Europe Soybean Oil Market Size, Share, Trends and Forecast by End User, and Country, 2026-2034

Europe Soybean Oil Market Size and Share:

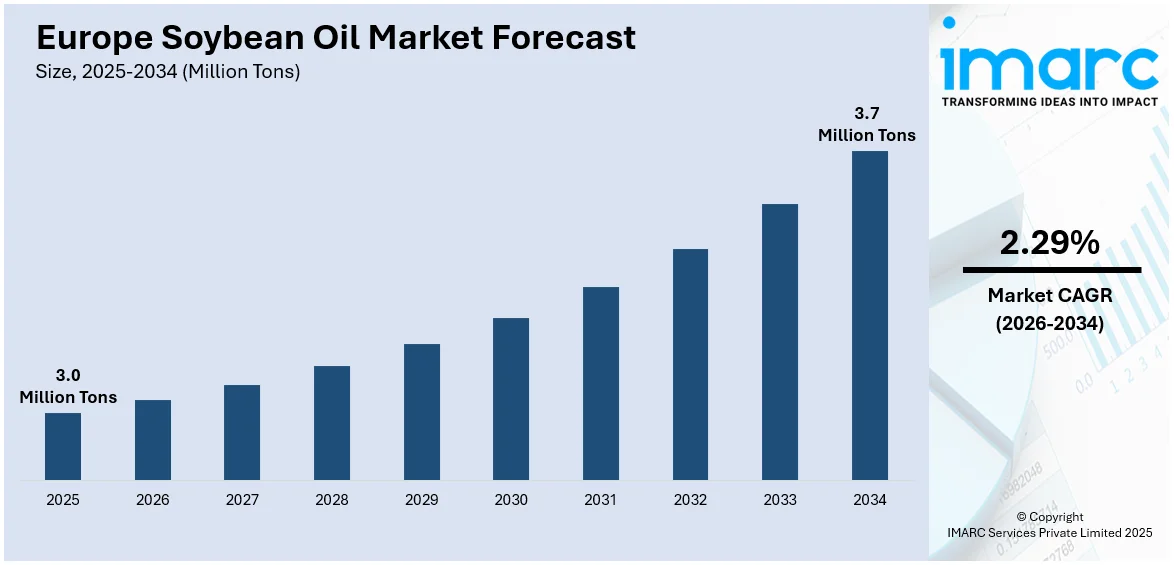

The Europe soybean oil market size reached 3.0 Million Tons in 2025. Looking forward, the market is expected to reach 3.7 Million Tons by 2034, exhibiting a CAGR of 2.29% during 2026-2034. The market is driven by the rising demand for plant food and an expanding emphasis on healthier and sustainable oils for cooking. Increased consciousness regarding the health benefits of soybean oil, including its polyunsaturated fat content, underpins its growth in domestic and industrial usage. Growing biofuel industry in Europe, aided by supportive government initiatives, and the growing food processing sector, applying soybean oil to foods such as snacks, baked products, and dressings are collectively fueling the Europe soybean oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 3.0 Million Tons |

| Market Forecast in 2034 | 3.7 Million Tons |

| Market Growth Rate 2026-2034 | 2.29% |

A major growth driver for the Europe soybean oil market is the region's increasing shift toward plant-based and sustainably friendly diets. Consumers in Europe are becoming more health-conscious, aware of their environment, and concerned about ethical food sourcing, which has driven an increasing need for plant-based oils such as soybean oil. Germany, the Netherlands, and the UK are leading in this shift in diet, with flexitarianism and veganism transforming consumption habits. Soybean oil, with its mild taste and multifunctional nature of use in food preparation and food production, is proving to be an increasingly popular option with both consumers and manufacturers. Its label as a cholesterol-free, heart-healthy oil fits well into Europe's wider public health initiatives promoting the consumption of reduced saturated fats. In addition, the oil's compatibility with organic and non-GMO certification resonates powerfully with Western European markets, where food label transparency and certification are playing increasingly important roles in purchasing decisions, and hence, contribute significantly to the Europe soybean oil market growth.

