Europe Silage Additives Market Size, Share, Trends and Forecast by Type, Form, Function, Silage Crop, and Country, 2025-2033

Europe Silage Additives Market Size and Share:

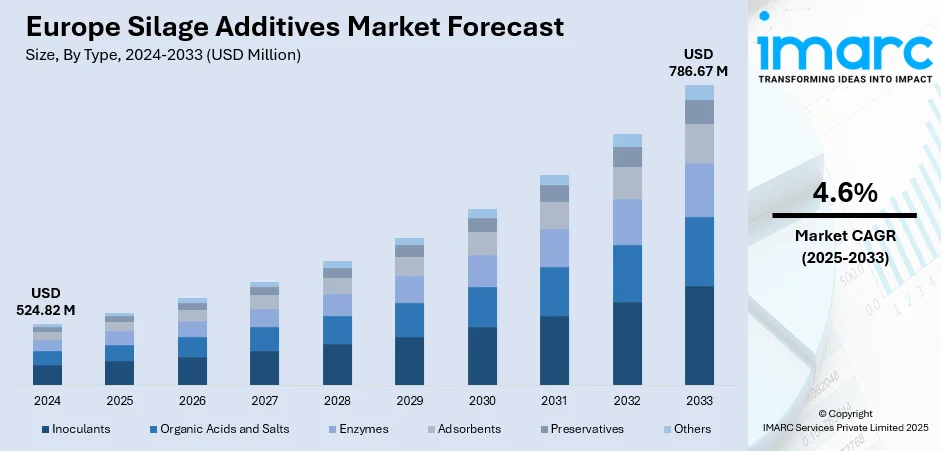

The Europe silage additives market size was valued at USD 524.82 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 786.67 Million by 2033, exhibiting a CAGR of 4.6% from 2025-2033. The growing population and rising meat consumption are fueling demand for high-quality animal feed, which in turn is boosting the use of silage additives. These additives help improve the nutritional value, preservation, and digestibility of silage, ensuring healthier livestock and better productivity. As farmers and producers seek efficient feed solutions to meet increasing consumer demand for meat and dairy products, the adoption of effective silage additives is rising, making it a key driver of rising Europe silage additives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 524.82 Million |

|

Market Forecast in 2033

|

USD 786.67 Million |

| Market Growth Rate 2025-2033 | 4.6% |

In Europe, the rising consumption of meat, milk, and other animal-based products is a key driver of the silage additives market. After years of decline, EU per-capita meat consumption rose to 66 kg in 2024, up 2 kg from the previous year, reflecting stronger demand for animal protein. Coupled with shifting dietary preferences, rising incomes, and urbanization, this trend is increasing the need for consistent, high-quality feed. Farmers are adopting silage additives to preserve forage, improve digestibility, and boost livestock productivity. With the EU’s dairy and beef industries relying on efficient feed solutions, this growing protein demand continues to stimulate steady Europe silage additives market growth.

To get more information on this market, Request Sample

The European Union’s strong focus on sustainability and agricultural efficiency is significantly boosting the adoption of silage additives. Agriculture contributes around 11% of total EU greenhouse gas emissions, with methane from livestock enteric fermentation making up 43% of agricultural emissions. To address this, the EU Green Deal and strict environmental regulations are driving farmers toward practices that reduce waste and optimize resources. Silage additives play a key role by improving fermentation, preserving nutrients, minimizing spoilage, and lowering methane emissions from livestock. This supports climate goals while ensuring profitability. Backed by policy frameworks and subsidies, sustainable livestock farming is accelerating silage additive use across Europe.

Europe Silage Additives Market Trends:

Rising Demand for Animal Protein

Europe’s growing appetite for meat, dairy, and other animal-derived products is a major driver of the Europe silage additives market trends. After years of decline, EU per-capita meat consumption rose to 66 kg in 2024, up 2 kg from 2023, highlighting renewed demand for animal protein. Urbanization, rising incomes, and shifting dietary preferences are further accelerating this trend, putting pressure on farmers to ensure year-round supplies of high-quality feed. Silage additives, which improve forage preservation, nutrient retention, and palatability, enable better feed efficiency and livestock health. Europe’s strong dairy and beef industries, which depend on consistent silage quality to remain competitive, are also fueling demand. By reducing spoilage losses, enhancing productivity, and supporting global exports, silage additives are becoming essential in meeting the region’s increasing protein requirements. This growing consumption trend is expected to continue sustaining steady adoption across Europe.

