Europe Used Truck Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, End User, and Country, 2026-2034

Europe Used Truck Market Size and Share:

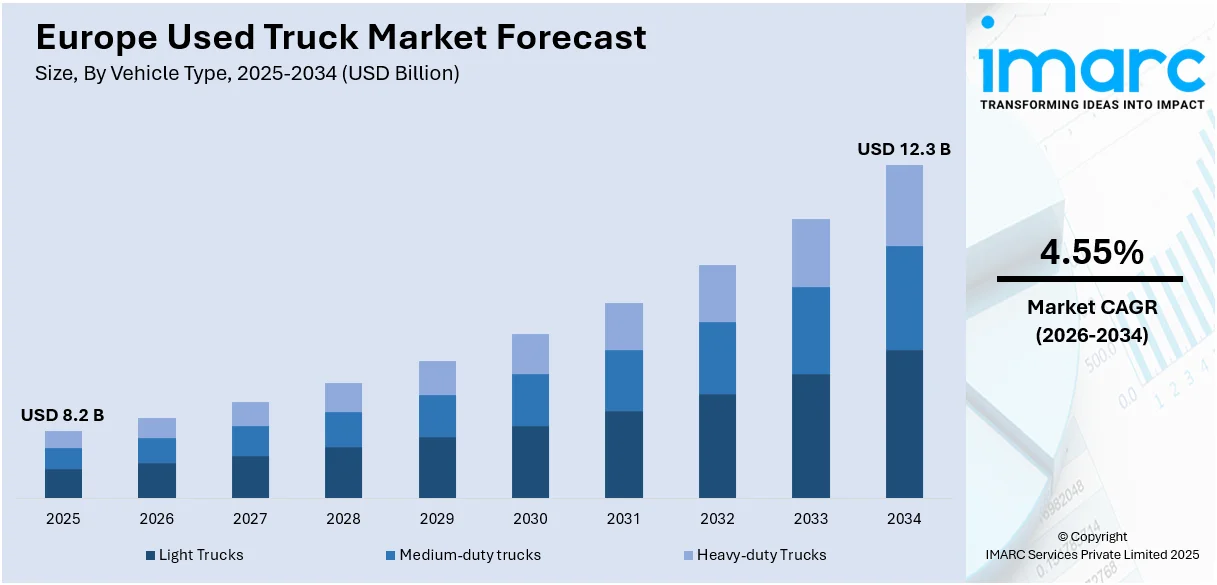

The Europe used truck market size was valued at USD 8.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 12.3 Billion by 2034, exhibiting a CAGR of 4.55% from 2026-2034. The market is chiefly driven by high demand for cost-effective logistics solutions, supported by expanding e-commerce and infrastructure development. Furthermore, favorable regulations on emissions and fleet modernization encourage businesses to invest in reliable, pre-owned trucks, fostering steady growth across key sectors such as transportation, construction, and agriculture.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.2 Billion |

| Market Forecast in 2034 | USD 12.3 Billion |

| Market Growth Rate (2026-2034) | 4.55% |

The Europe used truck market share is expanding due to the magnifying requirement for cost-efficient transportation solutions across key industries including agriculture, logistics, and construction. Businesses are actively navigating dependable substitutes of new vehicles to significantly reduce capital expenditures while sustaining operational efficacy. The availability of verified pre-owned trucks with upgraded warranties and quality assurances has further bolstered customer trust. Additionally, the fueling emphasis on sustainability incentivizes fleet operators to reuse and revamp existing vehicles, lowering environmental impact and facilitating the need for used trucks. For instance, according to industry reports, trucks contribute to 25% of road transport emissions in Europe, highlighting the necessity of fully decarbonizing the EU truck fleet in order to reach climate neutrality by 2050.

To get more information on this market Request Sample

In addition, regulatory aid for emissions adherence and trade-in schemes is also fostering the Europe used truck market growth significantly. Several countries in Europe have launched incentives to encourage cleaner fleets, positioning pre-owned vehicles with streamlined emissions systems a preferable choice for various businesses. The increasing proliferation of e-commerce has amplified the demand for effective logistics, further impacting the requirement for reduced-cost, reliable transportation. For instance, the International Trade Administration stated that Europe ranks as the third-largest retail e -commerce market globally, generating revenues of USD 631.9 billion in 2023. With an annual growth rate of 9.31%, revenues are projected to reach USD 902.3 billion by 2027, reflecting the market's robust expansion. These factors, combined with advancements in vehicle inspection technologies, ensure the market's sustained growth.

