Europe Tobacco Market Size, Share, Trends and Forecast by Type and Country, 2025-2033

Europe Tobacco Market Size and Share:

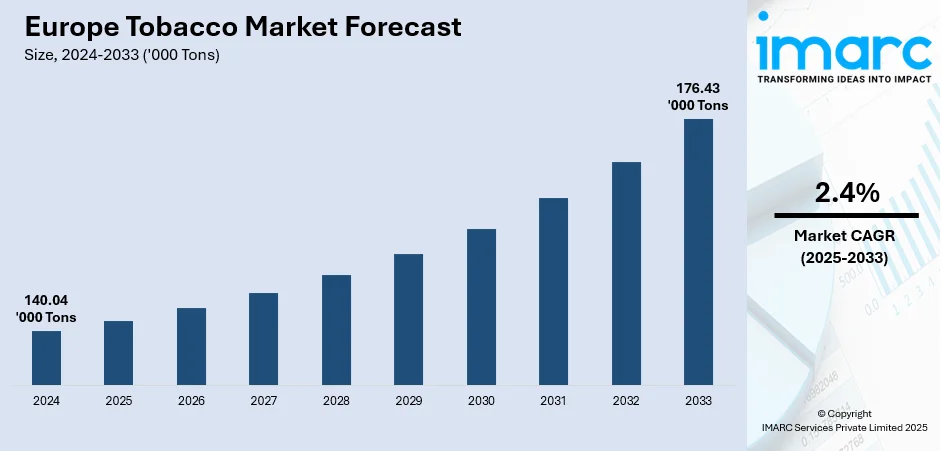

The Europe tobacco market size reached a volume of 140.04 Thousand Tons (production) in 2024. Looking forward, the market is expected to reach a volume of 176.43 Thousand Tons (production) by 2033, exhibiting a CAGR of 2.4% during 2025-2033. The market is influenced by high demand for premium and innovative tobacco products, growing consumer inclination toward smokeless and next-generation products such as e-cigarettes and heated tobacco, and the availability of established industry players. Cultural acceptance in certain regions and the expansion of online retail channels also contribute to sustained consumption. Ongoing investments in research and development further support market evolution and collectively influence the competitive landscape of Europe tobacco market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 140.04 Thousand Tons |

| Market Forecast in 2033 | 176.43 Thousand Tons |

| Market Growth Rate 2025-2033 | 2.4% |

One of the primary drivers of the Europe tobacco market is the shift in consumer preferences toward alternative tobacco and nicotine products. While conventional smoking is on the decline in several Customers in European countries are choosing next-generation products like nicotine pouches, heated tobacco, and e-cigarettes due to government pressure and health concerns. The trend is strongly present in Western and Northern Europe, where population-wide anti-smoking campaigns have been most aggressive and effective in deterring cigarette consumption. Tobacco players are countering with heavy investment in product innovation, to meet the need for reduced-risk products. The region's adult and highly segmented market provides a good setting for this kind of innovation, with consumers showing willingness to experiment with new forms. Additionally, nations such as Sweden and the UK have emerged as centers for reduced harm and smokeless products, with their impact percolating into wider market trends. This consumer-driven change continues to fuel expansion and redefine the conventional nature of Europe tobacco market outlook.

To get more information on this market, Request Sample

The policy environment throughout Europe has a twofold role in propelling the tobacco industry. Although stringent controls are intended to minimize tobacco use, they also compel firms to evolve and innovate. The EU's Tobacco Products Directive has brought in standardized packaging, advertising bans, and flavored cigarettes' bans, especially affecting traditional tobacco products. Nevertheless, these restrictions have fast-tracked the move to alternatives, with companies shifting their attention to creating compliant and innovative products. In Eastern Europe, with generally weaker regulation, classic products continue to dominate the marketplace, offering a contrast to changing tastes in Western Europe. Taxation disparities between countries also promote cross-border sales and price competition, impacting strategic choices by manufacturers. The diversity of regulatory environments in the region forces companies to have adaptive strategies with respect to specific markets. This continuous adaptation to policy changes acts as a significant driver for the Europe tobacco market’s structure and evolution.

