performance features. Modern PVC pipes provide superior pressure-resistance, increased flexibility, and enhanced chemical durability, making them highly suitable for a variety of demanding applications in construction and infrastructure development. These advancements are resulting in quicker and simpler installations, conserving time and labor on job sites. Additionally, the implementation of state-of-the-art manufacturing methods, including advanced extrusion technologies, real-time quality control, and automation, are greatly enhancing production efficiency. These advancements are simplifying the production process, minimized material waste, and improved product consistency and dependability. The advantages go beyond the factory floor, which include decreased energy use, improved material efficiency, and reduced emissions support sustainable manufacturing. Research indicates that PVC pipes can last over 100 years and require 2.4 times less energy throughout their life span compared to ductile iron pipes. Moreover, their carbon footprint is 45% less than that of reinforced concrete and they release 35% fewer greenhouse gases compared to ductile iron, emphasizing their ecological benefits. These efficiency improvements not only reduce production expenses but also allow manufacturers to provide competitively priced items, further offering a favorable Europe PVC pipes market outlook.

Europe PVC Pipes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe PVC pipes market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Rigid PVC Pipes

- Flexible PVC Pipes

Rigid PVC pipes represent the largest segment because of their robustness, longevity, and extensive use in critical infrastructure systems. These pipes are recognized for their outstanding durability against corrosion, chemicals, and physical stress, making them ideal for pressure-related uses like water supply, irrigation, sewage, and industrial fluid transportation. Their structural strength enables stable underground installation without distortion, which is essential for extensive public and private sector projects. Furthermore, rigid PVC pipes provide an extended service life with little maintenance, resulting in reduced lifecycle expenses. They can be easily transported, cut, and connected with standard fittings, which accelerates project schedules and lowers labor costs. The focus on utilizing safe and dependable materials in construction is bolstering their market stance. With the increasing demand for long-lasting, easy-to-maintain, and affordable piping options across various industries, rigid PVC pipes remain a top choice in the market. This continued preference is expected to play a central role in driving the Europe PVC pipes market.

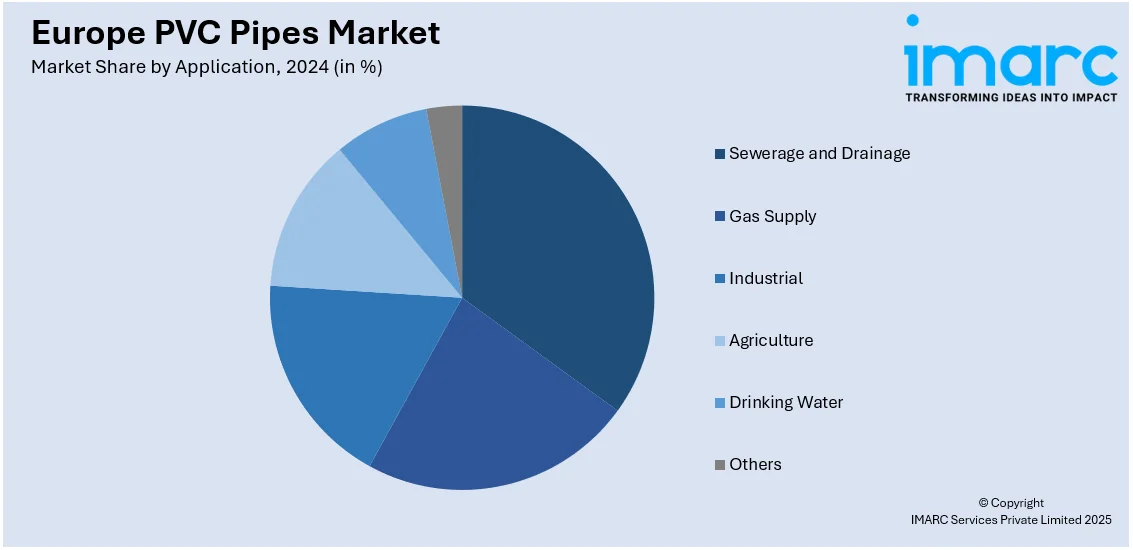

Analysis by Application:

- Sewerage and Drainage

- Gas Supply

- Industrial

- Agriculture

- Drinking Water

- Others

Sewage and drainage dominate the market, driven by rising population density and ongoing improvements in public sanitation systems. Municipal and residential developments throughout the region need dependable, durable piping systems that can manage significant quantities of wastewater and stormwater. PVC pipes are commonly favored for these uses due to their outstanding resistance to corrosion, chemical deterioration, and root invasion, which are frequent problems in underground sewer systems. Their light weight and simple installation also decrease construction duration and labor expenses, making them a cost-effective option for extensive drainage projects. Moreover, strict environmental laws throughout Europe require the adoption of materials that facilitate sustainable water management techniques. PVC pipes fulfill these criteria by providing an extended lifespan with little upkeep. The strength, structural reliability, and economical nature of PVC piping systems render them particularly ideal for extensive application in sewage and drainage systems.

