Europe Renewable Energy Market Size, Share, Trends and Forecast by Type, End User, and Country, 2026-2034

Europe Renewable Energy Market Summary:

The Europe renewable energy market size was valued at USD 258.8 Billion in 2025 and is projected to reach USD 465.1 Billion by 2034, growing at a compound annual growth rate of 6.73% from 2026-2034.

The market is driven by ambitious decarbonization commitments under the European Green Deal, supportive regulatory frameworks promoting clean energy transition, declining costs of renewable technologies making them increasingly competitive with fossil fuels, and growing energy security concerns following recent geopolitical disruptions. The continent's diverse renewable resource base enables strategic deployment across regions while accelerating electrification of industrial processes and transport sectors creates sustained demand for the Europe renewable energy market share.

Key Takeaways and Insights:

- By Type: Wind power dominates the market with a share of 33.12% in 2025, driven by extensive onshore installations in favorable northern coastal geographies and accelerating offshore projects using advanced turbines and floating platforms that improved efficiency capture rates.

- By End User: Industrial leads the market with a share of 47.08% in 2025, owing to manufacturing decarbonization mandates through electrification, renewable power purchase agreements, and clean energy integration into energy intensive production processes, lowering emissions and costs significantly.

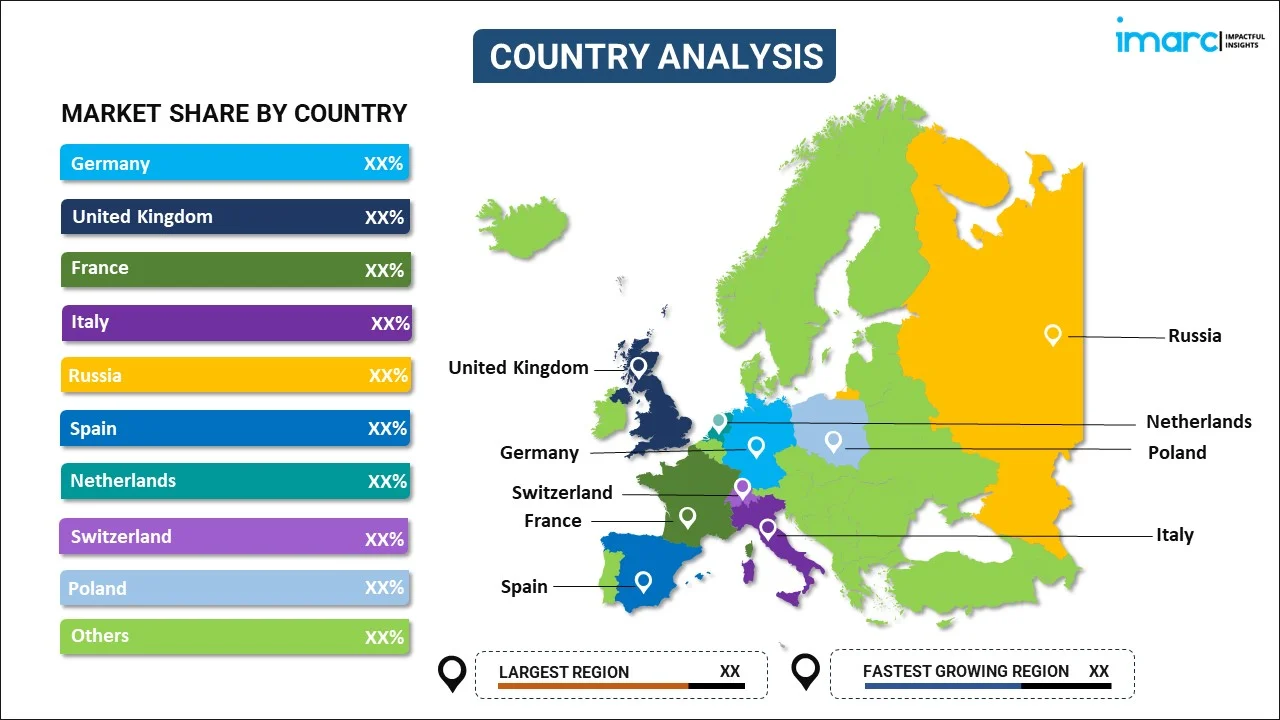

- By Country: Germany leads the market with a share of 24% in 2025, driven by aggressive wind and solar expansion targets, strong policy mechanisms including feed in tariffs, leadership in energy storage technologies, and investments in grid modernization.