Europe Used Truck Market Trends:

Growing Demand for Fuel-Efficient Trucks

The Europe used truck market is witnessing amplified need for fuel-effective models as variety of businesses are actively shifting their focusing towards adherence to environmental frameworks and significant reductions in operational costs. Stringent emissions policies are prompting buyers to employ trucks with lower emission levels and better mileage. For instance, in April 2024, The Council of the European Union adopted the Euro 7 regulation, setting stricter emission limits and battery durability standards for road vehicles, including heavy-duty trucks. The regulation introduces enhanced lifetime requirements and imposes stringent pollutant limits, including previously unregulated emissions such as nitrous oxide, to reduce air pollutants from exhaust and brakes. Consequently, fleet operators and logistics companies are upgrading to more sustainable options within the used truck segment, balancing affordability with regulatory requirements. This trend supports a steady transition toward eco-friendly transportation without significant capital investments, aligning with regional sustainability goals and promoting a more competitive used truck market.

Digital Platforms Facilitating Sales

The rise of digital marketplaces and various other platforms is significantly transforming the Europe used truck market by improving availability and transparency. Buyers benefit from comprehensive listings, detailed specifications, and vehicle history reports, enabling informed purchasing decisions. Whereas, sellers leverage these platforms to reach broader audiences and streamline transactions. Moreover, innovations such as virtual inspections, financing options, and integrated logistics support enhance the customer experience. For instance, DAF, a Europe-based provider of leasing and financing for used trucks through its in-house financier PACCAR Financial, announced a net profit of $2.32 billion ($4.40 per diluted share) for the first half of 2024, marking an increase from $1.96 billion recorded during the same timeframe in the year 2023. The company operates online virtual experiences platforms and offers financing options spanning 24, 36, 48, and 60 months. Furthermore, this digital shift is particularly impactful for cross-border transactions, simplifying the trade of used trucks across the European Union and fostering a more interconnected and efficient market ecosystem.

Increasing Popularity of Electric and Hybrid Trucks

The Europe used truck market is experiencing growing interest in electric and hybrid trucks as businesses focus on sustainability and reducing carbon footprints. Regulatory incentives and expanding charging infrastructure are encouraging the adoption of these models, even in the pre-owned segment. Logistics and urban delivery companies, in particular, are incorporating used electric and hybrid trucks to meet emission reduction targets cost-effectively. This trend is reshaping the market, with an increasing inventory of eco-friendly vehicles driving demand among environmentally conscious buyers and furthering the region's green mobility initiatives. For instance, as per industry reports, European truck manufacturers are prioritizing the mass production of battery electric trucks across all vehicle segments, including long-haul, starting in 2024. Approximately 30 zero-emission models are scheduled for mass production in Europe by 2025, signaling a significant shift toward sustainable transportation solutions.

Europe Used Truck Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe used truck market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on vehicle type, sales channel, and end user.

Analysis by Vehicle Type:

- Light Trucks

- Medium-duty trucks

- Heavy-duty Trucks

The light trucks segment in the Europe used truck market caters to businesses requiring agile and fuel-efficient vehicles for urban logistics and last-mile deliveries. These trucks are favored for their versatility, lower maintenance costs, and ease of navigation in congested cityscapes. Small and medium enterprises (SMEs) and retail operators often opt for used light trucks to manage transportation needs cost-effectively. Growing demand for e-commerce and urban deliveries has further fueled this segment, making it a key component in meeting evolving supply chain requirements across the region.

Medium-duty trucks are an essential segment in the Europe used truck market, serving diverse applications such as regional transportation, construction, and municipal services. Known for their balance of payload capacity and fuel efficiency, these trucks appeal to industries requiring reliable and durable vehicles. Moreover, businesses often choose used medium-duty trucks to reduce capital expenditures while maintaining operational flexibility. The segment is also influenced by increasing regulatory compliance for emissions, driving demand for newer, eco-friendly models in the pre-owned market.

Heavy-duty trucks dominate the Europe used truck market for long-haul logistics and industrial applications requiring substantial payload capacities. These vehicles are critical for industries such as freight transport, construction, and mining. Buyers in this segment prioritize durability, engine performance, and fuel efficiency, making used heavy-duty trucks a cost-effective alternative to new models. In addition, the segment benefits from strong demand for cross-border trade within the European Union, with fleet operators frequently updating inventory to meet operational demands and regulatory standards.

