Europe Radiation-Hardened Electronics Market Size, Share, Trends and Forecast by Product Type, Material Type, Technique, Component Type, Application, and Country, 2025-2033

Europe Radiation-Hardened Electronics Market Size and Share:

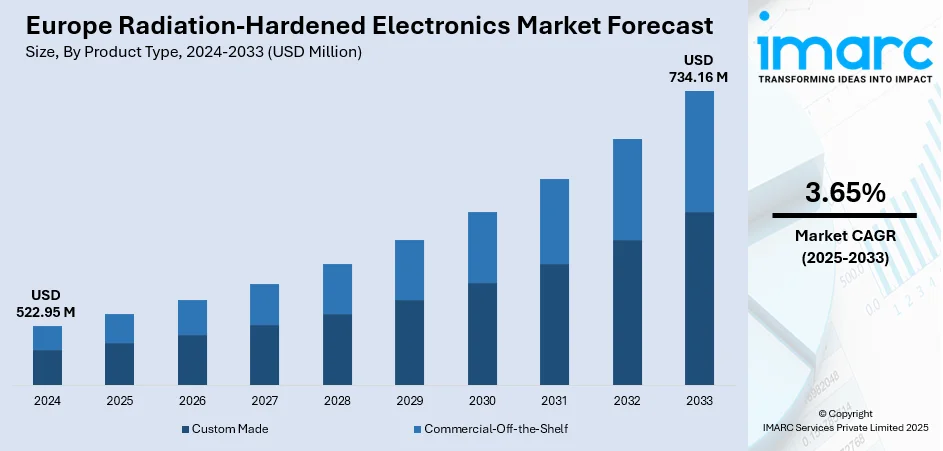

The Europe radiation-hardened electronics market size was valued at USD 522.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 734.16 Million by 2033, exhibiting a CAGR of 3.65% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. Its advanced manufacturing capabilities, strong defense infrastructure, and commitment to innovation contribute to its leadership. These strengths position Germany at the forefront, maintaining the highest Europe radiation-hardened electronics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 522.95 Million |

|

Market Forecast in 2033

|

USD 734.16 Million |

| Market Growth Rate 2025-2033 | 3.65% |

The market is being driven by increasing investments in space exploration and satellite deployment. European countries, particularly France, Germany, and the United Kingdom, are expanding their space programs and collaborating with agencies like the European Space Agency (ESA). These missions require radiation-hardened components to ensure equipment reliability in harsh space environments. In 2024, Europe’s investment in NewSpace companies surged to €1.5 Billion, marking a 56% year-over-year increase. Nearly 40% of this funding targeted space ventures with security applications, reflecting growing strategic priorities. Public institutions play a crucial role in Europe’s space sector funding, contributing nearly 80% of capital through direct or mixed investments alongside private investors. Additionally, the rising number of commercial satellite launches for communication, earth observation, and navigation applications is fueling demand for durable and radiation-resistant electronics. The defense sector also plays a critical role, with growing budgets allocated toward upgrading military equipment such as drones, missiles, and surveillance systems that must operate in high-radiation zones, thereby supporting market expansion.

To get more information on this market, Request Sample

Technological advancements in semiconductor manufacturing are also significantly driving the Europe radiation-hardened electronics market growth. Using cutting-edge materials and fabrication processes, businesses are creating radiation-hardened components that are more effective, small, and affordable. These developments are improving the functionality of systems used in defense, nuclear, and aerospace applications. The need for strong, secure hardware has also grown as a result of growing worries about cybersecurity and electronic warfare, which has accelerated the use of radiation-hardened electronics. Europe's position in the global radiation-hardened electronics market is being strengthened by government initiatives that support local manufacturing and research and development, as well as growing partnerships between space-tech companies and defense contractors.

Europe Radiation-Hardened Electronics Market Trends:

Strategic Space Investments and Satellite Programs

One of the most significant Europe radiation-hardened electronics market trends is increased public investment in space exploration and related technologies. The European Union has prioritized space innovation under its Horizon Europe initiative, allocating EUR 76 million to 28 space research projects in November 2024, with one-third of participants being SMEs or start-ups. These investments highlight a commitment to fostering innovation and enhancing the EU's competitive edge in space. Moreover, the increasing deployment of commercial satellites across Europe and Russia is elevating the demand for reliable electronics capable of withstanding high-radiation environments. Initiatives such as ESA’s Ariane 6 launch in July 2024 further strengthen Europe’s independent space capabilities, creating long-term demand for advanced, radiation-hardened components.

