Europe Tablet Market Report by Product (Detachable, Slate), Operating System (Android, IOS, Windows), Screen Size (8”, 8” and Above), End User (Consumer, Commercial), Distribution Channel (Online, Offline), and Country 2026-2034

Europe Tablet Market Overview:

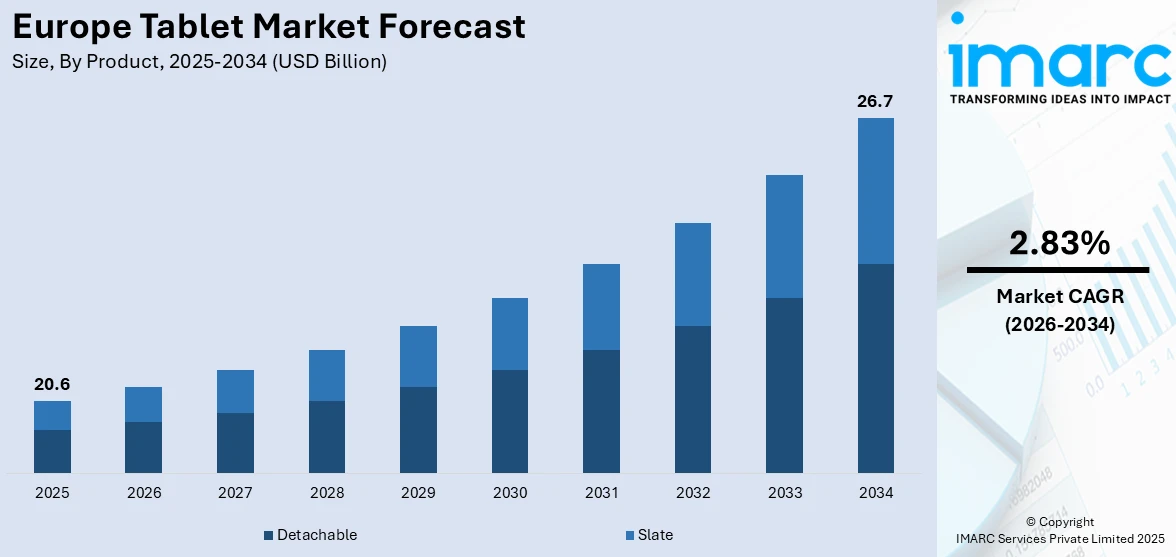

The Europe tablet market size reached USD 20.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 26.7 Billion by 2034, exhibiting a growth rate (CAGR) of 2.83% during 2026-2034. The continuous advancements in tablet technology, the increasing number of tech-savvy consumers, including both young and older demographics, and the rise of remote work and mobility trends represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 20.6 Billion |

| Market Forecast in 2034 | USD 26.7 Billion |

| Market Growth Rate (2026-2034) | 2.83% |

A tablet, in the context of computing and technology, refers to a portable and handheld device that typically features a flat touchscreen display. It is designed to be used as a personal computing device, capable of performing various tasks similar to a laptop or desktop computer but in a more compact and mobile form factor. They are often rectangular in shape and lack physical keyboards, relying mainly on the touch interface for user input. They are also lightweight and designed for easy portability. They are suitable for on-the-go use, making them convenient for tasks like reading, browsing the internet, or watching videos while traveling. Most tablets come with Wi-Fi connectivity, allowing users to access the internet wirelessly. Many models also offer cellular connectivity options, enabling internet access via mobile data networks. Tablets also support a wide range of applications (apps) that can be downloaded and installed from an app store specific to the operating system. These apps cater to various needs, including productivity, entertainment, education, gaming, and more. Moreover, tablets are equipped with built-in cameras, speakers, and microphones, allowing users to capture photos and videos, make video calls, and consume multimedia content.

To get more information on this market Request Sample

Europe Tablet Market Trends:

Tablets Reshaping Learning Environments

The shift toward digital learning in schools and universities has created strong momentum for tablet adoption. Many European governments are pushing for paperless classrooms, and tablets are increasingly integrated into teaching plans. The demand is especially high in countries like Germany, France, and the Nordics, where schools are equipping students with devices to support personalized learning. Publishers and edtech firms are tailoring content for younger users, making tablets more relevant across age groups. The rising appeal of education tablet models with kid-friendly features and built-in parental controls is pushing sales upward. With ongoing investments in digital curricula, this trend is expected to hold firm, reinforcing tablets as a core tool in modern classrooms.

Tablets Cementing Role in the New Work Routine

With hybrid work now the default for many across Europe, tablets are becoming a practical choice for remote collaboration, video calls, and content editing on the go. Professionals in fields like consulting, design, and field services are choosing tablets over bulkier laptops due to portability and stylus functionality. Companies are also issuing tablets to staff for internal communications and client presentations. The broader European consumer electronics market has seen a notable uptick in workplace-focused models featuring productivity apps, keyboard accessories, and security features tailored for business users. As flexible work policies solidify, tablets are moving from convenience devices to essential tools in the daily workflow.

Elderly Embracing Tablets for Accessibility and Connection

Tablet usage among older adults in Europe is rising due to larger screens, simplified interfaces, and growing interest in telehealth and digital communication. More seniors are turning to tablets to connect with family, access news, manage prescriptions, and attend virtual doctor appointments. Tech companies are responding with age-friendly UIs, voice assistants, and stylus support for easier use. Training programs and local government initiatives are also helping bridge the tech gap for retirees. This segment is especially promising in Western Europe where aging populations are a major demographic factor. Brands offering tailored tablet solutions for senior users are gaining traction in this expanding niche.