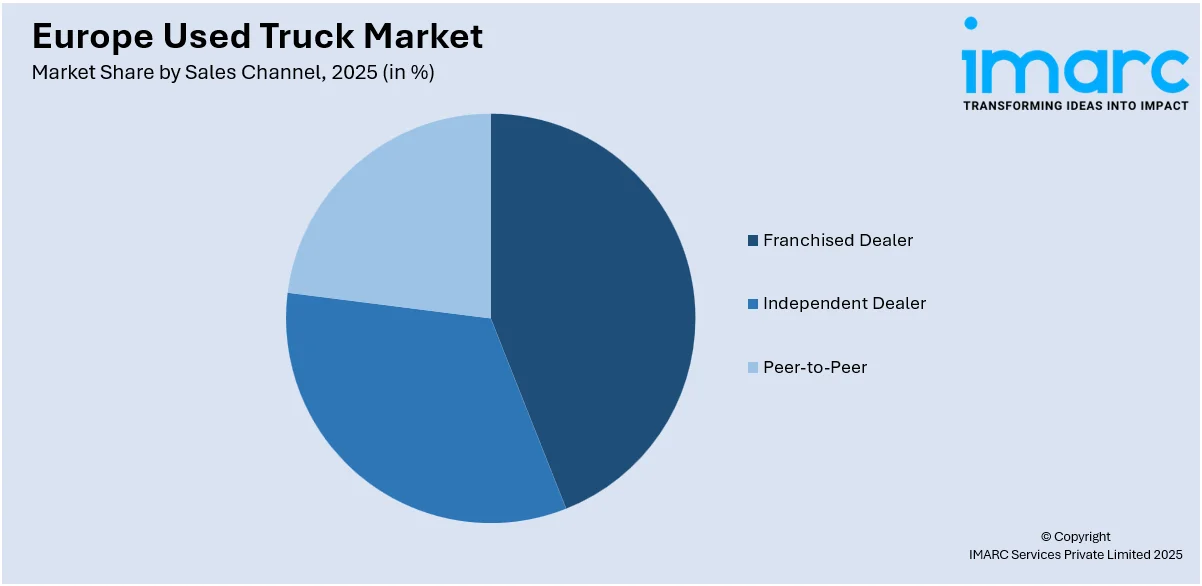

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- Franchised Dealer

- Independent Dealer

- Peer-to-Peer

Franchised dealers are highly prevalent in the Europe used truck market by offering certified pre-owned vehicles and comprehensive after-sales services. Their strong affiliation with original equipment manufacturers (OEMs) ensures the availability of high-quality trucks, detailed maintenance records, and warranty options, instilling buyer confidence. These dealers cater to fleet operators and businesses seeking reliable trucks with assured performance. Additionally, franchised dealers benefit from established brand trust and robust networks, making them a preferred choice for customers prioritizing dependability and long-term support.

Independent dealers play a significant role in the Europe used truck market by offering competitive pricing and diverse inventory. These dealers attract cost-conscious buyers and small businesses looking for flexible financing options and varied vehicle choices. Unlike franchised dealers, independent dealers operate with greater autonomy, enabling tailored solutions for niche market demands. Furthermore, their localized presence often enhances accessibility for customers, particularly in smaller towns or regions where franchised networks may be limited. Independent dealers continue to thrive by focusing on personalized service and meeting the specific needs of diverse customer segments.

Peer-to-peer sales are gaining traction in the Europe used truck market due to their cost-effectiveness and direct buyer-seller interaction. Digital platforms and marketplaces facilitate this channel, allowing buyers to access a wide range of trucks without intermediary fees. While lacking the guarantees offered by dealers, peer-to-peer transactions appeal to individual buyers and smaller operators seeking budget-friendly solutions. Moreover, the simplicity and transparency of this sales channel are driving its popularity, especially among those with specific vehicle requirements or limited financing options, making it a growing segment in the used truck market.

Analysis by End User:

- Construction

- Oil and Gas

- Others

The construction sector is a key end-user in the Europe used truck market, driven by the need for reliable, heavy-duty vehicles to transport materials and equipment. Used trucks offer an affordable alternative for construction companies to expand their fleets without significant capital investment. The sector benefits from the availability of specialized trucks, including tippers and dumpers, suited for on-site operations and bulk transportation. Additionally, increased urbanization and infrastructure projects across Europe further bolster demand, making used trucks indispensable in ensuring efficiency and cost-effectiveness in construction logistics.

