Europe Seaweed Market Size, Share, Trends and Forecast by Environment, Product, Application, and Country, 2025-2033

Europe Seaweed Market Size and Share:

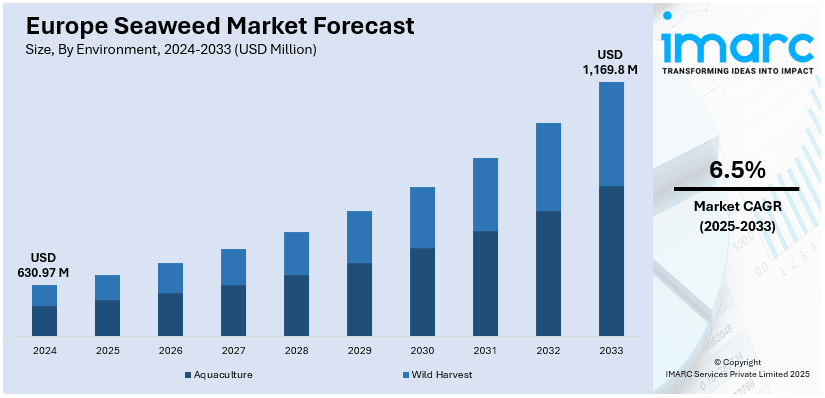

The Europe seaweed market size was valued at USD 630.97 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,169.8 Million by 2033, exhibiting a CAGR of 6.5% from 2025-2033. The market is driven by the heightened need for organic farming components or materials, increasing usage of sustainable ingredients in food and beverage (F&B), horticulture, and pharmaceutical industries, and rising awareness about the health benefits of maintaining a proper diet.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 630.97 Million |

| Market Forecast in 2033 | USD 1,169.8 Million |

| Market Growth Rate (2025-2033) | 6.5% |

Currently, rising consumer demand for sustainable consumables is offering a favorable market outlook. The market for seaweed is driven by the need for plant-based and functional foods. Nutrient-rich seaweed has gained popularity as a plant-based substitute because of the growing consumer acceptance of vegetarian, vegan, and flexitarian diets. Its low calorie profile and high vitamin, mineral, antioxidant, and dietary fiber content make it especially prized. Additionally, seaweeds are a rich source of bioactive substances like carrageenan and fucoidans, which have been linked to a number of health advantages, including enhanced gut health, immune system support, and anti-inflammatory qualities.

Sustainability is a key trend shaping the European seaweed market. As consumers and industries alike prioritize eco-friendly products, seaweed stands out as a highly sustainable resource. Unlike traditional crops, seaweed cultivation does not require arable land, freshwater, or chemical fertilizers, making it an eco friendly alternative. Additionally, seaweed farms contribute to marine biodiversity, absorb carbon dioxide, and improve water quality by reducing nutrient pollution. These factors align with Europe’s broader commitment to combating climate change and promoting sustainable development. Seaweed cultivation and utilization align with the goals of reducing greenhouse gas emissions and supporting sustainable aquaculture practices.

Europe Seaweed Market Trends:

Heightened Focus on Sustainability and Climate Change Mitigation Efforts

Seaweed's growing appeal throughout Europe is mostly due to its sustainability advantages. Seaweed is one of the most environment friendly resources because it doesn't require freshwater, arable land, or chemical fertilizers like other crops do. Additionally, it has been acknowledged that growing seaweed is a natural way to fight climate change. It supports Europe's aggressive climate neutrality objectives under the European Green Deal by absorbing significant volumes of carbon dioxide and lowering ocean acidification. Notable advancements in sustainable seaweed farming have surfaced in recent years. In 2024, Nordic SeaFarmers reported that InnoEnergy and Inter IKEA Group closed their most recent €2.2 million fundraising round. Additionally, consumer surveys revealed that a significant percentage of European consumers are prepared to pay more for seaweed goods that are supplied responsibly.

Rising Demand for Plant-Based and Functional Foods

The increasing popularity of plant-based and functional foods is one of the key factors impelling the growth of the European seaweed market. Consumers in Europe are embracing plant-based diets at unprecedented rates, driven by a mix of health-consciousness, ethical considerations, and environmental awareness. Seaweed, being a nutrient-dense, plant-based superfood, is gaining popularity among vegans, vegetarians, and flexitarians for its rich profile of vitamins, minerals, dietary fiber, and antioxidants. Apart from the purpose of being a source of food, functional properties such as gut health support and immune boost make seaweed an attractive ingredient in the functional food sector. Seaweed-based snack, seasoning, and supplement product launches took centre stage in recent times. For instance, in 2024, European alt-seafood and seaweed company, BettaF!sh announced its participation in the FunSea project. The region is working together to improve the safety and quality characteristics of both brown and green seaweed.