Businesses Turning to Tablets for Digital Operations

Companies across sectors are equipping staff with tablets to modernize operations, whether it's in logistics, healthcare, retail, or hospitality. Tablets support mobile inventory checks, POS systems, digital form entries, and real-time analytics. Many European firms now view tablets as scalable tech that’s easier to deploy and update than traditional systems. They're often part of broader IT transformation budgets, where mobility and speed matter more than sheer power. Rugged tablet variants are also seeing demand in field service and manufacturing. This surge in commercial use reflects a shift where tablets serve not as luxury accessories but as core tools driving day-to-day business activity.

Tech Advancements Driving Tablet Appeal

New-generation tablets now feature OLED displays, faster processors, improved battery life, and seamless software experiences, making them viable laptop alternatives for many users. 5G support, better stylus performance, and AI-enhanced apps have further expanded the range of use cases, from graphic design to gaming and professional editing. Leading brands are differentiating via screen refresh rates, camera systems, and multitasking features. These improvements are changing buyer expectations, especially in premium segments. In Europe, where users are often tech-savvy and selective, such upgrades are helping justify price increases. As innovation cycles shorten, this steady stream of enhancements is key to maintaining user interest and upgrading cycles.

Europe Tablet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe tablet market report, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product, operating system, screen size, end user, and distribution channel.

Product Insights:

- Detachable

- Slate

The report has provided a detailed breakup and analysis of the market based on the product. This includes detachable and slate.

Operating System Insights:

- Android

- iOS

- Windows

A detailed breakup and analysis of the market based on the operating system has also been provided in the report. This includes android, iOS, and windows.

Screen Size Insights:

- 8”

- 8” and Above

A detailed breakup and analysis of the market based on the screen size has also been provided in the report. This includes 8” and 8” and above.

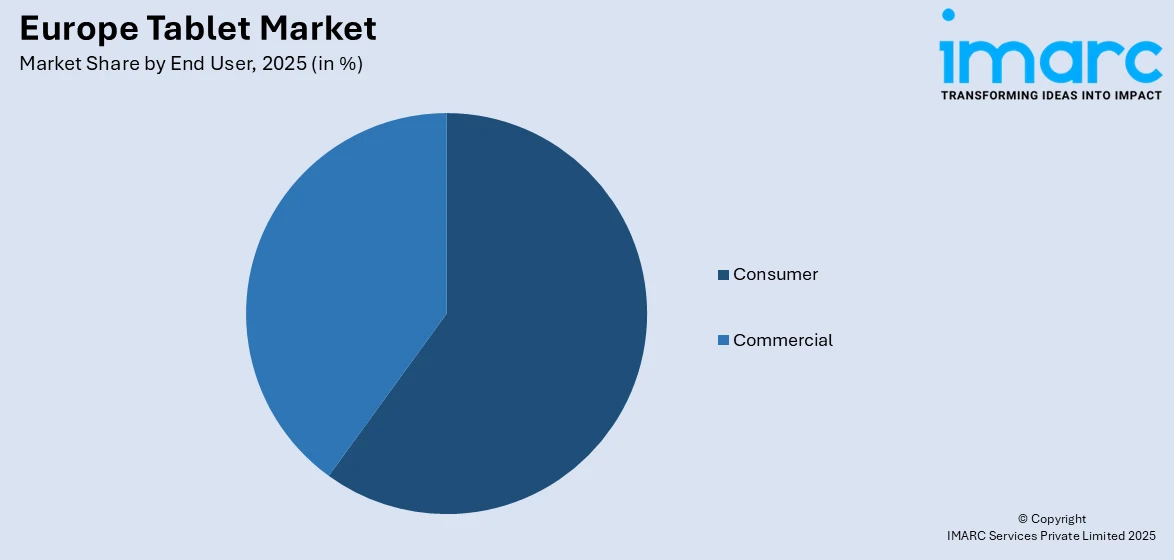

End User Insights:

Access the comprehensive market breakdown Request Sample

- Consumer

- Commercial

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes consumer and commercial.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes online and offline.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, United Kingdom, Italy, Spain, and Others.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Europe Tablet Market News:

- In March 2025, Align Technology launched its AI-powered Align X-ray Insights software across the EU and UK. The tool analyzed 2D radiographs using CADe AI and was integrated with iTero or was accessible via desktop or tablet. Developed following its acquisition of dentalXrai GmbH, the launch was presented at IDS 2025 in Cologne, Germany.

- In March 2024, Lenovo launched its 8.8-inch Legion Tab in select European markets. Built for gaming on the go, it features a Snapdragon 8+ Gen 1 processor, 12GB RAM, and a 144Hz QHD+ display. Weighing just 350g, the Android tablet supports up to 1TB of expandable storage. This move marks Lenovo’s push into Europe’s high-performance gaming tablet segment.

Europe Tablet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Detachable, Slate |

| Operating Systems Covered | Android, iOS, and Windows |

| Screen Sizes Covered | 8”, 8” and Above |

| End Users Covered | Consumer, Commercial |

| Distribution Channels Covered | Online, Offline |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe tablet market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe tablet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe tablet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tablet market in Europe was valued at USD 20.6 Billion in 2025.

The Europe tablet market is projected to exhibit a CAGR of 2.83% during 2026-2034, reaching a value of USD 26.7 Billion by 2034.

Key factors driving the Europe tablet market include rising remote work, digital learning adoption, and growing demand for 5G-enabled devices. Improved performance, affordable models, and increasing use in education and healthcare are also pushing sales. Sustainability and online retail growth are further driving the market forward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)