- Key Players: The market shows competition, with European utilities leveraging infrastructure scale, while specialized renewable developers emphasize project expertise and innovative financing, as vertically integrated firms and independent power producers accelerate deployment.

The Europe renewable energy market reflects a fundamental transformation of the continent's power generation paradigm driven by converging forces reshaping energy systems. Stringent climate commitments targeting net-zero emissions by midcentury compel nations to rapidly phase out carbon-intensive generation while energy security imperatives following fossil fuel supply disruptions accelerate domestic renewable deployment. As per sources, Great Britain approved 45 GW of renewable projects, up 96% year-on-year, led by battery storage and offshore wind, marking record planning approvals (Cornwall Insight) nationwide data shows growth. Moreover, technological maturation has rendered wind and solar economically competitive with conventional sources eliminating historical cost barriers while regulatory frameworks provide investment certainty through long-term policy stability. Industrial electrification requirements demand reliable clean power supplies as manufacturing sectors pursue decarbonization roadmaps.

Europe Renewable Energy Market Trends:

Distributed Energy Resource Integration and Grid Decentralization

The European power system is undergoing fundamental restructuring away from centralized fossil fuel generation toward distributed renewable assets scattered across residential, commercial and industrial locations. According to reports, in Romania, prosumer capacity surged to 2.44 GW by end of January 2025 with a nearly 79% increase in prosumer installations compared to the prior year, driven by government incentives and EU funding support. Furthermore, rooftop solar installations proliferate across urban centers while community wind projects enable local ownership of generation assets redistributing economic benefits to stakeholders. Prosumer participation transforms traditional consumer roles as households both consume and produce electricity managing energy flows bidirectionally through intelligent systems.

Advanced Energy Storage Systems Enabling Renewable Integration

Battery energy storage systems have emerged as critical infrastructure enabling high renewable penetration levels by addressing intermittency challenges inherent to wind and solar generation. In October 2025, ENGIE and Sungrow completed the first 400 MWh phase of a 200 MW/800 MWh battery energy storage project in Belgium, Europe’s largest BESS, strengthening grid flexibility and renewable integration. Furthermore, lithium-ion technology costs have declined dramatically making storage economically viable for applications ranging from residential systems pairing with rooftop solar to utility-scale installations providing grid stabilization services. Duration requirements extend beyond short-term balancing with technologies like redox-flow batteries offering multi-hour storage capabilities suitable for seasonal variations.

Industrial Sector Clean Energy Transition and Electrification

Manufacturing industries pursue aggressive decarbonization strategies driven by carbon pricing mechanisms under emissions trading systems and sustainability commitments from corporate stakeholders. In September 2025, AGCO signed a 10‑year virtual power purchase agreement with Spanish renewables developer BRUC to source solar energy for its European operations, advancing its industrial decarbonization strategy. Direct electrification replaces combustion processes where technically feasible with electric arc furnaces in steelmaking and heat pumps in chemical production reducing emissions while improving efficiency. Power purchase agreements enable industrial consumers to procure renewable electricity directly from generators establishing long-term price certainty and environmental credibility supporting corporate sustainability targets.

Market Outlook 2026-2034:

The Europe renewable energy market anticipates sustained expansion throughout the forecast period driven by accelerated deployment targets under revised policy frameworks and favorable investment conditions. Revenue growth reflects both capacity additions and electricity market participation as renewable sources transition from subsidized alternatives to economically competitive mainstream options. Wind and solar installations will constitute the primary growth vectors with offshore wind particularly benefiting from dedicated development zones and streamlined permitting processes. The market generated a revenue of USD 258.8 Billion in 2025 and is projected to reach a revenue of USD 465.1 Billion by 2034, growing at a compound annual growth rate of 6.73% from 2026-2034.

Europe Renewable Energy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Wind Power |

33.12% |

|

End User |

Industrial |

47.08% |

|

Country |

Germany |

24% |

Type Insights:

To get more information on this market, Request Sample

- Hydro Power

- Wind Power

- Solar Power

- Bioenergy

- Others

Wind power dominates with a market share of 33.12% of the total Europe renewable energy market in 2025.

Wind power commands the dominant position within the market reflecting decades of consistent deployment supported by favorable wind resources across Atlantic coastal regions and North Sea offshore zones. As per sources, in November 2025, RWE completed the installation of all recyclable turbine blades at its Sofia Offshore Wind Farm in the UK, marking a major sustainability milestone and strengthening the project’s capacity to produce clean energy when fully operational. Further, onshore installations continue expanding particularly in regions with available land resources and supportive local planning frameworks while technological improvements enable repowering of existing sites with higher capacity turbines maximizing energy yield from established locations.

