Europe Tooling Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Country, 2026-2034

Europe Tooling Market Size and Share:

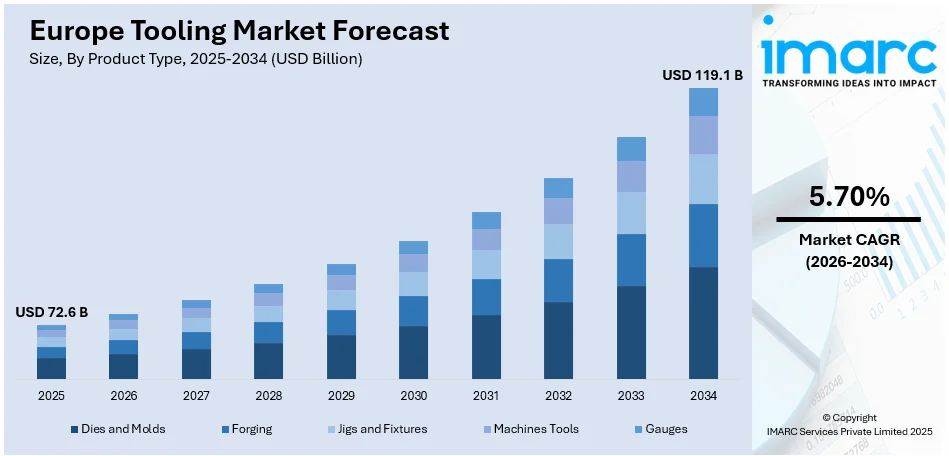

The Europe tooling market size was valued at USD 72.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 119.1 Billion by 2034, exhibiting a CAGR of 5.70% from 2026-2034. The market is primarily driven by rise in sustainable practices, ongoing smart tooling innovations integrating AI and IoT for precision, and increasing customizable modular systems, enabling efficiency, adaptability, and eco-friendly solutions across various sectors, while aligning with environmental and customer-centric demands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 72.6 Billion |

|

Market Forecast in 2034

|

USD 119.1 Billion |

| Market Growth Rate (2026-2034) | 5.70% |

The Europe tooling market is advancing due to the growing adoption of technologies like additive manufacturing and Industry 4.0, enhancing precision, efficiency, and production flexibility. Industries are upgrading tooling systems to meet changing demands, especially in sectors like automotive and aerospace. A notable example is the September 26, 2024, launch of Toray Cetex TC1130 PESU by Toray Advanced Composites, a lightweight, recyclable thermoplastic composite for aerospace interiors. This material offers superior fire safety, impact resistance, and cost-effective, eco-friendly mono-material sandwich structures, aligning with Europe’s sustainability goals. The emphasis on lightweight materials reduces energy consumption and emissions, addressing environmental concerns while encouraging innovation in tooling solutions to support complex designs and advanced materials.

To get more information on this market Request Sample

The increasing demand for automation is also a key driver of the European tooling market, with automated systems integrated with robotics and real-time data analytics enhancing efficiency and precision. Digitate's 2024 research reveals that 92% of European enterprises have adopted artificial intelligence (AI) and automation, investing an average of €103.4 Million and achieving €154.7 Million return on investment (ROI). Benefits include time savings (60%), efficiency (57%), and productivity (55%), with 78% planning further deployments in IT operations (74%) and cybersecurity (56%). Additionally, rapid urbanization and infrastructure development are fueling the construction sector, strengthening demand for durable and cost-effective tools. As industries prioritize quality, precision, and tailored solutions, investments in advanced tooling systems are propelling market growth and meeting changing operational requirements.

