Europe School Stationery Supplies Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Country, 2025-2033

Europe School Stationery Supplies Market Size and Share:

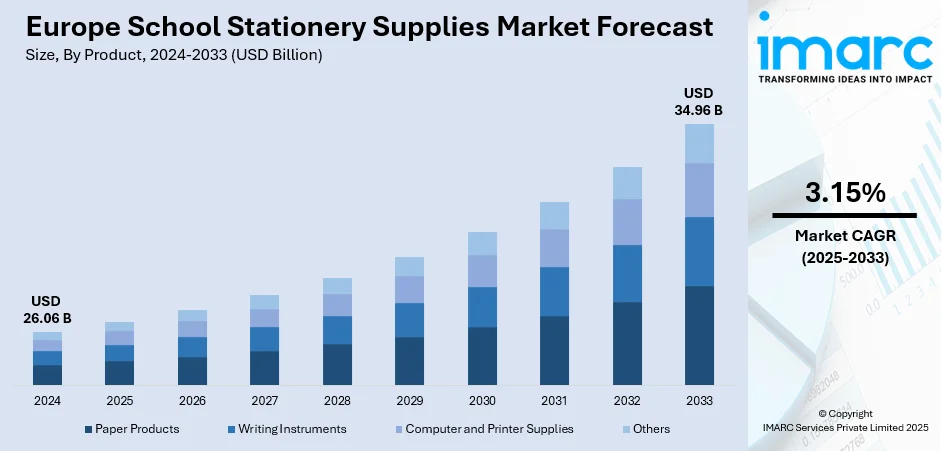

The Europe school stationery supplies market size was valued at USD 26.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.96 Billion by 2033, exhibiting a CAGR of 3.15% from 2025-2033. Germany currently dominates the market, driven by growing student populations, increasing educational enrollment, and government investments in education infrastructure. Rising demand for eco-friendly and sustainable stationery products further fuels market growth, reflecting consumer preference for environmentally responsible choices. Technological integration, such as smart pens and digital learning aids, also supports demand alongside traditional supplies. Seasonal spikes during back-to-school campaigns, coupled with strong retail networks and e-commerce expansion, enhance accessibility and sales, reinforcing steady rise in Europe school stationery supplies market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 26.06 Billion |

|

Market Forecast in 2033

|

USD 34.96 Billion |

| Market Growth Rate 2025-2033 | 3.15% |

One of the key drivers of the Europe school stationery supplies market is the steady growth in student enrollment across primary, secondary, and higher education institutions. Governments across Europe are investing heavily in improving educational infrastructure, making quality education more accessible. This creates a sustained demand for essential stationery items such as notebooks, pens, pencils, and art supplies. Additionally, initiatives promoting literacy and inclusive education further stimulate consumption. The recurring nature of stationery purchases, coupled with expanding classroom capacities, ensures consistent market growth and supports long-term opportunities for manufacturers and retailers across the region.

To get more information on this market, Request Sample

Another major driver is the increasing shift toward sustainable and eco-friendly stationery products. Rising environmental awareness among European consumers and stricter regulations on plastic usage have encouraged manufacturers to develop products made from recycled, biodegradable, or renewable materials. Parents, schools, and institutions are showing strong preference for eco-conscious options like recycled paper, wooden pencils, and refillable pens. This shift is also supported by retailers highlighting green product lines as a competitive differentiator. As sustainability becomes a core purchasing factor, it is pushing companies to innovate while meeting consumer expectations, significantly driving Europe school stationery supplies market growth.

Europe School Stationery Supplies Market Trends:

Expanding Educational Enrollment and Infrastructure Development

The Europe school stationery supplies market benefits greatly from rising student enrollment across all educational levels. In 2023, approximately 23.14 million children were enrolled in primary education across the European Union, reflecting the scale of demand for essential stationery products. Governments are actively investing in modernizing educational infrastructure, expanding schools, and promoting inclusive education programs, which collectively drive steady consumption. Countries like Germany, France, and the UK are witnessing growth in both domestic and international student populations, further amplifying the need for notebooks, pens, pencils, and art supplies. The cyclical nature of school reopening seasons provides a recurring sales boost, while education reforms aimed at digital literacy still preserve a strong parallel demand for traditional stationery. Moreover, initiatives to reduce dropout rates and encourage higher education participation support long-term market expansion, benefiting both global manufacturers and local suppliers.

