Europe Rice Market Report by Product Type (Regular, Aromatic), Type (Red Rice, Arborio Rice, Black Rice, Grain Fragrance Rice, Brown Rice, Rosematta Rice, Grain Parboiled Rice, Sushi Rice, and Others), Grain Size (Long Grain, Medium Grain, Short Grain), Distribution Channel (Offline Stores, Online Stores), Application (Food, Feed, and Others), and Region 2026-2034

Market Overview:

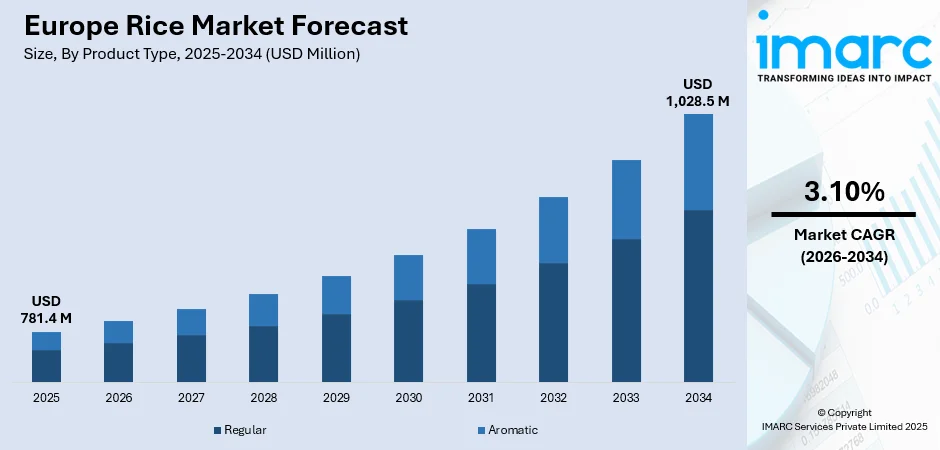

The Europe rice market size reached USD 781.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,028.5 Million by 2034, exhibiting a growth rate (CAGR) of 3.10% during 2026-2034. The rising consumption of rice as a healthier alternative to wheat across the region, and the escalating demand for exotic, premium-quality rice varieties, such as Basmati and Jasmine among the Europe populace represent some of the key factors driving the market. Moreover, the market recorded domestic rice consumption estimated at around 2.8 Million Tons. While the EU produces approximately 1.8 Million Tons, it relies on imports of about 1.2 Million Tons.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 781.4 Million |

|

Market Forecast in 2034

|

USD 1,028.5 Million |

| Market Growth Rate 2026-2034 | 3.10% |

Rice is a versatile and foundational food commodity, consumed by millions of people worldwide. It is a cereal grain that primarily comes from the two species of grass, namely Oryza sativa (Asian rice) and Oryza glaberrima (African rice). As a global dietary staple, rice provides more than one-fifth of the calories consumed worldwide by humans. As a highly adaptable crop, rice can be grown under different environmental conditions but ideally thrives in areas with high humidity and rainfall. It is distinguished into several categories, including long-grain, medium-grain, and short-grain, each with its unique texture, size, and flavor. Additionally, specialty rice types, such as Basmati, Jasmine, and Arborio, have specific culinary applications and geographical indications. Presently, the numerous applications of rice in culinary cultures, its nutritional value, and its ease of cooking are among the factors that contribute to its high global consumption. Moreover, the byproducts of rice processing, such as rice bran and husk, find applications in several industries, including the brewing, cosmetic, and biofuel industries, adding to the importance of this universal grain.

To get more information on this market Request Sample

Europe Rice Market Trends:

Rising demand for specialty and aromatic rice

Consumers across rice in Europe continue to pursue exotic and aromatic varieties, with increasing interest in Basmati and Jasmine. The Europe basmati rice market in particular is experiencing strong uptake as diners seek authentic flavors aligning with Asian and Middle Eastern culinary trends. Premium segments are expanding, driven by health-conscious individuals seeking perceived nutritional advantages and distinctive taste. Specialty rice appeals to festive, ethnic, or fine-dining applications, elevating its value and consumer appeal. Local importers and distributors are responding by securing dedicated supply chains for certified aromatic rice types, ensuring traceability. Pricing remains higher, but consumers exhibit willingness to invest for quality. Niche retailers, ethnic grocers, and high-end supermarkets are enhancing shelf space for these premium variants. This shift in preference has stimulated product innovation, such as organic aromatic offerings, reinforcing the importance of this segment within the EU rice market.

Convenience and ready-to-cook rice

Modern European lifestyles favor quick, simple meal solutions. The European rice market has seen a growing shift toward convenient and ready-to-cook rice formats—prewashed, parboiled, or in microwaveable formats. Consumers value time-saving options compatible with busy daily routines, and manufacturers are responding with packaging designed for speed and minimal preparation. This segment also caters to households seeking portion-controlled servings and consistent cooking outcomes. Retailers and private-label brands are expanding shelf offerings of these formats, promoting them as healthy fast alternatives within broader rice in Europe offerings. The move supports frozen and chilled ready-meal integration, while still positioning rice as a wholesome staple. Despite the convenience premium, consumers accept slight price elevation for ease-of-use. This evolution reflects operational efficiencies in the EU rice market, where production and packaging technologies enable scalable distribution and appeal to both households and foodservice operators.

