Europe Secondhand Luxury Goods Market Size, Share, Trends and Forecast by Product Type, Demography, Distribution Channel, and Country, 2025-2033

Europe Secondhand Luxury Goods Market Size and Share:

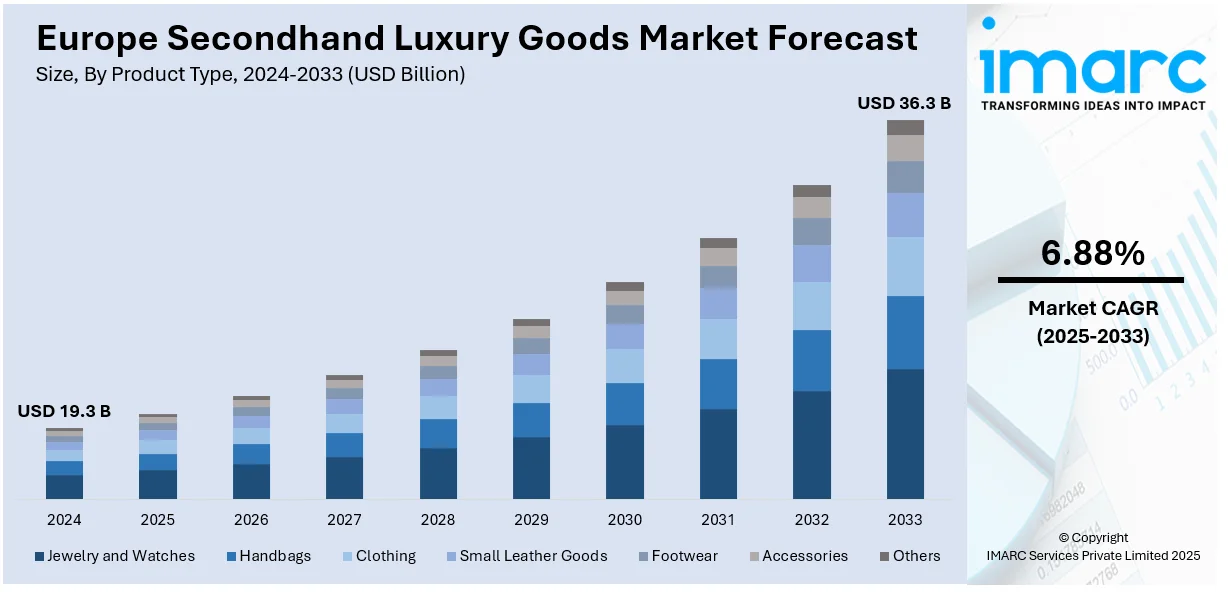

The Europe secondhand luxury goods market size was valued at USD 19.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 36.3 Billion by 2033, exhibiting a CAGR of 6.88% during 2025-2033. France currently dominates the market in 2024. The market is growing due to rising demand for sustainable and affordable fashion, particularly among Millennials and Gen Z. Economic uncertainty and high inflation make pre-owned luxury items more attractive. Digital resale platforms and improved authentication services have enhanced consumer trust, while influencers and celebrities promote secondhand shopping. Luxury brands are also entering the resale market, further legitimizing it. These factors, along with the appeal of rare and vintage pieces, are further expanding the Europe secondhand luxury goods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 19.3 Billion |

|

Market Forecast in 2033

|

USD 36.3 Billion |

| Market Growth Rate (2025-2033) | 6.88% |

The market is driven by shifting consumer preferences towards sustainability and affordability. As environmental awareness grows, buyers increasingly prioritize circular fashion, opting for pre-owned items to reduce waste. High inflation and economic uncertainty also make secondhand luxury more appealing, offering access to premium brands at lower prices. Additionally, younger consumers, particularly Millennials and Gen Z, value unique and vintage pieces, fueling demand. Generation Z is impacting the secondhand luxury industry significantly, as 83% of young shoppers are willing to buy secondhand products according to recent studies, thus helping the global resale market to grow by over 33%. Growing demand for vintage and pre-owned luxury products is driving the strong growth of the secondhand luxury industry in Europe, fueled by sustainable consumers looking for high-quality fashion that has a minimal environmental footprint. The rise of digital platforms such as Vestiaire Collective and The Real Real has made buying and selling pre-owned luxury more accessible, further supporting the Europe secondhand luxury goods market growth. These factors collectively create a robust demand for secondhand luxury goods in Europe.