Growth of E-Commerce and Digital Retail Channels

The rapid expansion of e-commerce has become a transformative driver among the Europe school stationery supplies market trends. Online platforms provide consumers with greater convenience, variety, and competitive pricing compared to traditional brick-and-mortar outlets. Back-to-school campaigns on e-commerce sites have emerged as significant sales boosters, allowing parents and students to purchase supplies in bulk from the comfort of their homes. The integration of advanced technologies such as AI-driven product recommendations, subscription services, and personalized bundles enhances the shopping experience and strengthens customer loyalty. Additionally, smaller brands and eco-friendly startups gain visibility online, broadening product choices beyond established players. The COVID-19 pandemic accelerated online purchasing habits, and this shift continues as consumers increasingly value efficiency and accessibility. With digital literacy expanding, online channels are expected to remain a dominant growth engine, reinforcing long-term demand for school stationery across Europe.

Rising Shift Toward Sustainability and Eco-Friendly Products

Sustainability has emerged as a key driver in shaping the Europe school stationery supplies market. Growing consumer awareness of environmental issues, combined with EU regulations on single-use plastics and waste reduction, is accelerating the shift toward eco-friendly products. Notably, new binding rules require up to 65% recycled content in single-use plastic bottles by 2040, reinforcing the broader push for circularity and minimal waste. This regulatory environment, alongside rising consumer demand, is encouraging schools, parents, and students to adopt sustainable stationery options such as recycled notebooks, bamboo pencils, and refillable pens. Major retailers are leveraging green product lines as a competitive differentiator, while CSR initiatives and school-led campaigns amplify awareness. With consumers increasingly willing to pay a premium for eco-conscious goods, sustainability not only boosts sales but also drives innovation and reshapes product portfolios across Europe school stationery supplies market outlook.

Europe School Stationery Supplies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe school stationery supplies market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on product, distribution channel, and end user.

Analysis by Product:

- Paper Products

- Writing Instruments

- Computer and Printer Supplies

- Others

Paper products account for the majority share of the Europe school stationery supplies market, driven by their essential role in everyday learning activities. Items such as notebooks, writing pads, drawing sheets, and graph paper remain indispensable across primary, secondary, and higher education levels despite growing digital adoption. The cyclical back-to-school demand ensures steady sales volumes, while art and creative subjects further boost paper consumption. Moreover, sustainability trends are fueling growth in recycled and eco-friendly paper products, appealing to environmentally conscious buyers and aligning with EU waste reduction policies. With their recurring use, affordability, and broad application across students of all ages, paper products maintain dominance in the stationery market, providing consistent revenue streams for manufacturers and retailers alike.

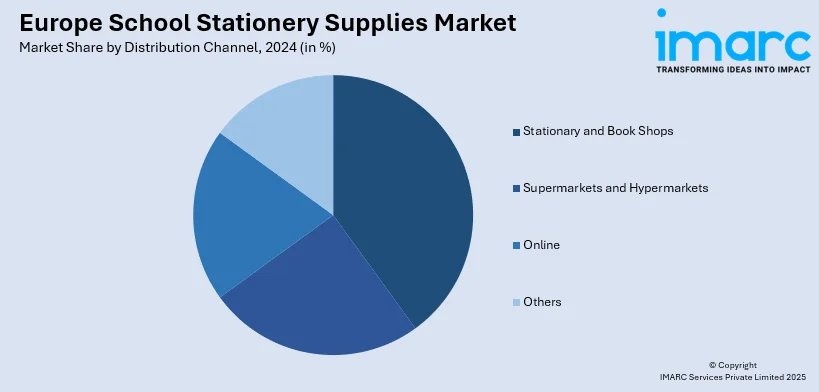

Analysis by Distribution Channel:

- Stationary and Book Shops

- Supermarkets and Hypermarkets

- Online

- Others

Stationery and book shops represent the majority share of distribution in the Europe school stationery supplies market owing to their accessibility, product variety, and established consumer trust. These outlets serve as one-stop destinations where students and parents can find a comprehensive range of products, from notebooks and pens to textbooks and art supplies. Their ability to offer personalized service, immediate product availability, and tailored recommendations gives them an edge over online platforms, especially during peak back-to-school seasons. Many shops also collaborate with schools to provide customized supply lists, ensuring convenience for families. Additionally, the presence of both large retail chains and independent local stores strengthens market penetration, making stationery and book shops the dominant sales channel across Europe.

