Europe Sapphire Glass Market Size, Share, Trends and Forecast by Product Type, Application, and Country, 2025-2033

Europe Sapphire Glass Market Size and Share:

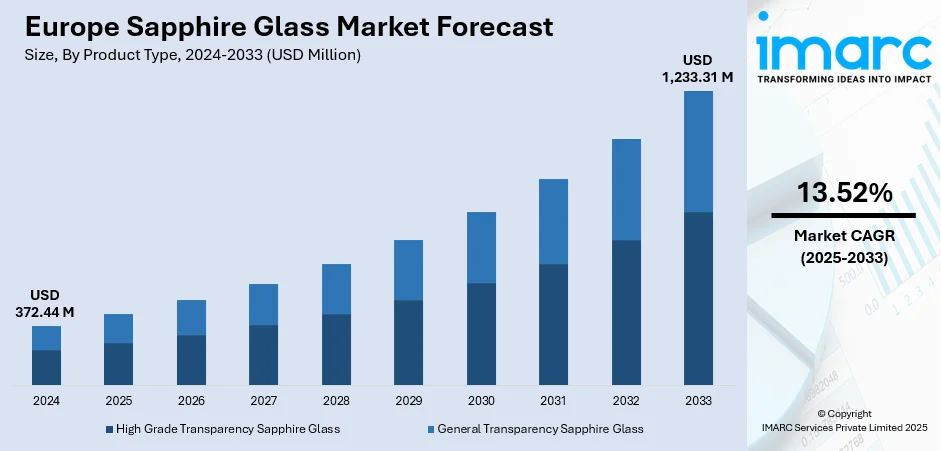

The Europe sapphire glass market size was valued at USD 372.44 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,233.31 Million by 2033, exhibiting a CAGR of 13.52% from 2025-2033. Germany currently dominates the market, driven by rising demand for durable, scratch-resistant materials in consumer electronics, particularly smartphones, tablets, and wearables. Growth in luxury watches and optical instruments further fuels adoption, as sapphire glass offers superior clarity and resilience compared to traditional glass. Increasing use in medical devices and defense applications adds momentum, supported by advancements in manufacturing technologies that reduce production costs. Additionally, Europe’s strong focus on innovation, premium product demand, and expanding electronics sector bolster Europe sapphire glass market share significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 372.44 Million |

|

Market Forecast in 2033

|

USD 1,233.31 Million |

| Market Growth Rate 2025-2033 | 13.52% |

The Europe sapphire glass market is significantly driven by increasing adoption in consumer electronics, especially smartphones, tablets, and wearables. Consumers demand premium devices with enhanced durability and scratch resistance, and sapphire glass offers superior hardness compared to conventional materials. Major tech brands are increasingly exploring sapphire glass for camera lenses, smartwatch screens, and high-end mobile displays, boosting its use across the region. With Europe’s strong appetite for advanced technology and luxury devices, the need for long-lasting, damage-resistant materials is bolstering the Europe sapphire glass market demand. This trend is further supported by rising disposable incomes and preference for premium electronic products.

To get more information on this market, Request Sample

Another key driver in the European sapphire glass market is its widespread use in luxury watches and optical instruments. Renowned European watchmakers prefer sapphire glass for its unmatched transparency, anti-reflective properties, and exceptional resistance to wear, making it ideal for high-end timepieces. The region’s strong luxury goods market, coupled with consumer demand for timeless, durable, and premium-quality products, enhances the adoption of sapphire glass. Additionally, its application in optical instruments, including lenses and scientific devices, strengthens its role across industries. The combination of Europe’s rich heritage in luxury watchmaking and technological precision fosters market growth.

Europe Sapphire Glass Market Trends:

Expanding Consumer Electronics Sector

One of the most significant drivers of the Europe sapphire glass market trend is the growing demand from the consumer electronics sector. With smartphones, tablets, wearables, and laptops becoming central to daily life, consumers increasingly seek products that combine performance with durability. Sapphire glass, known for its extreme hardness and scratch resistance, is being adopted in camera lenses, smartwatch displays, and high-end mobile devices. As European consumers show strong preferences for premium and luxury electronics, manufacturers are incorporating sapphire glass to meet expectations for longevity and style. The trend is further reinforced by advancements in device design, where thin yet resilient materials are required. Additionally, rising disposable incomes, coupled with an appetite for innovative technologies, continues to fuel the market. Overall, the expansion of Europe’s electronics ecosystem makes sapphire glass a crucial component for enhancing product value and consumer satisfaction.