Floating offshore platforms unlock deeper water resources previously considered unsuitable expanding the addressable resource base significantly across maritime territories. Wind's capacity factor advantages over solar particularly during winter months when electricity demand peaks across heating-dominated markets enhance its system value proposition. Established supply chains including turbine manufacturing tower fabrication and installation vessels create deep industrial ecosystems supporting continued expansion while workforce development initiatives address skilled labor requirements ensuring sustainable growth trajectories throughout the forecast period.

End User Insights:

- Industrial

- Residential

- Commercial

Industrial leads with a share of 47.08% of the total Europe renewable energy market in 2025.

Industrial represents the preeminent end user category for renewable energy consumption driven by substantial electricity requirements for manufacturing processes and mounting pressure to decarbonize production operations aligned with corporate sustainability commitments and regulatory mandates. According to reports, nearly 19 gigawatts (GW) of new renewable capacity was contracted through power purchase agreements across Europe, with industrial and corporate buyers driving the majority of deals and expanding direct renewable procurement. Moreover, energy-intensive industries including steel production chemical manufacturing cement production and automotive assembly face particular urgency given their significant carbon footprints and exposure to emissions trading costs creating strong economic incentives for clean energy adoption through various procurement mechanisms.

Industrial facilities possess the scale and technical capabilities to implement sophisticated renewable energy strategies including on-site generation through captive solar arrays and wind turbines direct power purchase agreements with renewable developers and participation in demand response programs optimizing consumption patterns. Industrial consumers increasingly view renewable energy procurement as strategic competitive advantage rather than mere environmental compliance recognizing cost stability benefits from long-term fixed-price contracts and supply chain requirements from customers mandating low-carbon production methods.

Country Insights:

To get more information on this market, Request Sample

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

Germany dominates with a market share of 24% of the total Europe renewable energy market in 2025.

Germany maintains its position as the leading market contributor representing the largest revenue share driven by aggressive solar and wind capacity expansion targets comprehensive policy support mechanisms and technological leadership in energy storage solutions. The nation's Energiewende energy transition strategy establishes ambitious renewable deployment milestones supported by feed-in tariffs contract-for-difference schemes and streamlined permitting frameworks facilitating project development. Substantial investments in grid modernization infrastructure including transmission corridors connecting northern wind resources to southern industrial consumption centers enable higher renewable penetration levels.

Advanced manufacturing capabilities across turbine production photovoltaic systems and power electronics position Germany as technology innovation leader while research institutions collaborate with industry developing next-generation solutions. Industrial heartland concentration in regions like North Rhine-Westphalia and Baden-Württemberg creates substantial electricity demand from energy-intensive sectors pursuing decarbonization pathways through renewable procurement. Political consensus spanning major parties ensures policy continuity transcending electoral cycles providing investment certainty attracting domestic and international capital flows toward renewable infrastructure development.

Market Dynamics:

Growth Drivers:

Why is the Europe Renewable Energy Market Growing?

Stringent Climate Policy Frameworks and Decarbonization Commitments

European nations have established the world's most ambitious climate policy architecture creating powerful regulatory drivers compelling rapid renewable energy deployment across all economic sectors. In November 2025, the European Union submitted an updated nationally determined contribution (NDC) to the UN ahead of COP30, committing to reduce greenhouse gas emissions by up to 72.5% by 2035 compared with 1990 levels, reinforcing its long‑term decarbonization and renewable energy goals. The European Green Deal establishes binding net-zero emissions targets by mid-century with intermediate reduction milestones requiring transformative energy system changes. Emissions trading systems impose escalating costs on carbon-intensive generation making fossil fuel electricity increasingly uneconomic while renewable energy directives establish mandatory minimum thresholds for clean energy shares creating legal obligations.

Technological Innovation and Cost Competitiveness Achievements

Renewable energy technologies have achieved fundamental economic competitiveness with fossil fuel generation eliminating historical subsidy dependencies that constrained market growth and political support. As per sources, in December 2025, the European Commission’s Innovation Fund announced €2.9 Billion in new funding for 61 net‑zero technology projects across Europe, including renewable energy and storage innovations, reinforcing EU support for advanced clean technologies. Furthermore, wind turbine advancements including larger rotor diameters and improved aerodynamics dramatically increase energy capture while reducing per-unit costs through manufacturing economies of scale. Solar photovoltaic efficiency improvements through advanced cell architectures increase power output while manufacturing cost reductions lower installation costs.

