Europe Signal Generator Market Size, Share, Trends and Forecast by Product, Technology, Application, End Use, and Country, 2025-2033

Europe Signal Generator Market Size and Share:

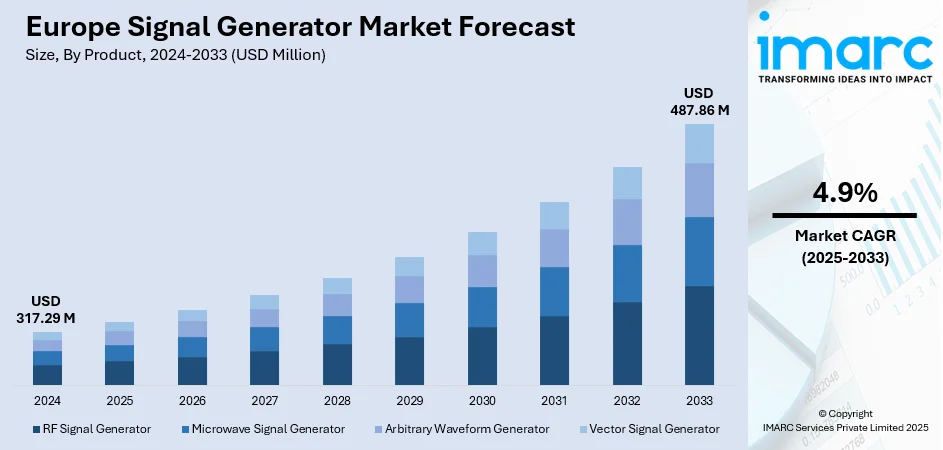

The Europe signal generator market size was valued at USD 317.29 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 487.86 Million by 2033, exhibiting a CAGR of 4.9% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. The market is powered by the region's robust focus on cutting-edge testing technologies across sectors such as aerospace, defense, telecommunications, and automotive. Expanding investment in 5G infrastructure, autonomous vehicle technology, and satellite communications necessitate accurate signal test equipment. Europe's robustly developed research institutions and partnerships between universities and manufacturers further boost innovation in tailored signal generation solutions. Strict regulatory requirements throughout the EU also compels businesses to implement high-performance signal generators that guarantee compliance and product reliability, which further adds to the increasing Europe signal generator market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 317.29 Million |

|

Market Forecast in 2033

|

USD 487.86 Million |

| Market Growth Rate 2025-2033 | 4.9% |

The signal generator industry of Europe flourishes due to its dedicated emphasis on advanced technological research, especially in industries such as aerospace, defense, and telecommunications. The existence of cooperative research centers and technology partnerships, like Eurocontrol, ESA-branded innovation centers, and inter-border defense consortia, drives the need for advanced signal generators that are intended for harsh test environments. European aerospace and defense manufacturers often employ advanced signal generators to model radar signatures, electronic warfare environments, and satellite communications protocols. These deployments mandate equipment that can provide superior frequency agility, phase stability, and close integration with digital modulation systems. Strategic thrust toward 5G network deployment, secure military communications, and space-launch testing activities guarantees continued demand for signal generator models that incorporate emerging standards and military specifications. Additionally, manufacturers in Europe tend to incorporate compliance with local standards such as CE marking and EMI/EMC directives in their units, facilitating easier local procurement by government agencies and companies seeking to guarantee conformity, which further contributes to the Europe signal generator market growth.

To get more information on this market, Request Sample

One of the key drivers in the Europe signal generator market is the region’s integrated industrial base and specialization of custom solutions required by automotive and research academies. Europe is home to a high density of EV and luxury vehicle makers, along with world-class engineering schools and R&D facilities, each calling for highly accurate signal generators to test EV powertrains, autonomous vehicle sensor qualification, and wireless communication modules. Automotive test facilities regularly need multi-channel, low-noise performance, and signal referencing capabilities for applications such as radar- or LIDAR-based target detection. At the same time, quantum computing, advanced electronics, and wireless protocol development institutions count on signal generators with programmable waveforms and synchronization features designed for very experimental setups. Europe is different in that industry and academia collaborate more closely: in-house test labs in universities frequently co-create or consult on advanced signal generator features with manufacturers, resulting in regional variations that encapsulate European engineering requirements and compliance issues. This ecosystem-driven customization both nurtures innovation and sustains steady adoption of advanced signal generator technologies across Europe.