Technological Advancements and Innovation in Silage Additives

Ongoing innovations in biotechnology and feed preservation are creating new opportunities in Europe’s silage additives market. Manufacturers are developing advanced microbial inoculants, enzymes, and chemical solutions that offer improved fermentation control, longer preservation, and higher nutrient retention. These technological improvements allow farmers to maximize feed utilization, improve livestock productivity, and reduce overall feed costs. Moreover, digital farming and precision agriculture practices are being integrated with silage management, enabling farmers to monitor feed quality in real-time and apply additives more efficiently. European farmers, who face high production costs and competitive markets, are increasingly adopting these advanced solutions to optimize efficiency and sustainability. The growing investment in research and development by key market players, along with rising awareness among farmers about the benefits of modern additives, is fueling significant growth. This technological progress remains a crucial driver shaping Europe silage additives market demand.

Emphasis on Sustainable Agriculture and Environmental Regulations

The European Union’s strong focus on sustainability and strict environmental regulations is significantly boosting the silage additives market. Agriculture accounts for around 11% of total EU greenhouse gas emissions, with methane from livestock enteric fermentation contributing 43% of these emissions and nitrous oxide from soils about 38%. To address these challenges, the EU Green Deal and Farm to Fork Strategy encourage farmers to adopt eco-friendly practices that reduce waste, cut emissions, and optimize resource use. Silage additives align directly with these goals by improving fermentation, reducing nutrient losses, and lowering methane emissions from livestock. They also enhance feed efficiency, decreasing reliance on external imports and supporting self-sufficiency. With subsidies and incentives promoting sustainable practices, farmers are increasingly adopting silage additives. By combining compliance with profitability, these solutions are becoming essential in shaping Europe’s sustainable agricultural future.

Europe Silage Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe silage additives market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on type, form, function, and silage crop.

Analysis by Type:

- Inoculants

- Organic Acids and Salts

- Enzymes

- Adsorbents

- Preservatives

- Others

Inoculants are microbial cultures, mainly lactic acid bacteria, added to silage to improve fermentation efficiency. They accelerate acidification, inhibit spoilage organisms, and preserve nutrients. By enhancing digestibility and feed quality, inoculants boost livestock productivity while reducing feed waste, making them the most widely used silage additive category.

In line with this, the organic acids, such as formic and propionic acid, and their salts are used to lower pH, control harmful bacteria, and reduce mold growth in silage. They act quickly to stabilize forage, prevent nutrient degradation, and improve preservation, ensuring safer, longer-lasting feed for livestock under varied storage conditions.

Additionally, the enzymes like cellulase, amylase, and hemicellulase break down complex carbohydrates in forage, releasing fermentable sugars that support lactic acid bacteria activity. This enhances silage fermentation, increases digestibility, and boosts energy availability for livestock. Enzyme-based additives are especially effective for fibrous crops, improving feed utilization and animal performance significantly.

Moreover, the adsorbents are used to bind excess moisture, toxins, or undesirable compounds in silage, thereby improving stability and reducing risks of spoilage. They enhance aerobic stability, prevent mold development, and safeguard feed quality. By ensuring drier, more consistent silage, adsorbents support animal health and reduce potential feed-related losses.

Besides this, the preservatives, including chemical compounds like formaldehyde or benzoates, are added to prevent microbial spoilage and extend silage shelf life. They inhibit mold, yeast, and clostridia growth, ensuring better feed safety. By maintaining nutrient value over longer storage periods, preservatives help farmers secure consistent, high-quality forage supplies year-round.

Also, the other category covers emerging or niche additives, such as antioxidants, flavoring agents, and novel bio-based solutions. These products provide specialized benefits like improving palatability, enhancing aerobic stability, or reducing greenhouse gas emissions. While smaller in market share, “others” represent an area of innovation responding to evolving sustainability and efficiency needs.

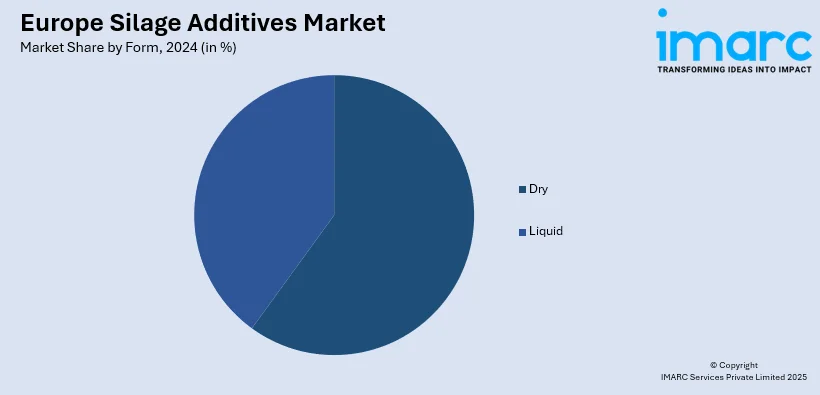

Analysis by Form:

- Dry

- Liquid

Dry silage additives, usually in powder or granular form, are easy to store, transport, and handle. They offer longer shelf life and stable microbial activity, making them highly convenient for farmers. Applied directly during ensiling, they effectively enhance fermentation, preserve nutrients, and ensure consistent silage quality.