Europe Tooling Market Trends:

Increased Integration of Sustainable Practices

Environmental regulation and increasing demand for the eco-friendly solution is moving the European tooling market towards sustainable practices. As on 18 June 2024, the Circularity Metrics Lab of the EEA monitors plastics circularity in Europe and, among other things, tracks a growing consumption rate, rising environmental impacts, and slowly improving recycling. Manufacturers increasingly opt for recyclable material and energy-efficient processes to cut down their carbon footprint. Technologies such as green manufacturing and additive manufacturing are enabling material and energy savings, aligning with EU sustainability goals. These innovations improve operational efficiency while reducing environmental impact. As sustainability becomes a key market driver, companies are investing in research and development (R&D) for eco-friendly tooling solutions. These advancements serve as competitive differentiators, supporting long-term growth and fostering compliance with Europe’s commitment to a sustainable, circular economy.

Continual Advancements in Smart Tooling Solutions

European smart tooling is revolutionizing the way Industry 4.0 and IoT-enabled technologies promote it. This kind of system allows real-time monitoring, predictive maintenance, and process optimization for increased efficiency and reduced downtime. These are enhanced decision-making factors with artificial intelligence (AI) and machine learning that reduce errors. A good example of the same is the CitiVerse European Digital Infrastructure Consortium, launched on 12th December 2024. Totally funded with a sum of about €80 Million from the Digital Europe Programme, smart cities are promoted through tools for city planning that derive from AI, digital twins, and immersive technologies-aiming to onboard around 100 cities in a period of two years. The rise in the demand for precise and automated applications of smart tooling is seen very rapidly in automotive, aerospace, and electronics sectors in Europe, and the global leader is the Europe.

Focus on Customization and Modular Tooling

Customization and modular tooling are shaping the European tooling market as industries increasingly demand tailored solutions to meet specific production needs. Modular tooling systems provide flexibility, scalability, and cost-efficiency, allowing manufacturers to adapt quickly to evolving demands and designs. These solutions reduce lead times and enhance operational efficiency, supporting sectors like automotive and electronics in achieving mass customization and high-mix, low-volume production. For instance, Tungaloy’s DrillMeister system, introduced on March 4, 2024, features modular drill bodies with chamfering inserts for M8-M18 pre-thread holes. With TungFlex connections and compatibility with five DrillMeister heads, it enhances efficiency, chip control, and versatility. The focus on bespoke tooling solutions highlights the market's commitment to innovation, customer-centric strategies, and long-term competitiveness in a shifting industrial landscape.

Europe Tooling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe tooling market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, material type, and end use industry.

Analysis by Product Type:

- Dies and Molds

- Forging

- Jigs and Fixtures

- Machines Tools

- Gauges

Dies and molds are integral to the Europe tooling market, catering to industries such as automotive, packaging, and consumer goods. Their precision and durability are essential for mass production of high-quality components. With advancements in materials and manufacturing processes, dies and molds are becoming increasingly sophisticated, enabling manufacturers to produce intricate designs efficiently. The European focus on automation and digitalization has further enhanced the demand for innovative die and mold tooling solutions.

Forging tools play a crucial role in the market, supporting sectors like aerospace, automotive, and industrial machinery. These tools are essential for shaping metal components under high pressure, ensuring superior strength and durability. The adoption of advanced forging techniques and materials, combined with Europe’s focus on sustainability, driving innovation in forging tooling. This is leading to improved efficiency, reduced waste, and enhanced performance, maintaining forging as a cornerstone of European manufacturing.

Jigs and fixtures are indispensable in the Europe tooling market, ensuring precision and consistency in manufacturing processes. These tools support industries such as electronics, automotive, and aerospace by enhancing production speed and accuracy. European manufacturers emphasize customized and modular jigs and fixtures to meet specific operational needs, leveraging automation and smart technologies. This focus on tailored solutions has reinforced the importance of jigs and fixtures in achieving high-quality outputs and maintaining competitiveness in the European market.

Analysis by Material Type:

- Stainless Steel

- Iron

- Aluminum

- Others

Stainless steel holds a significant position in the Europe tooling market due to its durability, corrosion resistance, and versatility. It is widely used in tooling applications across industries like automotive, aerospace, and medical devices. The material’s ability to withstand high temperatures and its low maintenance requirements render it ideal for manufacturing high-precision tools and molds. European manufacturers often prioritize stainless steel for applications demanding exceptional strength and long-term reliability.