Europe Signal Generator Market Trends:

Growth in Advanced Communication Systems

The increasing adoption of advanced wireless communication technologies across Europe is a key trend shaping the signal generator market. With widespread deployment and upgrading of 4G and 5G networks and Wi-Fi 6 and LTE deployments expanding, there is an onrushing demand for high-frequency, multi-band, and multi-protocol supporting signal generators for testing. For instance, according to a 2022 report, in Europe, Wi-Fi technologies accounted for approximately 90% of all fixed broadband traffic. Moreover, in Germany, Wi-Fi provided nearly 167 GB³ per Hz in 2021, only using the 2.4 GHz and 5 GHz wavelengths, making it 32 times more spectrum efficient in comparison to mobile networks. In order to satisfy the growing demand for high-speed data and low-latency services, European countries, especially Germany, France, and the Nordics, are making significant investments in their telecommunications infrastructure. With network service providers and communications equipment vendors preparing to test next-generation base stations, cell phones, and routers, signal generators have become a must for confirming performance under differing real-world scenarios. In addition, increasing the use of satellite-based internet access in rural locations provides another front of Europe signal generator market demand, necessitating sophisticated RF and microwave signal generators for precise system testing. This transition toward more sophisticated and high-speed communications is increasingly affecting the design and operation of signal generators specifically suited for the European market.

Increased Integration of IIoT and Industrial Automation Requirements

Europe's manufacturing and energy industries are witnessing a major digital shift fueled by the take-up of Industrial Internet of Things (IIoT) technologies. This has developed a trend where signal generators are more and more being incorporated into the testing and validation of connected industrial devices. For instance, the Industrial Internet of Things (IIoT) market in the United Kingdom reached USD 9.53 Billion in 2024 and is forecasted to reach USD 28.40 Billion by 2033, growing at a CAGR of 12.90% during 2025-2033. Moreover, factories in industries like Germany and Austria, where Industry 4.0 is well entrenched, are also implementing smart machinery equipped with embedded sensors, wireless modules, and automation systems—all of which need accurate signal input for diagnostics, calibration, and predictive maintenance simulations. Signal generators that can support M2M (machine-to-machine) communications, narrowband IoT (NB-IoT), and industrial Wi-Fi protocols are increasingly essential for engineers and automation professionals. This trend is also driven by Europe's robust regulatory environment related to data integrity, equipment reliability, and standards of interoperability that forces manufacturers to thoroughly test connected devices prior to deployment. This intersection of industrial automation and wireless technology is broadening the range of applications of signal generators in various industries, facilitating growth in the Europe signal generator market outlook.

Customization, Miniaturization, and Localized Innovation

Another key trend in Europe's signal generator market is increased demand for customizable, small-footprint, and application-oriented instruments. European industry and research institutions frequently need signal generators that cater to specialized applications, spanning low-power medical equipment to high-accuracy aerospace testing. This requirement is compelling manufacturers to create modular, transportable units that can be readily configured in varied test environments. Additionally, several European universities and R&D centers work in liaison with regional and international manufacturers to jointly design signal generation technology that addresses regional innovation requirements. The market also witnesses growing popularity in software-defined signal generators, which provide flexibility in different test conditions through programmable interfaces. Compact bench-top or USB-based devices are especially favored among start-ups and small laboratories engaged in the development of advanced electronics and IoT devices. This move toward convenience and integration friendliness promotes innovation as well as affordability, making it easier for smaller businesses and research institutions to compete while promoting the use of high-precision test equipment, as observed through Europe signal generator market trends.

Europe Signal Generator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe signal generator market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product, technology, application, and end use.

Analysis by Product:

- RF Signal Generator

- Microwave Signal Generator

- Arbitrary Waveform Generator

- Vector Signal Generator

RF signal generator stands as the largest component in 2024. RF signal generators are the top product segment in the Europe signal generator market, owing to its the extensive application base in the telecommunications, aerospace, defense, and industrial industries. RF signal generators are pivotal in producing continuous wave (CW) signals and modulated signals used in testing RF components, receivers, and transmitters. With Europe speeding up the installation of 5G infrastructure and growing its IoT ecosystem, the demand for accurate and high-frequency RF signal generation has increased immensely. Furthermore, industries in nations such as Germany and France depend significantly on RF signal generators for R&D, device qualification, and regulatory compliance testing. The frequency accuracy, flexibility, and wide modulation range of state-of-the-art RF signal generators make them an essential tool in commercial and military applications. Dominance is further justified by growing demand for wireless consumer electronics and the creation of connected cars, which need compelling RF performance validation over the design and manufacturing process.