Europe Tobacco Market Trends:

Rising Health Awareness and the Shift Toward Low-Risk Alternatives

In Europe, growing public concern for health and wellness has significantly shaped trends in the tobacco market. The European Commission reports that 29% of young Europeans aged 15 to 24 and 26% of the general population smoke, making the number of smokers in the EU still high. Governments, healthcare organizations, and NGOs across the region have implemented extensive anti-smoking campaigns, leading to increased awareness about the long-term effects of tobacco use. This has led to a discernible change in consumer demand, with numerous users opting for less dangerous alternatives. As a reaction, manufacturers of tobacco products have ramped up their research and development as a way of releasing innovative low-risk products such as heated tobacco, e-cigarettes, and nicotine pouches. Sweden and the UK are leading in this revolution since regulatory encouragement and openness among consumers have made the uptake take place at great speed. These Europe tobacco market trends enable firms to maintain a loyal clientele while also enabling them to penetrate new demographic niches, such as health-aware adults seeking alternatives. The strategic focus on innovation and lower-risk products is reconfiguring the competitive dynamics of the Europe tobacco market.

Lifestyle Pressures and the Changing Demographic of Smokers

The high-pressure, fast-living lifestyle common in many European city centers has also impacted tobacco usage patterns. Higher levels of stress linked to stressful workplace conditions, social isolation, and economic instability have been responsible for the increase in smoking behavior among both women and men. Notably, the WHO has predicted that by 2025, tobacco use will be prevalent in the WHO European Region, with 18.2% of women and 30.6% of men using tobacco. In contrast to past decades, when smoking was predominantly a male phenomenon, contemporary trends see a greater proportion of female smokers, most notably in France and Germany. This tendency mirrors greater societal change, such as changing gender roles and greater economic independence among women. In addition, social smoking in young professionals has also come back in fashion, frequently driven by peer culture and city nightlife. Tobacco manufacturers are reacting to these life-style behaviors by adapting product design, flavor, and branding to make their products more attractive to a wider and more diverse set of customers. These changing trends imply that tobacco consumption, though it is in the crosshairs of regulation and health issues, continues to evolve in its response to shifting dynamics in society throughout the region, further contributing to the Europe tobacco market growth.

Age of Smoking Onset and Its Long-Term Market Impact

Another notable trend influencing the Europe tobacco market is the changing age of smoking onset. Across many European nations, there has been a discernible trend of people starting to smoke at a younger age, despite extensive awareness campaigns and school-based education initiatives. Furthermore, industry studies show that 18% of young people in Europe start smoking at age 13 or younger, and in Romania, that number rises to 20%, highlighting the region's early tobacco use. Such early initiation is frequently driven by social settings, household behavior, and strategic marketing strategies, specifically on younger-population-oriented social media websites. Within Southern and Eastern Europe, where traditional tobacco smoking is more culturally embedded, early exposure among families and communities can establish normalizing patterns of tobacco use from an adolescent age. Such a trend presents public health issues and has long-term sustainability implications for the market. While governments keep ratcheting up restrictions on youth access, the premature uptake of smoking trends enables tobacco firms to sustain a long-term customer base. Meanwhile, companies are coming under greater pressure to adopt responsible marketing and spend on youth prevention programs, which in turn is transforming their engagement strategies in the region, while also supporting the Europe tobacco market demand.

Europe Tobacco Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Europe tobacco market, along with forecasts at the regional, and country levels from 2025-2033. The market has been categorized based on type.

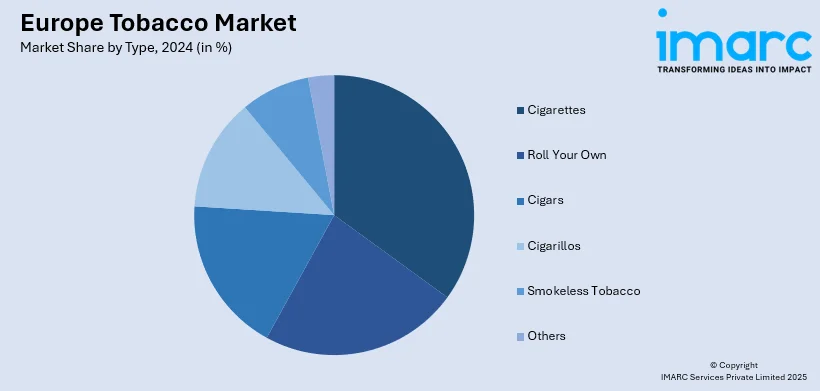

Analysis by Type:

- Cigarettes

- Roll Your Own

- Cigars

- Cigarillos

- Smokeless Tobacco

- Others

Cigarettes are still the most heavily consumed tobacco product, as per the Europe tobacco market analysis, sustained by deeply ingrained consumer tradition and brand loyalty. Despite official pressures and health issues, they remain predominant because of availability, variety, and established market presence, especially in Southern and Eastern Europe.

Roll-your-own tobacco is popular among price-sensitive customers, particularly in regions where cigarette prices are high. It provides flexibility and choice, commonly viewed as a cheaper and more personal option than manufactured cigarettes. The segment has witnessed sustained development, most notably among youth and rural communities throughout Europe.