Strong Demand in Luxury Watches and Premium Goods

The Swiss watchmaking industry, renowned for its luxury heritage and reliance on sapphire crystal, generated exports worth CHF 26.7 billion in 2023, reflecting a 7.6% increase over 2022. This aligns with Europe’s broader luxury goods sector—particularly in Switzerland, Germany, and France—which plays a pivotal role in driving sapphire glass adoption. Luxury watchmakers consistently favor sapphire glass for its exceptional scratch resistance, clarity, and aesthetic appeal, making it the material of choice for premium timepieces. Consumers across Europe associate sapphire with prestige, durability, and superior craftsmanship, strengthening its position in luxury markets. Beyond watches, sapphire glass is increasingly used in high-value jewelry and fashion accessories, where its resilience enhances product appeal. With Europe’s rich heritage in watchmaking and steady demand for iconic luxury brands, sapphire glass remains essential for preserving the exclusivity and quality of the region’s luxury goods market.

Advancements in Healthcare and Defense Applications

The healthcare and defense industries are emerging as important contributors to the Europe sapphire glass market analysis. In healthcare, sapphire glass is used in medical devices, diagnostic equipment, and surgical instruments due to its biocompatibility, durability, and resistance to wear. Hospitals and research institutions favor it for precision applications, ensuring reliability and patient safety. In defense, sapphire glass is valued for its ability to withstand extreme conditions, making it suitable for armored vehicles, transparent armor, and optical sensors. Europe’s strong focus on defense modernization and medical innovation enhances the demand for advanced materials like sapphire glass. Moreover, ongoing technological advancements in sapphire glass production are making it more cost-efficient and versatile, encouraging wider adoption. Together, these sectors highlight sapphire glass’s importance beyond consumer markets, solidifying its role as a high-performance material in Europe’s industrial and technological landscape.

Europe Sapphire Glass Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe sapphire glass market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- High Grade Transparency Sapphire Glass

- General Transparency Sapphire Glass

General transparency sapphire glass holds the majority share in the Europe market due to its wide applicability and superior performance across multiple industries. Its excellent optical clarity, high scratch resistance, and ability to withstand extreme conditions make it a preferred material for consumer electronics, luxury watches, optical devices, and medical instruments. Unlike specialized coatings or tinted versions, general transparency sapphire glass offers versatility, allowing manufacturers to use it in both premium and industrial-grade applications. The demand is further supported by Europe’s strong luxury goods sector and expanding healthcare technologies, where clear, durable materials are essential. Its balance of functionality, aesthetics, and adaptability ensures dominance over other sapphire glass categories.

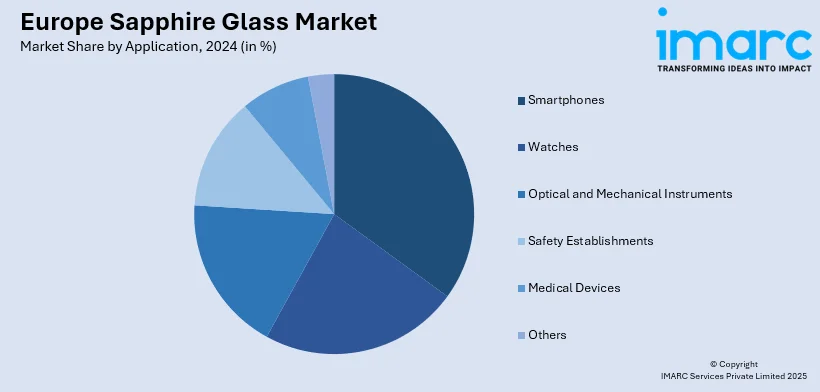

Analysis by Application:

- Smartphones

- Watches

- Optical and Mechanical Instruments

- Safety Establishments

- Medical Devices

- Others

Based on the Europe sapphire glass market forecast, the smartphones account for the majority share driven by rising consumer demand for durable, premium-quality devices. Sapphire glass is increasingly used in smartphone components such as camera lenses, fingerprint sensors, and high-end display covers due to its superior scratch resistance, hardness, and optical clarity. As European consumers favor luxury and technologically advanced devices, manufacturers integrate sapphire glass to enhance product lifespan and appeal. The rapid upgrade cycle of smartphones, combined with strong brand competition, further accelerates adoption. Additionally, the growth of 5G-enabled devices and advanced imaging features creates greater reliance on sapphire glass for precision and durability, securing smartphones as the dominant application segment in the market.