Technological Advancements in Radiation-Tolerant Components Driving Innovation

The adoption of technologically advanced products across aerospace and defense sectors is driving innovation and creating a robust Europe radiation-hardened electronics market outlook. Manufacturers are focusing on improving the radiation tolerance of optical fibers and fiber-based devices to extend the durability and reliability of electronics in severe environmental conditions. These improvements are essential for mission-critical applications in space and nuclear operations. The development of modular, re-ignitable upper stages in launch vehicles and the miniaturization of satellite systems necessitate compact, high-performance electronics. As part of a long-term strategy, the EU has committed EUR 1.9 billion over seven years to fund space-related R&D, which will further accelerate innovation. These developments underscore a broader trend toward building more resilient and efficient radiation-hardened technologies.

Europe Radiation-Hardened Electronics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe radiation-hardened electronics market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, material type, technique, component type, and application.

Analysis by Product Type:

- Custom Made

- Commercial-Off-the-Shelf

Custom-made radiation-hardened electronics play a vital role in Europe’s space and defense sectors due to their ability to meet highly specific and mission-critical requirements. These components are developed to endure extreme environmental conditions and ensure reliable performance in high-radiation zones, making them ideal for deep-space missions, military satellites, and strategic communication systems. The increasing complexity of European space programs and the growing emphasis on technological self-sufficiency are encouraging the use of custom solutions. These products offer tailored functionality, longer operational lifespans, and enhanced durability, which are crucial for applications where failure is not an option, thereby solidifying their importance in the market.

Commercial-Off-the-Shelf (COTS) components are becoming increasingly prominent in the European radiation-hardened electronics market due to their affordability, ease of integration, and shorter development cycles. These ready-made solutions are especially attractive for commercial satellite operators and research institutions seeking cost-effective alternatives for short-term or low-risk missions. Improvements in radiation tolerance and screening processes have made many COTS components viable for space use, especially in low-earth orbits and experimental missions. The trend toward miniaturized satellites and modular platforms further supports COTS adoption, as they allow faster deployment and innovation, helping meet the growing demand for accessible and scalable space technologies in Europe.

Analysis by Material Type:

- Silicon

- Silicon Carbide

- Gallium Nitride

- Others

Silicon remains the most widely used material in the Europe radiation-hardened electronics market due to its maturity, proven reliability, and cost-efficiency. Its established manufacturing infrastructure and compatibility with existing processes make it the default choice for many space and defense applications. Silicon-based components offer balanced performance across power consumption, processing speed, and radiation tolerance, making them suitable for a wide range of satellite systems and aerospace electronics. European companies continue to invest in refining silicon-based technologies to improve their resistance to radiation and extend mission lifespans. As demand for reliable electronics in mid-range performance applications grows, silicon continues to serve as a foundational material driving market development.

Silicon carbide is gaining traction in the Europe radiation-hardened electronics market due to its superior thermal conductivity, high voltage resistance, and exceptional radiation tolerance. These properties make it ideal for power-intensive applications such as spacecraft propulsion systems and deep-space missions, where components must operate efficiently under high-stress conditions. European space and defense agencies are increasingly turning to silicon carbide for high-performance, energy-efficient systems that can withstand extreme environments. The push for enhanced durability and reliability in longer missions is fostering research and development efforts in silicon carbide technologies, positioning it as a key material for next-generation radiation-hardened solutions.

Gallium nitride is emerging as a transformative material in the Europe radiation-hardened electronics market, primarily driven by its high electron mobility, breakdown voltage, and resistance to radiation damage. These features make it ideal for high-frequency and high-power applications, such as satellite communication systems, radar technologies, and high-speed data processing in space. The increasing need for compact, lightweight, and power-efficient components in European space programs is accelerating the adoption of gallium nitride. Moreover, the material's suitability for advanced applications supports the growing demand for miniaturized and multifunctional electronics. As space missions become more complex and demanding, gallium nitride’s prominence in the market is expected to rise steadily.