Analysis by Technology:

- Global System for Mobile Phones (GSM)

- Code Division Multiple Access (CDMA)

- Wideband Code Division Multiple Access (WCDMA)

- Long Term Evolution (LTE)

- Others

Global system for mobile phones (GSM) leads the market share in 2024. GSM continues to be the dominant technology segment according to the Europe signal generator market forecast, due to its significant status in mobile network infrastructure and tradition of use in regions around the world. Even though new technologies such as LTE and 5G have developed, GSM is still used massively for voice communication, text messaging, and general mobile services, especially in rural and less-prosperous regions. Signal generators capable of supporting GSM protocols are critical in the testing of legacy system embedded modules, mobile handsets, and base stations. As the home of GSM standards, Europe possesses a widespread infrastructure and regulatory environments still dependent on the technology. GSM technology is also commonly employed in machine-to-machine (M2M) applications for low-bandwidth IoT systems, smart metering, and remote monitoring, where reliability and ease of use are paramount. The long-term applicability of GSM in both commercial and industrial applications predicts ongoing demand for compatible signal generators throughout the region.

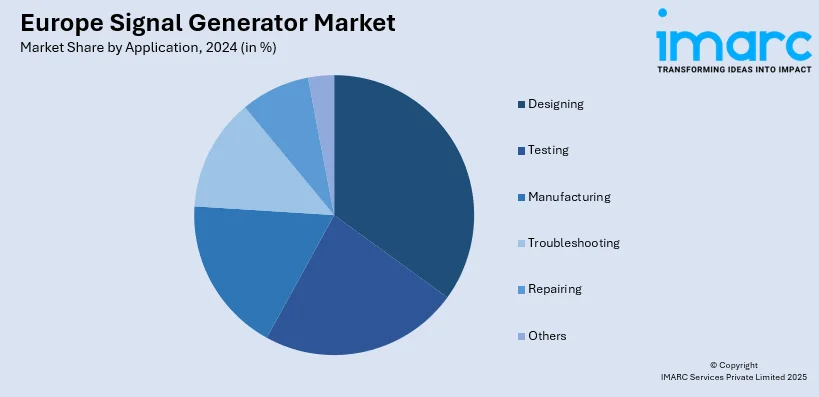

Analysis by Application:

- Designing

- Testing

- Manufacturing

- Troubleshooting

- Repairing

- Others

Designing leads the market share in 2024. Designing remains the top application segment as per the Europe signal generator market analysis, owing to the region's strong emphasis on innovation, research, and product development in high-tech industries. Signal generators are a priceless tool for the design and prototyping of electronic systems, which allow engineers to replicate and test real-world operating conditions for wireless devices, communication systems, radar systems, and automotive electronics. In nations such as Germany, the UK, and France, which are famous for engineering prowess and high-end manufacturing bases, telecommunications, aerospace, and defense design groups commonly employ signal generators to ensure system behavior under different frequencies and modulation types. The requirement for accuracy, flexibility, and repeatability in front-end design processes further pushes demand for advanced signal generation technology even higher. Additionally, as European businesses strive to remain competitive at the international level by continuously innovating, spending on R&D laboratories based on state-of-the-art signal generators becomes inevitable. This makes designing a vital, high-margin application area throughout the European region.

Analysis by End Use:

- Communications Industry

- Aerospace and Defense Industry

- Mechanical Industry

- Electronics Industry

- Healthcare

- Others

Communications industry leads the market share in 2024. The communications sector is the dominant end-use segment of the Europe signal generator market, primarily due to the advanced telecommunications infrastructure in the region and the ongoing shift toward next-generation connectivity. With European countries aggressively developing 5G networks and upgrading current LTE and Wi-Fi infrastructure, signal generators become critical for testing and certification of base station, antenna, router, and mobile device performance. Telecom operators in Germany, France, the UK, and the Nordics utilize high-frequency signal generators extensively to meet local and global standards, enhance signal quality, and minimize latency. Moreover, the growing need for a seamless connection, propelled by remote working, IoT expansion, and smart cities, accelerates the demand for non-stop innovation in communication systems. Signal generators facilitate accurate emulation of network conditions, allowing engineers to detect and solve performance problems in development and deployment. With Europe moving toward an entirely connected digital economy, communications is the key industry driving signal generator uptake.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. Germany is the dominant regional market in the Europe signal generator market due to the country's powerful industrial sector, advanced research facilities, and world leadership in engineering and production. The nation's leadership in automotive, aerospace, telecom, and electronics industries create a recurring demand for high-precision signal generators that are utilized in product design, testing, and verification. German businesses are leading the charge toward cutting-edge technologies like 5G, Industrial IoT, and autonomous mobility, which all need advanced signal test solutions to guarantee performance and regulatory compliance. Besides, there are several R&D facilities, technical institutes, and innovation clusters in Germany that closely work with signal generator manufacturers in the development of tailored test systems. The focus on quality control, compliance with stringent regulatory requirements, and emphasis on ongoing technological advancement fortifies the nation's presence in the market even more. With a well-established technological ecosystem and robust export-oriented manufacturing, Germany continues to be a prominent growth driver in the larger European signal generator market.