Expansion of Non-Food Applications

The applications of seaweed do not stop at the F&B sector but also extend to cosmetics, pharmaceuticals, biofuels, and bioplastics sectors with increasing demand and expanding markets. The seaweed-derived compounds like carrageenans, alginates, and fucoidans are being applied to the above sectors because of their functional properties. Pharmaceutical companies are using the bioactive compounds of seaweed for drug formulations, wound healing, and dietary supplements. Meanwhile, In the cosmetic sector, for example, extracts from seaweed are added to skin-care products for hydrating, anti-aging, and skin-soothing effects. For the development of FlexSea's biomaterial made from red seaweed, 2M Sustainable Packaging Technologies was presented an Innovate UK SMART Grant in the year 2024. The goal is to introduce a circular packaging solution for the personal care industry with this initiative.

Europe Seaweed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe seaweed market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on environment, product, and application.

Analysis by Environment:

- Aquaculture

- Wild Harvest

Dominant within the seaweed market is the aquaculture segment as cultivation methods move more toward controlled farming to increase their market share globally. Aquaculture offers a much more viable and scalable solution than wild harvesting as it ensures regular supply, quality control, and reduction of environmental impacts. Aquaculture farming in Europe is growing rapidly through government support and technological advances. European countries, including Norway, Ireland, and France, are making heavy investments in seaweed aquaculture because of its ability to fight climate change and compatibility with existing aquaculture infrastructure.

Seaweed is traditionally collected using the wild harvest segment, which mostly entails harvesting by hand or by machine from natural coastal habitats. For certain species of red and brown seaweed that can only thrive in natural environments, wild harvesting is nevertheless significant even though it is less scalable than aquaculture. Europe is where wild harvesting is most common, particularly in nations like Scotland, Ireland, and Spain that have abundant maritime biodiversity. In niche sectors where authenticity and natural sourcing are valued, such as gourmet foods, artisanal skincare, and traditional cures, wild-harvested seaweed is especially well-suited.

Analysis by Product:

- Red

- Brown

- Green

Red seaweed is an important market segment because of its numerous uses and great economic worth. Because of its strong nutritional profile especially its high protein, vitamin, and mineral content red seaweed is frequently utilized in food products. Carrageenan, a common natural thickener and stabilizer in food and beverage applications such as dairy products, plant-based milk, and processed meats, is mostly derived from red seaweed. Apart from the health benefits, it has bioactive compounds like sulfated polysaccharides and antioxidants, which make it valuable in medications and nutraceuticals.

Brown seaweed holds a major share in the market by volume due to its wide applications in industrial, agricultural, and food industries. Alginates, which are richly found in brown seaweed, are the most widely used thickeners in the food, drugs, and cosmetics industries. It also gained popularity in the agriculture industry due to its content of high iodine and potassium levels, which makes it a natural fertilizer that enhances crop yields and soil health.

Green seaweed, though smaller in market share compared to red and brown varieties, is gaining momentum due to its unique nutritional and functional properties. Known for its high chlorophyll, vitamin C, and protein content, green seaweed is increasingly used in health foods, dietary supplements, and culinary applications. Its mild flavor and vibrant color make it popular in fresh and dried formats for use in salads, soups, and snacks.

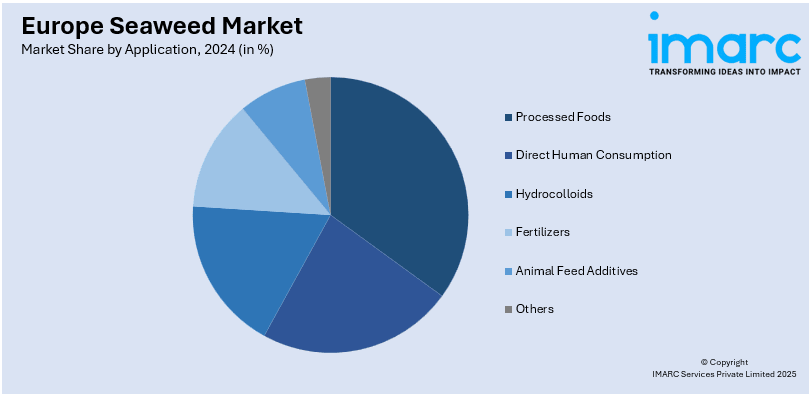

Analysis by Application:

- Processed Foods

- Direct Human Consumption

- Hydrocolloids

- Fertilizers

- Animal Feed Additives

- Others

The market is dominated by the processed foods segment due to the high demand for seaweed-derived ingredients such as carrageenan, alginates, and agar in the food and beverage industry. Hydrocolloids, being natural thickeners, stabilizers, and gelling agents, are added to products like dairy, plant-based beverages, sauces, and desserts. The addition of seaweed enhances the texture and extends the shelf life of processed foods, making them indispensable.

Seaweed as a direct food source is picking up much momentum, especially in Europe, where the demand for plant-based and superfoods is soaring. Edible seaweed, such as nori, wakame, and dulse, is consumed fresh, dried, or as an ingredient in snacks, soups, salads, and sushi. Its high nutritional value, including essential vitamins, minerals, and antioxidants, appeals to health-conscious consumers.