Analysis by Technique:

- Radiation Hardening by Design (RHBD)

- Radiation Hardening by Process (RHBP)

- Radiation Hardening by Software (RHBS)

Radiation hardening by design (RHBD) leads the market share in 2024. Radiation hardening by design (RHBD) dominates the Europe radiation-hardened electronics market due to its cost-efficiency, flexibility, and ability to leverage existing commercial semiconductor processes. Unlike radiation hardening by process (RHBP), RHBD techniques do not require specialized fabrication, allowing manufacturers to modify circuit layouts and architecture at the design level to enhance radiation tolerance. This approach supports quicker development cycles and lower production costs, which are essential for the growing number of space missions led by startups and SMEs in Europe. Additionally, RHBD enables better scalability and customization, making it suitable for a wide range of satellite, defense, and aerospace applications across the region.

Analysis by Component Type:

- Power Management

- Application Specific Integrated Circuit

- Logic

- Memory

- Field-Programmable Gate Array

- Others

Power management leads the market in 2024. The power management segment dominates the Europe radiation-hardened electronics market due to its critical role in ensuring the stable and efficient operation of electronic systems in radiation-prone environments, such as space and defense. With the increasing deployment of satellites, spacecraft, and deep-space exploration missions, there is a growing need for robust power regulation, distribution, and conversion systems that can withstand high radiation levels. Radiation-hardened power management components, such as voltage regulators and power converters, are essential for protecting sensitive onboard systems. Their ability to maintain consistent performance under extreme conditions makes them indispensable in mission-critical applications, driving their prominence across the European market.

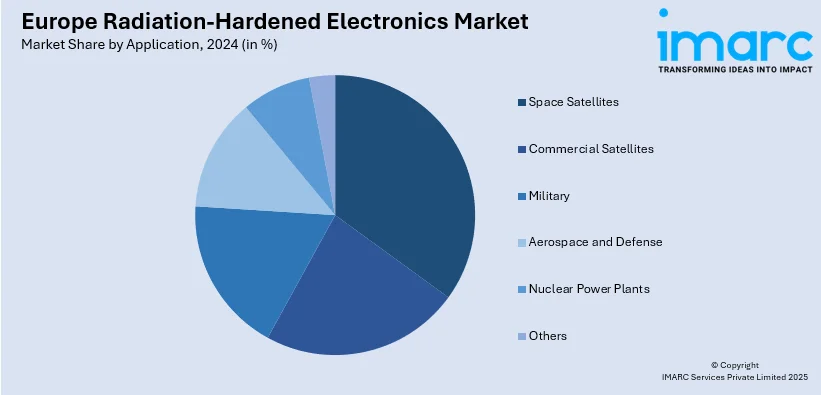

Analysis by Application:

- Space Satellites

- Commercial Satellites

- Military

- Aerospace and Defense

- Nuclear Power Plants

- Others

Space satellites lead the market in 2024. The space satellites segment dominates the Europe radiation-hardened electronics market because satellites operate in harsh space environments with high radiation levels that can damage standard electronics. Radiation-hardened components are essential to ensure the reliability and longevity of satellite systems, including communication, navigation, and Earth observation functions. Europe’s strong focus on space exploration, driven by agencies like the European Space Agency (ESA), fuels demand for advanced radiation-hardened technologies in satellite manufacturing. The growing number of commercial and government satellite launches in Europe further boosts this segment, as radiation-hardened electronics are crucial for mission success and maintaining continuous, uninterrupted satellite operations.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. Germany dominates the Europe radiation-hardened electronics market due to its advanced technological infrastructure and strong aerospace and defense industries. The country’s significant investment in research and development fosters innovation in radiation-hardened semiconductor technologies and electronic components. For instance, according to data by International Trade Administration, Germany holds the position as the third-largest aerospace and defense market in Europe, generating revenues of EUR 52 Billion (USD 56.3 Billion) in 2024. Germany is home to numerous key players and specialized manufacturers who supply critical components for space, military, and industrial applications. Additionally, its strategic collaborations with the European Space Agency and participation in major space missions enhance its leadership position. The country’s robust supply chain, skilled workforce, and government support for high-tech sectors collectively contribute to Germany’s dominant role in the European radiation-hardened electronics market.