Analysis by End User:

- K-12

- Higher Education

Based on the Europe school stationery supplies market forecast, the K-12 segment dominates market demand due to the large and consistent student population across primary and secondary education. Stationery items such as notebooks, pencils, pens, erasers, rulers, and art supplies are essential for daily classroom activities, making demand highly recurring and stable throughout the academic year. Back-to-school seasons significantly boost sales, as families purchase supplies in bulk to meet annual requirements. Government investments in universal education, inclusive learning, and literacy programs further drive stationery consumption within this group. Additionally, creative and extracurricular activities in K-12 schools increase the use of paper products and art materials. With its scale, regular replenishment needs, and policy support, K-12 remains the strongest demand driver in Europe.

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany leads the Europe school stationery supplies market due to its strong educational infrastructure, large student base, and high emphasis on academic excellence. The country’s well-developed school system, combined with a growing focus on inclusive education and vocational training, ensures consistent demand for a wide range of stationery products. Parents and institutions prioritize quality, driving steady consumption of notebooks, pens, and art supplies. Germany also has a highly organized retail and distribution network, supported by both global and domestic stationery brands, which makes products easily accessible. Additionally, growing awareness of sustainability is encouraging the use of eco-friendly stationery, boosting Europe school stationery supplies market demand. With a balance of tradition and innovation, Germany maintains its position as the leading region in this sector.

Competitive Landscape:

The competitive landscape is highly fragmented, characterized by the presence of both global brands and numerous regional players. Competition is driven by product quality, pricing, brand recognition, and innovation. Companies are increasingly focusing on sustainable and eco-friendly product development to align with consumer demand and regulatory requirements. The rise of e-commerce has intensified competition, enabling smaller brands to reach broader audiences and challenge established players. Seasonal back-to-school campaigns further heighten rivalry, as firms compete for higher visibility and sales. Additionally, strategic partnerships with educational institutions, retail chains, and digital platforms play a crucial role in shaping market share and sustaining long-term growth opportunities.

The report provides a comprehensive analysis of the competitive landscape in the Europe school stationery supplies market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025 – Konica Minolta refreshed its A4 black-and-white printing lineup with the launch of four new devices: the bizhub 4221i/5021i (All-in-One) and bizhub 4201i/5001i (Single Function Printer). These new models succeed their predecessors, delivering enhanced usability, improved performance, and expanded connectivity features including card reader support, barcode printing, AirPrint compatibility, and dual scan functionality on the All-in-One models.

- August 2025: Waterstones is expanding rapidly, opening 10 new stores each year, as younger adults increasingly turn to reading as a way to escape from screens. The UK bookshop chain attributes part of its sales growth to trends on social media platforms like BookTok, which have revived interest in reading among younger audiences.

Europe School Stationery Supplies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Paper Products, Writing Instruments, Computer and Printer Supplies, Others |

| Distribution Channels Covered | Stationary and Book Shops, Supermarkets and Hypermarkets, Online, Others |

| End Users Covered | K-12, Higher Education |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe school stationery supplies market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe school stationery supplies market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe school stationery supplies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The school stationery supplies market in Europe was valued at USD 26.06 Billion in 2024.

The Europe school stationery supplies market is projected to exhibit a (CAGR) of 3.15% during 2025-2033, reaching a value of USD 34.96 Billion by 2033.

The Europe school stationery supplies market is driven by rising student enrolment, growing demand for eco-friendly and sustainable products, technological integration in stationery, and strong back-to-school seasonal sales. Increasing consumer preference for premium, customizable items and supportive government education initiatives further fuel growth. E-commerce expansion and brand innovations in design, ergonomics, and multifunctionality also contribute significantly to market development.

Paper products dominate Europe’s school stationery market because they are essential for daily learning activities. Notebooks, writing pads, and art sheets are widely used across all educational levels. Their recurring demand, affordability, and versatility make them indispensable. Additionally, the growing preference for recycled and eco-friendly paper products supports sustained consumption, reinforcing their leading position in the market.

Stationery and book shops hold the largest share in Europe’s school stationery market due to their convenience, wide product selection, and trusted reputation. They offer immediate access to essential supplies, personalized service, and tailored recommendations. Collaborations with schools and presence of both local and large retail chains further strengthen their dominance as the preferred distribution channel for students and parents.

The K-12 segment dominates Europe’s school stationery market because it serves a large, stable student population across primary and secondary education. Daily classroom needs, back-to-school purchases, and extracurricular activities drive recurring demand for notebooks, pens, and art supplies. Government support for literacy and inclusive education further sustains consumption, making K-12 the primary revenue driver in the stationery sector.

Germany leads the Europe school stationery supplies market owing to its strong educational infrastructure, large and diverse student population, and focus on academic excellence. Consistent demand is supported by inclusive education policies, vocational training, and high consumer preference for quality products. A robust retail network and adoption of sustainable stationery further reinforce Germany’s market leadership.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)