Iron remains a key material in the Europe market, valued for its affordability and strength. It is extensively used in the production of heavy-duty tools and equipment for sectors such as construction and industrial machinery. While less versatile than other materials, iron’s cost-effectiveness and robustness render it a practical choice for applications where weight and corrosion resistance are less critical, ensuring its continued relevance in traditional tooling processes.

Aluminum plays a vital role in the market, particularly in applications requiring lightweight and corrosion-resistant solutions. Its excellent machinability and thermal conductivity render it suitable for producing molds and prototypes, especially in industries like automotive and aerospace. The increasing adoption of lightweight materials in manufacturing is bolstering the demand for aluminum tooling, as it enables faster production cycles and reduces energy consumption, aligning with Europe’s focus on sustainability and efficiency.

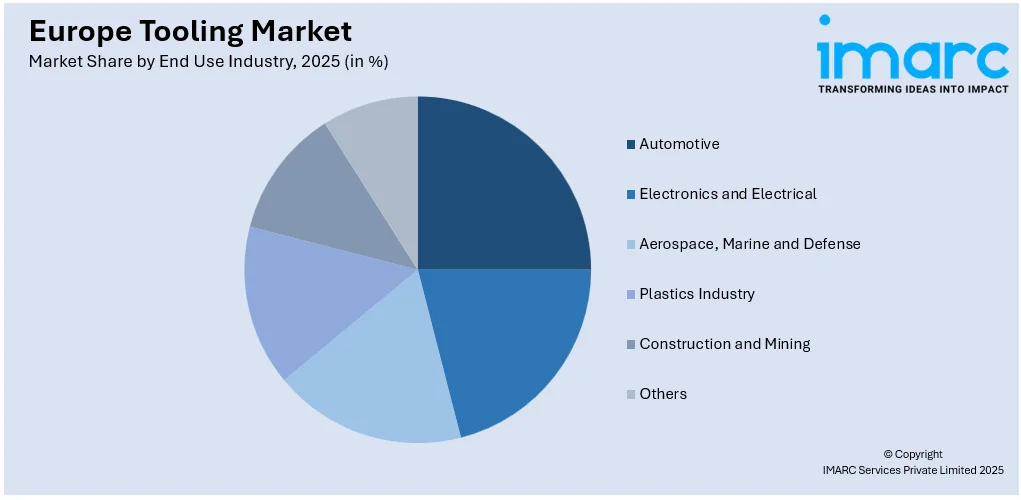

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electronics and Electrical

- Aerospace, Marine and Defense

- Plastics Industry

- Construction and Mining

- Others

The automotive sector is a major contributor to the Europe tooling market, driven by the demand for high-precision tools for vehicle manufacturing and assembly. With the rise of electric vehicles (EV), the need for specialized tooling solutions intensified. Automakers are increasingly adopting advanced materials and technologies, such as lightweight components and automated production lines, which further strengthen the demand for innovative tooling systems tailored to the changing needs of the industry.

The electronics and electrical sector significantly influence the market, fueled by the growing demand for renewable energy systems, consumer electronics, as well as industrial automation. This sector requires highly precise tools for manufacturing intricate components like microchips, circuits, and connectors. The shift towards miniaturization and smart technologies is leading to an increased focus on precision and efficiency, driving innovation in tooling systems designed specifically for electronics and electrical manufacturing processes.

The aerospace sector plays a crucial role in shaping the Europe tooling market, with its emphasis on precision, reliability, and high-performance materials. The production of aircraft components, including engines, fuselages, and avionics, requires advanced tooling solutions capable of meeting stringent quality and safety standards. The increasing demand for lightweight materials and the integration of additive manufacturing techniques in the marine and defense sectors as well have further elevated the need for sophisticated tooling systems in this high-tech and innovation-driven industries.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany plays a pivotal role in the Europe tooling market, primarily due to its robust manufacturing sector and focus on precision engineering. The country is home to several key players specializing in high-quality tools for industries such as automotive, aerospace, and machinery. Germany's commitment to innovation and investment in advanced technologies, including automation and digitalization, further solidifies its position as a leader in the tooling market across Europe.