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany leads the Europe sapphire glass market due to its strong industrial base, advanced manufacturing capabilities, and high demand across key end-use sectors. The country’s robust consumer electronics market, combined with its reputation for engineering excellence, drives significant adoption of sapphire glass in smartphones, wearables, and optical devices. Germany is also a hub for luxury watches, precision instruments, and automotive innovations, where sapphire glass is valued for its durability and clarity. Additionally, its thriving healthcare and defense industries further expand applications, particularly in medical devices and protective systems. Strong R&D investment, a focus on premium quality, and established global trade networks position Germany as the dominant regional market for sapphire glass in Europe.

Competitive Landscape:

The competitive landscape is characterized by intense rivalry among manufacturers focusing on innovation, cost efficiency, and product quality. Companies are investing heavily in research to improve manufacturing technologies, aiming to produce larger, thinner, and more affordable sapphire glass for diverse applications. Strategic partnerships with electronics, luxury goods, and healthcare sectors are common to strengthen market presence. Competition also extends to securing supply chains and enhancing production capacity to meet growing regional demand. Differentiation is largely driven by technological advancements, durability standards, and the ability to cater to both premium and industrial applications, making the market highly dynamic and innovation driven.

The report provides a comprehensive analysis of the competitive landscape in the Europe sapphire glass market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: Seiko launched the Prospex Alpinist SPB531 watch exclusively in Europe, limited to only 3,000 pieces. The watch features a night sky-inspired blue dial, a stainless steel case, and a 6R35 caliber movement with a 70-hour power reserve. It also includes a sapphire crystal, 200 m (20 bar) water resistance, and is priced for its premium design and exclusive release.

- August 2025: Harding+ and Citizen launched an exclusive Citizen x P&O Cruises Tsuyosa Special Edition timepiece, available only on selected P&O Cruises ships. This limited-edition watch features a signature sunray blue dial with the P&O Cruises logo and combines sport-luxe aesthetics with maritime elements. The 40mm stainless steel case houses an automatic movement, anti-reflective sapphire crystal, and a transparent case back with 50m water resistance.

Europe Sapphire Glass Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High Grade Transparency Sapphire Glass, General Transparency Sapphire Glass |

| Applications Covered | Smartphones, Watches, Optical and Mechanical Instruments, Safety Establishments, Medical Devices, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe sapphire glass market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe sapphire glass market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe sapphire glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sapphire glass market in Europe was valued at USD 372.44 Million in 2024.

The Europe sapphire glass market is projected to exhibit a (CAGR) of 13.52% during 2025-2033, reaching a value of USD 1,233.31 Million by 2033.

The Europe sapphire glass market is driven by rising demand for durable, scratch-resistant materials in smartphones, wearables, and consumer electronics; strong adoption in luxury watches and optical instruments; and expanding applications in healthcare and defense. Technological advancements in cost-efficient production further strengthen its market growth potential.

General transparency sapphire glass dominates the Europe market due to its versatility, exceptional clarity, and durability. Widely used in electronics, luxury watches, medical devices, and optical instruments, it meets both functional and aesthetic needs. Its adaptability across premium and industrial applications ensures sustained demand and majority market share.

Smartphones lead the Europe sapphire glass market as consumers seek durable, high-end devices. Sapphire glass enhances camera lenses, sensors, and displays with superior scratch resistance and clarity. Growing preference for premium models, frequent upgrades, and advanced features like 5G and imaging technologies further boost its adoption in smartphones.

Germany dominates the Europe sapphire glass market owing to its advanced manufacturing expertise, strong industrial foundation, and high demand across electronics, luxury watches, healthcare, and defense. Robust R&D investment, precision engineering, and focus on premium quality products further drive adoption, establishing Germany as the leading regional market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)