To get more information on this market Request Sample

Another key driver of the Europe soybean oil market is the increasing industrial consumption of the oil, especially in biofuels and oleochemicals. While the European Union sets more stringent renewable energy goals, soybean oil is increasingly becoming significant as a renewable feedstock for biodiesel production. France, Italy, and Spain are introducing higher percentages of biofuel in transport, and this is creating stable demand for vegetable oils like soy. The soybean oil sector is also seeing regional policy contexts like the Renewable Energy Directive II favoring the utilization of low-emission substitutes for fossil fuel. The European industry is also shifting toward soybean oil due to its application in lubricant production, paints, and cosmetics. Local crushing plants in strategic port hubs such as Rotterdam and Antwerp facilitate the effective processing of imported soybeans into meal and oil, minimizing reliance on foreign processing. This local infrastructure enhances Europe's supply chain resilience by improving the strategic position of soybean oil in industrial use.

Europe Soybean Oil Market Trends:

Increasing Use of Plant-Based Diets in Europe

One of the most noted trends influencing the Europe soybean oil market is the increasing use of plant-based diets throughout the region. Consumers in nations like Germany, Sweden, and the Netherlands are increasingly moving away from animal-based products toward more sustainable, plant-based alternatives. New research conducted in 2024 by The Vegan Society shows a rising trend in the UK toward plant-based eating, with 3% identifying as vegan or plant-based and 10% actively reducing or avoiding animal products. This change is dietary yet cultural, triggered by increasing concern about the environment, animal welfare, and the health of consumers. As more people turn to plant-based eating, so too does demand increase for vegetable oils such as soybean oil, commonly utilized in vegan and vegetarian foodstuffs such as meat alternatives, sauces, and ready meals. Food manufacturers and restaurant chains are now increasingly reformulating products to meet this demand, with much of it supplied by soybean oil due to its light taste, cooking characteristics, and nutritional profile. Retail shelves in Western Europe are also filling up with private-label and branded products that emphasize soybean oil as a main ingredient, reflecting its growing importance in the Europe soybean oil market trends.

Health Awareness and the Rise of Lifestyle-Related Illnesses

The European soybean oil market is also influenced by increasing sensitivity to chronic ailments, with a focus on obesity, diabetes, and cardiovascular diseases. These are conditions driven by lifestyle and are on the rise throughout the continent, especially among Southern and Eastern European nations. According to reports, nearly 51% of the EU population aged 16 and over are overweight, and 17% are obese. Rates of overweight and obesity are increasing significantly among both children and adults. This has compelled consumers and health organizations to focus on the quality of food and nutrition. Part of this change involves an increasing interest in oils with reduced saturated fat content and more polyunsaturated content, which are attributes with which soybean oil is endowed by nature. Consumers who care about health in nations such as Italy, Spain, and the UK are seeking oils that promote improved heart health without sacrificing taste or functionality at the cooktop. The consumer is responding with more transparent labeling, reformulated foods, and greater promotion of soybean oil as a healthier option compared to the customary saturated fats like butter, palm oil, and lard. This health-conscious trend is impacting both home preparation and the larger food service market, thus stimulating Europe soybean oil market demand through several channels.

Cleaner Energy Demand and Soybean Oil's Role in Biofuel Production

The trend for cleaner sources of energy and lower carbon emissions is a central driver of the Europe soybean oil market. As climate action increases in importance in the European Union, growth in renewable energy development, specifically biofuel manufacturing, is taking off. According to reports from the European Investment Bank (EIB), countries in the EU invested an amount of EUR 110 Billion toward renewable energy generation in the year 2023. Europe now invests ten times more in clean energy than in fossil fuels. Soybean oil, due to the renewable nature of its origin and chemical characteristics, is being used more and more as a feedstock in biodiesel production. France, Belgium, and Austria have been investing in policy mechanisms and infrastructural efforts that facilitate the utilization of vegetable oils such as soybean for alternative energy production. This is also backed by the increasing effort in Europe to reduce fossil fuel dependence and achieve stringent emission targets. Also, sustainable aviation fuel and low-carbon road fuels demand is increasing, resulting in a corresponding rise in the demand for oilseed-based feedstocks. Consequently, soybean oil occupies an increasing share in the food market while also emerging as a strategic commodity within Europe's clean energy transition, as per the Europe soybean oil market forecast.