France contributes significantly to the tooling market in Europe, driven by its diversified industrial base and strong emphasis on sustainability. French manufacturers are known for producing cutting-edge tools that cater to sectors like energy, aerospace, and automotive. The country’s proactive approach toward adopting eco-friendly practices and integrating smart technologies has enhanced the efficiency and global competitiveness of its tooling industry, making it a key contributor to the European market landscape.

The United Kingdom holds a notable position in the market, with its focus on high-value manufacturing and innovation-led growth. The UK’s tooling industry benefits from its advanced research facilities and skilled workforce, catering to sectors such as aerospace, defense, and automotive. Despite challenges like Brexit, the UK continues to attract investment in precision tooling, leveraging its expertise in custom solutions and rapid prototyping to remain competitive in the changing European market.

Competitive Landscape:

The Europe tooling market exhibits a highly competitive landscape, driven by the presence of established players and innovative newcomers. Key companies focus on developing advanced tooling solutions, integrating smart technologies like automation, Internet of Things (IoT), and 3D printing to meet shifting industry demands. Regional players emphasize precision engineering and customization, catering to diverse sectors such as automotive, aerospace, and electronics. The market also witnesses strategic partnerships, mergers, and acquisitions to expand product portfolios and geographical reach. Sustainability and energy efficiency are emerging as critical differentiators, with companies investing in eco-friendly materials and production methods. As competition intensifies, innovation and technological advancements remain pivotal for maintaining market leadership in the industry.

The report provides a comprehensive analysis of the competitive landscape in the Europe tooling market with detailed profiles of all major companies.

Latest News and Developments:

- October 3, 2024: Drilling Tools International Corp. acquired European Drilling Projects (EDP), a leading provider of advanced stabilizers, specialty reamers, and wellbore optimization technology for the drilling industry. This acquisition enhances DTI's global expansion and technological capabilities, complementing its existing Drill-N-Ream technology. Founded in 2004, EDP specializes in innovative, bespoke drilling tools like the Fixedblade stabilizer. The integration strengthens DTI’s market position, adds EDP's expertise, and fosters collaboration to address shifting challenges in the global oil and gas industry.

- August 01, 2024: McLaren Automotive teamed up with Atlas Copco as its 'Official Smart Tooling Supplier' to modify its manufacturing potential at the McLaren Production Centre (MPC). The collaboration integrated advanced technologies, including 150 wireless, 5G-enabled digital tools and AI-powered real-time data insights, enhancing precision and efficiency. McLaren is further automating bodyshell adhesive applications employing Atlas Copco’s improved joining and vision technologies. Additionally, McLaren's European dealerships are accepting orders for the 750S, indicating its availability to European consumers.

Europe Tooling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dies and Molds, Forging, Jigs and Fixtures, Machines Tools, Gauges |

| Material Types Covered | Stainless Steel, Iron, Aluminum, Others |

| End Use Industries Covered | Automotive, Electronics and Electrical, Aerospace, Marine and Defense, Plastics Industry, Construction and Mining, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe tooling market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe tooling market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe tooling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Tooling refers to the process of designing and manufacturing tools, molds, dies, fixtures, and jigs used in production to shape, cut, or assemble materials. Applications include automotive manufacturing, aerospace component fabrication, electronics assembly, and industrial machinery production, ensuring precision, efficiency, and consistency in mass production processes.

The Europe tooling market was valued at USD 72.6 Billion in 2025.

IMARC estimates the Europe tooling market to exhibit a CAGR of 5.70% during 2026-2034.

Key drivers of the Europe market include the rising emphasis on sustainability, advancements in smart tooling with AI and IoT integration, increasing use of modular systems for customization, growth in additive manufacturing and automation, and heightened demand from automotive, aerospace, and construction sectors for precision and environmentally friendly solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)