Europe Stacker Market Size, Share, Trends, and Forecast by Type, End User, and Country, 2025-2033

Europe Stacker Market Size and Share:

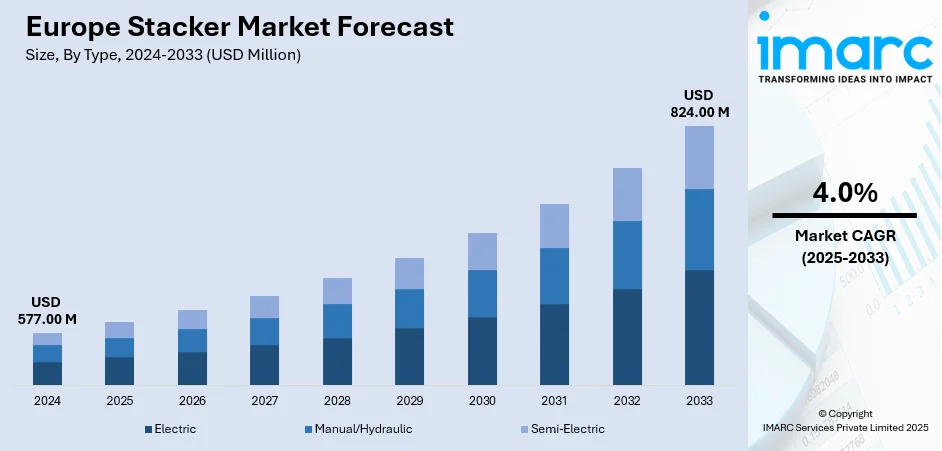

The Europe stacker market size was valued at USD 577.00 Million in 2024. Looking forward, the market is expected to reach USD 824.00 Million by 2033, exhibiting a CAGR of 4.0% during 2025-2033. The market is growing steadily, driven by rising demand for efficient material handling solutions across warehouses, logistics hubs, and manufacturing facilities. Increasing automation, focus on workplace safety, and adoption of advanced equipment for space optimization are some of the other factors collectively contributing to the Europe stacker market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 577.00 Million |

| Market Forecast in 2033 | USD 824.00 Million |

| Market Growth Rate 2025-2033 | 4.0% |

The market is growing steadily, supported by several key factors across industries and regulatory frameworks. One of the key drivers is the increasing adoption of industrial automation and smart manufacturing techniques. With the growing digitalization of operations by companies, efficient, flexible, and dependable material handling systems, such as stackers, are becoming a necessity. The machinery facilitates smooth workflows, improves productivity, and integrates seamlessly into automated systems; hence, they are critical to current production and logistics sectors. Another compelling factor is the region's strict workplace safety regulations. The European authorities put great importance on minimizing accidents and maintaining worker health, which pushes companies to spend money on safer machinery. Stackers equipped with innovative features like ergonomic controls, load sensors, and automatic safety measures are sought after, assisting companies in meeting regulations while safeguarding workers.

To get more information on this market, Request Sample

The Europe stacker market growth is also driven by the growing focus on sustainability and eco-friendly practices, which further fuels the adoption of electric-powered stackers. These models emit no emissions, have low noise levels, and are in line with company and regional sustainability targets. Companies are moving towards such environment-friendly solutions to minimize environmental impact without compromising on efficiency. Moreover, the growth in e-commerce and logistics networks is hugely driving demand. Distribution centers and warehouses need efficient material handling systems to handle bigger inventories, accelerate order fulfillment, and reduce storage space. Stackers are offering the flexibility and economy required to address these needs and are becoming the go-to solution in retail, logistics, and manufacturing industries.

Europe Stacker Market Trends:

Automation and Operational Efficiency

The Europe stacker market is strongly driven by the rise of industrial automation and smart manufacturing. As industries continue adopting automated systems, the need for efficient material handling equipment grows significantly. According to the International Federation of Robotics (IFR), investment in automating the car industry in Europe remains high, with 23,000 industrial robots installed in 2024. This underscores the region’s commitment to automation and highlights the growing requirement for stackers to support robotic operations. Stackers play a vital role by providing a cost-effective and streamlined solution for moving and stacking heavy loads. Their ability to boost productivity, improve workflows, and handle tasks with speed and precision makes them indispensable in modern industrial environments.

Workplace Safety and Ergonomic Design

Stringent workplace safety regulations in Europe are another key driver for stacker adoption. Industries are prioritizing equipment that minimizes accident risks and complies with regulatory standards. Advanced stackers with features like automatic braking systems, load sensors, and ergonomic operator controls are in high demand. These innovations not only enhance safety but also improve user comfort, reducing workplace fatigue and errors. The importance of such safety-focused solutions is evident, as the Government of the UK reported 124 worker fatalities in work-related accidents in 2024/25. This alarming figure underscores the urgency for safer, more reliable material handling equipment, positioning stackers as essential tools for promoting occupational safety across warehouses, factories, and logistics hubs.