The oil and gas industry significantly contributes to the Europe used truck market, requiring robust vehicles for operations in challenging environments. Used trucks equipped for hauling equipment, fuels, and other materials provide a cost-efficient solution for the sector’s demanding logistics. Their durability and adaptability make them well-suited for off-road and long-haul requirements prevalent in the energy supply chain. Moreover, as energy projects diversify across Europe, the oil and gas industry continues to rely on the affordability and availability of high-performing used trucks to meet transportation needs effectively.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany dominates the Europe used truck market due to its robust logistics sector and well-established automotive industry. The country’s strategic location as a central European trade hub drives high demand for used trucks, particularly for cross-border freight operations. Besides this, stricter emissions standards encourage the adoption of fuel-efficient and environmentally friendly models, further stimulating market growth. In addition, Germany's advanced infrastructure for vehicle inspections and certifications ensures reliability and trust in the used truck segment.

France represents a key market for used trucks, supported by its expansive agricultural and construction sectors. The need for cost-efficient transportation in rural and semi-urban areas drives demand, particularly for medium-duty and heavy-duty trucks. Additionally, government regulations on emissions influence purchasing trends, with buyers increasingly seeking Euro VI-compliant vehicles. Furthermore, the growing popularity of online platforms enhances accessibility, facilitating seamless transactions within the French used truck market.

The United Kingdom remains a significant player in the Europe used truck market, driven by its large logistics and e-commerce industries. Post-Brexit trade complexities have increased reliance on cost-effective used trucks for domestic and regional operations. Moreover, demand for lightweight and fuel-efficient vehicles is rising as businesses strive to optimize delivery networks. Digital platforms and financing solutions further enable smoother transactions, strengthening the UK’s used truck market dynamics.

Italy’s used truck market thrives on the strength of its manufacturing and construction industries. The demand for versatile vehicles capable of navigating diverse terrains is prominent, particularly in small-to-medium enterprises. The push toward greener transportation solutions has influenced the preference for fuel-efficient models. In addition to this, Italy’s dynamic economic landscape and government initiatives supporting sustainable practices continue to shape its used truck market.

Spain’s used truck market benefits from its expanding logistics and agriculture sectors, with demand driven by cost-conscious small and medium enterprises. The country’s focus on modernizing transportation fleets has increased interest in fuel-efficient and eco-friendly models. Furthermore, Spain’s strategic location for Mediterranean trade also enhances the resale value of used trucks, making it a competitive market within Europe.

Competitive Landscape:

The competitive landscape of the Europe used truck market is characterized by the presence of established manufacturers, independent dealerships, and online platforms. Key players are actively focusing on certified pre-owned programs, offering quality assurance and extended warranties to attract buyers. For instance, in March 2024, Volvo Trucks UK announced the extension of company warranty for used trucks. Customers can extend the manufacturer's driveline warranty from the standard 12 months to up to 36 months at the time of purchase. Additionally, independent dealers cater to cost-sensitive customers, while online platforms enhance market reach with transparent pricing and convenient purchase processes. Moreover, increasing competition among these stakeholders drives innovation in services, financing options, and after-sales support, ensuring a dynamic and customer-centric market environment across Europe.

The report provides a comprehensive analysis of the competitive landscape in the Europe used truck market with detailed profiles of all major companies.

Latest News and Developments:

- In April 2024, Scania UK announced the launch of its new sales platform, enabling customers to purchase used vehicles online. Customers will have a wide selection of used vehicles to choose from across the different Scania Go grading bands, including used trucks and cars.

- In September 2024, DAF Trucks, a Europe-based prominent used trucks provider, unveiled advanced innovations in fuel efficiency, safety, and driver comfort for its New Generation XD, XF, XG, and XG+ trucks. The company also showcased its battery-electric trucks, charging stations, and energy storage solutions, emphasizing sustainability leadership.

Europe Used Truck Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light Trucks, Medium-duty trucks, Heavy-duty Trucks |

| Sales Channels Covered | Franchised Dealer, Independent Dealer, Peer-to-Peer |

| End Users Covered | Construction, Oil and Gas, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe used truck market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe used truck market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe used truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe used truck market was valued at USD 8.2 Billion in 2025.

The key factors driving the Europe used truck market include rising demand for cost-effective logistics solutions, increased freight transportation activities, and growing preference for reliable used vehicles. Stringent environmental regulations also encourage the adoption of newer, low emission used trucks, while advancements in vehicle refurbishment enhance quality, fueling market growth.

The Europe used truck market is projected to exhibit a CAGR of 4.55% during 2026-2034, reaching a value of USD 12.3 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)