In addition, the growing trust in authentication services, which has reduced concerns about counterfeit products, is also supporting the market. In 2023, the EU authorities seized 152 million fake products worth EUR 3.4 Billion, an increase of 68% over 2022, out of which 74% of total fake products were from Italy. With the growth of the secondhand luxury market in Europe, it is critical to protect intellectual property and authenticity as counterfeit goods, including packaging materials, clothing, CDs, toys, and games, continue to dominate in seizures, highlighting ongoing enforcement challenges. Luxury brands are also embracing resale, partnering with platforms or launching their programs, enhancing credibility. Social media influencers and celebrities frequently showcase pre-owned fashion, normalizing and glamorizing secondhand purchases. Moreover, the scarcity of certain discontinued or rare items increases their resale value, attracting collectors and enthusiasts. The convenience of online marketplaces, coupled with seamless payment and shipping options, has expanded the customer base. As a result, the Europe secondhand luxury market continues to thrive, supported by changing consumer behaviors and technological advancements.

Europe Secondhand Luxury Goods Market Trends:

Growing Demand for Sustainable Consumption

The market in Europe is being driven by the increasing consumer preference for sustainable consumption practices. The Ministry of Foreign Affairs reported that in Europe’s five largest markets, 38% of consumers consider fashion brands' social and environmental impact when shopping. In 2022, 46.5% of Europeans purchased sustainable fashion items, with a growing perception of sustainable products as fashionable. As environmental concerns rise, more consumers are seeking ways to reduce their carbon footprint and minimize waste. This has led to a significant uptick in the demand for pre-owned luxury items, which align with the principles of circular economy and responsible consumption. The appeal lies in the ability to own high-quality, sought-after products at a fraction of the original cost, while also contributing to a reduction in the overall demand for new goods. This shift is compelling luxury brands and retailers to adapt their strategies to include pre-owned offerings, further creating a positive Europe secondhand luxury goods market outlook.

Influence of Online Platforms and Digitalization

The rapid growth of online platforms and digitalization has played a pivotal role in favoring the market in Europe. The European Commission reports that more than 1 million businesses in the EU sell goods or digital services through online platforms. The enhanced convenience and accessibility of e-commerce platforms have democratized the luxury market, making it easier for buyers and sellers to connect regardless of geographical boundaries. Online platforms have created a marketplace for pre-owned luxury items, expanding the potential customer base and driving market growth. Moreover, digitalization has enhanced transparency and authentication processes, eliminating concerns about the authenticity and condition of secondhand goods. As a result, consumers are more confident in making online purchases, which is further propelling the Europe secondhand luxury goods market demand.

Luxury Brands Embracing the Resale Revolution

Major luxury houses are actively entering the secondhand market, transforming it from a competitor to a strategic extension of their business. An increasing number of heritage brands are launching certified pre-owned programs, offering refurbished and authenticated vintage pieces directly to consumers. This shift reflects growing recognition of resale's potential to enhance brand loyalty, reach younger demographics, and promote sustainability. Notably, 78% of luxury consumers now consider a brand's involvement in resale when making purchasing decisions, according to a 2024 industry report. Brands are implementing buy-back schemes and trade-in options to control secondary market quality while driving new sales. Some are even designing products with future resale in mind, incorporating features that enhance long-term value. This strategic integration is blurring traditional boundaries between primary and secondary markets, creating a more circular luxury economy.

Europe Secondhand Luxury Goods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe secondhand luxury goods market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, demography, and distribution channel.

Analysis by Product Type:

- Jewelry and Watches

- Handbags

- Clothing

- Small Leather Goods

- Footwear

- Accessories

- Others

Jewely and watches stand as the largest component in 2024. The secondhand jewelry and watches segment is a key driver of Europe’s luxury resale market, prized for their timeless value and investment potential. High-end watches from brands retain or appreciate in value, attracting collectors and investors. Pre-owned jewelry, including iconic pieces from Cartier and Tiffany, appeals to buyers seeking sustainability and affordability. The segment benefits from strong authentication processes, ensuring trust in quality and authenticity. Limited-edition and vintage pieces further enhance demand, as they are often unavailable in retail markets. Online platforms specializing in certified pre-owned luxury watches and jewelry have expanded accessibility, making this segment one of the most resilient and lucrative in the secondhand luxury space.