Europe Soybean Oil Industry Segmentation:

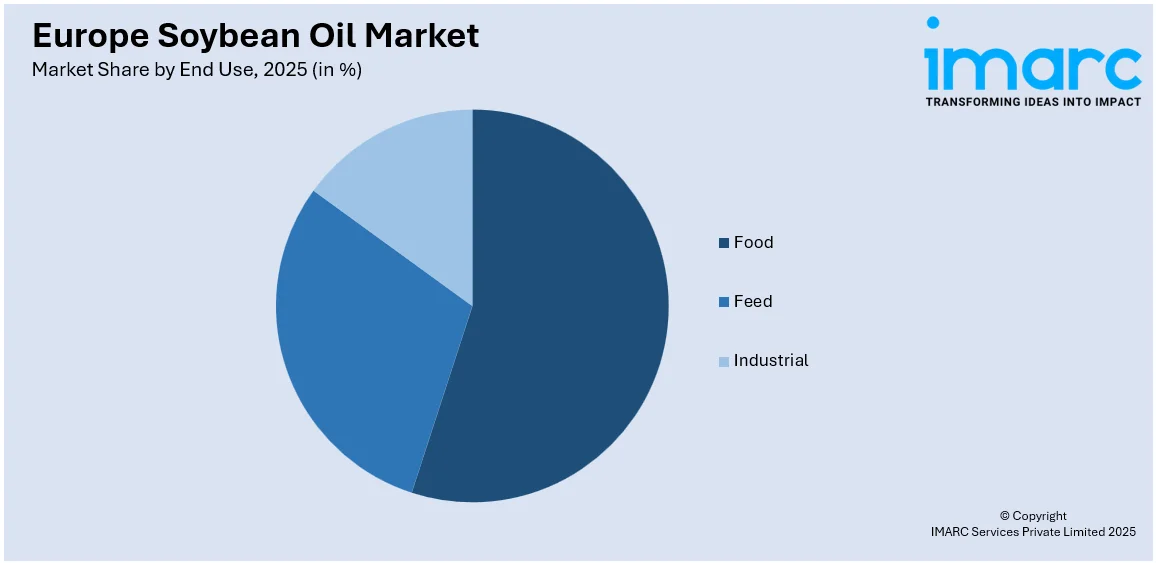

IMARC Group provides an analysis of the key trends in each segment of the Europe soybean oil market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on end use.

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Food

- Feed

- Industrial

Soybean oil has extensive applications in the food processing sector across Europe because of its taste-neutral character, cross-use, and health attributes. It is used as a base for margarine, salad dressings, mayonnaise, and frying fat. Increasing demand for non-GMO and plant-based ingredients adds fuel to its growth in food processing uses.

In animal feeding, soybean oil is a source of energy and contributes to feed palatability. It is widely used in poultry, pig, and cattle nutrition. The livestock industry in Europe depends on soybean oil as part of equitable nutrition to facilitate growth in animals, reproductive well-being, and overall performance along the supply chain.

Soybean oil serves as a key raw material in industrial applications, including biodiesel, lubricants, inks, and resins. Its biodegradable nature and low toxicity make it an eco-friendly alternative to petroleum-based products. In Europe, rising environmental awareness and sustainability regulations are driving industrial adoption of soybean oil across multiple sectors, ensuring a positive Europe soybean oil market outlook.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is one of the major consumers of soybean oil in Europe due to high food processing and biodiesel production demand. Industrial consumption is promoted through sustainability efforts and promotion of bio-based products. The increasing vegan and vegetarian consumer population also supports increased consumption within plant-based food manufacturing and retail industries.

France uses soybean oil primarily in food and feed applications. It has a focus on non-GMO and organic foodstuffs, which favors the use of sustainably produced soybean oil. Use in the production of biodiesel also exists, with the government incentivizing renewable fuels and decreasing dependency on fossil fuels in industry and transportation.

The UK soybean oil market is stimulated by food production, especially in ready meals, sauces, and snacks. Plant-based eating patterns are propelling growth. Although feed use is flat, industrial uses, notably biodiesel, are on the increase. Post-Brexit regulatory developments are impacting import trends and spurring domestic sourcing of sustainable oil substitutes.