Regional Analysis:

- Germany

- Italy

- United Kingdom

- Spain

- France

- Others

Germany leads the market owing to its strong infrastructure growth, superior manufacturing abilities, and stringent regulatory frameworks. In 2025, Germany announced a €500 billion infrastructure fund to modernize sectors like energy, transport, and digitalization, while promoting climate neutrality by 2045. The robust construction industry consistently requires reliable and efficient piping solutions, resulting in PVC pipes being a favored option because of their affordability, corrosion resistance, and extended lifespan. Government programs aimed at upgrading water supply, wastewater management, and drainage systems are further supporting the overall Europe PVC pipes market growth. Germany's rigorous environmental regulations encourage the use of recyclable and energy-efficient materials, which aligns closely with PVC's properties. Moreover, the involvement of top industry stakeholders and ongoing investment in research operations improve both product innovation and quality. Germany additionally enjoys a capable logistics and distribution network, facilitating prompt delivery throughout regions. The combination of intelligent manufacturing methods and quality assurance systems guarantees uniformity in product standards.

Competitive Landscape:

Major participants in the market are concentrating on increasing their production capacities and improving the quality of their products via process innovations and enhancements in materials. Many companies are investing in sustainable manufacturing methods to comply with environmental regulations and satisfy the increasing demand for environment-friendly building materials. Strategic partnerships, mergers, and acquisitions are sought to enhance regional distribution systems and boost market presence. Businesses are also focusing on product diversification by creating specialized PVC pipe variations for different end-use sectors. For instance, in 2024, PVC4Pipes sponsored two key studies presented at the PVC 2024 Conference in Edinburgh (April 15–18), which focused on the suitability of PVC pipes for hydrogen transport and on extending the durability of PVC-U pipes to over 100 years. The research highlighted PVC's potential role in Europe's hydrogen strategy and its long-term infrastructure reliability.

The report provides a comprehensive analysis of the competitive landscape in the Europe PVC pipes market with detailed profiles of all major companies, including:

- BASF SE

- Benvic Group

- Covestro AG

- Ercros S.A.

- Formosa Plastics Corporation

- Industrie Generali S.P.A

- INEOS

- KEM ONE

- Lukoil

- Oltchim SA

- Orbia

- Vynova

Latest News and Developments:

- February 2025: Welspun Corp. established a wholly-owned subsidiary, Welspun Europe S.A., in Spain to enhance its export operations across various product lines. This new entity will reportedly focus on trading materials such as pig iron and crude iron, as well as a range of fluid transport systems, including PVC-O conduits, ductile iron conduits, carbon steel conduits, stainless steel pipes, and water storage tanks.

- February 2025: Italian company Plastitalia joined TEPPFA, the European association for plastic pipe manufacturers. The partnership highlights Plastitalia’s commitment to quality, innovation, and sustainability in polyethylene fittings. TEPPFA welcomed the move, noting Italy's importance in Europe's plastic pipe industry and Plastitalia’s global presence across five continents.

- December 2024: Industrie Polieco acquired the smooth PVC and polyethylene pipe production operations of Picenum Plast. This move expanded Polieco's portfolio in potable water and gas distribution pipes.

- December 2024: TeraPlast Group acquired Wavin Hungary’s assets in PVC and PE pipe production. The acquisition, valued at EUR 7.04 million, positioned TeraPlast for market leadership in Hungary and enhanced its footprint across Europe, targeting markets like Slovakia, Austria, and Germany.

Europe PVC Pipes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, Million Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Rigid PVC Pipes, Flexible PVC Pipes |

| Applications Covered | Sewerage and Drainage, Gas Supply, Industrial, Agriculture, Drinking Water, Others |

| Countries Covered | Germany, Italy, United Kingdom, Spain, France, Others |

| Companies Covered | BASF SE, Benvic Group, Covestro AG, Ercros S.A., Formosa Plastics Corporation, Industrie Generali S.P.A, INEOS, KEM ONE, Lukoil, Oltchim SA, Orbia, Vynova, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe PVC pipes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe PVC pipes market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe PVC pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The PVC pipes market in the Europe was valued at 6.86 Million Tons in 2024.

The Europe PVC pipes market is projected to exhibit a CAGR of 3.7% during 2025-2033, reaching a value of 9.6 Million Tons by 2033.

The Europe PVC pipes market is driven by infrastructure upgrades, strict environmental regulations, growth in construction, and agricultural water management needs. Demand is rising due to PVC’s cost-effectiveness, durability, and recyclability. Technological advancements in pipe manufacturing and wider adoption in heating and fluid distribution systems also support market growth across multiple sectors.

Rigid PVC pipes represent the largest segment owing to their high strength, chemical resistance, affordability, and suitability for pressure applications.

Sewage and drainage lead the market accredited to extensive infrastructure development, rising urbanization, and the material’s resistance to corrosion and chemicals.

Germany dominates the market because of its advanced construction sector, strong manufacturing base, strict quality standards, and high infrastructure investment levels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)