Analysis by Demography:

- Men

- Women

- Unisex

Men lead the market in 2024, driven by increasing interest in high-end fashion, watches, and accessories. Male consumers are increasingly drawn to pre-owned luxury items for their investment potential, particularly in categories including Swiss watches (like Rolex and Audemars Piguet) and rare streetwear (like Supreme and Off-White). Sustainability-conscious younger buyers also favor secondhand purchases to reduce waste while maintaining a premium wardrobe. The rise of male influencers and digital platforms catering to men’s luxury resale has further normalized the trend. Additionally, the unisex appeal of certain items, such as designer sneakers and leather goods, blurs traditional gender lines, expanding the market. As men become more engaged in fashion resale, this segment is expected to grow steadily.

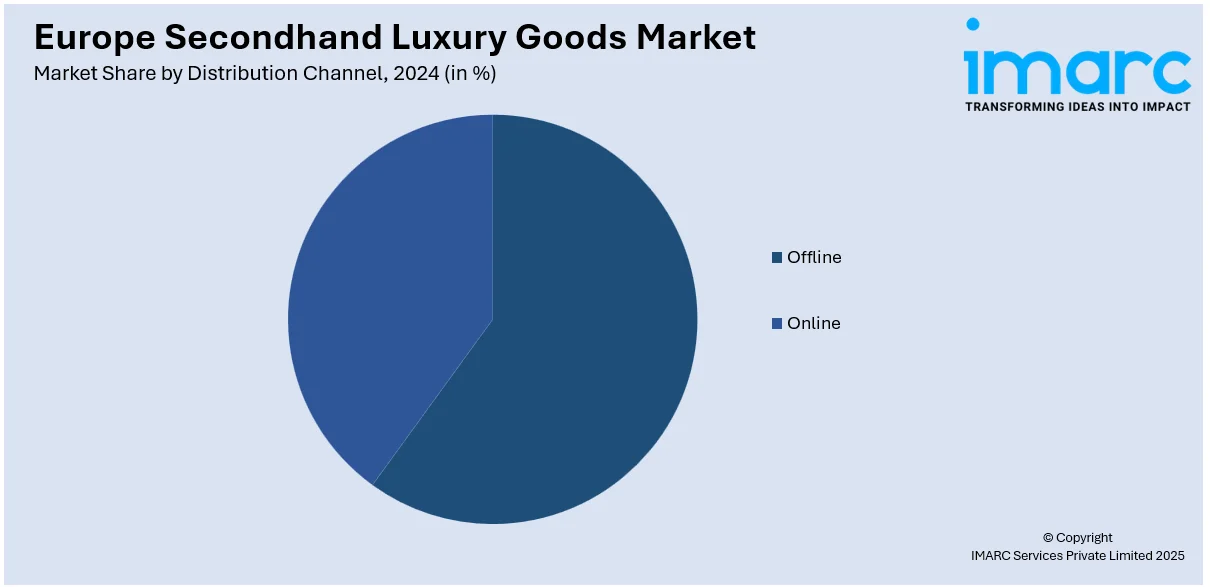

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market in 2024, driven by trust, tactile shopping experiences, and personalized service. High-end consignment boutiques, vintage stores, and auction houses attract discerning buyers seeking rare, authenticated pieces. Physical stores allow customers to inspect items for quality, craftsmanship, and condition—critical factors in luxury purchases. Established markets including Paris’ Rue Cambon or Milan’s vintage districts draw collectors and tourists. Additionally, luxury brands are increasingly opening certified pre-owned sections within flagship stores, enhancing credibility. While online platforms grow, offline channels cater to high-net-worth individuals who value exclusivity and face-to-face transactions. Pop-up events and luxury resale fairs also reinforce the offline segment’s appeal, creating immersive shopping environments that digital channels cannot replicate.

Country Analysis:

- France

- Italy

- United Kingdom

- Germany

- Russia

- Spain

- Others

In 2024, France accounted for the largest market share, fueled by its rich fashion heritage and Parisian luxury culture. As a home to iconic brands, the country attracts both local and international buyers seeking authenticated vintage pieces. Paris hosts prestigious consignment boutiques and flea markets, renowned for rare finds globally. Sustainability-conscious consumers and strict counterfeit laws further bolster trust in the resale market in France. French platforms such as Vestiaire Collective have gained global traction, while luxury brands increasingly embrace circular fashion. With high demand for timeless investment pieces, France remains a dominant force in the Europe pre-owned luxury sector.