Energy Security Imperatives and Supply Diversification Strategies

Recent geopolitical disruptions exposed Europe's vulnerability to fossil fuel import dependencies catalyzing urgent efforts to establish energy sovereignty through domestic renewable resource deployment. As per sources, in December 2025, the Council of the EU and European Parliament reached a provisional deal to phase out Russian natural gas imports by the end of 2026 for liquefied gas and autumn 2027 for pipeline gas, reinforcing strategic energy independence goals. Moreover, natural gas supply interruptions created severe economic impacts demonstrating strategic risks from reliance on external suppliers subject to political manipulation. Fossil fuel price volatility creates economic uncertainty while transferring substantial financial resources to exporting nations draining European economic capacity.

Market Restraints:

What Challenges the Europe Renewable Energy Market is Facing?

Grid Infrastructure Inadequacy and Integration Complexities

Existing electricity transmission and distribution infrastructure designed for centralized fossil fuel generation creates fundamental mismatches with distributed renewable patterns requiring bidirectional power flows. Aging grid assets lack capacity to transport renewable electricity from generation-rich regions to industrial consumption centers creating bottlenecks. Distribution network upgrades require substantial investments while technical challenges including voltage regulation and frequency stability grow more complex.

Intermittency and Variable Generation Characteristics

Wind and solar resources exhibit inherent variability dependent on weather conditions creating generation patterns misaligned with electricity demand profiles requiring balancing mechanisms. Wind generation peaks during winter overnight periods while solar concentrates in summer daylight hours creating seasonal mismatches. Weather-dependent output creates forecasting uncertainties complicating system operations. Market design challenges emerge as increasing renewable penetration creates periods of zero or negative electricity prices.

Permitting Delays and Regulatory Complexity

Renewable energy project development faces extended approval processes navigating multiple regulatory jurisdictions creating timeline uncertainties and development cost burdens. Environmental assessments examining impacts on wildlife habitats and marine ecosystems require detailed studies spanning multiple years. Local planning approvals encounter opposition from residents regarding visual impacts and noise levels. Regulatory fragmentation across European jurisdictions creates inconsistent requirements impeding standardization efficiencies.

Competitive Landscape:

The Europe renewable energy market exhibits sophisticated competitive dynamics characterized by diverse participant types spanning vertically integrated utilities traditional energy companies transitioning operations specialized renewable developers and international corporations entering attractive growth markets. Established European energy utilities leverage extensive existing infrastructure including transmission access customer relationships and operational expertise while adapting business models from centralized fossil generation toward distributed renewable portfolios. Pure-play renewable energy developers focus exclusively on clean energy projects employing specialized technical capabilities and innovative financing structures to capture market opportunities.

Recent Developments:

- In October 2025, Apple expanded renewable energy projects across Europe, including new large-scale solar and wind farms in Greece, Italy, Latvia, Poland, Romania, and Spain. These initiatives add 650 MW capacity, generating over 1 Million MWh of clean electricity by 2030, supporting Apple’s goal to match 100 percent of European customer electricity use.

Europe Renewable Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Hydro Power, Wind Power, Solar Power, Bioenergy, Others |

| End Users Covered | Industrial, Residential, Commercial |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe renewable energy market size was valued at USD 258.8 Billion in 2025.

The Europe renewable energy market is expected to grow at a compound annual growth rate of 6.73% from 2026-2034 to reach USD 465.1 Billion by 2034.

Wind power held the largest market share, driven by extensive deployment across favorable Atlantic coastal regions and North Sea offshore zones. Established supply chains, superior capacity factors during winter peak demand periods, and accelerating offshore development through floating platforms sustain wind power's leadership position.

Key factors driving the Europe renewable energy market include stringent climate policies enforcing decarbonization, technological innovations enabling cost competitiveness with fossil fuels, energy security promoting domestic deployment, industrial electrification increasing demand, and supportive regulations ensuring investment certainty.

Major challenges in the Europe renewable energy market include insufficient grid infrastructure limiting transmission from generation to consumption centers, intermittent renewable output requiring balancing, prolonged permitting processes delaying projects, and fragmented regulations across jurisdictions impeding standardization and efficient market deployment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)