Sustainability and E-Commerce Growth

Sustainability goals and the rapid growth of e-commerce are also influencing the Europe stacker market trends. Businesses are increasingly adopting eco-friendly solutions, with electric-powered stackers gaining traction due to their zero emissions and lower noise levels. This shift aligns with corporate efforts to reduce carbon footprints and meet environmental targets. Simultaneously, the surge in online shopping is boosting warehousing and logistics demand. A report highlights that 78% of France’s population shopped online in 2024, reflecting the strong expansion of e-commerce. To handle quick order fulfillment, warehouses rely on stackers for efficient space utilization, smooth inventory management, and faster goods movement. These trends collectively reinforce the rising importance of sustainable and versatile stacker solutions in Europe.

Europe Stacker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Europe stacker market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Electric

- Manual/Hydraulic

- Semi-Electric

Electric stackers dominate the market as industries increasingly prioritize sustainability, efficiency, and low-emission equipment. Businesses are adopting electric-powered solutions to align with EU environmental targets and reduce carbon footprints. These stackers offer quiet operations, lower maintenance costs, and high energy efficiency, making them ideal for warehouses and logistics hubs. Their ability to handle heavy loads while ensuring operator comfort and safety enhances productivity. With e-commerce and automation driving demand for quick, eco-friendly solutions, electric stackers continue to gain traction across retail, logistics, and manufacturing sectors, positioning them as the preferred choice for modern, sustainable material handling operations.

Manual and hydraulic stackers hold a strong share in the European market due to their affordability, simplicity, and suitability for small- to medium-scale operations. Many SMEs, retail outlets, and small warehouses prefer these stackers as they require minimal investment and no external power source. Their compact design makes them effective in narrow spaces, while low maintenance requirements add to their appeal. These stackers are particularly useful for handling lighter loads and short-distance operations. In regions with budget-sensitive buyers or smaller facilities, manual/hydraulic stackers remain a practical choice, ensuring steady demand despite the rising trend toward automation and electric-powered alternatives.

Semi-electric stackers are widely adopted in Europe because they offer the perfect balance between manual operation and electric assistance. According to the Europe stacker market forecast, they are more affordable than fully electric models while still providing higher efficiency and reduced operator fatigue compared to manual stackers. These features make them attractive for medium-sized businesses seeking cost-effective yet modern material handling solutions. Semi-electric stackers are especially valued in retail, logistics, and light manufacturing sectors where moderate loads need to be lifted and moved quickly. Their versatility, lower energy consumption, and improved ergonomics ensure steady adoption, making them a vital contributor to the European stacker market’s growth.

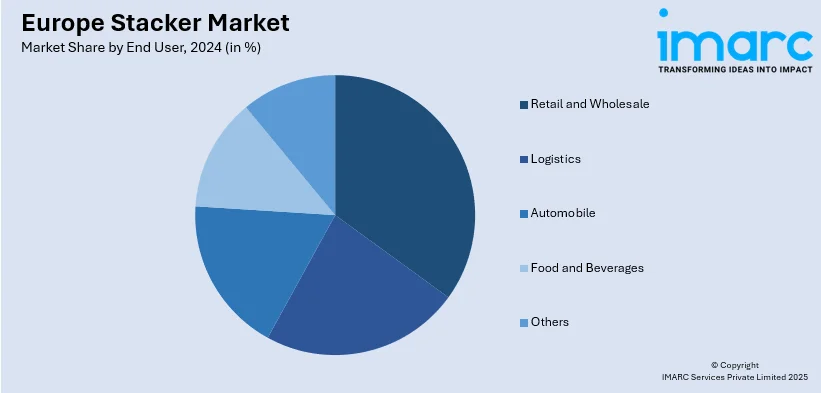

Analysis by End User:

- Retail and Wholesale

- Logistics

- Automobile

- Food and Beverages

- Others

Retail and wholesale sectors hold a dominant share in the European stacker market due to the high volume of goods movement and the need for efficient space utilization. With rising consumer demand and the expansion of supermarket chains, warehouses, and distribution centers, reliable stackers are required to manage inventory and streamline operations. The growth of e-commerce is further fueling order fulfillment needs, making stackers essential for handling varied product loads quickly and safely. Stackers enable improved productivity, safer storage, and faster stock management, which are critical in retail and wholesale environments. Their adaptability across small and large facilities reinforces their extensive adoption.

The logistics sector significantly drives the demand for stackers as it depends on efficient material handling solutions to manage increasing freight volumes. With the boom in e-commerce and international trade, warehouses and distribution hubs across Europe require equipment that ensures smooth operations, optimized workflows, and rapid goods movement. Stackers are cost-effective, versatile, and suitable for handling heavy loads, making them essential for modern logistics networks. Their role in reducing manual labor and improving operational safety also strengthens adoption. As companies invest in automation and digitalized logistics systems, stackers remain a crucial component of supply chain efficiency across the region.