Apart from this, the liquid silage additives provide rapid dispersion and uniform coverage of forage, ensuring quick microbial action. They are highly effective in controlling pH, suppressing spoilage organisms, and promoting efficient fermentation. While requiring careful storage and handling, liquid forms are preferred for large-scale silage operations seeking immediate and consistent preservation results.

Analysis by Function:

- Stimulation

- Inhibition

- Others

Stimulation additives, such as microbial inoculants and enzymes, enhance the fermentation process by promoting lactic acid bacteria activity and breaking down complex fibers. They improve nutrient availability, silage digestibility, and overall feed quality. These additives directly support livestock performance, maximizing productivity and efficiency in both dairy and meat production systems.

Concurrently, the inhibition additives, including organic acids, salts, and preservatives, suppress harmful microorganisms like molds, yeasts, and clostridia that degrade silage quality. By preventing spoilage, reducing nutrient losses, and improving aerobic stability, they extend silage shelf life. Their use ensures safer, more consistent feed supplies while protecting animal health and farm profitability.

Furthermore, the other functional additives provide specialized benefits, such as antioxidants to reduce nutrient oxidation, adsorbents to control moisture and toxins, and flavor enhancers to improve feed intake. These niche solutions complement primary stimulatory and inhibitory functions, addressing specific challenges in silage management and supporting sustainability, efficiency, and innovation within livestock farming.

Analysis by Silage Crop:

- Corn

- Alfalfa

- Sorghum

- Oats

- Barley

- Rye

- Others

Corn is the most widely used silage crop in Europe due to its high energy content and digestibility. Rich in starch, it supports dairy and beef productivity. Silage additives improve fermentation, reduce spoilage, and preserve nutrients in corn silage, ensuring consistent feed quality and enhancing livestock performance throughout the year.

Additionally, the alfalfa silage is protein-rich, making it a valuable feed for dairy cattle. However, it has low sugar content and high buffering capacity, making fermentation challenging. Silage additives such as inoculants and enzymes enhance fermentation, improve palatability, and preserve protein, helping farmers maximize its nutritional value for sustainable livestock production.

Moreover, the sorghum is a drought-tolerant crop widely used as silage in regions with limited water resources. Though lower in energy than corn, it provides reliable forage. Additives improve its fermentation efficiency, enhance digestibility, and reduce fiber content, enabling farmers to optimize feed quality while supporting livestock productivity in challenging growing conditions.

Also, the oats provide a versatile silage option with good fiber and moderate energy levels. However, they ferment less efficiently compared to corn or barley. Silage additives play a key role in enhancing lactic acid production, preserving nutrients, and improving palatability, ensuring oat silage serves as a dependable feed source for livestock.

Besides this, the barley silage offers high digestibility and rapid fermentation but can be prone to spoilage if not managed carefully. Additives such as organic acids and inoculants help stabilize fermentation, reduce dry matter losses, and maintain feed quality. Its nutritional profile makes barley silage popular in both beef and dairy farming systems.

Furthermore, the rye is valued for its rapid growth and adaptability to colder climates, making it a common silage crop in Northern Europe. However, it is susceptible to spoilage due to high moisture content. Silage additives enhance preservation, improve aerobic stability, and maintain nutrient quality, ensuring rye silage is safe and nutritious.

Apart from this, the other silage crops include wheat, triticale, clover, and grass varieties, which vary in nutritional content and preservation challenges. Additives are tailored to improve fermentation, enhance digestibility, and extend shelf life across these crops. By reducing spoilage and nutrient loss, they support diverse feeding strategies in Europe’s livestock production systems.

Analysis by Country:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

Germany, with its strong dairy and beef industries, is a leading market for silage additives. Farmers face high production costs and strict environmental regulations, driving adoption of inoculants, enzymes, and organic acids. Sustainable farming practices and advanced silage management technologies further support market expansion across the country’s livestock sector.

Additionally, the UK silage additives market benefits from its robust dairy industry and growing focus on sustainable farming. Farmers face increasing pressure to reduce emissions and maximize feed efficiency. Enzymes and inoculants are widely adopted to improve forage quality, ensuring competitiveness and compliance with environmental goals in domestic and export markets.

Moreover, France, one of Europe’s largest agricultural producers, has strong demand for silage additives due to its extensive cattle and dairy farming sectors. High consumption of cheese and dairy products drives feed demand. Policies promoting sustainability and productivity improvements are pushing farmers toward advanced additives for consistent, high-quality forage preservation.

Meanwhile the Italy’s silage additives market is shaped by its thriving dairy industry, particularly for cheese production. Corn and alfalfa are common silage crops. Additives improve fermentation, enhance digestibility, and ensure year-round feed availability. Growing consumer demand for premium dairy products supports additive adoption, with sustainability policies further strengthening market opportunities.