Competitive Landscape:

Several major players in the Europe signal generator market are proactively driving growth by investing strategically in innovation, localization, and cutting-edge technology development. Firms are placing emphasis on the development of signal generators with improved frequency ranges, better modulation abilities, and better user interfaces to address the changing requirements of sectors like telecommunications, aerospace, defense, and automotive. Top players are setting up regional R&D facilities and engineering support groups in Europe to closely interact with local customers to ensure products are custom-made to address particular application requirements and conformity regulations. Moreover, some companies are enlarging their product lines by adding modular, box-size, and software-defined signal generators to address growing demand from research centers and small design labs. Collaborations with universities in Europe and government-supported tech programs also facilitate co-development of emerging test tools, especially for 5G, IIoT, and automotive radar applications. In addition, businesses are utilizing online platforms to provide remote calibration services, cloud-based testing software, and real-time performance monitoring, which improve customer experience. Several are also meeting environmental and green goals by creating energy-efficient devices with longer product lives. These extensive measures by industry leaders are strengthening their market positioning while speeding up the technological development and uptake of signal generators in the European region.

The report provides a comprehensive analysis of the competitive landscape in the Europe signal generator market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Spectrum Instrumentation announced the launch of four new Arbitrary Waveform Generators (AWGs), the latest additions to its DN2.63x NETBOX series of signal generators. With a 16-bit resolution and transmission speeds of as much as 10 GS/s, the high-speed devices can be directly connected to PCs, laptops, or even workplace networks.

- January 2025: Rohde & Schwarz announced an upgrade to its renowned R&S SMW200A vector signal generator and the R&S SMM100A. The upgraded R&S SMW200A offers significant improvements in error vector magnitude (EVM) performance, making it a reliable option for high-demand RF applications such as power amplifier testing as well as 5G NR FR3 research.

- June 2024: AnaPico AG officially launched the APLC and APHSP range of analog signal generators. With this launch, AnaPico now provides an extensive lineup of signal generators designed to address different performance requirements, enabling engineers to select the most suitable device with the best price-performance ratio.

- April 2024: Rohde & Schwarz announced the launch of its new R&S SMB100B microwave signal generator for the generation of analog signals as high as 40 GHz. With four frequency possibilities, the novel device significantly improves analog microwave signal generation with exceptional transmission capabilities, spectral purity, significantly low close-in phase noise, and nearly no wideband noise.

Europe Signal Generator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | RF Signal Generator, Microwave Signal Generator, Arbitrary Waveform Generator, Vector Signal Generator |

| Technologies Covered | Global System for Mobile Phones (GSM), Code Division Multiple Access (CDMA), Wideband Code Division Multiple Access (WCDMA), Long Term Evolution (LTE), Others |

| Applications Covered | Designing, Testing, Manufacturing, Troubleshooting, Repairing, Others |

| End Uses Covered | Communications Industry, Aerospace and Defense Industry, Mechanical Industry, Electronics Industry, Healthcare, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe signal generator market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe signal generator market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the signal generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The signal generator market in Europe was valued at USD 317.29 Million in 2024.

The Europe signal generator market is projected to exhibit a (CAGR) of 4.9% during 2025-2033, reaching a value of USD 487.86 Million by 2033.

The Europe signal generator market is driven by rising demand for advanced wireless communication systems, rapid 5G deployment, and increased integration of Industrial IoT technologies. Growth in aerospace, automotive, and defense sectors further fuels adoption, with emphasis on high-precision testing and compliance across diverse electronic and connectivity-based applications.

Germany accounts for the largest share in Europe signal generator market, driven by its advanced automotive, aerospace, and telecommunications sectors. Strong emphasis on R&D, Industry 4.0 adoption, and precision testing in manufacturing fuels demand. Collaboration between engineering institutions and industry players further accelerates innovation, making Germany a leading hub for high-performance signal generation technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)