The hydrocolloids segment is one of the most lucrative applications of seaweed, driven by the high demand for carrageenan, agar, and alginates in food, pharmaceuticals, and cosmetics. These seaweed-derived hydrocolloids are essential for their emulsifying, thickening, and stabilizing properties. They are widely used in products such as ice cream, dairy alternatives, baked goods, and pharmaceutical gels.

Seaweed-based fertilizers are increasingly popular in Europe’s agricultural sector, driven by the need for organic and sustainable farming solutions. Rich in nutrients such as potassium, iodine, and trace minerals, seaweed fertilizers improve soil health, enhance plant growth, and reduce the reliance on chemical inputs.

Seaweed is increasingly used as an additive in animal feed, owing to its nutritional benefits and role in reducing environmental impact. It is rich in minerals, vitamins, and antioxidants, which enhance animal health and productivity. Certain seaweed species, such as red algae, have been shown to reduce methane emissions in livestock, aligning with Europe’s sustainability goals.

Country Analysis:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

Germany is a significant region in Europe, because of its strong food processing, cosmetics, and pharmaceutical industries drive the market. The country's emphasis on sustainability and organic products creates an ideal environment for seaweed adoption. Hydrocolloids derived from seaweed, such as carrageenan and alginates, are highly applied in Germany's processed food and plant-based industries, which aligns with the increasing demand for vegan and clean-label products.

The United Kingdom is becoming a leader in the European seaweed market, attributed to the growing demand for sustainable food products and functional ingredients among consumers. The U.K. has a long tradition of seaweed consumption, with native species such as dulse and laver commonly used in traditional dishes.

France’s seaweed market, driven by its rich culinary heritage and strong presence in the cosmetics and pharmaceutical industries. French consumers are increasingly adding seaweed to their diets, especially as an ingredient in gourmet and functional foods.

Italy’s seaweed market is growing steadily, driven by the country's rich culinary culture and increasing awareness of seaweed's health benefits. Seaweed is being embraced as a natural ingredient in traditional Italian dishes such as pasta, risotto, and soups, catering to the rising demand for functional and plant-based foods.

Russia represents a growing market for seaweed, with increasing applications in the food, pharmaceutical, and agricultural sectors. Seaweed is widely consumed in traditional Russian cuisine, particularly in salads and soups. The country’s vast coastline provides ample opportunities for wild harvesting and aquaculture.

Spain is a major player in the European seaweed market, driven by its strong aquaculture industry and growing interest in sustainable food products. Seaweed is increasingly incorporated into Spanish cuisine, particularly in premium seafood dishes and gourmet products.

The Netherlands is a rapidly growing market for seaweed, driven by its strong sustainability initiatives and innovation-focused industries. Dutch companies are at the forefront of seaweed-based bioplastics and biofuels, aligning with the country’s circular economy goals.

Switzerland’s seaweed market is primarily driven by its strong demand for premium health foods and nutraceuticals. Seaweed is being incorporated into dietary supplements, functional beverages, and vegan products, catering to the country’s health-conscious population.

Poland is an emerging market for seaweed, driven by growing consumer awareness of its nutritional and environmental benefits. Seaweed is increasingly being used in processed foods, dietary supplements, and traditional dishes.

Competitive Landscape:

To capture a larger share of the market, seaweed companies in Europe are launching innovative products tailored to various industries, including food, cosmetics, pharmaceuticals, and biofuels. Product diversification ensures that seaweed companies cater to a wide range of applications, from direct human consumption to industrial uses, helping them penetrate new markets and meet diverse consumer needs. With sustainability being a key concern across Europe, leading seaweed companies are prioritizing ecofriendly practices to align with consumer values and government initiatives. These sustainability-focused initiatives not only improve the environmental footprint of these companies but also enhance their appeal to eco-conscious consumers and industries. In 2024, Citizens of Soil and Notpla launched innovative single-serve extra virgin olive pipettes for its Spanish Extra Virgin Olive Oil (EVOO), packed in a material made with seaweed in the UK.

The report provides a comprehensive analysis of the competitive landscape in the Europe seaweed market with detailed profiles of all major companies.

Latest News and Developments:

- July 2024: Seaweed Enterprises Limited declared its new brand House of Seaweed, taking a major step in the brand’s journey to emerge as a leading trade processing hub in the UK, Scotland, and various other locations.

-

November 2024: Europe announced its plan to fund €9 million initiative for facilitating innovation and interregional collaboration with the region’s seaweed industry.

Europe Seaweed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Aquaculture, Wild Harvest |

| Products Covered | Red, Brown, Green |

| Applications Covered | Processed Foods, Direct Human Consumption, Hydrocolloids, Fertilizers, Animal Feed Additives, Others |

| Regions Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe seaweed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe seaweed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe seaweed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe seaweed market was valued at USD 630.97 Million in 2024.

The market growth is driven by the rising demand for sustainable consumables, the increasing popularity of plant-based and functional foods, and growing consumer awareness of health benefits. Additionally, the adoption of seaweed in pharmaceuticals, cosmetics, and eco-friendly packaging contributes to its expanding demand.

The Europe seaweed market is projected to exhibit a CAGR of 6.5% during 2025-2033, reaching a value of USD 1,169.8 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)