Competitive Landscape:

The competitive landscape of the market is intensifying as established players expand their authentication capabilities and omnichannel strategies. Leading platforms are investing heavily in AI-powered verification systems and blockchain technology to enhance consumer trust in product authenticity. Several major operators have formed strategic partnerships with luxury brands to source exclusive inventory and launch certified pre-owned programs. Mobile app development and personalized shopping experiences are being prioritized to capture younger demographics. Some competitors are diversifying into adjacent services such as buyback guarantees and luxury rentals. Traditional auction houses are modernizing their digital presence to compete with agile online marketplaces. According to the Europe secondhand luxury goods market forecast, regional expansion remains a key focus, with players localizing their offerings to cater to country-specific preferences. The market is also seeing consolidation through mergers and acquisitions as companies race to scale operations and secure market share.

The report provides a comprehensive analysis of the competitive landscape in the Europe secondhand luxury market with detailed profiles of all major companies, including:

- Buddy & Selly

- CHRONEXT GmbH

- Collector Square

- FARFETCH UK Limited

- Fashionphile Group LLC

- Love Luxury

- Rewind Vintage Affairs

- The RealReal Inc.

- Vestiaire Collective

Latest News and Developments:

- April 2025: Faume has raised €8 million (approximately USD 9.1 Million) to support the European expansion of its resale platform for premium and luxury fashion brands. The platform currently supports 45 French brands and aims to increase that number to 150 brands across Europe within four years, beginning with expansions in the U.K. and Italy. Faume has already signed its first U.K. partnership with fashion house Victoria Beckham and plans to onboard several heritage brands in Italy later this year. Since its launch in 2020, Faume has facilitated the sale of 300,000 secondhand premium fashion pieces, 40% of which were sold outside of France.

- October 2024: Vestiaire Collective marked its 15th anniversary by launching a special sale, offering over 100 secondhand luxury items for USD 15 on its website. The celebration highlights the platform's commitment to sustainable fashion and its growing use of AI for enhanced user experiences.

- October 2024: Vinted, Europe’s leading secondhand fashion marketplace, raised EUR 340 Million (USD 366.8 Million) in a funding round led by TPG, bringing its valuation to EUR 5 Billion (USD 5.4 Billion). The platform aims to accelerate secondhand fashion adoption across Europe, expand services, and enhance sustainable shopping experiences.

- September 2024: eBay UK launched a luxury consignment service focusing on pre-owned designer handbags. Partnering with Luxe Collective, the service simplifies selling, managing listing and pricing. As demand for pre-owned luxury grows, eBay expands its offerings, building on its Authenticity Guarantee to ensure secure and verified transactions.

- September 2024: Hatton Jewels partnered with Antiques Roadshow jewellery specialist Ishy Khan to launch "Ishy’s Expert Edit." The collaboration offers insights into pre-owned and antique jewellery through social media content and blog posts. Hatton Jewels specializes in acquiring and reselling rare, vintage pieces from renowned luxury brands.

Europe Secondhand Luxury Goods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Jewelry and Watches, Handbags, Clothing, Small Leather Goods, Footwear, Accessories, Others |

| Demographies Covered | Men, Women, Unisex |

| Distribution Channels Covered | Offline, Online |

| Countries Covered | France, Italy, United Kingdom, Germany, Russia, Spain, OthersS |

| Companies Covered | Buddy & Selly, CHRONEXT GmbH, Collector Square, FARFETCH UK Limited, Fashionphile Group LLC, Love Luxury, Rewind Vintage Affairs, The RealReal Inc., Vestiaire Collective, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe secondhand luxury goods market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe secondhand luxury goods market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe secondhand luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The secondhand luxury goods market was valued at USD 19.3 Billion in 2024.

Rising demand for sustainable and affordable fashion, increased economic uncertainty, Gen Z and Millennial interest in vintage items, expanding digital resale platforms, improved authentication services, and luxury brand involvement in the resale ecosystem are driving strong market growth.

The secondhand luxury goods market is projected to exhibit a CAGR of 6.88% during 2025-2033, reaching a value of USD 36.3 Billion by 2033.

Major players in the market include Buddy & Selly, CHRONEXT GmbH, Collector Square, FARFETCH UK Limited, Fashionphile Group LLC, Love Luxury, Rewind Vintage Affairs, The RealReal Inc., Vestiaire Collective, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)