Also, the Russia’s vast livestock and dairy industries drive significant demand for silage additives. Corn and barley are widely used silage crops, requiring inoculants and preservatives to enhance quality. Government initiatives to boost domestic meat and dairy production, alongside modernization of farming practices, are accelerating the adoption of silage additive solutions.

Besides this, Spain, with its warm climate, relies heavily on silage to support cattle and dairy production. Corn and sorghum are prominent forage crops. Additives help reduce spoilage in high-temperature conditions, improving silage stability. Rising demand for dairy and meat, combined with efficiency-focused farming, supports steady silage additives market growth.

However, the Netherlands is a key hub for dairy exports, particularly cheese, driving high demand for quality silage. Farmers prioritize additives that enhance fermentation and reduce emissions in line with strict EU sustainability targets. Innovative feed preservation technologies and precision agriculture practices are widely adopted, supporting strong market growth nationally.

Similarly, the Switzerland’s dairy industry, known for premium milk and cheese, underpins demand for silage additives. With limited arable land, efficient forage use is critical. Additives improve nutrient preservation and feed consistency, supporting livestock productivity. Sustainability standards and consumer preference for high-quality animal products further encourage additive adoption among Swiss farmers.

Along with this, the Poland’s rapidly expanding dairy and beef industries make it a growing market for silage additives. Corn and rye silage are widely used, with additives ensuring better fermentation and nutrient retention. Government support for agricultural modernization and rising export potential are driving increased adoption of advanced silage management solutions.

Apart from these, the other European countries, including Denmark, Ireland, and Austria, also contribute significantly to the silage additives market. Strong dairy sectors, sustainability policies, and modern farming practices fuel demand. Additives help improve forage preservation, meet environmental standards, and boost livestock productivity, ensuring competitiveness in both domestic and international protein markets.

Competitive Landscape:

The competitive landscape is characterized by strong rivalry, driven by the increasing demand for high-quality animal feed and sustainable farming solutions. Market players compete on the basis of product innovation, offering advanced microbial inoculants, enzymes, and chemical formulations that enhance silage preservation and livestock productivity. Strategic partnerships with distributors, technological advancements, and research investments are common approaches to strengthen market presence. Additionally, companies focus on expanding product portfolios to address diverse livestock requirements and regulatory compliance. With sustainability and efficiency becoming key priorities, the Europe silage additives market analysis shows intensifying competition, where innovation, cost-effectiveness, and value-added solutions are critical. Companies that successfully deliver advanced, sustainable, and affordable products are more likely to achieve long-term success and retain market share in this evolving agricultural landscape.

The report provides a comprehensive analysis of the competitive landscape in the Europe silage additives market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: De Heus Animal Nutrition, a prominent supplier of various animal feed and farm solutions, including silage additives, successfully acquired Voeders Huys. This acquisition reinforces the standing of De Heus in Western Europe, an important region where the business has already achieved substantial commercial success and is going to soon manufacture locally.

- May 2025: FM BioEnergy reported significant improvements in its new grass silage additive product. Silasil Energy SG was especially established to produce a silage additive that would address the unpredictability of grass grown in the United Kingdom. With its distinctive blend of four bacterial strains, it has performed well in the UK's erratic summer climate.

- October 2024: Lallemand Animal Nutrition (LAN), a renowned manufacturer of various technical products, including silage inoculants, announced the establishment of the LabCom ‘Biofilm1Health’ in partnership with INRAE Micalis Institute. This innovative collaborative initiative seeks to promote the One Health strategy, which is a comprehensive plan that incorporates environmental, animal, and human health.

- March 2024: EW Nutrition successfully completed the acquisition of the BIOMIN BIOSTABIL range of products from DSM-Firmenich. Through this agreement, EW Nutrition has become the owner of a widely recognized and profitable silage inoculant line.

Europe Silage Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Inoculants, Organic Acids and Salts, Enzymes, Adsorbents, Preservatives, Others |

| Forms Covered | Dry, Liquid |

| Functions Covered | Stimulation, Inhibition, Others |

| Silage Crops Covered | Corn, Alfalfa, Sorghum, Oats, Barley, Rye, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe silage additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe silage additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe silage additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The silage additives market in Europe was valued at USD 524.82 Million in 2024.

The Europe silage additives market is projected to exhibit a (CAGR) of 4.6% during 2025-2033, reaching a value of USD 786.67 Million by 2033.

Key factors driving Europe silage additives market include rising demand for meat and dairy products, the need for high-quality, nutrient-rich feed, and strict EU sustainability regulations. Technological advancements in inoculants and enzymes, coupled with subsidies promoting eco-friendly farming, are boosting adoption, ensuring better livestock productivity and reduced environmental impact.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)