Italy's soybean oil usage is focused in food processing, particularly in cooking oils, condiments, and processed food. The nation's cooking traditions coincide with health trends toward vegetable oils. Biodiesel manufacture is growing, spurred by EU environmental objectives, while feed purposes remain significant in Italy's strong livestock and dairy sectors.

In Spain, the soybean oil has extensive usage in food and biodiesel applications. Spain's geographical position facilitates import and processing of the oil. Industrial application is being encouraged through renewable energy policies, while an expanding food industry and consumer preference toward healthy oils are driving growing demand for all retail and horeca channels.

Competitive Landscape:

Major players in the Europe soybean oil market are aggressively investing in strategic moves to extend their market penetration and cope with growing consumer interest in sustainable, plant-based oils. According to the Europe soybean oil market analysis, players like Bunge Limited, Cargill, Louis Dreyfus Company, and Archer Daniels Midland Company (ADM) are investing heavily in raising their processing capacities and optimizing supply chain efficiency. These companies are concentrating on vertical integration, from procurement of non-GMO soybeans to refining and distribution of pure soybean oil in Europe. Sustainability is high on their priority list, with companies embracing environmentally friendly cultivation methods, deforestation-free supply chains, and obtaining certifications like RSPO and ISCC. Further, major players are also aligning with the EU's Green Deal and Farm to Fork initiatives by minimizing carbon emissions and maximizing traceability in manufacturing. Another focus area is innovation, with firms formulating low-trans-fat and organic soybean oil options to address the increasing health-aware customer base. Strategic collaborations and acquisitions are also being used to access new markets and expand product portfolios. Furthermore, digitalization in logistics and inventory management is aiding in terms of enhancing response to market needs. These combined efforts are hugely determining the destiny of the soybean oil market in Europe, setting up large players for long-term growth in a competitive market.

The report provides a comprehensive analysis of the competitive landscape in the Europe soybean oil market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Moolec Science announced a merger with Bioceres Group, Nutrecon, and Gentle Tech in an all-stock deal. The new entity will expand molecular farming innovations like Piggy Sooy (pork-producing soybeans) and GLASO safflower-derived soybean oil, focusing on sustainable protein and oil production, with 2024 sales exceeding USD 500 Million.

- April 2025: UK flour supplier Whitworths agreed to acquire KTC Edibles Group, a vertically integrated company supplying over 370,000 Tons of oils and fats annually across major UK food channels. The deal awaits approval from Irish competition authorities and marks Whitworths’ expansion into the edible oils sector.

- February 2025: SD Guthrie International acquired a 48% stake in Marvesa for EUR 54 Million to strengthen its European presence. The deal enhances SDGI’s supply of oils and fats, including soy oil, to animal feed and biofuel sectors, supporting diversification into non-palm markets and expanding global growth opportunities.

- October 2024: ADM acquired Vandamme Hungaria to strengthen its non-GM soybean and corn germ processing capacity in Europe. The Hungarian facility processes 700 metric tons/day, expanding ADM’s non-GM soybean offerings for food, feed, pet, and oil markets while supporting crop rotation and EU deforestation regulation compliance.

- August 2024: ADM announced its focus at SPACE 2024 on fully verified, traceable soybean meal and oil to meet EU deforestation rules. Sourced via its re:source program, ADM will also showcase science-backed animal nutrition solutions, including species-specific feed, trace minerals, sweeteners, and new XRF analysis services.

Europe Soybean Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Food, Feed, Industrial |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe soybean oil market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe soybean oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe soybean oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soybean oil market in Europe size reached 3.0 Million Tons in 2025.

The Europe soybean oil market is projected to exhibit a (CAGR) of 2.29% during 2026-2034, reaching a volume of 3.7 Million Tons by 2034.

The Europe soybean oil market is driven by rising demand for plant-based foods, increasing health awareness, and the growing biofuel industry. Regulatory support for renewable energy, coupled with sustainability concerns, also boosts soy oil usage. Additionally, shifts in consumer preferences toward non-GMO and organic products further influence market trends and drive innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)