The automobile industry in Europe contributes substantially to the stacker market growth due to its heavy reliance on advanced material handling equipment. With high levels of automation in car manufacturing and component production, stackers are vital for transporting, stacking, and organizing parts efficiently. According to the International Federation of Robotics (IFR), Europe’s car industry installed 23,000 industrial robots in 2024, reflecting the sector’s focus on automation. To complement these robotic operations, stackers provide a safe and streamlined solution for load management. Their ability to handle heavy-duty tasks with precision supports productivity, safety, and efficiency in automotive manufacturing plants and supply chains.

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany’s stacker market is primarily driven by its strong manufacturing and automotive base, which demands advanced and efficient material handling equipment. The country’s emphasis on Industry 4.0 and widespread adoption of automation technologies are boosting the use of stackers in factories and logistics hubs. Sustainability goals are also encouraging the shift toward electric-powered stackers with low emissions and energy efficiency. Additionally, Germany’s expanding e-commerce sector requires modern warehouses equipped with reliable stackers to support high-volume order fulfillment. Stringent workplace safety standards further push businesses to adopt stackers with advanced safety features, reinforcing steady growth in the German market.

In France, the rapid growth of e-commerce is a major driver for the Europe stacker market demand, as logistics centers and warehouses increasingly require efficient handling solutions. France’s focus on reducing carbon emissions also supports the adoption of electric and eco-friendly stackers. Additionally, government initiatives promoting workplace safety and sustainability encourage industries to invest in advanced equipment with ergonomic and secure features. Expanding food and beverage, retail, and automotive sectors further fuel the need for reliable material handling systems, making stackers an essential part of operations.

The United Kingdom stacker market is driven by a combination of strict workplace safety regulations and the need for efficient material handling in logistics and industrial sectors. The booming e-commerce industry, led by increased online shopping, continues to expand warehousing and distribution centers, creating strong demand for advanced stackers. Sustainability initiatives also play a crucial role, as businesses transition toward low-emission, electric-powered equipment. The UK’s diverse economy, including retail, manufacturing, and logistics, ensures steady adoption of stackers across multiple applications.

Italy’s stacker market is being propelled by its growing industrial base and strong presence of small and medium-sized enterprises (SMEs) requiring cost-effective material handling solutions. Rising automation in manufacturing and logistics is boosting the adoption of advanced stackers for greater efficiency and productivity. The country’s increasing focus on reducing workplace accidents also drives demand for stackers with modern safety features such as load sensors and braking systems. Additionally, the retail and e-commerce boom is expanding warehousing operations, creating further opportunities for stacker use. Italy’s push toward sustainability and electric-powered equipment aligns with broader European environmental goals, creating a positive impact on the Europe stacker market outlook.

In Spain, the stacker market benefits from expanding warehousing and logistics operations fueled by rapid e-commerce growth and increasing retail demand. Businesses are investing in efficient stackers to optimize space utilization and streamline inventory management. Spain’s agricultural and food processing sectors also rely on material handling equipment, boosting adoption. Additionally, the country’s efforts to meet EU sustainability targets are encouraging the shift toward eco-friendly, electric-powered stackers. Workplace safety awareness is further driving demand for equipment with operator-friendly and secure features. Combined with the rise of automation in industrial and logistics facilities, these factors continue to strengthen stacker adoption in Spain.

Competitive Landscape:

The competitive landscape of the Europe stacker market is characterized by the presence of global manufacturers and regional players focusing on innovation, sustainability, and safety. Leading companies are investing in advanced electric-powered stackers to meet rising demand for eco-friendly and energy-efficient solutions. Product differentiation through ergonomic designs, automation integration, and enhanced safety features has become a key strategy. Additionally, partnerships with logistics providers, e-commerce warehouses, and industrial clients are helping expand market presence. Intense competition is also driving firms to focus on after-sales services, fleet management solutions, and digital connectivity features. With growing adoption across industries, companies that balance cost-effectiveness, technological advancements, and regulatory compliance are expected to strengthen their position in the Europe stacker market.

The report provides a comprehensive analysis of the competitive landscape in the Europe stacker market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: SANY unveiled the world’s first 50-ton energy storage reach stacker, designed to meet the growing demands of large-scale energy storage projects. This innovative machine features a powerful lifting capability, allowing it to handle ISO 20-foot and 40-foot energy storage containers with a stacking capacity of up to six containers. It boasts impressive energy efficiency, with an electric control pump system and over 65% energy recovery during descent.

Europe Stacker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electric, Manual/Hydraulic, Semi-Electric |

| End Users Covered | Retail and Wholesale, Logistics, Automobile, Food and Beverages, Others |

| Countries Covered | Germany, France, the United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe stacker market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe stacker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe stacker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The stacker market in Europe was valued at USD 577.00 Million in 2024.

The Europe stacker market is projected to exhibit a (CAGR) of 4.0% during 2025-2033, reaching a value of USD 824.00 Million by 2033.

The Europe stacker market is driven by increasing industrial automation, stricter workplace safety regulations, and the shift toward sustainable, eco-friendly equipment. Rising e-commerce activity further boosts demand, as warehouses and logistics centers require efficient, safe, and versatile stackers to enhance productivity, optimize space, and support rapid order fulfillment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)