Cigars address a small, premium segment of the market in Europe, which is linked to luxury and sporadic consumption. Cigars are popular among consumers who look for intense flavor profiles and tend to be associated with social or special-occasion use. Western Europe, particularly Spain and Germany, experiences steady demand for this category.

Cigarillos are a blend of cigarettes and cigars, providing an instant smoking experience with stronger flavor. They are short in length and come in flavored versions, so they appeal to young adults. Cigarillos are heavily regulated yet continue to have a strong consumer base in nations such as France and the Netherlands.

Smokeless tobacco, such as snus and nicotine pouches, is picking up pace in Europe because consumers are becoming increasingly health-conscious, and smoking is being banned in many places. Widely used in Scandinavia, and especially Sweden, these products are positioned as lower-risk alternatives and are helping to change consumer trends throughout the continent.

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is Europe's largest tobacco market, facilitated by a robust consumer base for both conventional cigarettes and roll-your-own. Despite regulation for health, smoking continues to be deeply entrenched in culture. There is also growing interest in reduced-risk products such as e-cigarettes that will drive future consumption trends in tobacco.

According to the Europe tobacco market forecast, France exhibits a high rate of smoking, especially among young adults and women. The government places significant emphasis on anti-smoking practices, yet cultural forms of tobacco consumption continue to be popular. The nation is also experiencing greater use of alternatives such as heated tobacco and e-cigarettes, fueled by shifting consumer behaviors and increasing regulation.

The United Kingdom is the leader in harm reduction policies among the European tobacco market. Cigarette smoking has fallen precipitously as a result of strong public health regulations, with e-cigarettes and nicotine pouches becoming increasingly popular. The UK regulatory landscape supports innovation in reduced-risk products, making it an important market for future-generations tobacco.

Italy boasts a strong tobacco culture, particularly for cigarettes and cigars. The industry is evolving in response to new trends with heated tobacco and e-cigarettes gaining increasing acceptance. Regulation and health education initiatives are taking an impact on consumer attitudes gradually, yet conventional products continue to dominate, particularly among the elderly.

Spain's tobacco market is heterogeneous with consistent demand for roll-your-own products, cigars, and cigarettes. The hospitable and sociable culture of the country fosters smoking prevalence, especially in cities. Although there are anti-smoking regulations, enforcement is not consistent. Alternative products are slowly finding popularity, particularly among younger, health-conscious adults.

Competitive Landscape:

Major players in the Europe tobacco industry are embarking on strategic initiatives to stay in touch with the market and propel growth in the face of changing consumer needs and regulatory hurdles. Investing heavily in research and development to create low-risk, next-generation goods like nicotine pouches, heated tobacco products, and e-cigarettes is one of the most crucial initiatives. Players such as British American Tobacco, Philip Morris International, and Imperial Brands are spearheading the movement by introducing new-age alternatives that appeal to health-aware customers who seek lower-risk offerings. They are also actively interacting with regulatory authorities to make supportive policies for new product segments. Furthermore, market leaders are strengthening their online footprint and leveraging digital channels to connect with a wider, technology-knowledgeable segment. Brand and packaging strategies have also changed, with premiumization and user experience aimed at building customer loyalty. Localization of products according to regional tastes like flavor adjustments and culturally appealing marketing, is another strategy being utilized. Additionally, strategic alliances and acquisitions are enabling businesses to expand into more European markets. Together, these initiatives demonstrate a strong intent by major stakeholders to evolve with shifting market forces while also defining the future of the Europe tobacco market.

The report provides a comprehensive analysis of the competitive landscape in the Europe tobacco market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: PMI Global Travel Retail launched Veev One, a closed-pod vaping system, in major European airports, and Veev Now Ultra, a premium disposable, in Southern hubs. Integrated into multi-category retail spaces, the rollout reinforced PMI’s smoke-free strategy, expanding its product footprint and consumer engagement across international travel gateways.

Europe Tobacco Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cigarettes, Roll Your Own, Cigars, Cigarillos, Smokeless Tobacco, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe tobacco market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe tobacco market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe tobacco industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tobacco market in Europe reached 140.04 Thousand Tons in 2024.

The Europe tobacco market is projected to exhibit a (CAGR) of 2.4% during 2025-2033, reaching a volume of 176.43 Thousand Tons by 2033.

The Europe tobacco market is driven by shifting consumer preferences toward reduced-risk products, rising investments in product innovation, and lifestyle-related stress. Regulatory pressures encourage manufacturers to diversify offerings, while cultural acceptance in certain regions sustains demand. Online retail and premium product trends further contribute to market growth and transformation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)