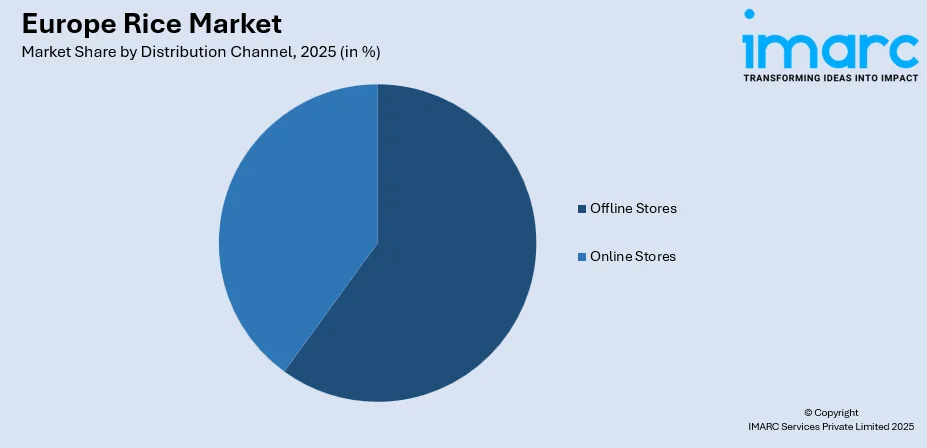

Expanding online retail channels

E-commerce is reshaping the market, with more consumers purchasing grains via online platforms both general grocery delivery services and specialty food sites. The EU rice market distribution is shifting as online storefronts offer broader variety, including exotic and bulk options not always found in physical outlets. Digital channels enable convenient comparison across producers, pricing, and certifications (organic, aromatic, fair-trade). Demand for rice in Europe through subscription boxes or meal-kit inclusion has boosted visibility and accessibility. Producers and brands are optimizing packaging and logistics for direct-to-consumer delivery, improving order fulfilment and shelf life. Online marketplaces also support targeted promotions tied to ethnic festivals, wellness trends, or limited-time offers. This trend fuels market penetration beyond metropolitan centers, bringing rice varieties to underserved regions. It also provides rich consumer data, enabling personalized marketing and stock planning—benefiting supply chain resilience in the Europe basmati rice market and broader segments.

Europe Rice Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe rice market report, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product type, type, grain size, distribution channel, and application.

Product Type Insights:

- Regular

- Aromatic

The report has provided a detailed breakup and analysis of the market based on the product type. This includes regular and aromatic.

Type Insights:

- Red Rice

- Arborio Rice

- Black Rice

- Grain Fragrance Rice

- Brown Rice

- Rosematta Rice

- Grain Parboiled Rice

- Sushi Rice

- Others

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes red rice, arborio rice, black rice, grain fragrance rice, brown rice, rosematta rice, grain parboiled rice, sushi rice, and others.

Grain Size Insights:

- Long Grain

- Medium Grain

- Short Grain

The report has provided a detailed breakup and analysis of the market based on the grain size. This includes long grain, medium grain, and short grain.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline Stores

- Online Stores

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes offline stores and online stores.

Application Insights:

- Food

- Feed

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food, feed, and others.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, United Kingdom, Italy, Spain, and Others.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Europe rice market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Europe Rice Market News:

- June 2025: The EU-funded BIOARC Project was launched to convert agricultural residues, including rice from Italy, into bio-based, fire-resistant construction materials. The initiative supports the European Green Deal and regenerative architecture goals, linking agriculture with sustainable building innovation

Europe Rice Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Regular, Aromatic |

| Types Covered | Red Rice, Arborio Rice, Black Rice, Grain Fragrance Rice, Brown Rice, Rosematta Rice, Grain Parboiled Rice, Sushi Rice, Others |

| Grain Sizes Covered | Long Grain, Medium Grain, Short Grain |

| Distribution Channels Covered | Offline Stores, Online Stores |

| Applications Covered | Food, Feed, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe rice market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe rice market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe rice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe rice market was valued at USD 781.4 Million in 2025.

The Europe rice market is projected to exhibit a CAGR of 3.10% during 2026-2034, reaching USD 1028.5 Million by 2034.

Key factors include rising consumption as a healthier alternative to wheat, increased demand for exotic premium varieties, and convenience-led formats supported by evolving distribution channels.

Italy is the largest producer of rice in Europe, accounting for nearly half of total EU output. Its fertile Po Valley supports extensive cultivation of Arborio, Carnaroli, and other varieties used in risottos, making Italy central to European rice production.

Spain consumes the most rice in Europe, largely due to its strong culinary traditions such as paella and arroz caldoso. Per-capita consumption remains higher than in northern regions, reflecting the cultural integration of rice into daily diets and festive occasions.

Valencia in Spain is often called the rice capital of Europe. Its surrounding wetlands, the Albufera region, host centuries-old rice cultivation, while the city itself is globally recognized for paella, cementing its identity as Europe’s cultural and culinary rice hub.

Basmati is the most popular rice in Europe, particularly within the Europe Basmati Rice Market, owing to its aromatic quality, long slender grains, and versatility in international cuisines. Demand is further driven by the growing popularity of Indian, Pakistani, and Middle Eastern dishes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)