Competitive Landscape:

The competitive landscape of the Europe radiation-hardened electronics market is characterized by a mix of established industry leaders and innovative emerging companies focusing on advanced technologies and product differentiation. Key players are investing heavily in research and development to enhance radiation tolerance, improve reliability, and reduce costs. Strategic collaborations, mergers, and acquisitions are common to expand market reach and technological capabilities. Companies emphasize customized solutions tailored to specific aerospace, defense, and industrial applications, driving innovation in materials and design techniques. The market is also seeing increased adoption of cutting-edge semiconductor technologies like silicon carbide and gallium nitride. For instance, in March 2025, Infineon Technologies expanded its radiation-tolerant power MOSFET portfolio for space applications by introducing the first P-channel device, designed for Low-Earth-Orbit missions. These cost-effective MOSFETs feature plastic packaging, enabling higher production volumes and faster deployment for satellite constellations lasting two to five years. Qualified under AEC-Q101 standards, they offer robust radiation tolerance and operate between -55 °C to 175 °C. Overall, the Europe radiation-hardened electronics market forecast projects steady growth driven by rising demand in space exploration and defense sectors, fostering intense competition and technological advancement.

The report provides a comprehensive analysis of the competitive landscape in the Europe radiation-hardened electronics market with detailed profiles of all major companies.

Latest News and Developments:

-

May 2025: Infineon Technologies launched radiation-hardened GaN HEMT transistors for space applications, built on CoolGaN technology and certified to JANS MIL-PRF-19500/794 standards. These 100 V, 52 A devices offer low RDS(on), high TID tolerance, and SEE hardness, supporting satellites, deep space missions, and aerospace power system reliability.

- April 2025: BAE Systems partnered with NEXT Semiconductor to use its radiation-hardened NX450 ultra-wideband antenna processor units for satellite communications. The 100GHz APU supports software-defined radio architectures, enhancing reliability and reducing SWaP for LEO satellites. It’s built using 12nm FinFET tech and enables advanced, reconfigurable space payloads.

- April 2025: Frontgrade Gaisler launched its GRAIN product line with the GR801, the first radiation-hardened neuromorphic AI SoC for space. Developed with BrainChip’s Akida technology and support from SNSA and KTH, the chip enables energy-efficient, autonomous space missions with real-time data processing and enhanced AI capabilities.

- December 2024: Frontgrade Gaisler began leading an ESA-backed initiative to develop radiation-hardened semiconductor technologies using Ultra Deep Sub-Micron nodes as advanced as 7nm. The project aims to enhance Europe’s space sovereignty by creating high-performance, radiation-tolerant microprocessors and IP cores for next-generation satellites, AI computing, and deep-space missions.

- November 2024: NanoXplore acquired the ASIC division of Dolphin Design to expand its footprint in the defense sector. Known for its radiation-hardened FPGAs for aerospace, NanoXplore aims to strengthen its R&D, diversify offerings, and support European semiconductor sovereignty through enhanced high-reliability electronics capabilities and a new Grenoble office.

- October 2024: BAE Systems released the RAD510 Software Development Unit, supporting early software integration for its upcoming RAD510 radiation-hardened single-board computer. Offering triple the performance of the RAD750, the RAD510 SBC is designed for extreme space environments and will complete qualification in 2026 for critical mission use.

Europe Radiation-Hardened Electronics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Custom Made, Commercial-Off-the-Shelf products |

| Material Types Covered | Silicon, Silicon Carbide, Gallium Nitride, Others |

| Techniques Covered | Radiation Hardening by Design (RHBD), Radiation Hardening by Process (RHBP), Radiation Hardening by Software (RHBS) |

| Component Types Covered | Power Management, Application Specific Integrated Circuits, Logic, Memory, Field-Programmable Gate Arrays, Others |

| Applications Covered | Space Satellites, Commercial Satellites, Military, Aerospace and Defense, Nuclear Power Plants, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe radiation-hardened electronics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe radiation-hardened electronics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe radiation-hardened electronics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The radiation-hardened electronics market in Europe was valued at USD 522.95 Million in 2024.

The Europe radiation-hardened electronics market is projected to exhibit a CAGR of 3.65% during 2025-2033, reaching a value of USD 734.16 Million by 2033.

The market growth is driven by increasing investments in space exploration projects, rising demand for commercial and military satellites, and technological advancements improving radiation tolerance in electronic components. Additionally, government initiatives supporting independent space access and innovation in radiation-hardening techniques contribute to market expansion.

Germany holds the largest market share in Europe, supported by its strong industrial base, advanced research capabilities, and significant investments in aerospace and defense sectors. The country’s leadership in innovation and infrastructure also underpins its dominance in the regional radiation-hardened electronics market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)